Gold and silver have been trusted stores of value for thousands of years. They were used as currency, traded between nations, and valued as symbols of wealth. Even in modern economies, these metals maintain their significance, especially during periods of inflation or economic uncertainty.

Historically, when currencies weakened or stock markets faltered, gold and silver often held or increased in value. This resilience makes them attractive to investors seeking stability and long-term preservation of wealth. Both metals offer benefits that other asset classes cannot replicate, and their global acceptance ensures they can be traded or sold almost anywhere. According to the U.S. Department of the Treasury, gold and silver play a significant role in maintaining economic stability, making it a valuable hedge for investors.

Beyond their financial roles, gold and silver have cultural and industrial importance, contributing to their ongoing demand and relevance.

The Key Benefits of Adding Gold and Silver to Your Portfolio

Precious metals offer a unique set of benefits that appeal to both conservative and growth-minded investors:

Hedge against inflation: Their value tends to rise when the purchasing power of currency declines.

Portfolio diversification: They can reduce overall portfolio volatility by moving differently than stocks or bonds.

Tangible value: Unlike digital assets or paper investments, gold and silver are physical, finite resources.

Global liquidity: Widely recognized and accepted around the world.

For investors looking to balance risk, gold and silver can be effective tools for preserving wealth. They are not dependent on the performance of any one company or government, which can provide a sense of security when markets become unpredictable.

Gold vs. Silver: How They Compare as Investments

While gold and silver share similarities, they also have distinct characteristics:

Price per ounce: Silver is much more affordable, making it accessible to smaller budgets.

Volatility: Silver prices tend to swing more dramatically than gold, which can mean higher risk but also greater short-term gains.

Industrial demand: Silver is used heavily in electronics, solar energy, and medical devices, making it sensitive to industrial cycles.

Storage: Because silver is less dense, large investments take up more space than equivalent values of gold.

Historical performance: Gold has been a more stable store of value, while silver has had periods of rapid growth.

Current Promotion: $15,000 in Free Silver on Qualified Purchases

Understanding these differences helps investors determine whether one metal, or a mix of both, better aligns with their goals.

Ways to Invest in Gold and Silver

Investors can choose from several methods, each with unique advantages.

Physical Bullion: Coins, Bars, and Rounds

Buying physical gold and silver means holding tangible assets. Popular products include American Gold Eagles, Canadian Silver Maple Leafs, and gold or silver bars of varying weights. Buyers should look for high purity levels (.999 fine silver, .9999 fine gold) and purchase from reputable dealers. Storage solutions include home safes, bank safety deposit boxes, or insured third-party vaults. Owning bullion provides direct control over your investment, but it also requires careful consideration of security.

Precious Metal ETFs and Mutual Funds

These funds track the price of gold or silver and trade like stocks. Physically-backed ETFs hold bullion in secure vaults, while some funds offer synthetic exposure through derivatives. ETFs provide liquidity and ease of trading without the need for personal storage. They also allow smaller, more frequent investments compared to buying physical bullion.

Mining Stocks and Streaming Companies

Investing in companies that mine or finance gold and silver operations offers indirect exposure. Returns can be amplified compared to metal prices but carry additional risks tied to business operations and market conditions. These investments may perform well when metals are in demand but can underperform during downturns.

Current Promotion: get your Free Gold IRA Guide Today!

Futures and Options Contracts

For experienced investors, gold and silver futures allow speculation on price movements without owning the metals. These contracts can offer high returns but also carry significant risk, making them unsuitable for most beginners.

Digital Precious Metals and Tokenized Assets

Some platforms offer digital ownership of gold and silver, backed by physical reserves. This allows fractional investing, easy transfers, and online storage. It can be a cost-effective way to access precious metals without managing physical storage.

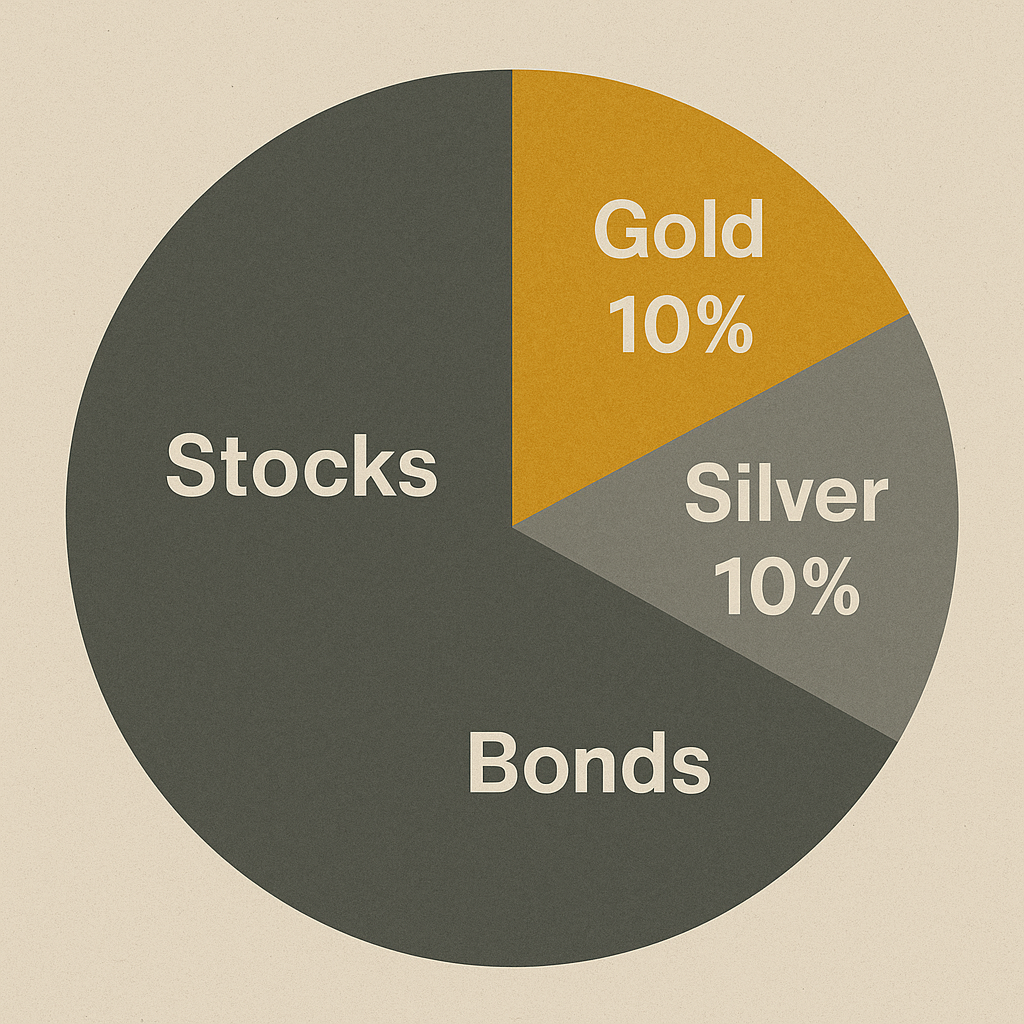

How to Decide Between Gold and Silver (or Both)

The decision depends on budget, risk tolerance, and investment goals. Gold is often preferred for stability and wealth preservation. Silver offers greater growth potential and is more affordable. Many investors choose a combination to balance security and opportunity, creating a portfolio that benefits from the strengths of both metals.

How to Start Investing in Gold and Silver

Starting with precious metals requires careful planning:

Define your investment objectives.

Decide on your allocation between gold, silver, and other assets.

Understand spot prices and dealer premiums.

Work only with trusted dealers and verify authenticity.

A step-by-step plan helps ensure your investment fits within your broader financial strategy.

Spotlight on Hamilton Gold Group

Hamilton Gold Group is a trusted provider in the precious metals market. They offer gold and silver bullion, coins, and IRA rollover services. Their emphasis on transparency, education, and secure storage makes them a valuable resource for beginners who want to invest confidently. Partnering with a reputable dealer can help you avoid common mistakes and gain confidence in your investment decisions.

Current Promotion: Unconditional Buy Back Guarantee

Common Mistakes to Avoid When Investing in Gold and Silver

Focusing only on one metal and missing diversification benefits.

Paying excessive premiums due to lack of price comparison.

Storing metals in unsecured or uninsured locations.

Ignoring the liquidity differences between gold and silver.

Avoiding these pitfalls can protect both your assets and your potential returns.

Long-Term Strategies for Precious Metals Investing

Successful precious metals investors often:

Rebalance their portfolios periodically.

Monitor market trends and economic indicators.

Maintain a balanced allocation with other asset classes.

Use both gold and silver to capture their unique strengths.

Over time, disciplined investing and a willingness to adjust to changing market conditions can make gold and silver valuable long-term holdings.

Conclusion

Gold and silver each bring valuable qualities to an investment portfolio. Gold offers stability and long-term wealth preservation, while silver provides growth potential and affordability. By understanding their differences, exploring various investment methods, and working with trusted sources, you can build a balanced and resilient precious metals strategy. Whether you choose one or both metals, a thoughtful approach can help you achieve your long-term financial goals. Investing in precious metals is not a get-rich-quick strategy, but it can serve as a reliable cornerstone in a diversified portfolio.

Want a more in depth look at buying gold? Check out our new article: How to Buy Gold for Beginners!

FAQ

It depends on your budget and goals. Gold is more stable, while silver is more affordable and has higher volatility.

Yes, silver often experiences larger price swings due to its industrial demand and smaller market size.

Yes, many self-directed IRAs allow for both gold and silver, provided they meet purity requirements.

Options include bank safety deposit boxes, home safes, and insured third-party vaults.

In the United States, both are generally taxed as collectibles, but specific rates may vary.

The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is “Excess Return” which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025: