When it comes to non-traditional or alternative investment options, one of the more successful ones is farmland (arable land). The annual return in the agricultural sector has historically outperformed traditional asset classes such as the S&P 500, Nasdaq, Gold, Real Estate Investment Trusts, and Timber.

One of the platforms that allow you to invest in agricultural commodities, including acres of farmland, is AcreTrader.

In our AcreTrader review, we talk about how this is a way to hold physical farmland directly, but we didn’t talk about the benefits of investing in farmland.

If you’re thinking about trying out the platform and becoming a farmland investor, below are just a few of the reasons why farmland is a good addition to your investment portfolio.

1. Hedge Against Inflation

Inflation is the bane of any investor. It is the gradual erosion of consumer buying power and the slow decrease in the value of the U.S. dollar. Normally, the Federal Reserve looks to keep the average inflation rate at 2% annually, but in recent years, we have experienced an extremely low inflationary environment.

To give you an idea of how inflation works in action, an acre of farmland cost $90 in 1900, whereas in 2000, farmland prices rose to $1,050. This is how inflation works and how it will continue to work.

Agricultural land has demonstrated itself to be extremely resilient in all types of economic conditions, including inflation, much in the same way as gold. This is due to the fact when inflation rises the value of the farmland increases as well.

2. True Diversity in Your Portfolio

At Modest Money, we are firm believers in the power of a diversified portfolio. You need to build a portfolio that’s capable of weathering all market conditions in order to achieve stable returns.

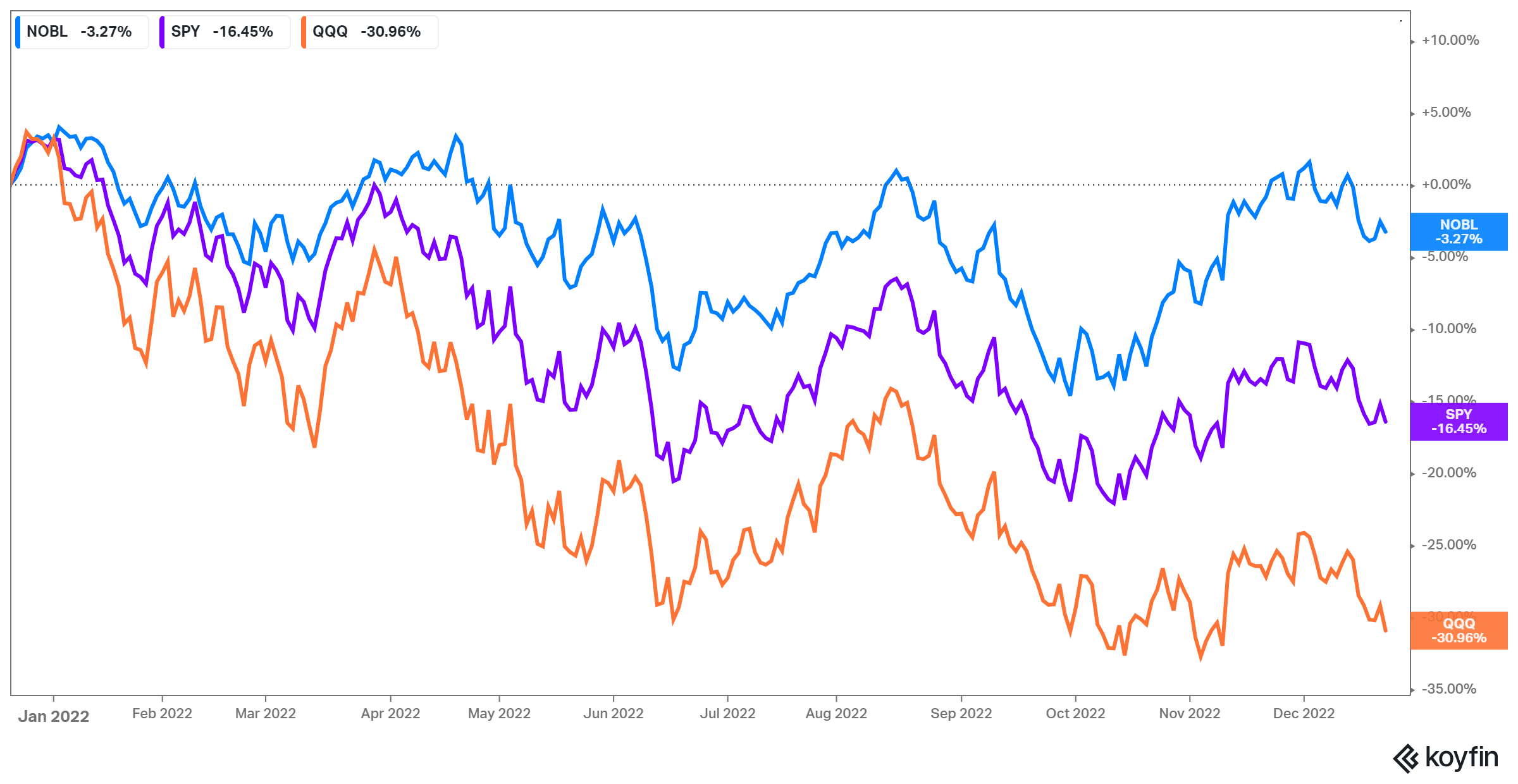

Agricultural land with AcreTrader is especially valuable because it negatively correlates with common investments like stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

Furthermore, since farmland produces food and operates in a different market than other forms of real estate, it only slightly correlates with residential and commercial real estate investments.

When the markets are down is when farmland returns are at their highest, which adds a huge amount of value to anybody’s portfolio.

3. Equity and Dividend Earning Opportunities

AcreTrader pays out to investors in two ways. Firstly, there’s the potential for the farmland itself to grow in value. Growth increases on the equity you hold mean that your investment could spike in value in the coming years.

But even if it doesn’t grow in the near future, these farms are rented out to real people who will proceed to work the land, including the permanent crops and annual row crops. For the privilege of being able to farm, they pay an annual rent. These are your dividends, which means you get a payout every year regardless.

Dividends can be taken out and used as income or they can be reinvested so you can increase your equity holdings.

AcreTrader investing offers two ways to earn with minimal management. You don’t need to know anything about farming to hold this type of investment.

4. Add Stability to Your Portfolio

Every investor would love to nail those solid returns. But every investor needs stability in their assets. Without stability, your money is at risk with every passing day. Speculative land purchases, penny stocks, and cryptocurrency are investments that can yield big returns but may also crash at any point.

Farmland investing is a stable asset because not only does it hedge against inflation it hedges against volatility.

The reason why agricultural land offers such resilience is there’s always a demand for all different types of farmland, including organic farmland. Without farms, there’s no food production, permanent crops, or annual crops, so there’s always an economic demand.

In fact, between now and 2050, global crop demand will increase by 110%, according to one study. It makes sense because as the population expands, the demand for food goes up.

This type of market demand is why agricultural real estate doesn’t correlate with other forms of real estate.

5. The Power of Scarcity

AcreTrader includes only a limited number of potential investment opportunities because available farmland is scarce. Gold is such a popular investment because it’s a finite resource, and the same goes for farmland.

As the population grows and the food demand explodes, there’s going to be even more need for farmland. Just 17% of the country’s land is dedicated to farming, yet agriculture provides $992 billion to the U.S. economy every year.

We strongly recommend considering a farmland investment because it has everything you need for success:

ScarcityDemandHistorical performancePositive returnsInflation resistant

It’s rare for any investment to have all of these traits. Plus, with potential dividends via cash income and general market value increases, this is a solid investment vehicle.

Invest in Farmland

Only since 2012 have ordinary Americans gained access to farmland investment opportunities via the markets. Previously, the farming sector was a protected investment asset class reserved for major wealth funds, institutional investors, and other prestige categories of investors. The only way for normal people to invest in agriculture industries was to buy a farm and work the land themselves.

Thanks to companies such as AceTrader farmland ownership has never been easier or more attainable for everyday investors. Our AcreTrader review is so positive because it’s one of the few avenues the average investor has to add this investment class to their portfolios.

If you want to learn more about AcreTrader or create an account, click on this link. Get Started with AcreTraderRelated Investing Product Reviews: