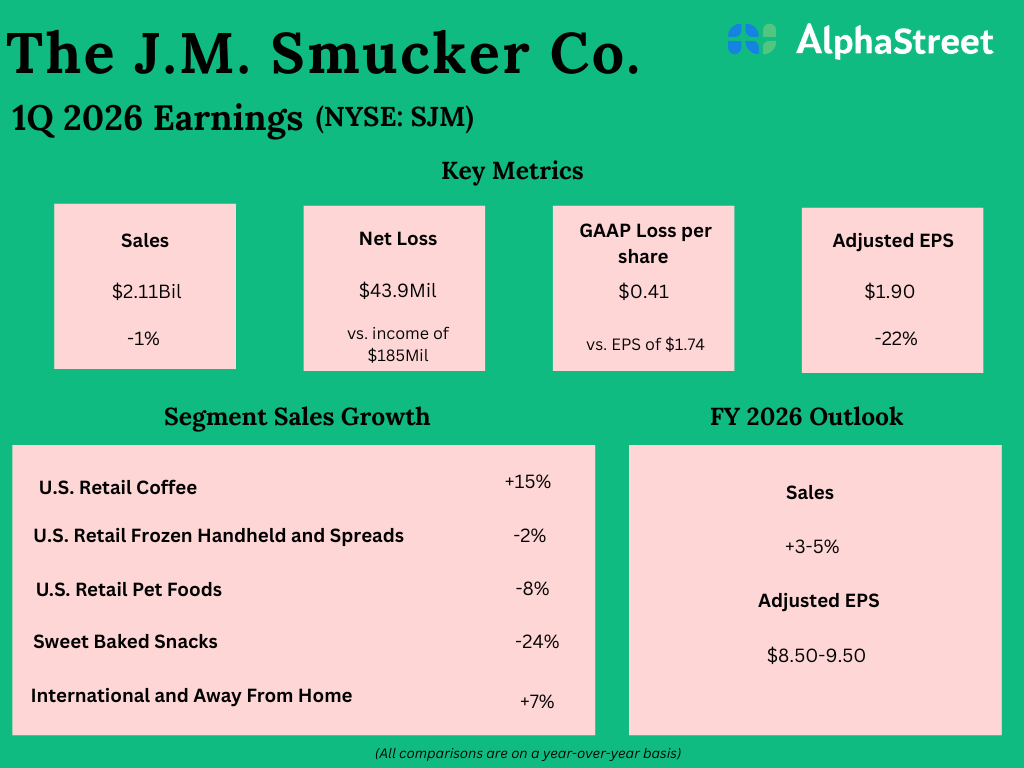

Shares of The J.M. Smucker Co. (NYSE: SJM) were down 4% on Wednesday, after the company reported its earnings results for the first quarter of 2026. The top and bottom line numbers decreased versus the previous year but came in line with estimates. The company revised its outlook for the full year based on its quarterly performance.

Sales and earnings decrease

Net sales decreased 1% year-over-year to $2.11 billion but surpassed expectations of $2.10 billion. Comparable sales increased 2%, driven mainly by higher pricing for coffee. On a GAAP basis, the company reported a loss of $0.41 per share. On an adjusted basis, earnings per share decreased 22% YoY to $1.90 but came in line with estimates.

Business performance

In Q1, SJM saw sales decrease across most of its segments, barring Coffee and International. Sales in the US Retail Coffee segment increased 15% to $717.2 million, driven mainly by higher pricing. Volume/mix was down, reflecting decreases for the Dunkin and Folgers brands, partly offset by an increase for the Café Bustelo brand. Café Bustelo saw sales growth of 36% in the quarter. The company expects the coffee category to remain resilient, despite inflationary pressures.

Sales in the US Retail Frozen Handheld and Spreads segment decreased 2% to $484.7 million. Volume/mix was negatively impacted by decreases in peanut butter and fruit spreads, partly offset by an increase for Uncrustables sandwiches.

In US Retail Pet Foods, sales declined 8% to $368 million. This segment saw decreases in dog snacks due to a moderation in demand caused by discretionary income pressures. At the same time, cat food continues to see momentum helped by a growth in pet population. A recent rebound in the dog snacks category provides optimism for the portfolio, while the trend of pet humanization is expected to benefit the segment as a whole.

The Sweet Baked Snacks segment saw sales decrease by 24% to $253.2 million. Comparable sales were down 10%. This segment was impacted by pressures on consumers’ discretionary spend. However, the company is seeing improved traffic trends in the convenience store channel and stable demand for its breakfast products.

Sales in International and Away From Home rose 7% to $290.2 million. Comparable sales were also up 7%. Comparable sales for the Away From Home business increased 14%, driven by coffee and Uncrustables while comparable sales for the International business decreased 6%, reflecting a decrease in the coffee portfolio.

Updated outlook

SJM updated its outlook for fiscal year 2026 and now expects net sales to grow 3-5% YoY versus the prior expectation of 2-4%. Comparable net sales are expected to increase approx. 4.5-6.5%. Adjusted EPS is expected to range between $8.50-9.50.