Up to date on December ninth, 2022 by Bob Ciura

Month-to-month dividend shares have prompt attraction for a lot of revenue buyers. Shares that pay their dividends every month supply extra frequent payouts than conventional quarterly or semi-annual dividend payers.

For that reason, we created a full checklist of 49 month-to-month dividend shares.

You possibly can obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink under:

As well as, shares which have excessive dividend yields are additionally engaging for revenue buyers.

With the common S&P 500 yield hovering round 1.6%, buyers can generate rather more revenue with high-yield shares.

Screening for month-to-month dividend shares that even have excessive dividend yields makes for an interesting mixture.

This text will checklist the 20 highest-yielding month-to-month dividend shares.

Desk Of Contents

The next 20 month-to-month dividend shares have excessive dividend yields above 5%. Shares are listed by their dividend yields, from lowest to highest.

You possibly can immediately soar to a person part of the article by using the hyperlinks under:

Excessive-Yield Month-to-month Dividend Inventory #20: Gladstone Capital (GLAD)

Gladstone Capital is a enterprise growth firm, or BDC, that primarily invests in small and medium companies. These investments are made by way of a wide range of fairness (10% of portfolio) and debt devices (90% of portfolio), typically with very excessive yields. Mortgage dimension is often within the $7 million to $30 million vary and has phrases as much as seven years. The BDC’s acknowledged goal is to generate revenue it could actually distribute to its shareholders.

Supply: Investor Presentation

Gladstone reported fourth quarter and full-year earnings on November 14th, 2022, and outcomes have been considerably blended.

The belief reported internet funding revenue per-share of twenty-two cents, which was a penny forward of expectations. Whole funding revenue was $15.94 million, up 11% year-over-year, however missed expectations very barely. The belief invested $59.6 million in 4 new portfolio firms, and $26.4 million in present portfolio firms. Gladstone noticed $64.2 million in internet new originations accounting for repayments and internet proceeds.

Click on right here to obtain our most up-to-date Positive Evaluation report on GLAD (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #19: Cross Timbers Royalty Belief (CRT)

Cross Timbers is an oil and gasoline belief (about 50/50), arrange in 1991 by XTO Power. Unit holders have a 90% internet revenue curiosity in producing properties in Texas, Oklahoma, and New Mexico; and a 75% internet revenue curiosity in working curiosity properties in Texas and Oklahoma.

The belief’s belongings are static in that no additional properties could be added. The belief has no operations however is merely a move–by means of automobile for the royalties. CRT had royalty revenue of $5.3 million in 2020 and $7.4 million in 2021.

In mid-November, CRT reported (11/14/22) monetary outcomes for the third quarter of fiscal 2022. Manufacturing of oil decreased 12% as a result of timing of gross sales and pure decline whereas manufacturing of gasoline edged up 1% over final 12 months’s quarter.

The typical realized costs of oil and gasoline grew 63% because of the sanctions of western nations on Russia, which have despatched the benchmark costs of oil and gasoline to multi-year highs. Consequently, distributable money move (DCF) per unit jumped 63%, from $0.38 to $0.62. The belief doesn’t present any steering for the working 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on CRT (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #18: SL Inexperienced Realty (SLG)

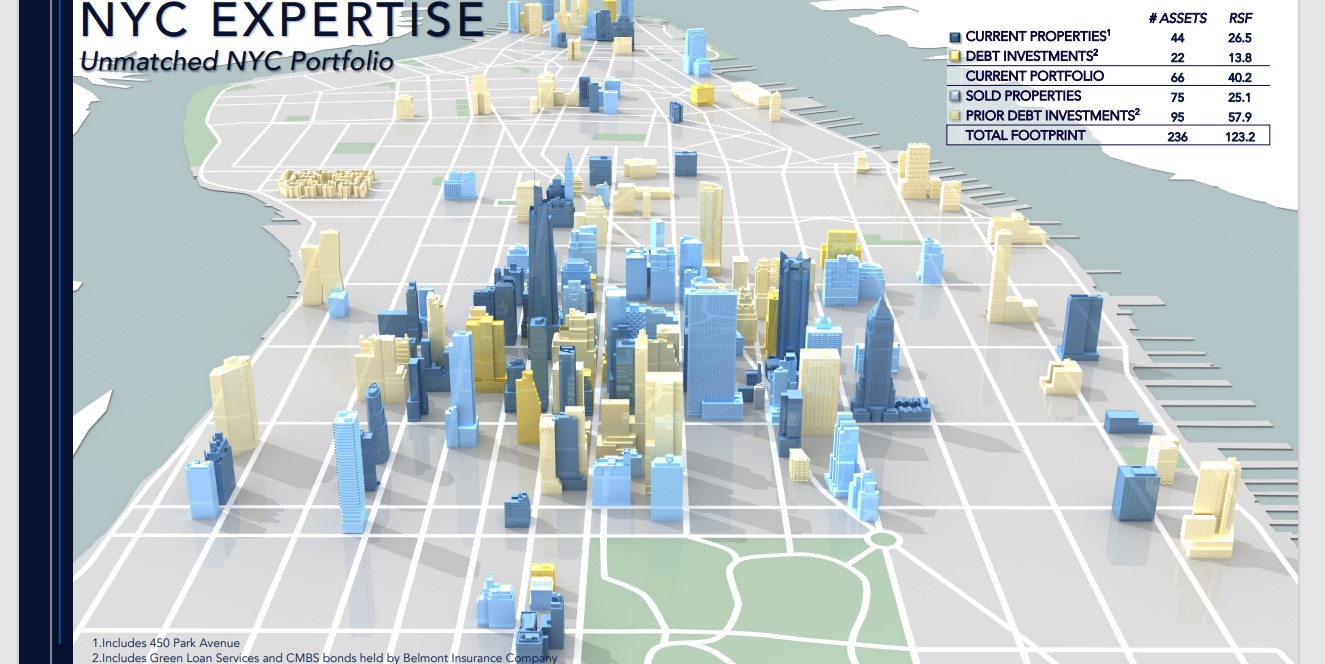

SL Inexperienced Realty Corp was fashioned in 1980. It’s an built-in actual property funding belief (REIT) that’s centered on buying, managing, and maximizing the worth of Manhattan industrial properties. It’s Manhattan’s largest workplace landlord, and presently owns 73 buildings totaling 35 million sq. ft.

Supply: Investor Presentation

In mid-October, SLG reported (10/19/2022) monetary outcomes for the third quarter of fiscal 2022. Its occupancy price edged up from 92.0% on the finish of the earlier quarter to 92.1%, however its same-store internet working revenue dipped -0.5% over the prior 12 months’s quarter.

Given additionally the detrimental impact of some belongings gross sales, its funds from operations (FFO) per share decreased -7% over the prior 12 months’s quarter, from $1.78 to $1.66. The REIT exceeded the analysts’ consensus by $0.01. In the course of the quarter, SLG signed 32 Manhattan workplace leases for a complete of 930,232 sq. ft.

Click on right here to obtain our most up-to-date Positive Evaluation report on SLG (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #17: Technology Revenue Properties (GIPR)

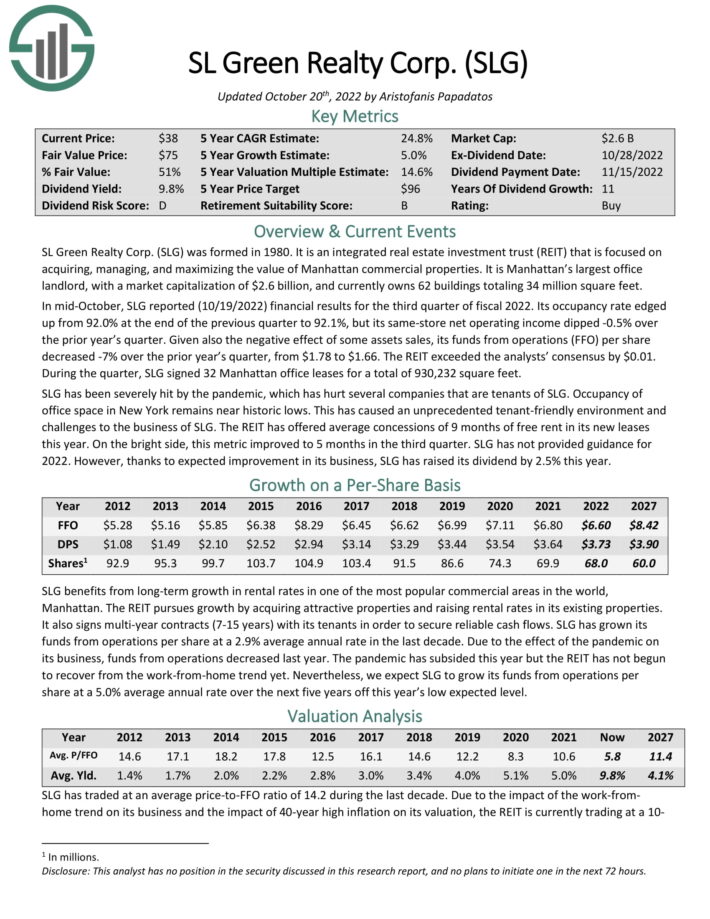

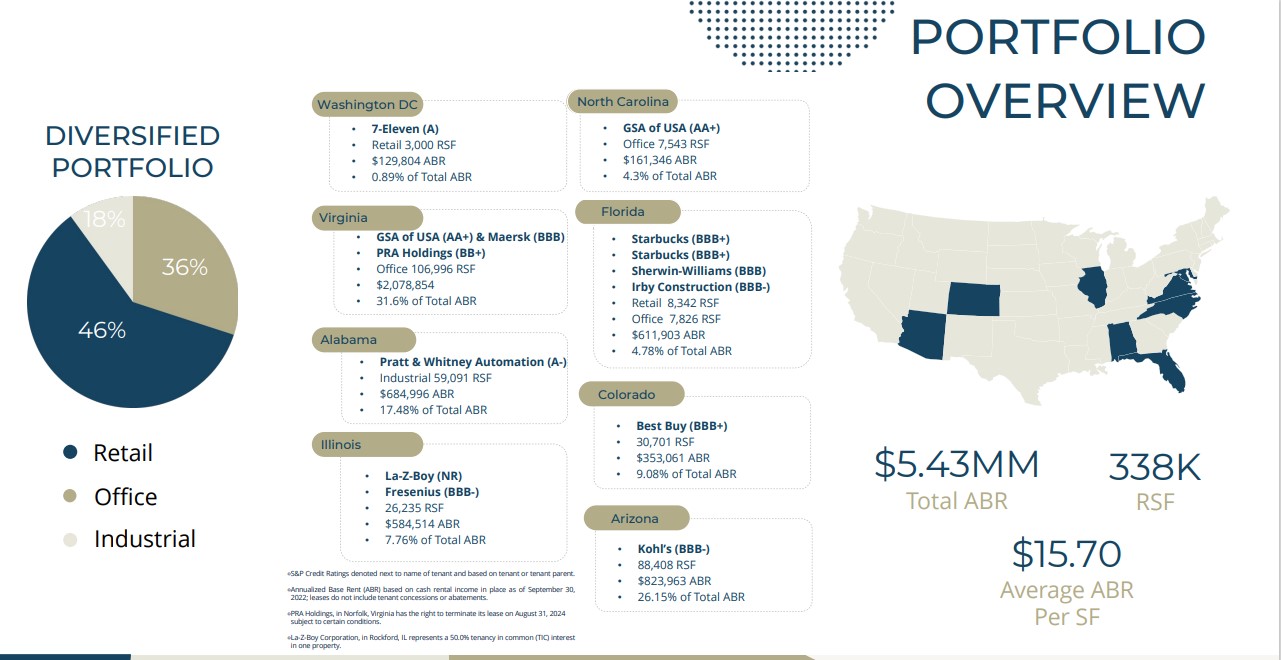

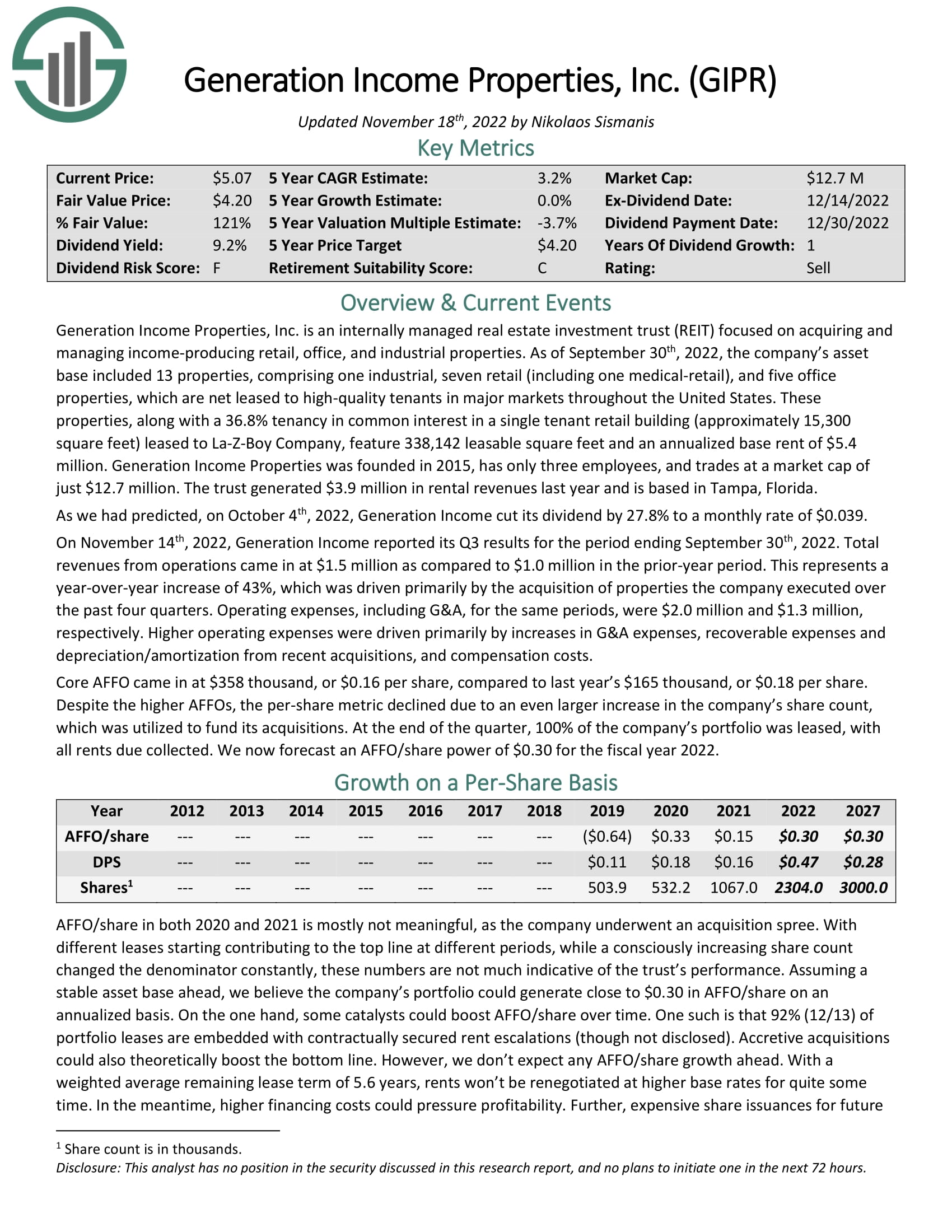

Technology Revenue Properties is an internally managed REIT centered on buying and managing income-producing retail, workplace, and industrial properties.

These properties characteristic 338,000 leasable sq. ft and an annualized base lease of $5.43 million. The belief additionally owned a 36.8% tenancy in widespread curiosity in a single tenant retail constructing (roughly 15,300 sq. ft) leased to La-Z-Boy Firm. The belief generated $3.9 million in rental revenues final 12 months and relies in Tampa, Florida.

Supply: Investor Presentation

On November 14th, 2022, Technology Revenue reported its Q3 outcomes for the interval ending September thirtieth, 2022. Whole revenues from operations got here in at $1.5 million as in comparison with $1.0 million within the prior-year interval. This represents a year-over-year improve of 43%, which was pushed primarily by the acquisition of properties the corporate executed over the previous 4 quarters.

Core AFFO got here in at $358 thousand, or $0.16 per share, in comparison with final 12 months’s $165 thousand, or $0.18 per share. Regardless of the upper AFFOs, the per-share metric declined as a result of a good bigger improve within the firm’s share rely, which was utilized to fund its acquisitions. On the finish of the quarter, 100% of the corporate’s portfolio was leased, with all rents due collected.

Click on right here to obtain our most up-to-date Positive Evaluation report on GIPR (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #16: Prospect Capital (PSEC)

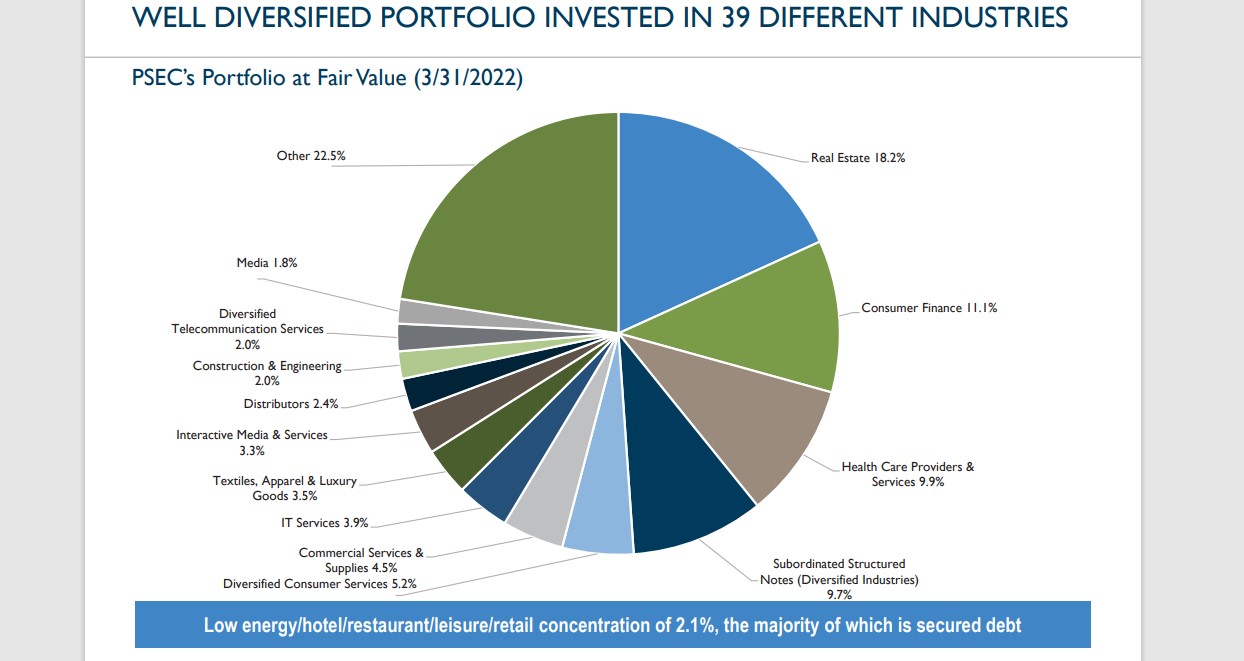

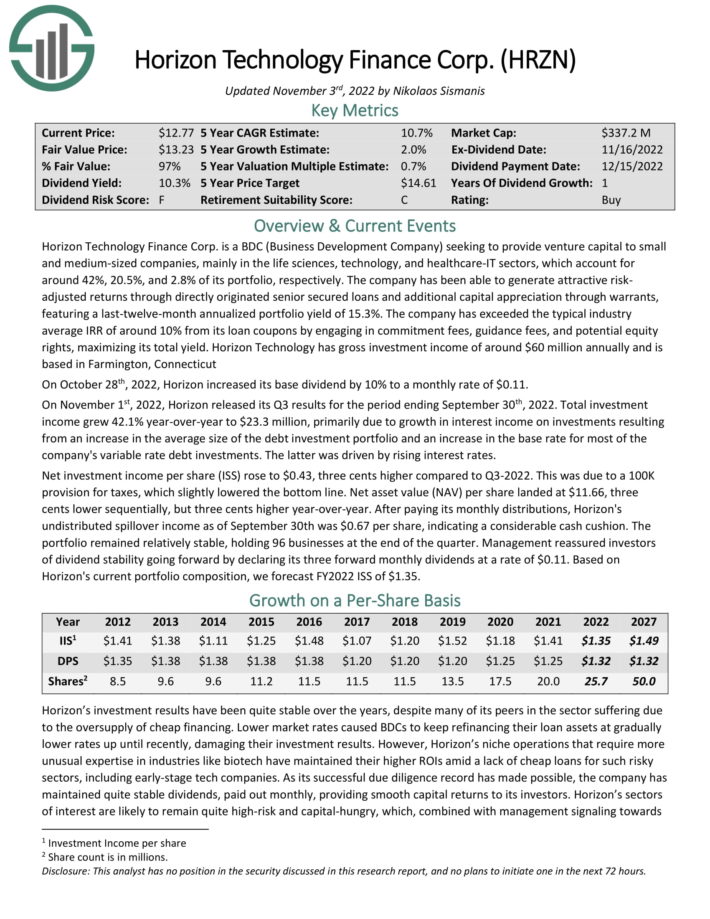

Prospect Capital Company is BDC that gives non-public debt and personal fairness to center–market firms within the U.S. The corporate focuses on direct lending to proprietor–operated firms, in addition to sponsor–backed transactions.

Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments. The corporate produces about $680 million in annual income.

Supply: Investor Presentation

Prospect reported fourth quarter and full-year earnings on August twenty ninth, 2022, and outcomes have been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to 21 cents, which was three cents forward of estimates. Whole funding revenue soared 17% year-over-year to $185 million, and beat expectations by $8 million.

The corporate’s beat was despite the truth that originations declined. Originations have been $477 million in This autumn, down from $565 million in Q3. Whole repayments through the quarter have been down as effectively from Q3, falling from $185 million to $151 million.

Working bills have been $95 million, flat with Q3, however up from $84 million within the year-ago interval. Internet funding revenue per share of 21 cents was up from 20 cents in Q3 and 19 cents in final 12 months’s This autumn. Internet asset worth of $10.48 was down from $10.81 in Q3.

Click on right here to obtain our most up-to-date Positive Evaluation report on PSEC (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #15: PennantPark Floating Charge (PFLT)

PennantPark Floating Charge Capital Ltd. is a BDC that makes secondary direct, debt, fairness, and mortgage investments.

The fund also goals to speculate by means of floating price loans in non-public or thinly traded or small–cap, public center market firms, fairness securities, most popular inventory, widespread inventory, warrants or choices obtained in reference to debt investments or by means of direct investments.

Supply: Investor Presentation

It typically invests in the US and to a restricted extent non–U.S. firms. It goals to spend money on firms not rated by nationwide score businesses.

On November sixteenth, 2022 PennantPark Floating Charge Capital Ltd. introduced outcomes for the Fourth Quarter and Fiscal 12 months Ended September 30, 2022. Funding revenue was $28.8 million, up from $21.6 million within the year-ago quarter. Funding revenue for the fiscal 12 months ended September 30, 2022 was $105.5 million and was attributable to $89.1 million from first lien secured debt and $16.4 million from different investments.

Funding revenue for the 12 months ended September 30, 2021 was $82.7 million and was attributable to $72.1 million from first lien secured debt and $10.6 million from different investments, indicating that PFLT generated appreciable progress year-over-year.

The rise in funding revenue in comparison with the identical intervals within the prior 12 months was primarily as a result of a rise in LIBOR and SOFR base charges and a rise within the dimension of the belief’s interest-bearing portfolio.

Click on right here to obtain our most up-to-date Positive Evaluation report on PFLT (preview of web page 1 of three proven under):

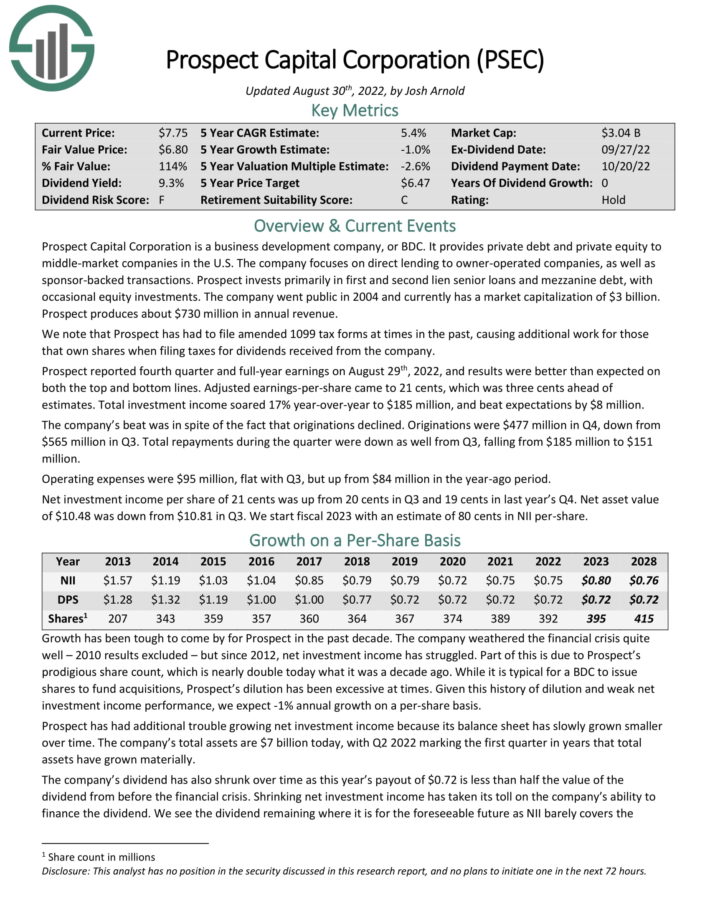

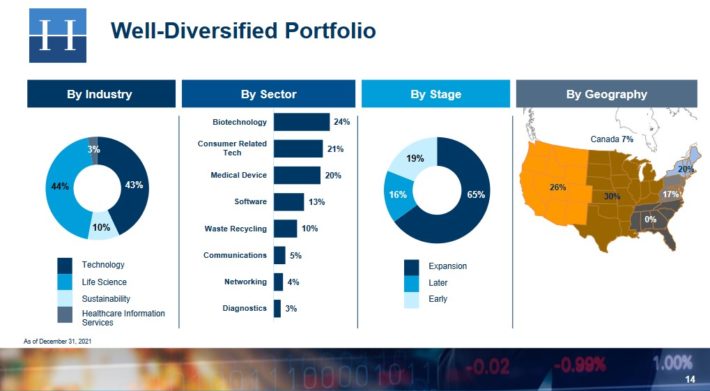

Excessive-Yield Month-to-month Dividend Inventory #14: Horizon Know-how (HRZN)

Horizon Know-how Finance Corp. is a BDC that gives enterprise capital to small and medium–sized firms within the expertise, life sciences, and healthcare–IT sectors.

Supply: Investor Presentation

The corporate has generated engaging danger–adjusted returns by means of immediately originated senior secured loans and extra capital appreciation by means of warrants, featuring a final–9–month annualized portfolio yield of 14.7%.

The corporate has exceeded the standard trade common IRR of round 10% from its mortgage coupons by participating in dedication charges, steering charges, and potential fairness rights, maximizing its complete yield. Horizon Know-how has gross funding revenue of round $47 million yearly.

On October twenty eighth, 2022, Horizon elevated its base dividend by 10% to a month-to-month price of $0.11.

On November 1st, 2022, Horizon launched its Q3 outcomes for the interval ending September thirtieth, 2022. Whole funding revenue grew 42.1% year-over-year to $23.3 million, primarily as a result of progress in curiosity revenue on investments ensuing from a rise within the common dimension of the debt funding portfolio and a rise within the base price for many of the firm’s variable price debt investments. The latter was pushed by rising rates of interest. Internet funding revenue per share (ISS) rose to $0.43, three cents greater in comparison with Q3-2022.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRZN (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #13: Sabine Royalty Belief (SBR)

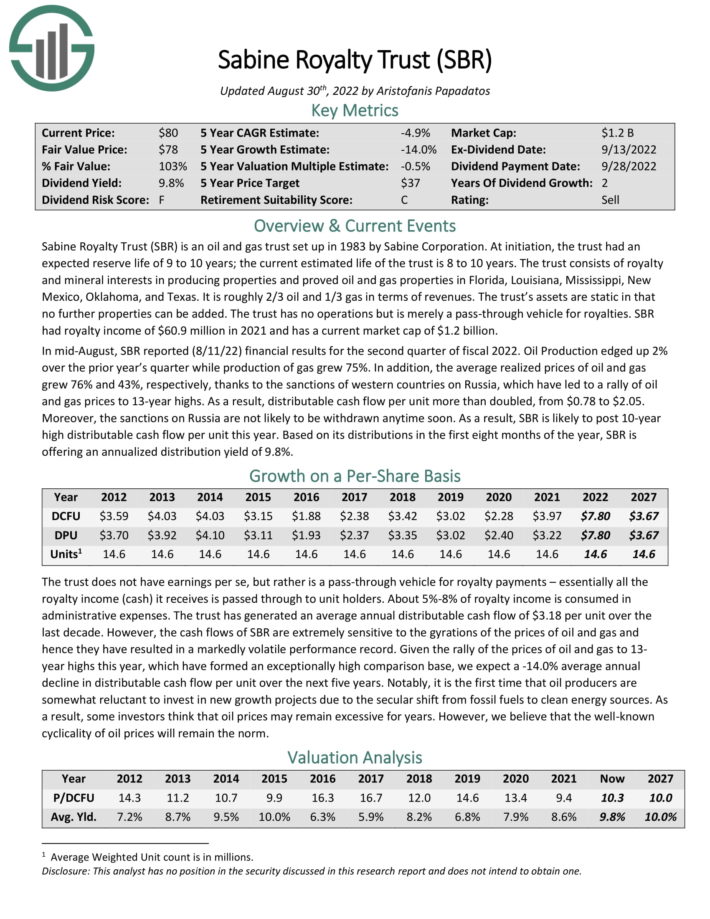

Sabine Royalty Belief is an oil and gasoline belief arrange in 1983 by Sabine Company. At initiation, the belief had an anticipated reserve lifetime of 9 to 10 years; the present estimated lifetime of the belief is 8 to 10 years.

The belief consists of royalty and mineral pursuits in producing properties and proved oil and gasoline properties in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas. It’s roughly 2/3 oil and 1/3 gasoline by way of revenues.

The belief’s belongings are static in that no additional properties could be added. The belief has no operations however is merely a pass-through automobile for royalties. SBR had royalty revenue of $60.9 million in 2021.

In mid-August, SBR reported (8/11/22) monetary outcomes for the second quarter of fiscal 2022. Oil Manufacturing edged up 2% over the prior 12 months’s quarter whereas manufacturing of gasoline grew 75%. As well as, the common realized costs of oil and gasoline grew 76% and 43%, respectively, because of the sanctions of western nations on Russia, which have led to a rally of oil and gasoline costs to 13-year highs. Consequently, distributable money move per unit greater than doubled, from $0.78 to $2.05.

Furthermore, the sanctions on Russia should not prone to be withdrawn anytime quickly. Consequently, SBR is prone to publish 10-year excessive distributable money move per unit this 12 months. Based mostly on its distributions within the first eight months of the 12 months, SBR is providing an annualized distribution yield of 9.8%.

Click on right here to obtain our most up-to-date Positive Evaluation report on SBR (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #12: SLR Funding Corp. (SLRC)

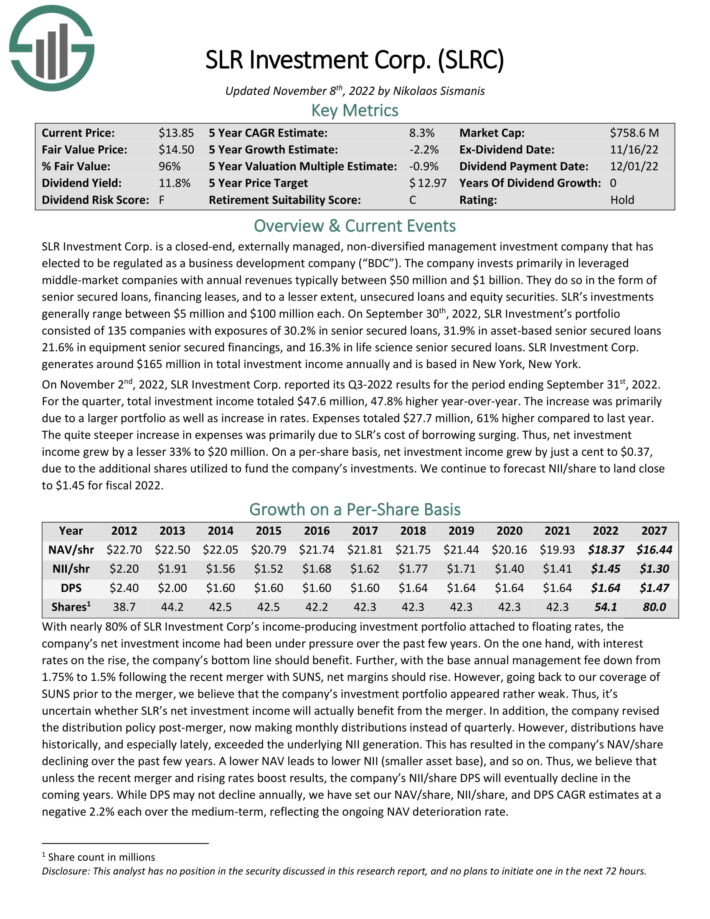

SLRC is a Enterprise Improvement Firm that primarily invests in U.S. center market firms. The corporate has 5 core enterprise items which embrace money move, asset-based, life science lending, gear finance, and company leasing.

The belief’s debt investments primarily consist of money move senior secured loans, together with first lien and second lien debt devices. It additionally affords asset-based loans together with senior secured loans collateralized on a primary lien foundation by present belongings.

On November 2nd, 2022, SLR Funding Corp. reported its Q3-2022 outcomes for the interval ending September thirty first, 2022. For the quarter, complete funding revenue totaled $47.6 million, 47.8% greater year-over-year. The rise was primarily as a result of a bigger portfolio in addition to improve in charges. Bills totaled $27.7 million, 61% greater in comparison with final 12 months.

The steep improve in bills was primarily as a result of SLR’s price of borrowing surging. Thus, internet funding revenue grew by a lesser 33% to $20 million. On a per-share foundation, internet funding revenue grew by only a cent to $0.37, because of the extra shares utilized to fund the corporate’s investments.

Click on right here to obtain our most up-to-date Positive Evaluation report on SLRC (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #11: Dynex Capital (DX)

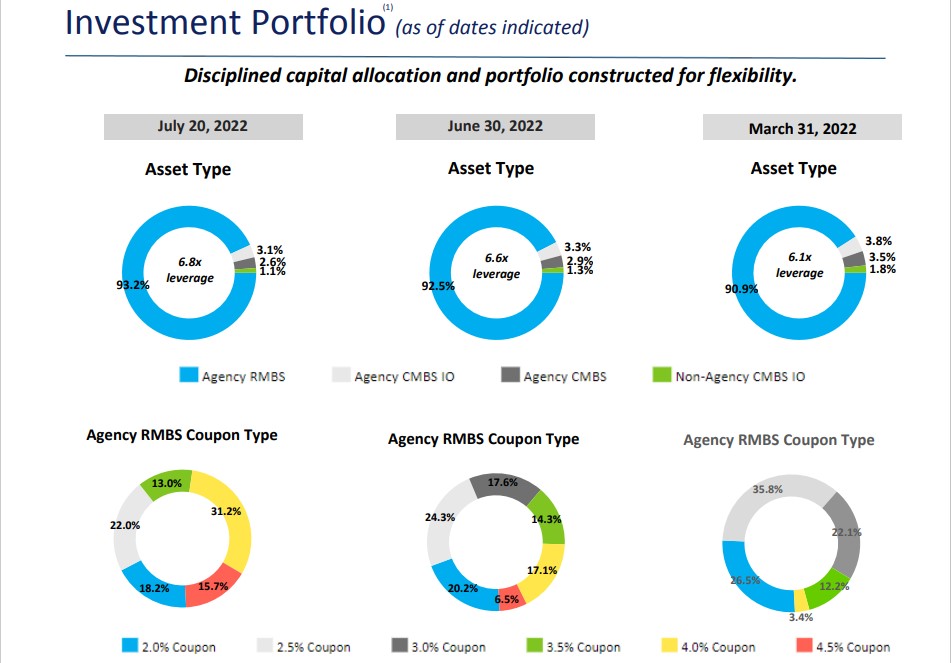

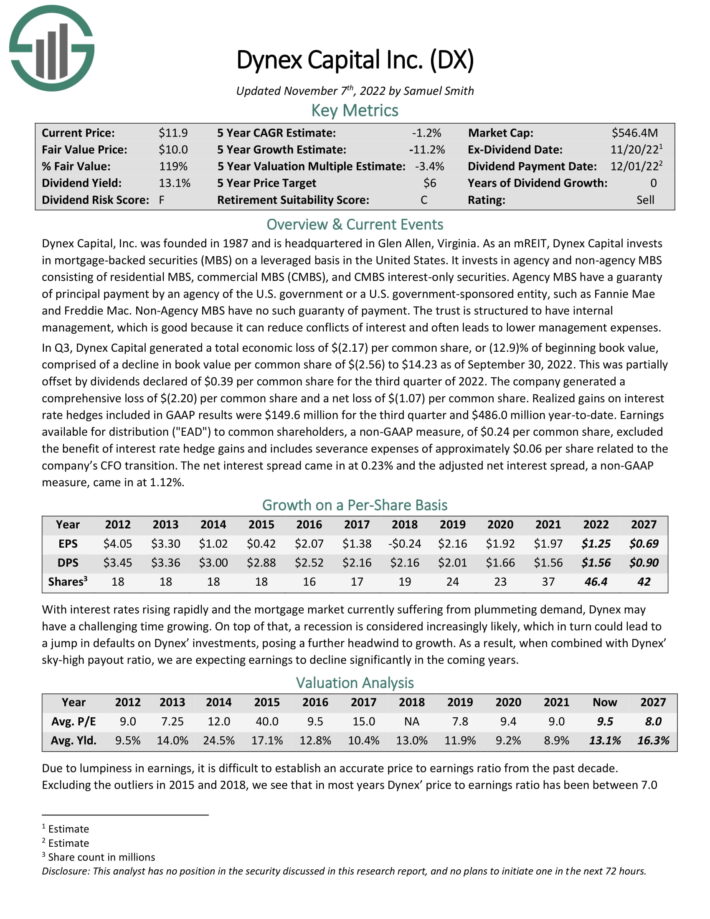

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged foundation in the US. It invests in company and non–company MBS consisting of residential MBS, industrial MBS (CMBS), and CMBS curiosity–solely securities.

Supply: Investor Presentation

Company MBS have a warranty of principal cost by an company of the U.S. authorities or a U.S. authorities–sponsored entity, comparable to Fannie Mae and Freddie Mac. Non–Company MBS don’t have any such warranty of cost.

In Q3, Dynex Capital generated a complete financial lack of $(2.17) per widespread share, or (12.9)% of starting e-book worth, comprised of a decline in e-book worth per widespread share of $(2.56) to $14.23 as of September 30, 2022. This was partially offset by dividends declared of $0.39 per widespread share for the third quarter of 2022.

The corporate generated a complete lack of $(2.20) per widespread share and a internet lack of $(1.07) per widespread share. Realized features on rate of interest hedges included in GAAP outcomes have been $149.6 million for the third quarter and $486.0 million year-to-date.

Earnings accessible for distribution (“EAD”) to widespread shareholders, a non-GAAP measure, of $0.24 per widespread share, excluded the advantage of rate of interest hedge features and contains severance bills of roughly $0.06 per share associated to the corporate’s CFO transition. The online curiosity unfold got here in at 0.23% and the adjusted internet curiosity unfold, a non-GAAP measure, got here in at 1.12%.

Click on right here to obtain our most up-to-date Positive Evaluation report on DX (preview of web page 1 of three proven under):

Excessive-Yield Month-to-month Dividend Inventory #10: Permianville Royalty Belief (PVL)

Permianville Royalty Belief is an oil and pure gasoline royalty belief. It owns a internet earnings curiosity representing the best to obtain 80% of the online earnings from the sale of oil and pure gasoline manufacturing from numerous oil and gasoline properties positioned in Texas, Louisiana, and New Mexico.

The corporate was previously often called Enduro Royalty Belief and adjusted its identify to Permianville Royalty Belief in September 2018. As oil and gasoline royalty trusts are intently correlated to grease and gasoline costs, royalty trusts like PVL are basically a guess on commodity costs.

Excessive-Yield Month-to-month Dividend Inventory #9: Ellington Monetary (EFC)

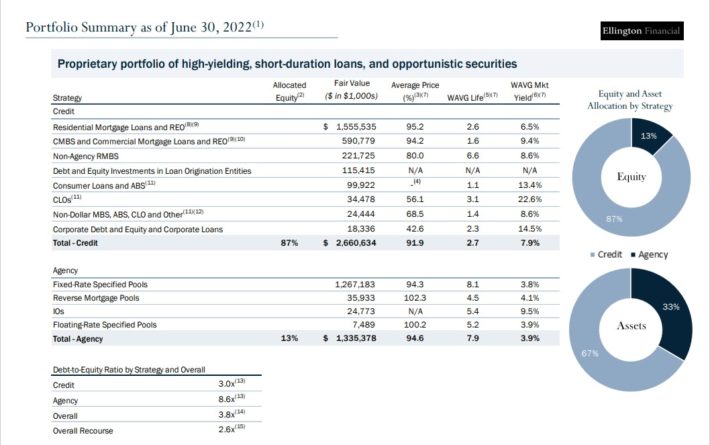

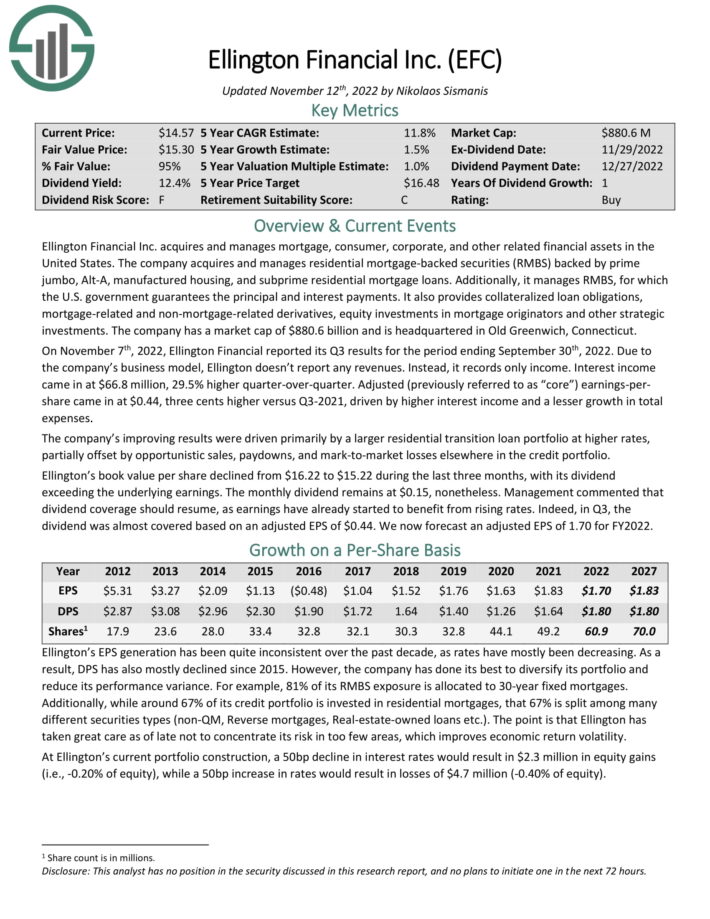

Ellington Monetary Inc. acquires and manages mortgage, shopper, company, and different associated monetary belongings within the United States. The corporate purchases and manages residential mortgage–backed securities (RMBS) backed by prime jumbo, Alt–A, manufactured housing, and subprime residential mortgage loans.

Moreover, it manages RMBS, for which the U.S. authorities ensures the principal and curiosity payments. It additionally supplies collateralized mortgage obligations, mortgage–associated and non–mortgage–associated derivatives, fairness investments in mortgage originators and different strategic investments.

Supply: Investor Presentation

On November seventh, 2022, Ellington Monetary reported its Q3 outcomes for the interval ending September thirtieth, 2022. As a result of firm’s enterprise mannequin, Ellington doesn’t report any revenues. As a substitute, it information solely revenue. Curiosity revenue got here in at $66.8 million, 29.5% greater quarter-over-quarter. Adjusted (beforehand known as “core”) earnings-pershare got here in at $0.44, three cents greater versus Q3-2021, pushed by greater curiosity revenue and a lesser progress in complete bills.

The corporate’s bettering outcomes have been pushed primarily by a bigger residential transition mortgage portfolio at greater charges, partially offset by opportunistic gross sales, paydowns, and mark-to-market losses elsewhere within the credit score portfolio. Ellington’s e-book worth per share declined from $16.22 to $15.22 over the past three months, with its dividend exceeding the underlying earnings.

Click on right here to obtain our most up-to-date Positive Evaluation report on EFC (preview of web page 1 of three proven under):

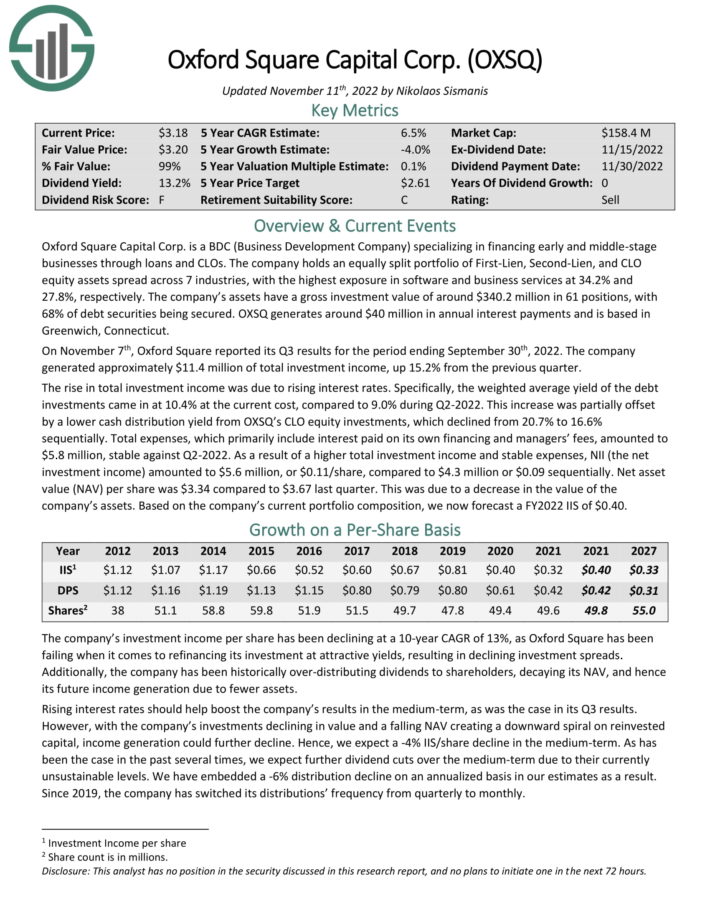

Excessive-Yield Month-to-month Dividend Inventory #8: Oxford Sq. Capital (OXSQ)

Oxford Sq. Capital Corp. is a BDC specializing in financing early and center–stage companies by means of loans and CLOs.

The firm holds an equally cut up portfolio of First–Lien, Second–Lien, and CLO fairness assets unfold throughout 8 industries, with the very best publicity in enterprise companies and healthcare, at 36% and 25%, respectively.

On November seventh, Oxford Sq. reported its Q3 outcomes for the interval ending September thirtieth, 2022. The corporate generated roughly $11.4 million of complete funding revenue, up 15.2% from the earlier quarter. The rise in complete funding revenue was as a result of rising rates of interest.

Particularly, the weighted common yield of the debt investments got here in at 10.4% on the present price, in comparison with 9.0% throughout Q2-2022. This improve was partially offset by a decrease money distribution yield from OXSQ’s CLO fairness investments, which declined from 20.7% to 16.6% sequentially.

Because of the next complete funding revenue and secure bills, NII (the online funding revenue) amounted to $5.6 million, or $0.11/share, in comparison with $4.3 million or $0.09 sequentially. Internet asset worth (NAV) per share was $3.34 in comparison with $3.67 final quarter. This was as a result of a lower within the worth of the corporate’s belongings.

Click on right here to obtain our most up-to-date Positive Evaluation report on OXSQ (preview of web page 1 of three proven under):

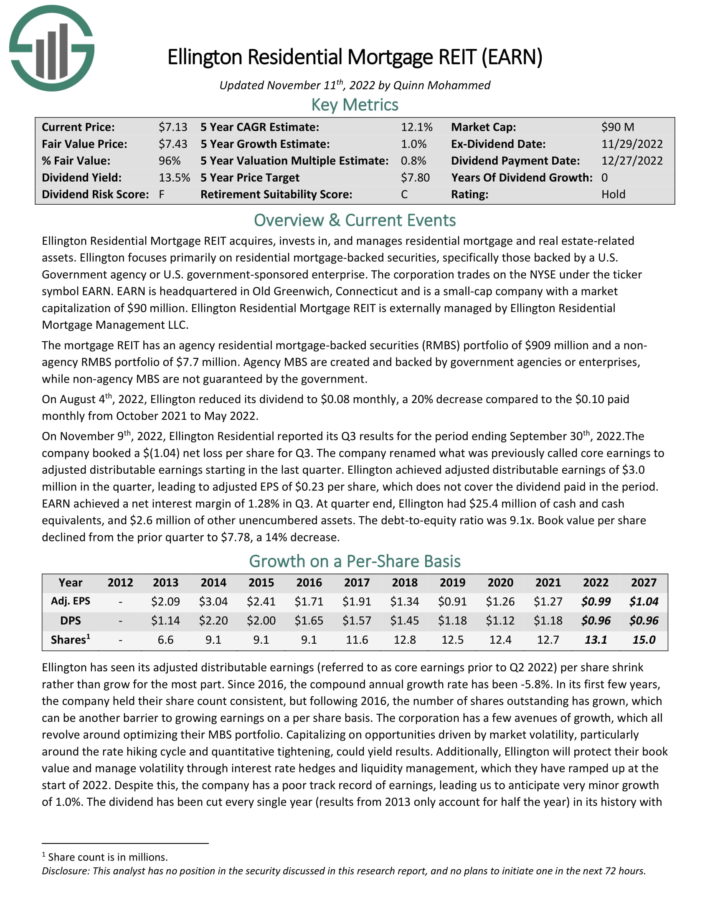

Excessive-Yield Month-to-month Dividend Inventory #7: Ellington Residential Mortgage REIT (EARN)

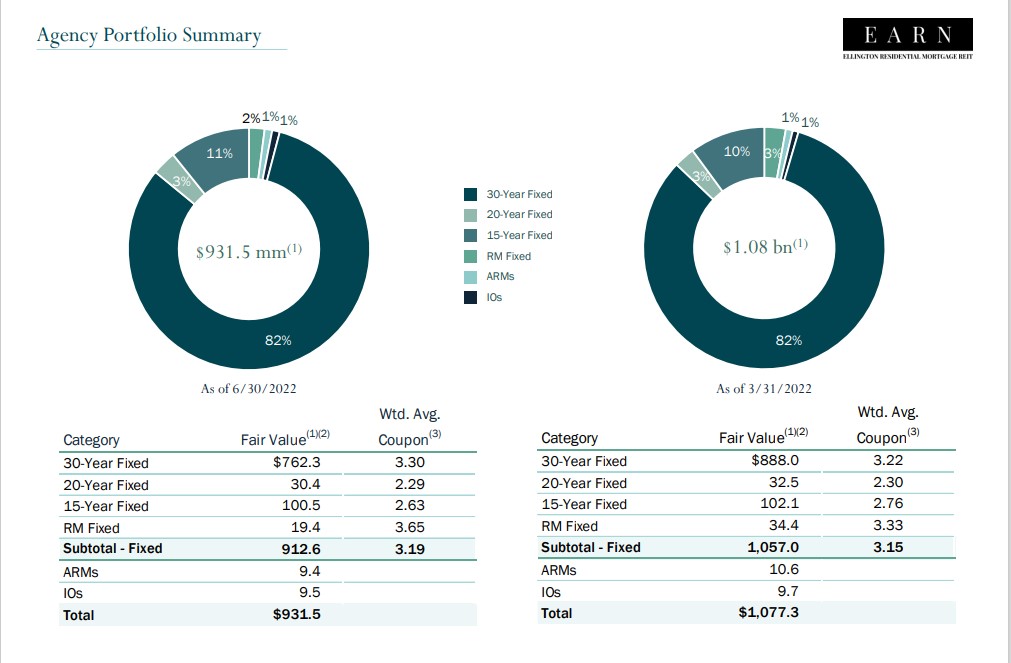

Ellington Residential Mortgage REIT acquires, invests in, and manages residential mortgage and actual property associated belongings. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise. Company MBS are created and backed by authorities businesses or enterprises, whereas non-agency MBS are not assured by the federal government.

Supply: Investor Presentation

On November ninth, 2022, Ellington Residential reported its Q3 outcomes for the interval ending September thirtieth, 2022. The corporate booked a $(1.04) internet loss per share for Q3. The corporate renamed what was beforehand referred to as core earnings to adjusted distributable earnings beginning within the final quarter.

Ellington achieved adjusted distributable earnings of $3.0million within the quarter, resulting in adjusted EPS of $0.23 per share, which doesn’t cowl the dividend paid within the interval.

EARN achieved a internet curiosity margin of 1.28% in Q3. At quarter finish, Ellington had $25.4 million of money and money equivalents, and $2.6 million of different unencumbered belongings. The debt-to-equity ratio was 9.1x. E book worth per share declined from the prior quarter to $7.78, a 14% lower.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven under):

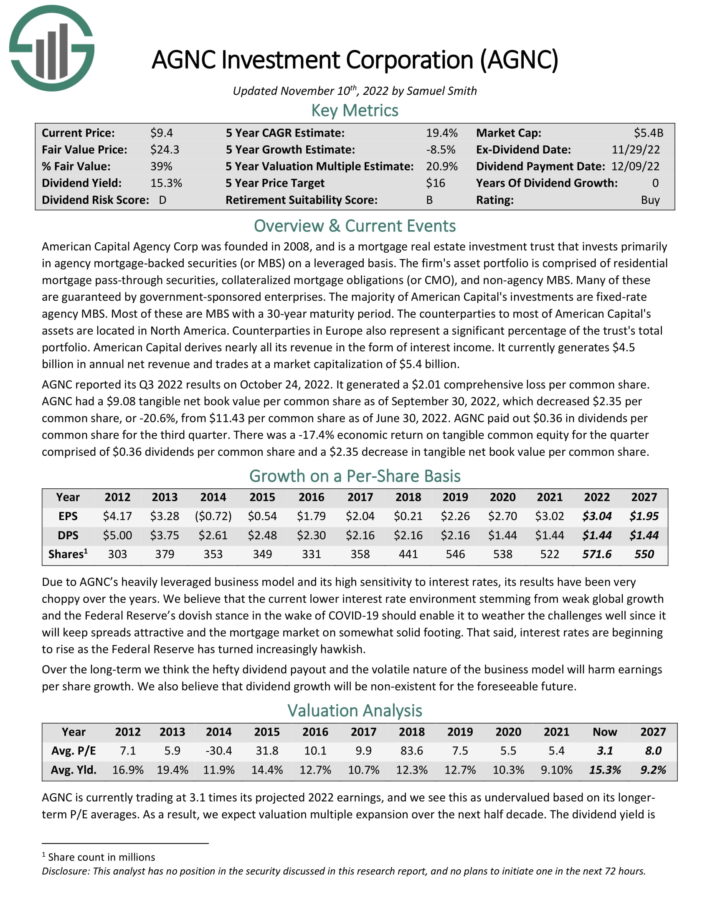

Excessive-Yield Month-to-month Dividend Inventory #6: AGNC Funding Company (AGNC)

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage move–by means of securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

Nearly all of American Capital’s investments are mounted–price company MBS. Most of those are MBS with a 30–12 months maturity interval. American Capital derives practically all its income within the type of curiosity revenue.

AGNC reported its Q3 2022 outcomes on October 24, 2022. It generated a $2.01 complete loss per widespread share. AGNC had a $9.08 tangible internet e-book worth per widespread share as of September 30, 2022, which decreased $2.35 per widespread share, or -20.6%, from $11.43 per widespread share as of June 30, 2022.

AGNC paid out $0.36 in dividends per widespread share for the third quarter. There was a -17.4% financial return on tangible widespread fairness for the quarter comprised of $0.36 dividends per widespread share and a $2.35 lower in tangible internet e-book worth per widespread share.

We anticipate 17.7% annual returns for AGNC, made up of the 14.5% dividend yield, detrimental EPS progress of -0.9%, and a small increase from a rising P/FFO a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGNC (preview of web page 1 of three proven under):

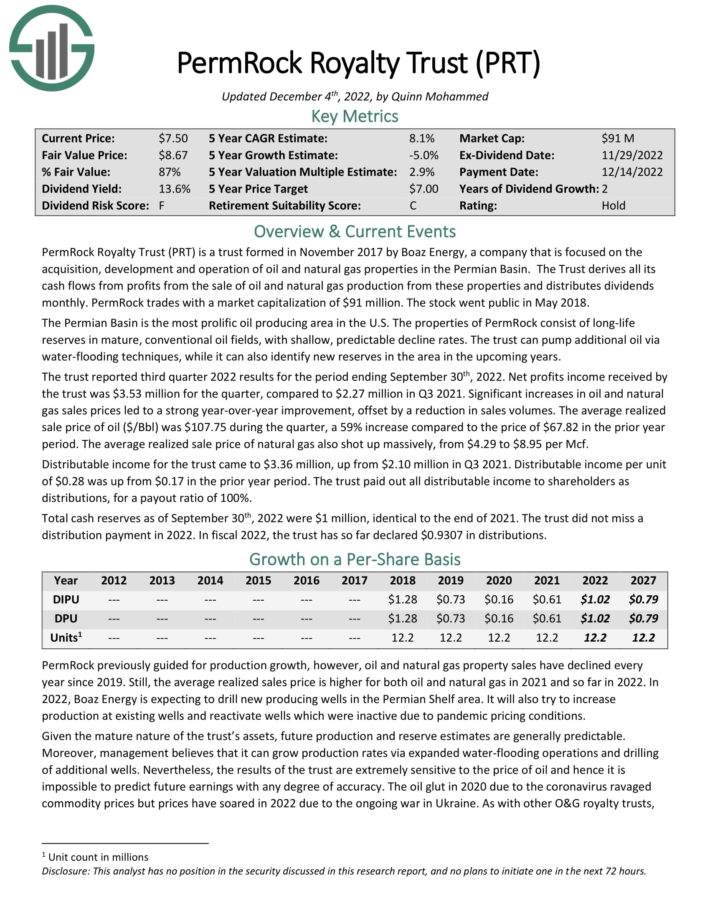

Excessive-Yield Month-to-month Dividend Inventory #5: PermRock Royalty Belief (PRT)

PermRock Royalty Belief is a belief fashioned in November 2017 by Boaz Power, an organization that’s centered on the acquisition, growth and operation of oil and pure gasoline properties within the Permian Basin. The Belief derives all its money flows from earnings from the sale of oil and pure gasoline manufacturing from these properties and distributes dividends month-to-month.

The belief reported third quarter 2022 outcomes for the interval ending September thirtieth, 2022. Internet earnings revenue obtained by the belief was $3.53 million for the quarter, in comparison with $2.27 million in Q3 2021. Important will increase in oil and pure gasoline gross sales costs led to a powerful year-over-year enchancment, offset by a discount in gross sales volumes.

The typical realized sale value of oil ($/Bbl) was $107.75 through the quarter, a 59% improve in comparison with the worth of $67.82 within the prior 12 months interval. The typical realized sale value of pure gasoline additionally shot up massively, from $4.29 to $8.95 per Mcf.

Distributable revenue for the belief got here to $3.36 million, up from $2.10 million in Q3 2021. Distributable revenue per unit of $0.28 was up from $0.17 within the prior 12 months interval. The belief paid out all distributable revenue to shareholders as distributions, for a payout ratio of 100%.

Click on right here to obtain our most up-to-date Positive Evaluation report on PRT (preview of web page 1 of three proven under):

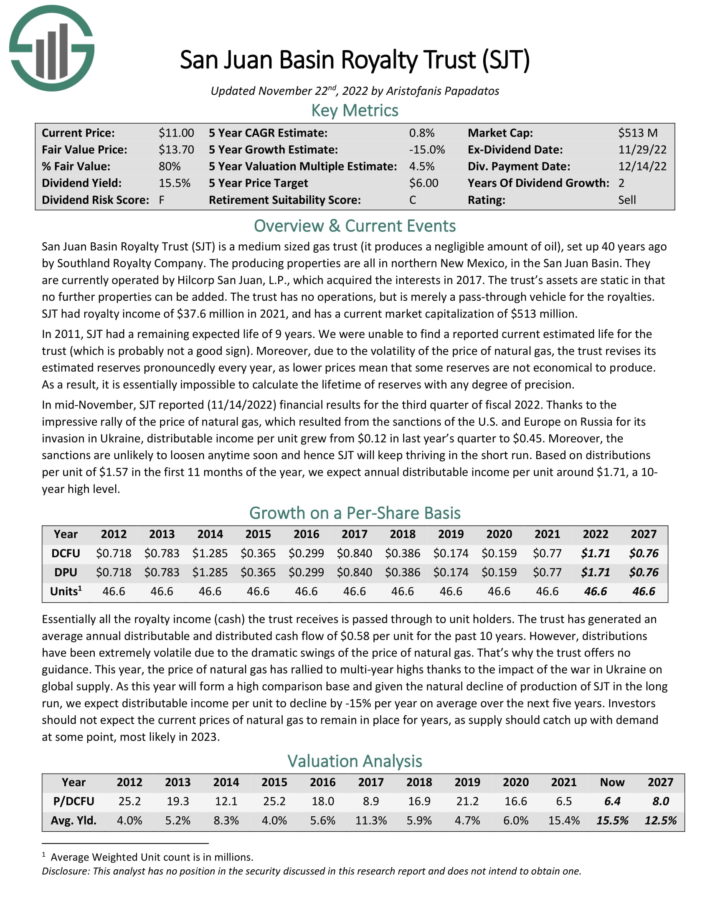

Excessive-Yield Month-to-month Dividend Inventory #4: San Juan Basin Royalty Belief (SJT)

San Juan Basin Royalty Belief is a medium sized gasoline belief (it produces a negligible quantity of oil), arrange by Southland Royalty Firm. The manufacturing properties are all in northern New Mexico, within the San Juan Basin. They are presently operated by Hilcorp San Juan, L.P., which acquired the curiositys in 2017.

The belief’s belongings are static in that no additional properties could be added. The belief has no operations, however is merely a move–by means of automobile for the royalties. SJT had royalty revenue of $37.6 million in 2021.

In mid-November, SJT reported (11/14/2022) monetary outcomes for the third quarter of fiscal 2022. Because of theimpressive rally in pure gasoline costs, distributable revenue per unit grew from $0.12 in final 12 months’s quarter to $0.45 per unit. Based mostly on distributions per unit of $1.57 within the first 11 months of the 12 months, we anticipate annual distributable revenue per unit round $1.71, a 10-year excessive.

Click on right here to obtain our most up-to-date Positive Evaluation report on SJT (preview of web page 1 of three proven under):

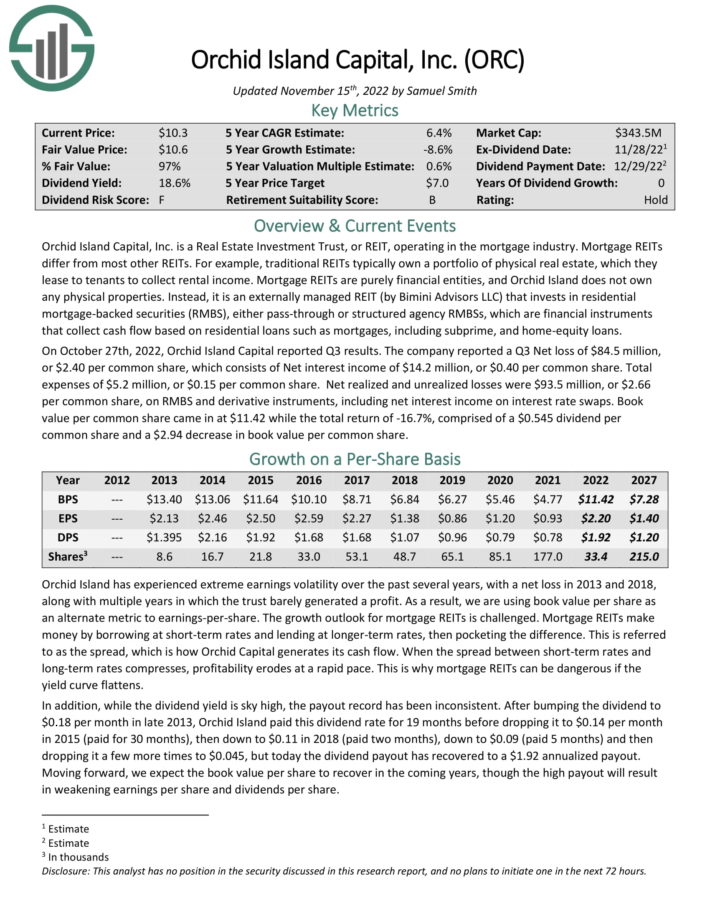

Excessive-Yield Month-to-month Dividend Inventory #3: Orchid Island Capital (ORC)

Orchid Island Capital, Inc. is a Actual Property Funding Belief, or REIT, working within the mortgage trade. Mortgage REITs differ from most different REITs. For instance, conventional REITs sometimes personal a portfolio of bodily actual property, which they lease to tenants to gather rental revenue.

Orchid is an externally managed REIT (by Bimini Advisors LLC) that invests in residential mortgage-backed securities (RMBS), both pass-through or structured company RMBSs, that are monetary devices that acquire money move primarily based on residential loans comparable to mortgages, together with subprime, and home-equity loans.

On October twenty seventh, 2022, Orchid Island Capital reported Q3 outcomes. The corporate reported a Q3 Internet lack of $84.5 million, or $2.40 per widespread share, which consists of Internet curiosity revenue of $14.2 million, or $0.40 per widespread share. Whole bills of $5.2 million, or $0.15 per widespread share.

Internet realized and unrealized losses have been $93.5 million, or $2.66 per widespread share, on RMBS and by-product devices, together with internet curiosity revenue on rate of interest swaps. E book worth per widespread share got here in at $11.42 whereas the entire return of -16.7%, comprised of a $0.545 dividend per widespread share and a $2.94 lower in e-book worth per widespread share.

Click on right here to obtain our most up-to-date Positive Evaluation report on ORC (preview of web page 1 of three proven under):

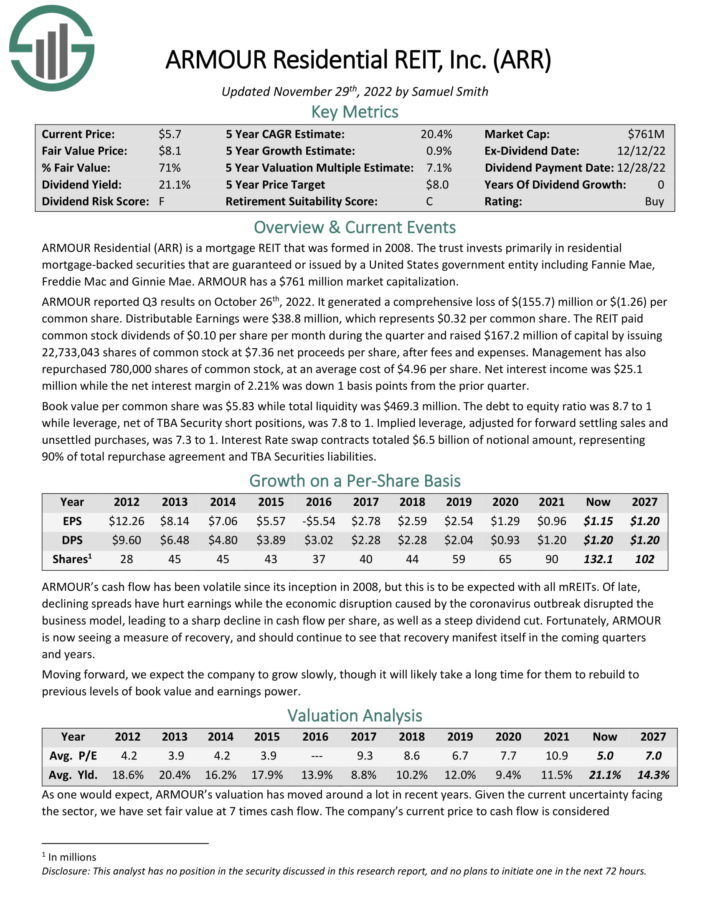

Excessive-Yield Month-to-month Dividend Inventory #2: ARMOUR Residential REIT (ARR)

ARMOUR is a mortgage REIT that invests primarily in residential mortgage–backed securities that are assured or issued by a United States authorities entity together with Fannie Mae, Freddie Mac and Ginnie Mae.

Supply: Investor Presentation

ARMOUR reported Q3 outcomes on October twenty sixth, 2022. It generated a complete lack of $(155.7) million or $(1.26) per widespread share. Distributable Earnings have been $38.8 million, which represents $0.32 per widespread share.

The REIT paid widespread inventory dividends of $0.10 per share per 30 days through the quarter and raised $167.2 million of capital by issuing 22,733,043 shares of widespread inventory at $7.36 internet proceeds per share, after charges and bills. Administration has additionally repurchased 780,000 shares of widespread inventory, at a mean price of $4.96 per share. Internet curiosity revenue was $25.1 million whereas the online curiosity margin of two.21% was down 1 foundation factors from the prior quarter.

E book worth per widespread share was $5.83 whereas complete liquidity was $469.3 million. The debt to fairness ratio was 8.7 to 1 whereas leverage, internet of TBA Safety brief positions, was 7.8 to 1. Implied leverage, adjusted for ahead settling gross sales and unsettled purchases, was 7.3 to 1. Curiosity Charge swap contracts totaled $6.5 billion of notional quantity, representing 90% of complete repurchase settlement and TBA Securities liabilities.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARR (preview of web page 1 of three proven under):

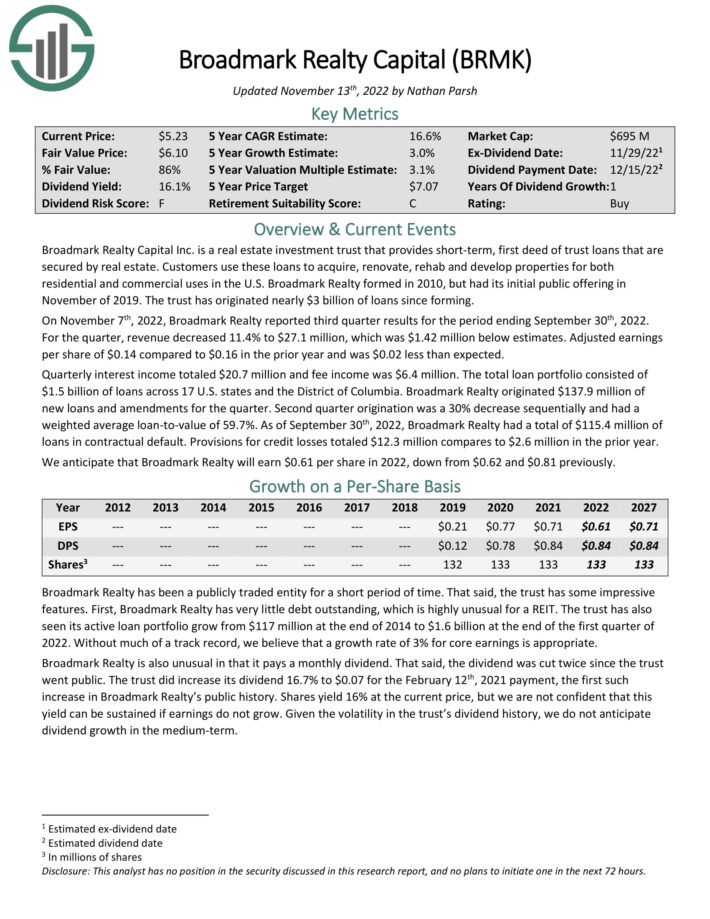

Excessive-Yield Month-to-month Dividend Inventory #1: Broadmark Realty Capital (BRMK)

Broadmark Realty Capital Inc. is an actual property funding belief that gives short-term, first deed of belief loans which are secured by actual property. Prospects use these loans to amass, renovate, rehab and develop properties for each residential and industrial makes use of within the U.S. Broadmark Realty fashioned in 2010, however had its preliminary public providing in November 2019.

Supply: Investor Presentation

On November seventh, 2022, Broadmark Realty reported third quarter outcomes for the interval ending September thirtieth, 2022. For the quarter, income decreased 11.4% to $27.1 million, which was $1.42 million under estimates. Adjusted earnings per share of $0.14 in comparison with $0.16 within the prior 12 months and was $0.02 lower than anticipated.

Quarterly curiosity revenue totaled $20.7 million and payment revenue was $6.4 million. The full mortgage portfolio consisted of $1.5 billion of loans throughout 17 U.S. states and the District of Columbia. Broadmark Realty originated $137.9 million of recent loans and amendments for the quarter. Second quarter origination was a 30% lower sequentially and had a weighted common loan-to-value of 59.7%.

As of September thirtieth, 2022, Broadmark Realty had a complete of $115.4 million of loans in contractual default. Provisions for credit score losses totaled $12.3 million compares to $2.6 million within the prior 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on BRMK (preview of web page 1 of three proven under):

Remaining Ideas

Month-to-month dividend shares may very well be extra interesting to revenue buyers than quarterly or semi-annual dividend shares. It’s because month-to-month dividend shares make 12 dividend funds per 12 months, as an alternative of the same old 4 or 2.

Moreover, month-to-month dividend shares with excessive yields above 5% are much more engaging for revenue buyers.

The 20 shares on this checklist haven’t been vetted for dividend security, that means every investor ought to perceive the distinctive danger elements of every firm.

That stated, these 20 dividend shares make month-to-month funds to shareholders, and all have excessive dividend yields.

Additional Studying

In case you are all in favour of discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases might be helpful:

The foremost home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].