Published on July 15th, 2025 by Aristofanis Papadatos

Cardinal Energy (CRLFF) has two appealing investment characteristics:

#1: It is offering an above-average dividend yield of 10.4%, which is more than eight times the average dividend yield of the S&P 500.

#2: It pays dividends monthly instead of quarterly.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Cardinal Energy’s combination of an above-average dividend yield and a monthly dividend makes it an attractive option for individual investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about Cardinal Energy.

Business Overview

Cardinal Energy is a Canadian oil and gas producer that has operations primarily in Alberta and Saskatchewan, with a strong focus on conventional light and medium oil.

Its operations are centered on mature, low-decline fields where enhanced oil recovery methods, such as water flooding and CO₂ injection, are actively used to maintain stable production. The company was formed in 2010 and is headquartered in Calgary, Canada.

Cardinal Energy manages a large inventory of vertical and horizontal wells tied into company-owned infrastructure, which supports efficient field operations and cost control.

With over 90% of production weighted to oil and natural gas liquids (NGLs), Cardinal’s day-to-day operations are heavily oil-driven, with ongoing maintenance, re-completions, and targeted infill drilling forming the backbone of its development activity.

As an almost pure oil producer, Cardinal Energy is highly sensitive to the dramatic cycles of the oil industry. It has reported losses in 5 of the last 10 years and has exhibited a highly volatile performance record. The company initiated a dividend in 2014.

On the other hand, Cardinal Energy has some advantages compared to well-known oil producers. Most oil and gas producers have been struggling to replenish their reserves due to the natural decline of their producing wells.

Source: Investor Presentation

Cardinal Energy is the conventional producer with the lowest decline rate in Canada. This is a major competitive advantage, as the company needs to spend lower amounts on capital expenses than most of its peers to replenish its reserves.

It is also remarkable that Cardinal Energy grew its total proved plus probable reserves by 30% last year. This certainly bodes well for future production growth.

In the first quarter of this year, Cardinal Energy maintained essentially flat production vs. the prior year’s quarter but its earnings per share dipped 20%, from $0.15 to $0.12, primarily due to a decrease in realized oil prices.

OPEC provided strong support to the price of oil via deep production cuts in recent years but this strategy reached its limits last year. The U.S., Canada and Brazil, which do not belong to the cartel, have been boosting their production and thus they have been grasping market share from OPEC.

This has led many OPEC members to become dissatisfied with their reduced production quotas.

Angola exited the cartel early last year. As a result, OPEC recently began to increase its production, with a goal to raise it by 2.2 million barrels per day until the end of next year.

As this strategic shift of OPEC is likely to result in a global surplus of oil, the price of oil has declined this year. Nevertheless, it has remained above average and thus Cardinal Energy is likely to maintain strong profitability this year.

Growth Prospects

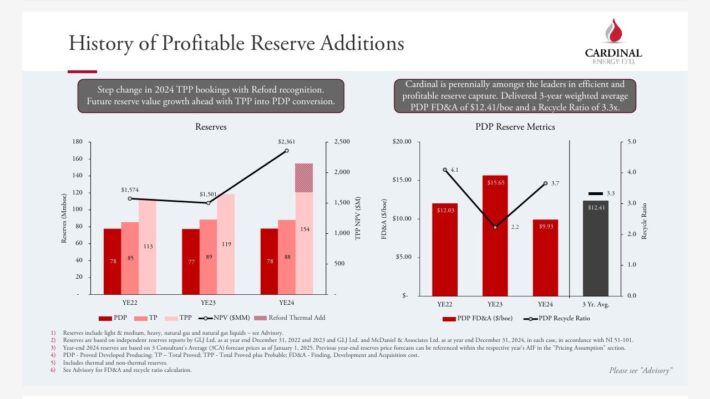

Cardinal Energy has posted one of the highest reserve growth rates in its peer group in recent years.

Source: Investor Presentation

Even better, the company has ample room for future growth thanks to some growth projects.

Cardinal Energy has provided guidance for average production of 21,300-21,700 barrels per day this year. If it meets its guidance, it will post essentially flat output compared to last year.

However, when the ongoing growth projects begin to contribute to the output of the company, they are likely to result in meaningful production growth.

Overall, in the absence of a major downturn, Cardinal Energy can grow its earnings per share by 5% per year on average over the next five years.

On the other hand, as an oil producer, Cardinal Energy is highly sensitive to the fluctuations in the price of oil. The company posted record earnings per share in 2021 and 2022 thanks to the recovery of global oil consumption, which led the price of oil to surge to a 13-year high.

However, now that the global oil market has absorbed the impact of the Ukrainian crisis and OPEC has begun to restore its output, the price of oil has moderated.

As a result, the earnings per share of Cardinal Energy have decreased from an all-time high of $1.46 in 2021 and $1.42 in 2022 to $0.47 in 2024. We expect earnings per share of approximately $0.50 this year.

Notably, Cardinal Energy has a rock-solid balance sheet. Its interest expense consumes just 3% of its operating income while its net debt is only $262 million, which is 32% of the market capitalization of the stock.

A strong balance sheet is paramount in the oil industry, as it is likely to help the company endure future downturns in its business.

Dividend & Valuation Analysis

Cardinal Energy is currently offering an above-average dividend yield of 10.4%, which is more than eight times the 1.2% yield of the S&P 500. The stock is an interesting candidate for income investors, but they should be aware that the dividend is far from safe due to the dramatic cycles of the price of oil.

Cardinal Energy has a high payout ratio of 106%, which is unsustainable over the long run. Nevertheless, thanks to the solid financial position of the company, its dividend is not likely to be reduced dramatically under current oil prices.

In reference to the valuation, Cardinal Energy is currently trading for 10.2 times its expected earnings per share this year. Given the high cyclicality of the company, we assume a fair price-to-earnings ratio of 9.0, which is a typical mid-cycle valuation level for oil producers.

Therefore, the current earnings multiple is higher than our assumed fair price-to-earnings ratio. If the stock trades at its fair valuation level in five years, it will incur a 2.5% annualized drag in its returns.

Taking into account the 5.0% annual growth of earnings per share, the 10.4% current dividend yield but also a 2.5% annualized headwind of valuation level, Cardinal Energy could offer a 10.5% average annual total return over the next five years.

The expected return signals that the stock is a good long-term investment, even though we have passed the peak of the oil industry’s cycle.

Final Thoughts

Cardinal Energy has been thriving since 2021 thanks to an ideal environment of above-average oil prices. The stock is offering an above-average dividend yield of 10.4%, albeit with a high payout ratio of 106%. Given its decent growth prospects and its reasonable valuation, the stock appears attractive.

On the other hand, the company has proven highly vulnerable to the fluctuations in the price of oil. As a result, it is not suitable for investors who cannot stomach high stock price volatility.

Moreover, Cardinal Energy is characterized by low trading volume. This means that it is hard to establish or sell a large position in this stock.

Additional Reading

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].