Revealed by Josh Arnold on December ninth, 2022

There are a lot of examples of conglomerates within the inventory market. These firms consider that, over time, proudly owning many several types of companies will supply higher and extra steady shareholder returns than specializing in a extra slim set of targets. Nevertheless, typically conglomerates look to promote or in any other case divest components of the enterprise if the portfolio has turn out to be too cumbersome, or components of it merely don’t match the corporate’s strategic priorities.

In conditions like these, we frequently see spinoffs as the popular technique of the dad or mum firm. This permits the dad or mum firm to primarily cut up off a part of the enterprise to current shareholders, giving these shareholders the choice to proceed to carry each components of the enterprise, one, or none. It additionally permits the administration groups of each the dad or mum firm and the spun-off entity to be extra centered on the enterprise, given scope narrows in spinoffs.

Dividend Aristocrat Brookfield Asset Administration (BAM) very not too long ago underwent a by-product because it distributed 25% of its asset administration enterprise in early December 2022.

You may obtain an Excel spreadsheet with the complete record of all 65 Dividend Aristocrats (with further monetary metrics comparable to price-to-earnings ratios and dividend yields) by clicking the hyperlink under:

On this article, we’ll check out the dad or mum firm, in addition to the influence that this spinoff can have on Brookfield Asset Administration shareholders, and our advice trying ahead.

Asset Administration Spinoff

Brookfield is a number one world different asset supervisor, and its focus is considerably distinctive in that it owns so-called “actual” belongings. These embody issues like actual property, renewable energy technology, infrastructure belongings, and a few personal fairness investments. Brookfield not solely has a large enterprise of its personal, nevertheless it additionally manages three publicly-traded partnerships: Brookfield Infrastructure Companions (BIP), Brookfield Renewable Companions (BEP), and Brookfield Enterprise Companions (BBU). As well as, it can now have the connection of proudly owning 75% of the asset administration enterprise, with the opposite 25% owned by shareholders following the distribution of these shares within the spinoff.

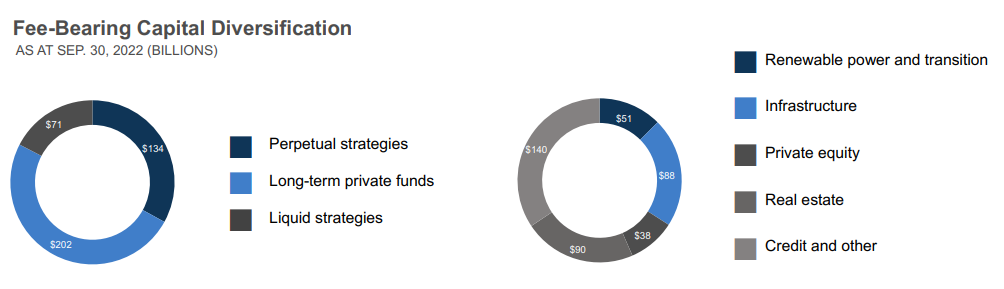

Supply: Q3 supplemental data

The present capital allocation when it comes to fee-bearing capital, which is how the asset administration enterprise is utilizing its capital, is above. The corporate focuses on a mixture of long-term and “perpetual” methods, with solely about 17% of fee-bearing capital in liquid methods. That signifies that at anyone time, roughly $83 of each $100 is invested in some kind of long-term undertaking that the corporate intends to carry for years. Whereas that makes disposition earnings lumpy, it additionally means the corporate has extra steady working earnings from its holdings.

The transaction is to distribute a 25% curiosity within the asset administration enterprise of Brookfield Asset Administration, which leads to two publicly-traded firms. The dad or mum firm, Brookfield Asset Administration, shall be name Brookfield Company. The “Supervisor”, which is the spun-off portion of the enterprise, shall be a pure-play world different asset administration enterprise.

Brookfield Company, which is the dad or mum firm, will personal 75% of the asset administration enterprise, whereas shareholders will obtain the opposite 25%. The dad or mum firm’s ticker shall be modified from BAM to BN, whereas the asset administration spinoff will take over the ticker of BAM. The spinoff is being made on a tax-deferred foundation for shareholders within the U.S. and Canada, the latter of which being the place Brookfield’s household of firms relies. Every shareholder will obtain one share of the asset administration enterprise for each 4 shares of the dad or mum firm held.

How Will the Spinoff Influence Development?

Previous to the spinoff, we projected Brookfield to have 8% common annual earnings-per-share development over the medium time period. That’s a robust quantity, however steering from administration means that might be understated. Certainly, Brookfield’s administration believes the corporate can produce a 17% annualized return via 2027, which is sort of an formidable purpose. That features shareholder distributions, besides, we’re not ready to imagine such a lofty goal shall be achieved.

The excellent news for shareholders of the dad or mum firm is that we see a minimal influence to development from the asset administration spinoff.

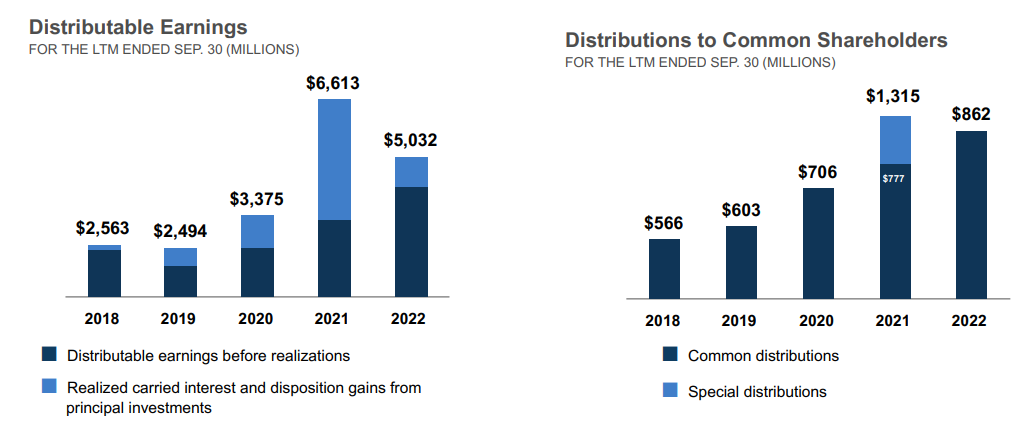

Supply: Q3 supplemental data

We will see that Brookfield’s development has been lumpy, however that’s to be anticipated given the bizarre nature of lots of its investments. Distributable earnings are a key metric, and as we are able to see, the realized carried curiosity and disposition positive aspects are many of the firm’s earnings from the previous few years. These earnings happen when Brookfield sells an asset for a achieve, however these earnings are unpredictable in each timing and measurement. The distributable earnings earlier than realizations are a extra conventional type of working earnings, and we consider this needs to be largely unchanged following the spinoff.

The dad or mum firm, ticker BN following the spinoff, will nonetheless personal 75% of the asset supervisor. Thus, even when the asset administration enterprise takes with it some measure of development, the dad or mum firm is ceding management of solely 25%, not the whole enterprise. With this in thoughts, we consider the influence to the expansion profile of the dad or mum firm to be minimal as it’s not spinning off everything of the asset administration enterprise.

How Ought to Shareholders React?

Previous to the spinoff, we believed Brookfield was buying and selling at a premium to its truthful worth, and we due to this fact positioned a maintain ranking on the inventory. On condition that the mixed valuation of the dad or mum firm and the spun off firm needs to be the identical because it was pre-spinoff, not less than initially, and the truth that we don’t consider Brookfield’s development profile shall be materially altered, we proceed to fee shares a maintain. After the businesses have time to commerce on their very own, the market could produce differing truthful values, and we’ll reassess accordingly. For now, given the small proportion of the asset administration enterprise being spun off, we don’t consider the outlook for the dad or mum firm’s shares has modified materially.

Ultimate Ideas

Whereas spinoffs can typically be transformative for sure firms, we discover this one to be a comparatively minor occasion. Brookfield is spinning off a minority stake in a single a part of its enterprise, and we due to this fact consider the outlook for the dad or mum firm’s shares is comparatively unchanged. On condition that, we consider shares of each the dad or mum firm and people of the asset supervisor are a maintain. Each firms ought to have strong development outlooks following the separation, and we like the truth that the dad or mum firm will retain a big majority of the asset administration enterprise, which means its outlook needs to be comparatively unchanged.

The next articles comprise shares with very lengthy dividend or company histories, ripe for choice for dividend development buyers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].