Up to date on December seventh, 2022 by Bob CiuraSpreadsheet knowledge up to date day by day

In poker, the blue chips have the best worth. We don’t like the concept of utilizing poker analogies for investing. Investing needs to be far faraway from playing. With that stated, the time period “blue-chip shares” has caught for a choose group of shares….

So, what are blue-chip shares?

Blue-chip shares are established, protected, dividend payers. They’re typically market leaders and have a tendency to have an extended historical past of paying rising dividends. Blue-chip shares have a tendency to stay worthwhile even throughout recessions.

You might be questioning “how do I discover blue-chip shares?”

You will discover blue-chip dividend shares utilizing the lists and spreadsheet under.

At Positive Dividend, we qualify blue-chip shares as corporations which can be members of 1 or extra of the next 3 lists:

You possibly can obtain the entire checklist of all 350+ blue-chip shares (plus essential monetary metrics akin to dividend yield, P/E ratios, and payout ratios) by clicking under:

Along with the Excel spreadsheet above, this text covers our high 7 finest blue-chip inventory buys in the present day as ranked utilizing anticipated whole returns from the Positive Evaluation Analysis Database.

Our high 7 finest blue-chip inventory checklist excludes MLPs and REITs. The desk of contents under permits for simple navigation.

Desk of Contents

The spreadsheet above provides the total checklist of blue chips. They’re a superb place to get concepts in your subsequent high-quality dividend progress inventory investments…

Our high 7 favourite blue-chip shares are analyzed intimately under.

The 7 Finest Blue-Chip Buys As we speak

The 7 finest blue-chip shares as ranked by 5-year anticipated annual returns from the Positive Evaluation Analysis Database (excluding REITs and MLPs) are analyzed intimately under.

On this part, shares have been additional screened for a passable Dividend Danger rating of ‘C’ or higher.

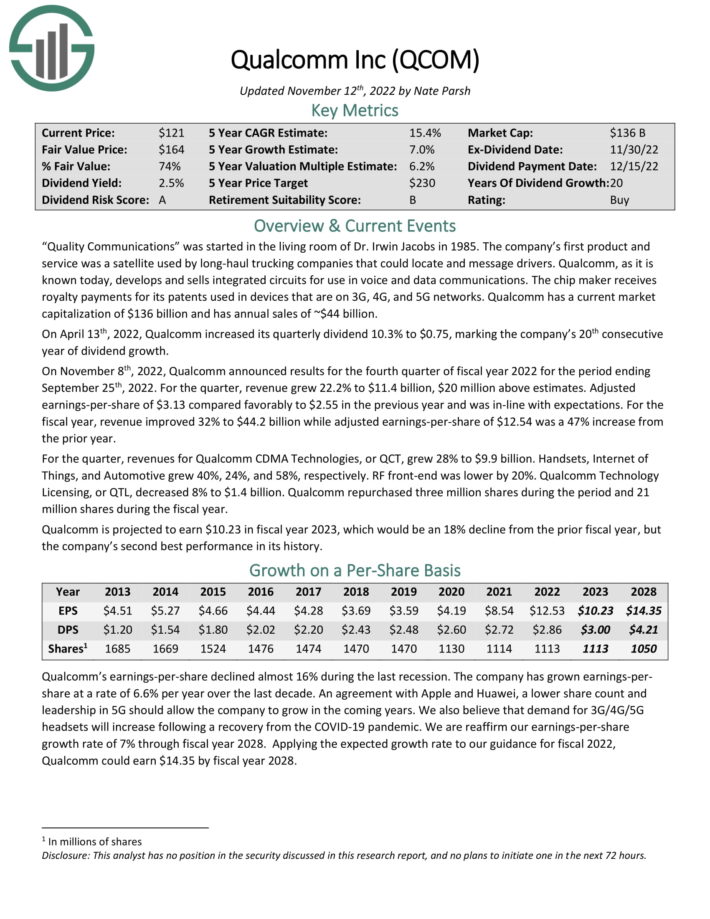

Blue-Chip Inventory #7: Qualcomm Inc. (QCOM)

Dividend Historical past: 20 years of consecutive will increase

Dividend Yield: 2.5%

Anticipated Complete Return: 15.7%

Qualcomm develops and sells built-in circuits to be used in voice and knowledge communications. The chip maker receivesroyalty funds for its patents utilized in units which can be on 3G and 4G networks. Qualcomm is a large-cap inventory with a market cap above $140 billion and will generate gross sales of greater than $44 billion this 12 months.

On April thirteenth, 2022, Qualcomm elevated its quarterly dividend 10.3% to $0.75, marking the corporate’s twentieth consecutive 12 months of dividend progress.

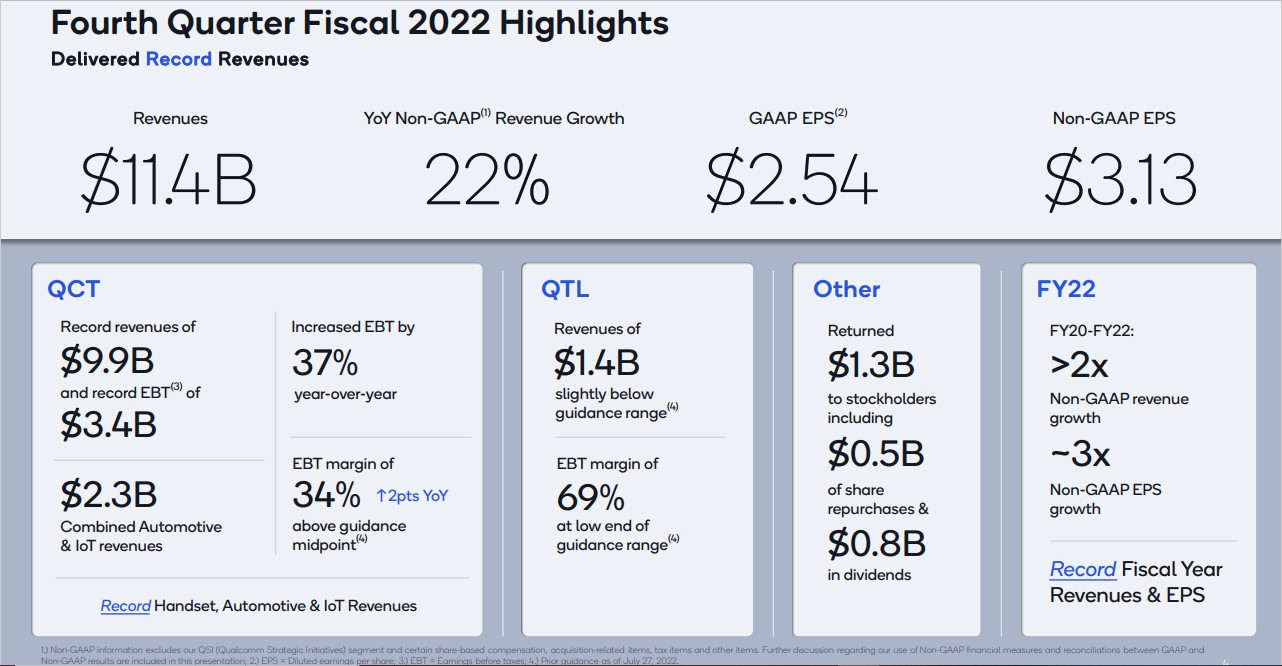

Qualcomm lately concluded its fiscal 2022. Outcomes for the fourth fiscal quarter will be seen within the picture under:

Supply: Investor Presentation

Revenues for Qualcomm CDMA Applied sciences, or QCT, grew 28% to $9.9 billion. Handsets, Web of Issues, and Automotive grew 40%, 24%, and 58%, respectively. RF front-end was decrease by 20%. Qualcomm Know-how Licensing, or QTL, decreased 8% to $1.4 billion. Qualcomm repurchased three million shares through the interval and 21 million shares through the fiscal 12 months.

Qualcomm is projected to earn $10.23 in fiscal 12 months 2023, which might be an 18% decline from the prior fiscal 12 months, however the firm’s second finest efficiency in its historical past.

We count on whole returns of 15.7% per 12 months over the following 5 years, pushed by 7% anticipated EPS progress, the two.5% dividend yield, and a major increase from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on QCOM (preview of web page 1 of three proven under):

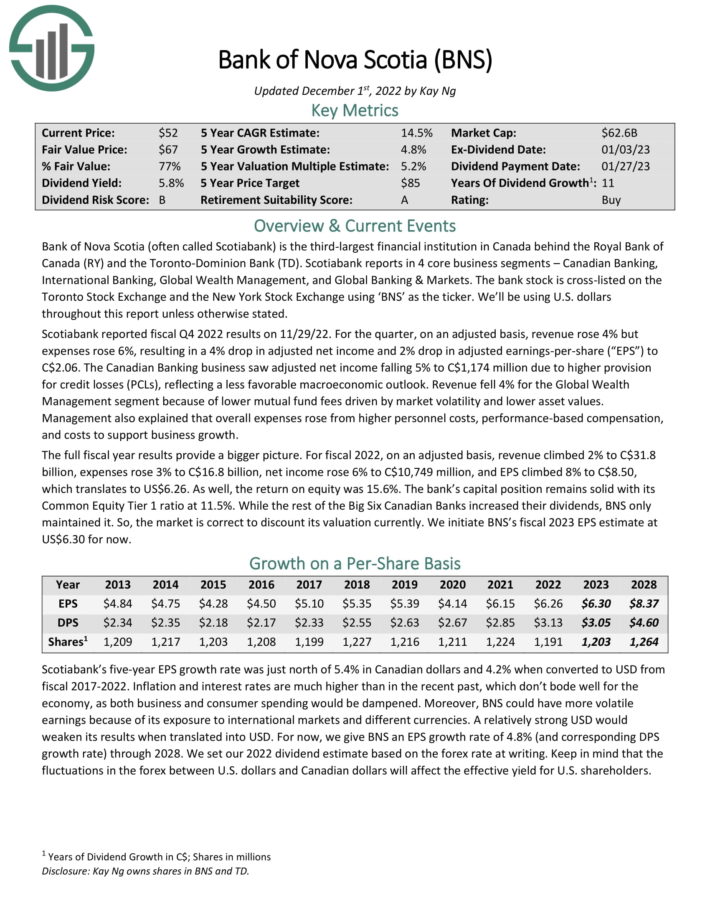

Blue-Chip Inventory #6: Financial institution of Nova Scotia (BNS)

Dividend Historical past: 11 years of consecutive will increase

Dividend Yield: 6.1%

Anticipated Complete Return: 15.8%

Financial institution of Nova Scotia is the third-largest monetary establishment in Canada behind the Royal Financial institution of Canada (RY) and the Toronto-Dominion Financial institution (TD). Scotiabank operates 4 core enterprise segments – Canadian Banking, Worldwide Banking, World Wealth Administration, and World Banking & Markets.

Scotiabank reported fiscal This fall 2022 outcomes on 11/29/22. For the quarter, on an adjusted foundation, income rose 4% however bills rose 6%, leading to a 4% drop in adjusted internet revenue and a couple of% drop in adjusted earnings-per-share toC$2.06.

For fiscal 2022, on an adjusted foundation, income climbed 2%, internet revenue rose 6%, and EPS climbed 8% to C$8.50, which interprets to US$6.26. Return on fairness was 15.6%. The financial institution’s capital place stays stable with its Widespread Fairness Tier 1 ratio at 11.5%.

Click on right here to obtain our most up-to-date Positive Evaluation report on BNS (preview of web page 1 of three proven under):

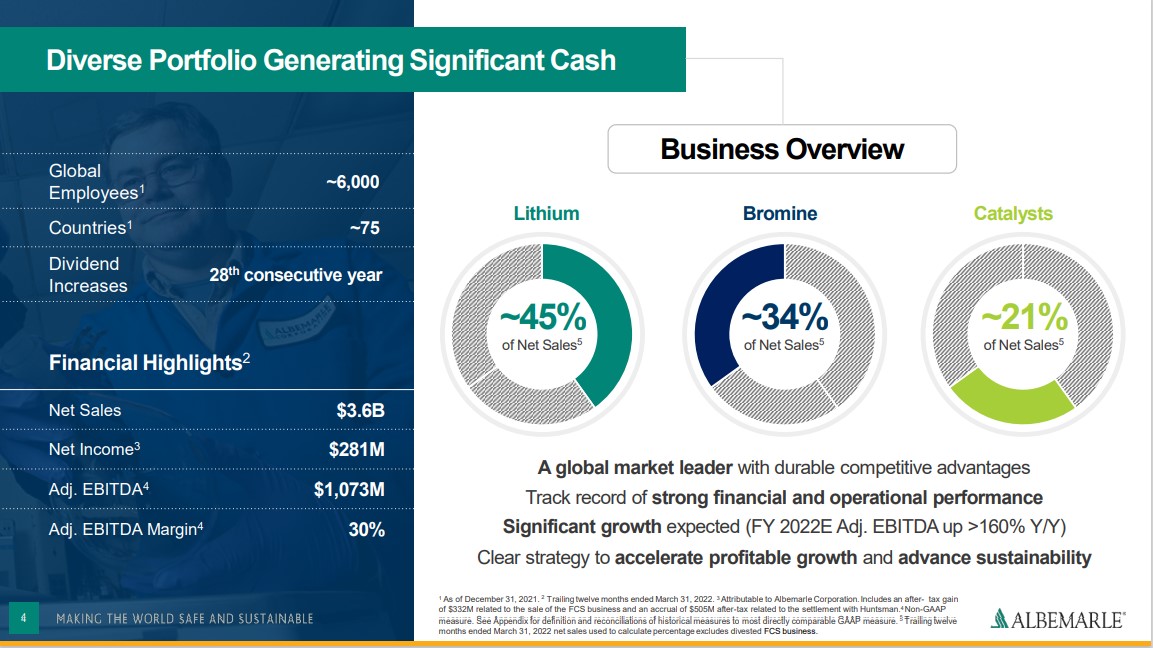

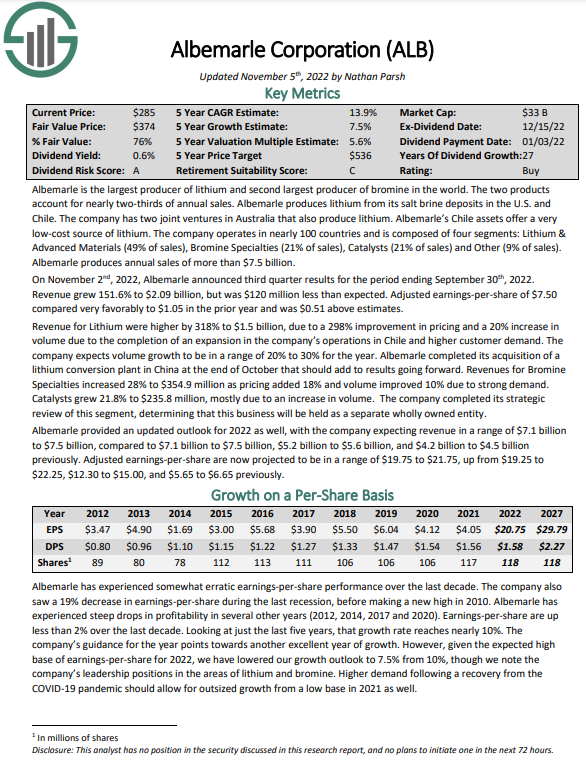

Blue-Chip Inventory #5: Albemarle Company (ALB)

Dividend Historical past: 27 years of consecutive will increase

Dividend Yield: 0.6%

Anticipated Complete Return: 16.2%

Albemarle is the most important producer of lithium and second largest producer of bromine on the planet. The 2 merchandise account for practically two-thirds of annual gross sales. Albemarle produces lithium from its salt brine deposits within the U.S. and Chile. The corporate has two joint ventures in Australia that additionally produce lithium. Albemarle’s Chile belongings supply a really low-cost supply of lithium.

Associated: 2022 Lithium Shares Listing

The corporate operates in practically 100 international locations and consists of 4 segments: Lithium & Superior Supplies (49% of gross sales), Bromine Specialties (21% of gross sales), Catalysts (21% of gross sales) and Different (9% of gross sales). Albemarle produces annual gross sales of greater than $7.5 billion.

Supply: Investor Presentation

On November 2nd, 2022, Albemarle introduced third quarter outcomes. Income grew 151.6% to $2.09 billion, however was $120 million lower than anticipated. Adjusted earnings-per-share of $7.50 in contrast very favorably to $1.05 within the prior 12 months and was $0.51 above estimates.

Income for Lithium was larger by 318% to $1.5 billion, on account of a 298% enchancment in pricing and a 20% improve in quantity as a result of completion of an enlargement within the firm’s operations in Chile and better buyer demand. The corporate expects quantity progress to be in a spread of 20% to 30% for the 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Albemarle (preview of web page 1 of three proven under):

Blue-Chip Inventory #4: Williams-Sonoma (WSM)

Dividend Historical past: 16 years of consecutive will increase

Dividend Yield: 2.8%

Anticipated Complete Return: 17.4%

Williams-Sonoma is a specialty retailer that operates residence furnishing and houseware manufacturers, akin to Williams-Sonoma, Pottery Barn, West Elm, Rejuvenation, Mark and Graham and others. Williams-Sonoma operates conventional brick-andmortar retail places but in addition sells its items by e-commerce and direct-mail catalogs.

In mid-November, Williams-Sonoma reported (11/17/22) monetary outcomes for the third quarter of fiscal 2022. Comparable model income grew 8.1% over final 12 months’s quarter because of progress of 19.6% and 4.2% in Pottery Barn and West Elm, respectively. The corporate grew its earnings-per-share 13%, from $3.29 to $3.72, however missed the analysts’ consensus by $0.02. It was the primary earnings miss after not less than 20 consecutive quarters.

Regardless of the practically all-time excessive earnings, progress decelerated considerably vs. the earlier blowout quarters. As well as, administration withdrew its steerage for mid-to-high single digit annual income progress till 2024 as a result of particularly difficult enterprise panorama prevailing proper now amid 40-year excessive inflation.

Click on right here to obtain our most up-to-date Positive Evaluation report on WSM (preview of web page 1 of three proven under):

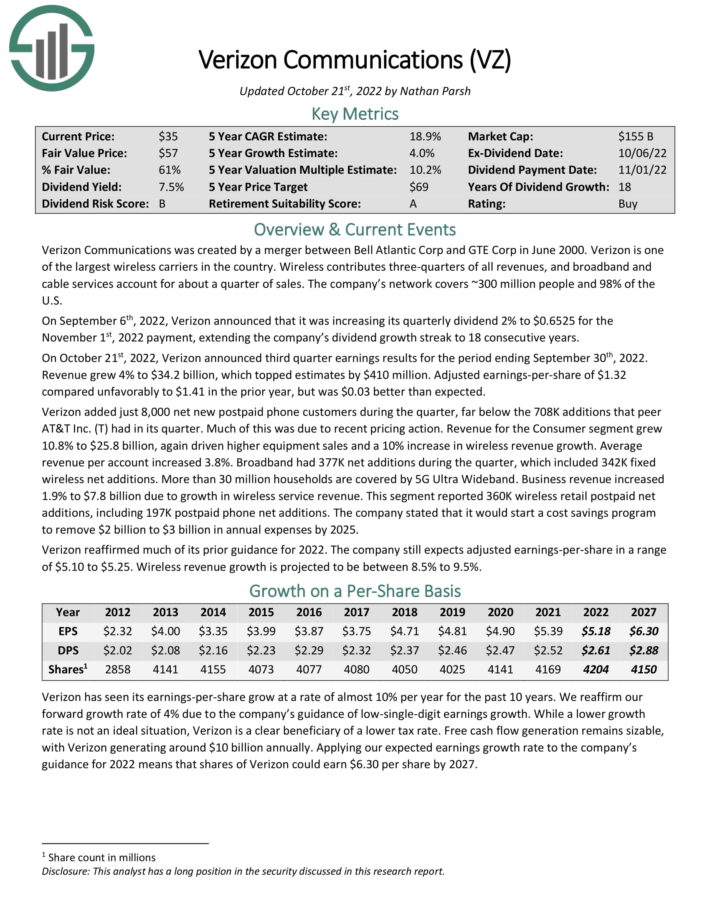

Blue-Chip Inventory #3: Verizon Communications (VZ)

Dividend Historical past: 18 years of consecutive will increase

Dividend Yield: 7.1%

Anticipated Complete Return: 17.7%

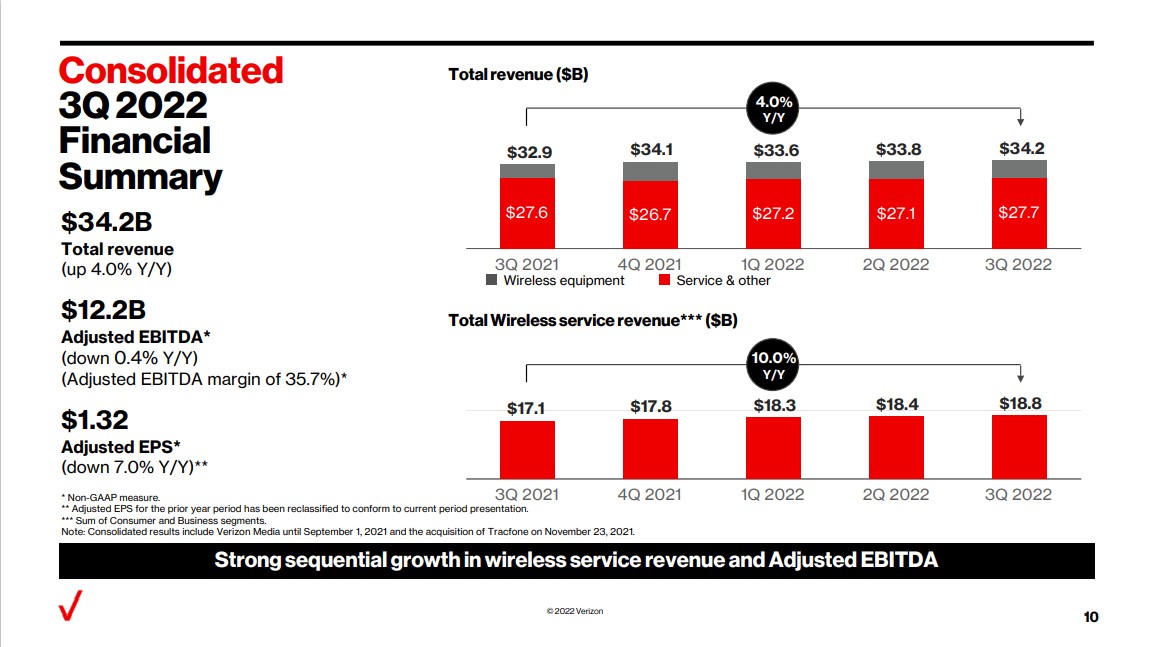

Verizon Communications is among the largest wi-fi carriers within the nation. Wi-fi contributes three-quarters of all revenues, and broadband and cable companies account for a few quarter of gross sales. The corporate’s community covers ~300 million individuals and 98% of the U.S.

On October twenty first, 2022, Verizon introduced third quarter earnings outcomes for the interval ending September thirtieth, 2022. Income grew 4% to $34.2 billion, which topped estimates by $410 million. Adjusted earnings-per-share of $1.32 in contrast unfavorably to $1.41 within the prior 12 months, however was $0.03 higher than anticipated.

Supply: Investor Presentation

Verizon added simply 8,000 internet new postpaid cellphone prospects through the quarter. Income for the Client section grew 10.8% to $25.8 billion, once more pushed larger tools gross sales and a ten% improve in wi-fi income progress. Common income per account elevated 3.8%. Broadband had 377K internet additions through the quarter, which included 342K mounted wi-fi internet additions.

Click on right here to obtain our most up-to-date Positive Evaluation report on VZ (preview of web page 1 of three proven under):

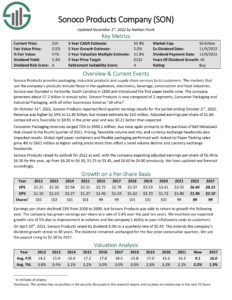

Blue-Chip Inventory #2: Sonoco Merchandise (SON)

Dividend Historical past: 40 years of consecutive will increase

Dividend Yield: 3.2%

Anticipated Complete Return: 8.6%

Sonoco manufactures shopper packaging merchandise globally. The corporate makes a wide selection of paper, textile, meals, chemical, cable, and packaging merchandise. Sonoco was based in 1899 and produces about $7.3 billion in annual income.

Sonoco trades for 9.4 instances its anticipated 2022 earnings. This might drive important returns to shareholders because the valuation a number of expands over the following 5 years.

The inventory additionally has a dividend yield roughly double that of the S&P 500, at 3.2%. Not solely that, however Sonoco has a 40-year streak of dividend will increase, placing it in a uncommon firm on that measure as properly.

We see progress at 5% yearly, so we consider the inventory can produce ~18.6% whole returns within the years to come back from its mix of valuation, yield, and progress.

Click on right here to obtain our most up-to-date Positive Evaluation report on Sonoco Merchandise Co. (preview of web page 1 of three proven under):

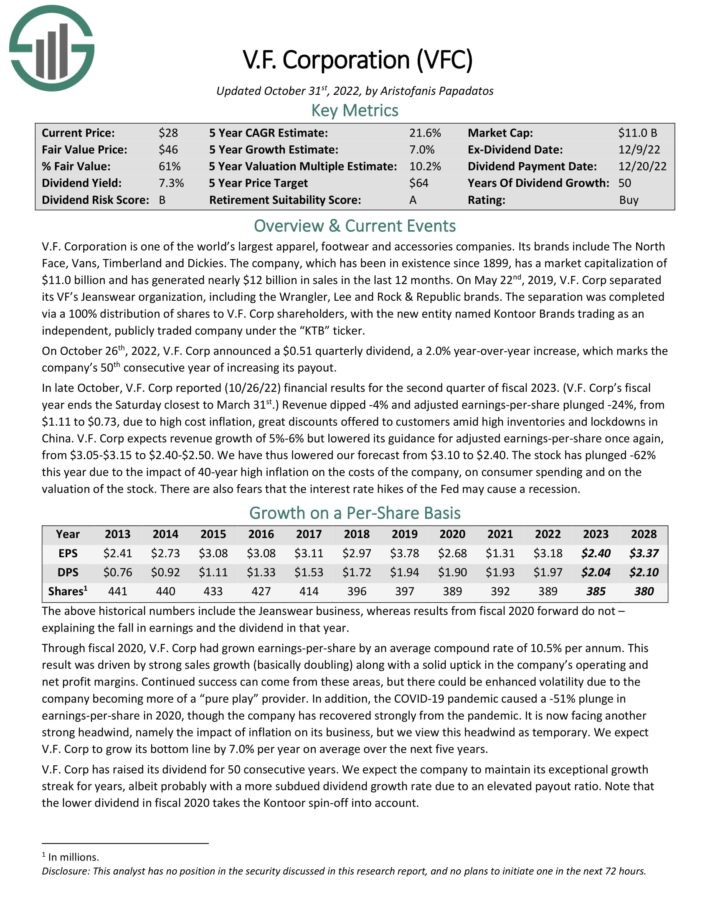

Blue-Chip Inventory #1: V.F. Corp. (VFC)

Dividend Historical past: 50 years of consecutive will increase

Dividend Yield: 6.9%

Anticipated Complete Return: 20.6%

V.F. Company is among the world’s largest attire, footwear and equipment corporations. The corporate’s manufacturers embody The North Face, Vans, Timberland and Dickies. The corporate, which has been in existence since 1899, generated over $11 billion in gross sales within the final 12 months.

V.F. Company is among the world’s largest attire, footwear and equipment corporations. The corporate’s manufacturers embody The North Face, Vans, Timberland and Dickies. The corporate, which has been in existence since 1899, generated over $11 billion in gross sales within the final 12 months.

On October twenty sixth, 2022, V.F. Corp introduced a $0.51 quarterly dividend, a 2.0% year-over-year improve, which marks the corporate’s fiftieth consecutive 12 months of accelerating its payout.

In late October, V.F. Corp reported (10/26/22) monetary outcomes for the second quarter of fiscal 2023. Income declined by 4% and adjusted earnings-per-share declined by 24%, from $1.11 to $0.73, on account of excessive value inflation, and reductions.

We count on 7% annual EPS progress over the following 5 years. VFC inventory additionally has a dividend yield of 6.9%. Annual returns from an increasing P/E a number of are estimated at ~6.7%, equaling whole anticipated annual returns of 20.6% by 2027.

Click on right here to obtain our most up-to-date Positive Evaluation report on V.F. Corp. (preview of web page 1 of three proven under):

The Blue-Chip Shares In Focus Sequence

You possibly can see all Blue-Chip Shares In Focus articles under. Every is sorted by GICS sectors and listed in alphabetical order by title. The most recent Positive Evaluation Analysis Database report for every safety is included as properly.

Client Staples

Communication Providers

Client Discretionary

Financials

Industrials

Well being Care

Data Know-how

Supplies

Utilities

Ultimate Ideas

Shares with lengthy histories of accelerating dividends are sometimes one of the best shares to purchase for long-term dividend progress and excessive whole returns.

However simply because an organization has maintained an extended monitor document of dividend will increase, doesn’t essentially imply it is going to proceed to take action sooner or later.

Traders must individually assess an organization’s fundamentals, significantly in instances of financial misery.

These 7 blue-chip shares have engaging dividend yields, and lengthy histories of elevating their dividends every year. In addition they have compelling valuations that make them engaging picks for traders inquisitive about whole returns.

The Blue Chips checklist is just not the one approach to shortly display screen for shares that often pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].