Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Capriole founder Charles Edwards argues that Bitcoin’s famous four-year boom-and-bust pattern has effectively ended—not because markets have matured into a placid equilibrium, but because the engine that once forced 80–90% drawdowns has been dismantled by Bitcoin’s own monetary design.

The 4-Year Bitcoin Cycle Is Dead

In his Update #66 newsletter published on August 15, 2025, Edwards writes that since the April 2024 halving, Bitcoin’s annual supply growth has fallen to roughly 0.8%, “less than half of Gold’s 1.5–3%,” adding that this shift “made Bitcoin the hardest asset known to man, with look-ahead certainty.” With miners’ new-issuance supply now a rounding error compared with aggregate demand, the dramatic, miner-driven busts of prior cycles look increasingly like artifacts of an earlier era. “In short – the primary driving force behind Bitcoin cycle 80-90% drawdowns historically is dead.”

Edwards does not deny that cycles exist. He reframes their causes. Reflexive investor behavior, macro liquidity, on-chain valuation extremes, and derivatives-market “euphoria” can still combine to produce sizable drawdowns. But if the halving calendar no longer dictates those inflection points, investors must recalibrate the signals they monitor and the timelines on which they expect risk to crystalize.

Related Reading

On reflexivity, he cautions that belief in the four-year script can itself become a price driver. If “enough Bitcoiners believe in the 4 year cycle… they will structure their investing activities around it,” he notes, invoking George Soros’s notion that market narratives feed back into fundamentals. That self-fulfilling element can still trigger “sizeable drawdowns,” even if miners are no longer the marginal price-setters.

Macro liquidity, in Edwards’s framework, remains decisive. He tracks a “Net Liquidity” gauge—the year-over-year growth in global broad money minus the cost of debt (proxied by US 10-year Treasury yields)—to distinguish genuinely expansive regimes from nominal money growth that is offset by higher rates.

Historically, “All of Bitcoin’s historic bear markets have occurred while this metric was declining… with the depths… while this metric was less than zero,” he writes, whereas “All of Bitcoin’s major bull runs have occurred in positive Net Liquidity environments.” As of mid-August, he characterizes conditions as constructive: “We are currently in a positive liquidity environment and the Fed is now forecast to cut rates 3 times in the remainder of 2025.”

On-Chain Data Is Still Supportive

If liquidity sets the tide, euphoria marks the froth. Edwards points to established on-chain gauges—MVRV, NVT, Energy Value—that have historically flashed red at cycle peaks. Those indicators, he says, are not yet there: “In 2025 we still see no signs of onchain Euphoria. Bitcoin today is appreciating in a steady, relatively sustainable way versus historic cycles.”

A chart of MVRV Z-Score “shows we are nowhere near the price euphoria of historic Bitcoin tops.” By contrast, his derivatives composite—the “Heater,” which aggregates positioning and leverage across perps, futures, and options—has been hot enough to warrant short-term caution. “The heat is on… Of all the metrics we will look at here, this one is telling us that the market locally has overheated near all time highs this week.” In his telling, elevated Heater readings can cap near-term upside unless they persist for months alongside rising open interest—conditions more consistent with a major top.

One metric, however, eclipses the rest in 2025–26: institutional absorption of new supply. “Today, 150+ public companies and ETFs are buying over 500% of Bitcoin’s daily supply creation from mining,” Edwards writes. “When demand outruns supply like this, Bitcoin has historically surged over the coming months. Every time this has happened in Bitcoin’s history (5 occurrences), price has shot up by 135% on average.” He emphasizes that the current, extended period of high multiples on this measure is “good news for Bitcoin,” while conceding the obvious caveat: no one can know how long such conditions will last.

Related Reading

Because institutional demand can flip to supply, Edwards details a “treasury company early warning system.” He highlights four watch-items that his team tracks “24/7 for cycle risk management and positioning purposes”: a Treasury Buy-Sell Ratio that, if falling, “suggests growing selling by the 150+ companies”; a Treasury CVD whose flattening or lurch into a “red zone” is “risk off”; the percentage of Coinbase volume that is net buying; and a Treasury Company Seller Count that, on spikes, has historically preceded pressure.

Layered on top is balance-sheet fragility. The more treasuries lever up to accumulate Bitcoin, the more a drawdown can cascade through forced deleveraging. “Total Debt relative to Enterprise value are key to track,” he says, adding that Capriole will publish a fresh tranche of treasury-risk metrics “next week.”

Quantum Computers Vs. Bitcoin

Edwards then makes an argument many Bitcoin investors will find uncomfortable: quantum computing is both an attractive return opportunity and Bitcoin’s most concrete long-term tail risk. Capriole, he says, expects “the asset class will outperform Bitcoin by circa 50% p.a. over the next 5–10 years,” citing today’s small market capitalizations against a “$2T+” addressable market.

At the same time, “in the long-term (without change) QC is existential to Bitcoin,” with a worst-case window of “3–6 years” to break the cryptography that secures wallets and transactions. He notes that China “is spending 5X more on QC than the US” and recently “presented a QC machine a million times more powerful than Google’s,” arguing that the pace of breakthroughs, “with… innovations occurring every quarter,” suggests “this technology will mature sooner than many think. Just like ChatGPT.”

The operational challenge, even if the risk is not imminent, is the migration path. Edwards sketches back-of-the-envelope constraints: roughly 25 million Bitcoin addresses hold more than $100; on “a good day,” the network handles about 10 transactions per second. If everyone tried to rotate to quantum-resistant keys at once—and many would prudently send test transactions—it would take “3–6 months” just to push the transactions through, before even counting the time to achieve consensus on, and deploy, a preferred upgrade. “Optimistically we are looking at a 12 month lead time to move the Bitcoin network to a Quantum proof system,” he writes. He flags work by Jameson Lopp as a starting point and urges the community to “encourage action on the QC Bitcoin Improvement Proposals (BIPS).” Capriole itself holds quantum-computing exposure both for return potential and as “a portfolio hedge should a worst case scenario eventuate.”

His conclusion is clear without being complacent. “The Bitcoin miner driven cycle is largely dead.” If institutional demand holds, “there is a strong chance of a right translated cycle,” with “a significant period of price expansion still ahead of us.” But vigilance is essential.

The two variables to prioritize this halving epoch, in his view, are “Net Liquidity and Institutional Buying,” while the “biggest risk to this cycle” is paradoxically the cohort that has powered it: the Bitcoin treasury companies whose balance-sheet choices can compound both upside and downside. Quantum computing, he stresses, “isn’t a risk to Bitcoin this Halving cycle,” but absent action “it certainly will be in the next one.” The prescription is not to fear cycles, but to retire the outdated ones and prepare—technically and operationally—for the cycles that remain.

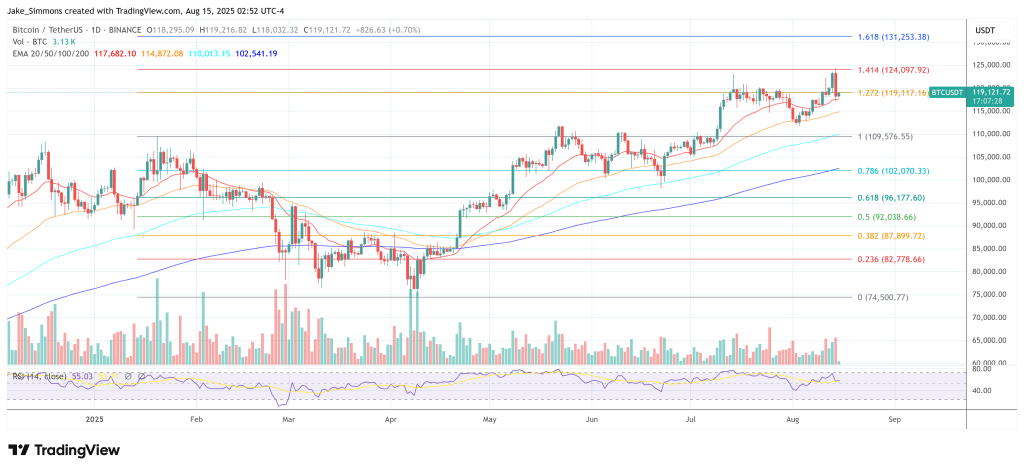

At press time, BTC traded at $119,121.

Featured image created with DALL.E, chart from TradingView.com