Marcus & Millichap (NYSE: MMI) MMI Q4 2025 Earnings exceeded expectations as the real estate investment services firm reported revenue growth. The company posted fourth quarter results of $244.0 million, up 8.5% year-over-year. Also, net income surged 57.0% versus the prior year period. So profitability improved dramatically.

MMI Q4 2025 Earnings: Company Overview

Marcus & Millichap, Inc. operates in commercial real estate investment sales. The company also provides financing and advisory services. Based in Calabasas, California, MMI operates through three segments. Brokerage commissions form the largest revenue stream. Financing revenue adds stable income. Management fees provide supplemental revenue.

Marcus & Millichap Q4 2025 Earnings: Financial Performance

Total revenue hit $244.0 million in Q4 2025. This is up 1.6% from $240.1 million in prior year. Yet year-over-year results show 8.5% growth. Real estate brokerage revenue reached $205.3 million. This improved 1.2% versus Q4 2024. So the gain reflects higher transaction volume. Plus, the average commission rate expanded. Financing revenue climbed to $31.2 million.

Quarterly Revenue Performance

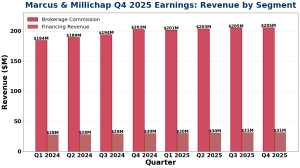

Marcus & Millichap Q4 2025 earnings quarterly revenue trend chart showing eight quarters of data from Q1 2024 through Q4 2025

MMI Q4 2025 Earnings: Key Business Drivers

Brokerage revenue expanded as transaction volume jumped 9.2% year-over-year. The average commission rate increased 9 basis points. Multiple positive factors drove the gain. Indeed, sales volume fell 4.0%. However, higher transaction counts offset the decline. Management expanded the agent base. Moreover, market presence improved across regions. Market demand indicators point to positive trends. So the company captured additional market share. For detailed financial information, see the Marcus & Millichap Q4 2025 earnings press release.

Revenue by Segment Analysis

MMI Q4 2025 Earnings revenue by segment showing brokerage commission and financing revenue across eight quarters

MMI Q4 2025 Earnings: Profitability Surge

Net income surged 57.0% to reach record levels in Q4 2025 versus Q4 2024. This represents a substantial gain in profitability. Operating margins expanded on the higher revenue base. Management controlled costs throughout the period. Also, the balance sheet remained solid. Liquidity improved year-over-year. So the profit performance indicates improved efficiency.

Marcus & Millichap Q4 2025 Earnings: Market Outlook

Management sees continued growth ahead in commercial real estate services. The business model provides diversification benefits. Plus, the expanded agent network supports future expansion. Industry dynamics remain positive for investment specialists. So MMI is positioned well for growth. The company has guided to positive trends. Investors can track performance on Yahoo Finance (MMI) or visit MMI’s investor relations page.

MMI Q4 2025 Earnings: Summary

Marcus & Millichap Q4 2025 earnings showed impressive results. Revenue expanded 8.5% year-over-year. Transaction volume surged 9.2% in the period. So net income jumped 57.0% year-over-year. The diversified business model supports stability. Management’s discipline improved margins. Plus, investor sentiment appears positive. Also, the outlook for 2026 remains constructive. In fact, the company is gaining market share.

Click Here to visit the AlphaStreet website.