Updated on February 13th, 2026 by Nathan Parsh

The Dividend Aristocrats consist of companies that have raised their dividends for at least 25 years in a row. Over the decades, many of these companies have become huge multinational corporations, but not all of them.

You can see the full list of all 69 Dividend Aristocrats here.

We created a full list of all Dividend Aristocrats, along with important financial metrics like price-to-earnings ratios and dividend yields. You can download your copy of the Dividend Aristocrats list by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

Dover Corporation (DOV) has raised its dividend for 70 consecutive years, one of the longest dividend growth streaks in the stock market.

The company has achieved such an exceptional dividend growth record thanks to its strong business model, resilience to recessions, and steady long-term growth.

There is room for continued dividend raises each year going forward, but on the other hand the stock appears to be overvalued right now.

Business Overview

Dover is a diversified global industrial manufacturer that offers its customers equipment and components, consumable supplies, aftermarket parts, software, and digital solutions.

It has annual revenues of more than $8 billion and operates in five segments: Engineered Products, Clean Energy & Fueling, Imaging & Identification, Pumps & Process Solutions, and Climate & Sustainability Technologies.

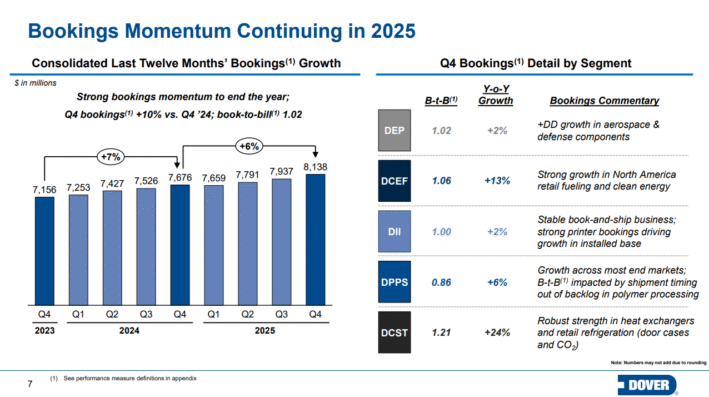

On January 29th, 2026, Dover reported fourth-quarter and full-year results. Revenue grew 8.8% for the quarter to $2.1 billion, which was $10 million above estimates. Adjusted earnings-per-share of $2.51 compared favorably to $2.20 in the prior year and was $0.02 better than expected. For the year, revenue increased 4% to $8.1 billion while adjusted earnings-per-share of $9.61 compared to $8.29 in 2024.

For the quarter, organic revenue was higher by 5% year-over-year while bookings grew by 10%.

Organic growth declined 6% for Engineered Products as strength in aerospace and defense were once again offset by weaker volumes in vehicle services.

Clean Energy & Fueling increased 4% due to continued strong demand for clean energy components and retail fueling in North America.

Image & Identification was up 1% due to demand for core marking and coding equipment and serialization software.

Revenue for Pumps and Process Solutions grew 11% due to higher demand for single-use biopharma components and AI and energy infrastructure products. Polymers had their first period of growth since Q1 2024.

Climate & Sustainability Technologies returned to growth as sales were up 9%. This segment benefited from solid shipment and order rates in refrigerated door cases and CO2 systems. This segment benefited from record shipments for heat exchangers in North America.

Overall, Dover enters 2026 with strong momentum in its business.

Source: Investor Presentation

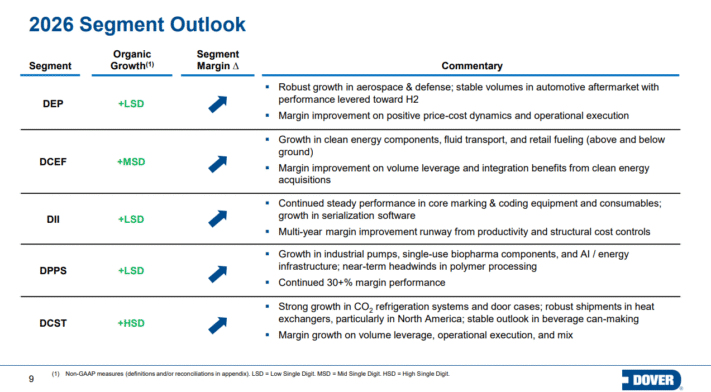

Dover expects adjusted earnings-per-share in a range of $10.45 to $10.65 for 2026. At the midpoint, this would represent 9.8% growth from 2025. Organic revenue growth is projected to be in a range of 3% to 5%.

Growth Prospects

Dover has pursued growth by expanding its customer base and through bolt-on acquisitions. To reshape its portfolio and maximize its long-term growth, Dover routinely executes a series of bolt-on acquisitions and occasional divestments.

The management team is constantly focused on delivering the most value to shareholders through portfolio transformation, which has generally been successful. The company’s prospects for 2025 also look strong in every aspect of its business.

Source: Investor Presentation

All of the company’s segments are projected to see at least single-digit organic growth in 2026.

Today, the company is a highly diversified industrial company with an attractive growth profile. In addition, Dover is also likely to enhance its earnings per share via opportunistic share repurchases.

We see 8% long-term earnings-per-share growth in the years to come, driven primarily by revenue increases, with a boost from share repurchases reducing the float.

Competitive Advantages & Recession Performance

Dover is a manufacturer of industrial equipment. The company offers highly engineered products that are critical to its customers. Switching to another supplier is also uneconomic for its customers because the risk of lower performance is material.

Therefore, Dover essentially operates in niche markets, which offer the company a significant competitive advantage. This competitive advantage helps explain Dover’s consistent long-term growth trajectory.

On the other hand, Dover is vulnerable to recessions due to its reliance on industrial customers. In the Great Recession, its earnings per share were as follows:

2007 earnings-per-share of $3.22

2008 earnings-per-share of $3.67 (14% increase)

2009 earnings-per-share of $2.00 (45% decline)

2010 earnings-per-share of $3.48 (74% increase)

Dover got through the Great Recession with just one year of decline in its earnings per share, and the company almost fully recovered from the recession in 2010.

Given its sensitivity to economic cycles, it is impressive that Dover has grown its dividend for 69 consecutive years.

Another reason is management’s conservative dividend policy, which targets a payout ratio of around 30%. This policy provides a wide margin of safety during rough economic periods. The expected payout ratio for 2026 is just 20%.

Overall, Dover will undoubtedly continue to raise its dividend for many more years thanks to its low payout ratio, decent recessions resilience, and healthy balance sheet.

Valuation & Expected Returns

Dover is expected to generate earnings-per-share of $10.55 for 2026. That means the stock trades at 22 times this year’s earnings, which is higher than our estimate of fair value at 18 times earnings.

That implies a ~3.9% annual headwind to total returns from valuation compression over the next five years.

Including 8% expected annual earnings-per-share growth, the 0.9% current dividend yield, and the annualized compression of the price-to-earnings ratio, we expect Dover to offer 4.5% average annual return over the next five years.

This puts Dover stock into the territory of a hold rating.

Final Thoughts

Dover has an impressive dividend growth record, with seven decades of dividend raises. This is an impressive achievement, particularly given the company’s dependence on industrial customers, who tend to struggle during recessions.

Dover has consistently grown its earnings per share over the years, which has translated into annual dividend increases.

This strategy gives the company ample room to continue growing for many more years. However, the stock is overpriced, meaning it earns a hold rating.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].