Updated on February 6th, 2026 by Nathan Parsh

PPG Industries (PPG) is one of the largest paint companies in the world. It is also one of the most reliable dividend stocks in the market—PPG has paid dividends every quarter since 1899.

Moreover, the company has increased its dividend each year for the last 54 years, which qualifies it for the exclusive Dividend Aristocrats list.

This is a group of 69 stocks in the S&P 500 Index that have had at least 25 consecutive years of dividend growth.

We consider the Dividend Aristocrats to be among the elite dividend-paying companies. With this in mind, we created a full list of all 69 Dividend Aristocrats.

You can download the entire Dividend Aristocrats list, with important financial metrics like dividend yields and P/E ratios, by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

The stock is also on the exclusive list of Dividend Kings.

PPG’s remarkable dividend consistency gives it broad appeal to the more conservative members of the dividend growth investing community.

Indeed, the company’s strong business model ensures a very safe dividend payment and room for steady dividend increases each year. This is still very much the case today.

This article will analyze PPG’s investment prospects in detail and determine whether the company merits a buy recommendation at current prices.

Business Overview

PPG Industries was founded in 1883 as a glass manufacturer and distributor. The company’s name, Pittsburgh Plate Glass, refers to its original operations.

Over time, PPG has made remarkable strides to become a leader in the paints and coatings industry.

With annual revenues of about $16 billion, PPG’s only competitors of similar size are fellow Dividend Aristocrat Sherwin-Williams (SHW) and Dutch paint company Akzo Nobel (AKZOY).

Thanks to its worldwide operating presence and focus on technology and innovation, PPG Industries has grown to such an impressive size.

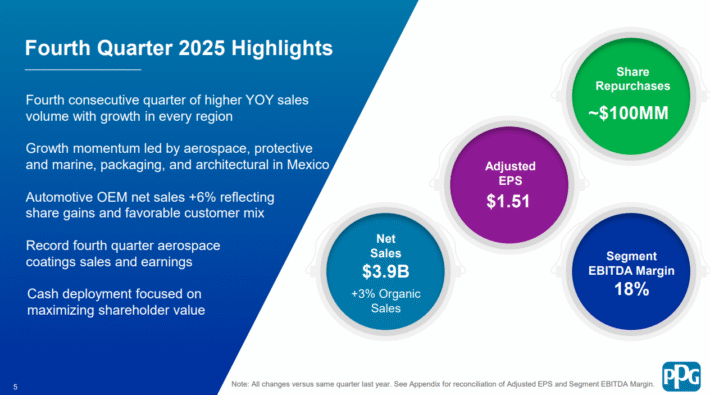

On January 27th, 2026, PPG Industries reported fourth-quarter and full year results for the period ending December 31st, 2025.

Source: Investor Presentation

For the quarter, revenue grew 4.8% to $3.91 billion, which was $140 million more than expected. Adjusted earnings-per-share of $1.51 compared unfavorably to $1.61 in the prior year and was $0.07 less than expected.

For the year, revenue from continuing improved 0.6% to $15.9 billion while adjusted earnings-per-share of $7.58 was down from $7.87 in 2025.

Fourth-quarter organic revenue growth was higher by 3% while full year results increased 2%. Global Architectural Coatings’ revenue, formerly part of Performance Coatings, grew 8% to $951 million for the quarter. Higher prices added 2% while foreign currency translation was a 9% tailwind to results. Volume was unchanged. Latin America and Asia Pacific were once again strong during the period.

Performance Coatings was up 5% to $1.32 billion as a 4% increase in prices and a small contribution from currency exchange offset a 1% drop in volume. Aerospace posted record results and the backlog increased $315 million.

The Industrial Coatings segment was higher by 3% to $1.64 billion as volume gains were offset by weaker prices and divestitures. Automotive OEMs produced another quarter of growth as this segment outpaced the global industry.

PPG Industries repurchased ~$100 million of shares during Q4 and and retired ~$790 million worth of stock during 2025. The company has $2.0 billion, or ~7.1% of its current market capitalization, remaining on its share repurchase authorization.

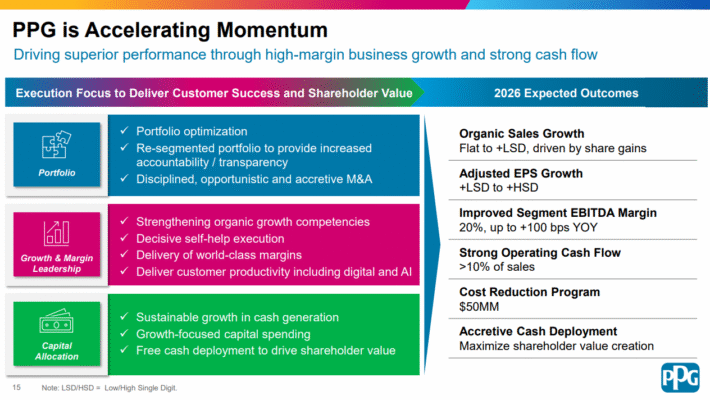

For 2026, the company expects organic sales to be in a range of flat to up a low single-digit percentage. Adjusted earnings-per-share in a range of $7.70 to $8.10. At the midpoint, this would represent a 4.2% improvement from 2025.

Growth Prospects

A company’s ability to increase revenues and profits is largely a function of its capital allocation.

In recent years, PPG has spent billions of dollars buying its next generation of growth. It tries to maintain a somewhat balanced capital allocation strategy, but it is also not afraid to spend big on acquisitions when opportunities present themselves.

PPG has spent much more of its deployed cash on share repurchases than its competitors, which has been a major source of earnings-per-share growth over time.

Acquisitions have been a key growth driver for PPG for many years. That growth has come at a cost, namely an increase in the company’s debt.

PPG is now virtually exclusively a coatings business. In recent years, the company has transformed away from legacy businesses like glass and chemicals, leaving it with a portfolio of coatings products that collectively generate nearly $16 billion in annual revenue. These businesses have largely seen improvements in margins in recent years.

Its track record suggests that its underlying business is likely to continue growing at a satisfactory rate for the foreseeable future. In the past decade, the company has grown its earnings-per-share at an average rate of just under 10%, but this growth rate deaccelerates to 3.1% when looking at just the last five years.

While the declining growth rate is obvious and concerning, we believe that the company has the ability to grow at a high single-digit rate given its strong fundamentals.

Source: Investor Presentation

We believe investors can reasonably expect 7% adjusted earnings-per-share growth from PPG Industries through full economic cycles.

However, PPG’s performance is likely to suffer during periods of economic recession. The good news is that we would likely see such an event as a buying opportunity for this high-quality business.

Competitive Advantages & Recession Performance

PPG enjoys several competitive advantages. It operates in the paints and coatings industry, which is economically attractive for several reasons. First, these products have high profit margins for manufacturers.

They also have low capital investment, which results in significant cash flow. As discussed above, PPG has used this significant cash flow over time.

Given all this, it makes sense that only two coatings companies (Sherwin-Williams and PPG Industries) are on the Dividend Aristocrats list.

That said, the paint and coatings industry is not recession-resistant because it depends on healthy housing and construction markets. This impact can be seen in PPG’s performance during the 2007-2009 financial crisis:

2007 adjusted earnings-per-share: $2.52

2008 adjusted earnings-per-share: $1.63 (35% decline)

2009 adjusted earnings-per-share: $1.02 (37% decline)

2010 adjusted earnings-per-share: $2.32 (127% increase)

PPG’s adjusted earnings-per-share fell by more than 50% during the last major recession and took two years to recover.

As PPG’s 2020 results showed, the decline in new construction is the dominant factor during a recession. The 2020 recession was no different, as PPG faced factory shutdowns and severely reduced consumer demand, although that proved to be transitory.

While this Dividend Aristocrat’s long-term prospects remain bright, investors should be willing to accept volatility in a recession.

Valuation & Expected Total Returns

We are forecasting earnings-per-share of $7.90 for the fiscal year of 2026, putting the price-to-earnings ratio at 15.7. This is below our fair value estimate of 19 times earnings, meaning PPG is undervalued today.

As such, we expect total returns from valuation expansion to increase by 3.9% annually over the next five years.

In total, we project that PPG will return 13.0% annually through 2031, stemming from 7% earnings growth and the starting yield of 2.3%, along with a 3.9% annualized return from an expanding P/E multiple.

Final Thoughts

PPG Industries has many of the characteristics of a very high-quality business. Its proven business model has allowed the company to weather any recession.

It also has a significant international presence and multiple catalysts for future growth. Lastly, it has increased its dividend for more than 50 years.

PPG’s dividend outlook is exemplary and we see many more years of dividend increases on the horizon. With expected annual returns of 13%, we rate PPG stock a buy.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].