Wells Fargo Cautions: Tech Sector’s High Hopes Could Lead to Big Letdowns

The AI-fueled rally — led once again by Nvidia — made a comeback this week, but renewed concerns around CoreWeave are putting a damper on enthusiasm. Investors are increasingly caught between FOMO on the AI boom and fears that this could be another dot-com-style bubble in the making.

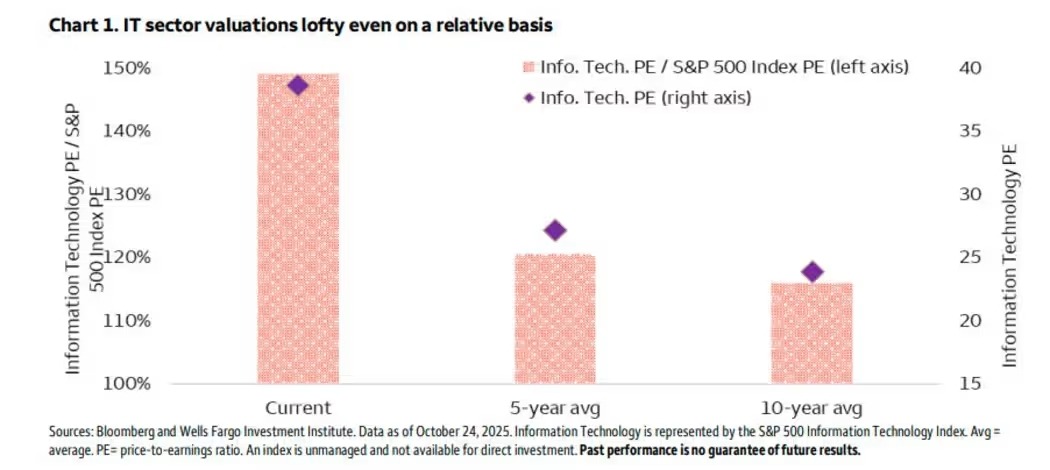

That tension is exactly what prompted the Wells Fargo Investment Institute (WFII) to downgrade the S&P 500 Information Technology sector — home to major AI players like Nvidia, Microsoft, and Broadcom — from favorable to neutral.

According to Douglas Beath, WFII’s global investment strategist, the decision largely comes down to valuation risks.

After turning bullish back in April, when the sector began a powerful 60% rally — outpacing the S&P 500 by more than 25% — WFII now believes the trade looks stretched.

Beath acknowledges that the AI tailwind remains strong, fueling sales, earnings, and impressive free cash flow across tech giants. However, he warns that “elevated expectations and overly bullish sentiment” leave the sector vulnerable to disappointment, especially if even a few companies report modest earnings misses.

Tensions between the U.S. and China over tech trade remain an undercurrent of risk. Meanwhile, massive AI-related spending has investors questioning return on investment and debt sustainability.

While Beath believes any pullback may be temporary, he recommends locking in some profits and reducing IT exposure back to market weight.

Instead, WFII sees opportunities in industrials, utilities, and financials — sectors that can still benefit from the AI-driven data center boom, but at lower valuations.

Industrials and utilities are riding the data infrastructure wave.

Financials stand to gain from a steeper yield curve, supportive regulation, and their role in financing AI growth.

In short: AI isn’t going away — but the easy money in tech might be.