Market Breadth Weakness Flags Concern, Says Mark Newton

Stocks remain under pressure early Friday, following Thursday’s sharp selloff — the worst session in over a month — where the Nasdaq Composite fell 2.3%. Tech looks set to lead declines again as investors balance concerns about stretched valuations with the possibility that Fed rate cuts may come slower than expected.

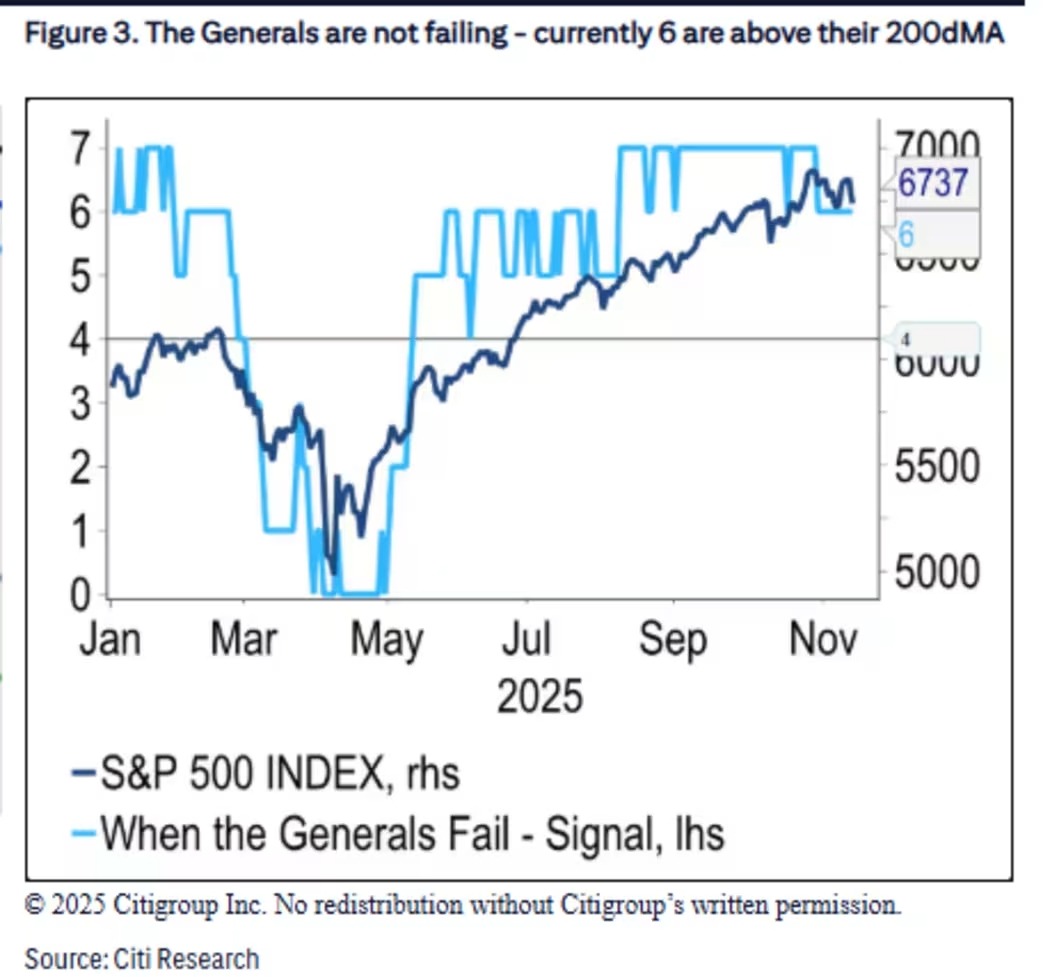

When markets turn shaky and fundamental drivers lose momentum, technical indicators often take center stage. Citi strategists point to one such signal suggesting the longer-term trend for big tech is still intact. Their “When Generals Fail” indicator — focused on the Mag 7 — shows only Meta is trading below its 200-day moving average, keeping the broader outlook constructive.

But not everyone is as calm. Mark Newton, head of technical strategy at Fundstrat, remains cautious about market breadth — the share of stocks rising alongside the major indexes. Weakness here can hint at deeper market fragility.

Newton notes that the percentage of Russell 3000 stocks within 20% of their 12-month highs has begun to roll over, a pattern seen just before the 2022 peak and late last year. At roughly 50%, he warns, this metric needs to firm up into year-end. Continued slippage could spell trouble for equities.

“Markets typically show internal weakness before corrective phases. This time looks no different,” he says.

A potential bright spot? Nvidia. After closing Thursday at $186.86, the AI leader reports earnings on Nov. 19. Strong results could provide a much-needed catalyst for a broader market rebound. Newton adds that while Nvidia has pulled back with semiconductors, near-term bearishness is unlikely unless it breaks below $178.91, last Friday’s low.

He also highlights key support levels:• S&P 500: 6,631• QQQ: 599

Breaking below these early-November lows could usher in more volatility before markets stabilize.

Newton still expects a December rebound, though a return to new highs may take time. Despite the caution, he remains upbeat: market breadth is a challenge, but subdued sentiment creates attractive opportunities to buy dips during a historically strong season.