Looking at the largest NYC startup funding rounds from June 2025, leveraging data from CrunchBase, we’ve analyzed the most significant venture capital deals of the month. Beyond the raw funding numbers, this analysis includes detailed information about each company’s industry focus, founding team, business model, investor participation, and total funding history to provide deeper context about these high-growth ventures driving innovation across the city.

🚀 REACH NYC TECH LEADERS

AlleyWatch is NYC’s leading source of tech and startup news, reaching the city’s most active founders, investors, and tech leaders. Learn More →

11. OpenRouter $40.0MRound: Series ADescription: New York-based OpenRouter is a platform that connects AI applications with large language models and cloud hosting providers. Founded by Alex Atallah and Louis Vichy in 2023, OpenRouter has now raised a total of $40.0M in total equity funding and is backed by Andreessen Horowitz, Menlo Ventures, Sequoia Capital, and Transpose Platform Management.Investors in the round: Andreessen Horowitz, Menlo Ventures, Sequoia Capital, Transpose Platform ManagementIndustry: Artificial Intelligence (AI), Information Technology, SoftwareFounders: Alex Atallah, Louis VichyFounding year: 2023Location: New York, NYTotal equity funding raised: $40.0M

11. Sword Health $40.0MRound: VentureDescription: New York-based Sword Health offers AI-powered physical therapy solutions for pain recovery at home. Founded by Marcio Colunas and Virgilio Bento in 2015, Sword Health has now raised a total of $366.0M in total equity funding and is backed by General Catalyst, Founders Fund, Khosla Ventures, Bond, and ADQ.Investors in the round: Armilar Venture Partners, Comcast Ventures, General Catalyst, Indico Capital Partners, Khosla Ventures, Lince Capital, Oxy Capital, ShillingIndustry: Artificial Intelligence (AI), Health Care, Medical, mHealth, TherapeuticsFounders: Marcio Colunas, Virgilio BentoFounding year: 2015Location: New York, NYTotal equity funding raised: $366.0M

11. Sword Health $40.0MRound: VentureDescription: New York-based Sword Health offers AI-powered physical therapy solutions for pain recovery at home. Founded by Marcio Colunas and Virgilio Bento in 2015, Sword Health has now raised a total of $366.0M in total equity funding and is backed by General Catalyst, Founders Fund, Khosla Ventures, Bond, and ADQ.Investors in the round: Armilar Venture Partners, Comcast Ventures, General Catalyst, Indico Capital Partners, Khosla Ventures, Lince Capital, Oxy Capital, ShillingIndustry: Artificial Intelligence (AI), Health Care, Medical, mHealth, TherapeuticsFounders: Marcio Colunas, Virgilio BentoFounding year: 2015Location: New York, NYTotal equity funding raised: $366.0M

11. Certify $40.0MRound: Series BDescription: New York-based Certify is an API-driven platform automating all stages of provider network management: licensing, enrollment, credentialing, monitoring. Founded by Anshul Rathi, Mitchell Gorodokin, and Shrishti Mamidi in 2021, Certify has now raised a total of $59.1M in total equity funding and is backed by General Catalyst, Hustle Fund, Transformation Capital, Max Ventures, and Upfront Ventures.Investors in the round: General Catalyst, SemperVirens Venture Capital, Transformation Capital, Upfront VenturesIndustry: Developer APIs, Health Care, SoftwareFounders: Anshul Rathi, Mitchell Gorodokin, Shrishti MamidiFounding year: 2021Location: New York, NYTotal equity funding raised: $59.1M

11. Certify $40.0MRound: Series BDescription: New York-based Certify is an API-driven platform automating all stages of provider network management: licensing, enrollment, credentialing, monitoring. Founded by Anshul Rathi, Mitchell Gorodokin, and Shrishti Mamidi in 2021, Certify has now raised a total of $59.1M in total equity funding and is backed by General Catalyst, Hustle Fund, Transformation Capital, Max Ventures, and Upfront Ventures.Investors in the round: General Catalyst, SemperVirens Venture Capital, Transformation Capital, Upfront VenturesIndustry: Developer APIs, Health Care, SoftwareFounders: Anshul Rathi, Mitchell Gorodokin, Shrishti MamidiFounding year: 2021Location: New York, NYTotal equity funding raised: $59.1M

10. Yieldstreet $45.0MRound: Series DDescription: New York-based Yieldstreet is an alternative investment platform that provides retail investors access to income-generating investment products. Founded by Dennis Shields, Michael Weisz, and Milind Mehere in 2015, Yieldstreet has now raised a total of $339.7M in total equity funding and is backed by Gaingels, Monroe Capital, Edison Partners, Greycroft, and JP Morgan.Investors in the round: Edison Partners, Mayfair Equity Partners, Tarsadia InvestmentsIndustry: Finance, Financial Services, FinTech, Wealth ManagementFounders: Dennis Shields, Michael Weisz, Milind MehereFounding year: 2015Location: New York, NYTotal equity funding raised: $339.7M

10. Yieldstreet $45.0MRound: Series DDescription: New York-based Yieldstreet is an alternative investment platform that provides retail investors access to income-generating investment products. Founded by Dennis Shields, Michael Weisz, and Milind Mehere in 2015, Yieldstreet has now raised a total of $339.7M in total equity funding and is backed by Gaingels, Monroe Capital, Edison Partners, Greycroft, and JP Morgan.Investors in the round: Edison Partners, Mayfair Equity Partners, Tarsadia InvestmentsIndustry: Finance, Financial Services, FinTech, Wealth ManagementFounders: Dennis Shields, Michael Weisz, Milind MehereFounding year: 2015Location: New York, NYTotal equity funding raised: $339.7M

9. Octaura $46.5MRound: VentureDescription: New York-based Octaura is an electronic trading solution created by the industry, for the industry. Founded by Brian Bejile in 2022, Octaura has now raised a total of $46.5M in total equity funding and is backed by Citi, Deutsche Bank, Apollo, Goldman Sachs, and Bank of America.Investors in the round: Apollo, Bank of America, Barclays, BNP Paribas, Citi, Deutsche Bank, Goldman Sachs, JP Morgan Chase, MassMutual Ventures, Moody’s Investors Service, Morgan Stanley, Motive Partners, OMERS Ventures, Wells FargoIndustry: Analytics, Finance, Financial Services, FinTech, Trading PlatformFounders: Brian BejileFounding year: 2022Location: New York, NYTotal equity funding raised: $46.5MAlleyWatch’s exclusive coverage of this round: Octaura Raises $46.5M to Digitize Electronic Trading in Syndicated Loan and CLO Markets

9. Octaura $46.5MRound: VentureDescription: New York-based Octaura is an electronic trading solution created by the industry, for the industry. Founded by Brian Bejile in 2022, Octaura has now raised a total of $46.5M in total equity funding and is backed by Citi, Deutsche Bank, Apollo, Goldman Sachs, and Bank of America.Investors in the round: Apollo, Bank of America, Barclays, BNP Paribas, Citi, Deutsche Bank, Goldman Sachs, JP Morgan Chase, MassMutual Ventures, Moody’s Investors Service, Morgan Stanley, Motive Partners, OMERS Ventures, Wells FargoIndustry: Analytics, Finance, Financial Services, FinTech, Trading PlatformFounders: Brian BejileFounding year: 2022Location: New York, NYTotal equity funding raised: $46.5MAlleyWatch’s exclusive coverage of this round: Octaura Raises $46.5M to Digitize Electronic Trading in Syndicated Loan and CLO Markets

8. Traversal $48.0MRound: Series ADescription: New York-based Traversal is building the AI SRE for the enterprise. Founded by Anish Agarwal, Raj Agrawal, Raaz Dwivedi, and Ahmed Lone in 2023, Traversal has now raised a total of $48.0M in total equity funding and is backed by Sequoia Capital, Kleiner Perkins, NFDG Ventures, and Hanabi Capital.Investors in the round: Hanabi Capital, Kleiner Perkins, NFDG Ventures, Sequoia CapitalIndustry: Artificial Intelligence (AI), Software, Software EngineeringFounders: Anish Agarwal, Raj Agrawal, Raaz Dwivedi, Ahmed LoneFounding year: 2023Location: New York, NYTotal equity funding raised: $48.0M

8. Traversal $48.0MRound: Series ADescription: New York-based Traversal is building the AI SRE for the enterprise. Founded by Anish Agarwal, Raj Agrawal, Raaz Dwivedi, and Ahmed Lone in 2023, Traversal has now raised a total of $48.0M in total equity funding and is backed by Sequoia Capital, Kleiner Perkins, NFDG Ventures, and Hanabi Capital.Investors in the round: Hanabi Capital, Kleiner Perkins, NFDG Ventures, Sequoia CapitalIndustry: Artificial Intelligence (AI), Software, Software EngineeringFounders: Anish Agarwal, Raj Agrawal, Raaz Dwivedi, Ahmed LoneFounding year: 2023Location: New York, NYTotal equity funding raised: $48.0M

7. Tastewise $50.0MRound: Series BDescription: New York-based Tastewise is a consumer intelligence platform that provides insights for food brands. Founded by Alon Chen and Eyal Gaon in 2018, Tastewise has now raised a total of $71.6M in total equity funding and is backed by PeakBridge, PICO Venture Partners, TELUS Global Ventures, Disruptive, and Disruptive AI Venture Capital.Investors in the round: Disruptive AI Venture Capital, Duo Partners, PeakBridge, PICO Venture Partners, TELUS Global VenturesIndustry: Analytics, Artificial Intelligence (AI), Big Data, Consumer Goods, Food and Beverage, Marketing, Predictive Analytics, Restaurants, RetailFounders: Alon Chen, Eyal GaonFounding year: 2018Location: New York, NYTotal equity funding raised: $71.6M

7. Tastewise $50.0MRound: Series BDescription: New York-based Tastewise is a consumer intelligence platform that provides insights for food brands. Founded by Alon Chen and Eyal Gaon in 2018, Tastewise has now raised a total of $71.6M in total equity funding and is backed by PeakBridge, PICO Venture Partners, TELUS Global Ventures, Disruptive, and Disruptive AI Venture Capital.Investors in the round: Disruptive AI Venture Capital, Duo Partners, PeakBridge, PICO Venture Partners, TELUS Global VenturesIndustry: Analytics, Artificial Intelligence (AI), Big Data, Consumer Goods, Food and Beverage, Marketing, Predictive Analytics, Restaurants, RetailFounders: Alon Chen, Eyal GaonFounding year: 2018Location: New York, NYTotal equity funding raised: $71.6M

6. Vivrelle $62.0MRound: Series CDescription: New York-based Vivrelle is a luxury accessories membership club that provides access to a shared closet of designer handbags, jewelry, and diamonds. Founded by Blake Cohen Geffen and Wayne Geffen in 2018, Vivrelle has now raised a total of $131.0M in total equity funding and is backed by Origin Ventures, Protagonist, 3L Capital, Plus Capital, and Chapford Capital Group.Investors in the round: ProtagonistIndustry: E-Commerce, Fashion, Jewelry, Subscription ServiceFounders: Blake Cohen Geffen, Wayne GeffenFounding year: 2018Location: New York, NYTotal equity funding raised: $131.0M

6. Vivrelle $62.0MRound: Series CDescription: New York-based Vivrelle is a luxury accessories membership club that provides access to a shared closet of designer handbags, jewelry, and diamonds. Founded by Blake Cohen Geffen and Wayne Geffen in 2018, Vivrelle has now raised a total of $131.0M in total equity funding and is backed by Origin Ventures, Protagonist, 3L Capital, Plus Capital, and Chapford Capital Group.Investors in the round: ProtagonistIndustry: E-Commerce, Fashion, Jewelry, Subscription ServiceFounders: Blake Cohen Geffen, Wayne GeffenFounding year: 2018Location: New York, NYTotal equity funding raised: $131.0M

💡 CONNECT WITH NYC INNOVATORS

Join NYC’s top tech companies in reaching AlleyWatch’s engaged audience of founders, investors, and decision-makers. Learn More →

5. Tennr $101.0MRound: Series CDescription: New York-based Tennr is a healthcare AI startup that provides an automation platform for medical documents. Founded by Diego Baugh, Trey Holterman, and Tyler Johnson in 2021, Tennr has now raised a total of $161.0M in total equity funding and is backed by Andreessen Horowitz, Y Combinator, IVP, Lightspeed Venture Partners, and Foundation Capital.Investors in the round: Andreessen Horowitz, Foundation Capital, Frank Slootman, Google Ventures, ICONIQ Capital, IVP, Lightspeed Venture PartnersIndustry: Artificial Intelligence (AI), Health Care, Medical, SoftwareFounders: Diego Baugh, Trey Holterman, Tyler JohnsonFounding year: 2021Location: New York, NYTotal equity funding raised: $161.0M

5. Tennr $101.0MRound: Series CDescription: New York-based Tennr is a healthcare AI startup that provides an automation platform for medical documents. Founded by Diego Baugh, Trey Holterman, and Tyler Johnson in 2021, Tennr has now raised a total of $161.0M in total equity funding and is backed by Andreessen Horowitz, Y Combinator, IVP, Lightspeed Venture Partners, and Foundation Capital.Investors in the round: Andreessen Horowitz, Foundation Capital, Frank Slootman, Google Ventures, ICONIQ Capital, IVP, Lightspeed Venture PartnersIndustry: Artificial Intelligence (AI), Health Care, Medical, SoftwareFounders: Diego Baugh, Trey Holterman, Tyler JohnsonFounding year: 2021Location: New York, NYTotal equity funding raised: $161.0M

4. Digital Asset $135.0MRound: Series EDescription: New York-based Digital Asset develops distributed ledger and smart contract infrastructure aimed at enabling synchronized finance across institutions. Founded by Don Wilson, Eric Saraniecki, Shaul Kfir, Sunil Hirani, and Yuval Rooz in 2014, Digital Asset has now raised a total of $442.2M in total equity funding and is backed by Citi, Republic, Goldman Sachs, YZi Labs, and BNP Paribas.Investors in the round: 7RIDGE, BNP Paribas, Circle Ventures, Citadel Securities, DRW Venture Capital, DTCC, Goldman Sachs, IMC, Liberty City Ventures, Optiver, Paxos, Polychain, QCP, Republic, Tradeweb, Virtu Financial, YZi LabsIndustry: Blockchain, Cryptocurrency, Developer Platform, Developer Tools, FinTechFounders: Don Wilson, Eric Saraniecki, Shaul Kfir, Sunil Hirani, Yuval RoozFounding year: 2014Location: New York, NYTotal equity funding raised: $442.2M

4. Digital Asset $135.0MRound: Series EDescription: New York-based Digital Asset develops distributed ledger and smart contract infrastructure aimed at enabling synchronized finance across institutions. Founded by Don Wilson, Eric Saraniecki, Shaul Kfir, Sunil Hirani, and Yuval Rooz in 2014, Digital Asset has now raised a total of $442.2M in total equity funding and is backed by Citi, Republic, Goldman Sachs, YZi Labs, and BNP Paribas.Investors in the round: 7RIDGE, BNP Paribas, Circle Ventures, Citadel Securities, DRW Venture Capital, DTCC, Goldman Sachs, IMC, Liberty City Ventures, Optiver, Paxos, Polychain, QCP, Republic, Tradeweb, Virtu Financial, YZi LabsIndustry: Blockchain, Cryptocurrency, Developer Platform, Developer Tools, FinTechFounders: Don Wilson, Eric Saraniecki, Shaul Kfir, Sunil Hirani, Yuval RoozFounding year: 2014Location: New York, NYTotal equity funding raised: $442.2M

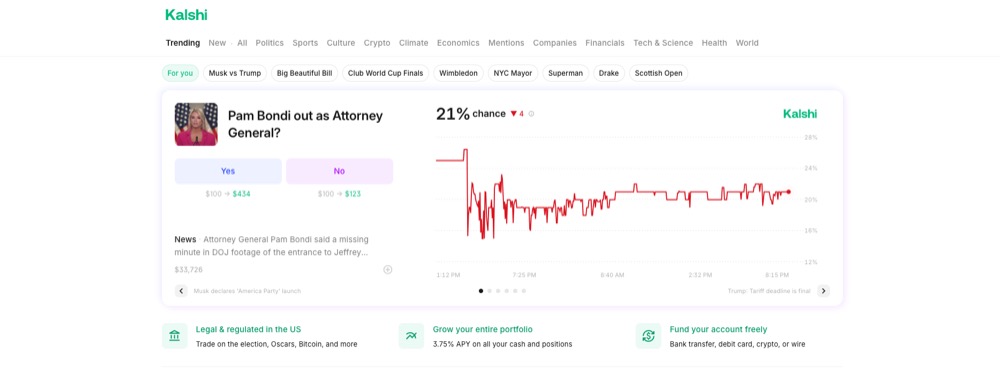

3. Kalshi $185.0MRound: Series CDescription: New York-based Kalshi is an exchange app that allows people to trade on event outcomes. Founded by Luana Lopes Lara and Tarek Mansour in 2018, Kalshi has now raised a total of $215.2M in total equity funding and is backed by Y Combinator, Bond, Sequoia Capital, Paradigm, and SV Angel.Investors in the round: Bond, Multicoin Capital, Neo, Paradigm, Peng Zhao, Sequoia CapitalIndustry: Finance, Financial Services, FinTech, Internet, Predictive AnalyticsFounders: Luana Lopes Lara, Tarek MansourFounding year: 2018Location: New York, NYTotal equity funding raised: $215.2M

3. Kalshi $185.0MRound: Series CDescription: New York-based Kalshi is an exchange app that allows people to trade on event outcomes. Founded by Luana Lopes Lara and Tarek Mansour in 2018, Kalshi has now raised a total of $215.2M in total equity funding and is backed by Y Combinator, Bond, Sequoia Capital, Paradigm, and SV Angel.Investors in the round: Bond, Multicoin Capital, Neo, Paradigm, Peng Zhao, Sequoia CapitalIndustry: Finance, Financial Services, FinTech, Internet, Predictive AnalyticsFounders: Luana Lopes Lara, Tarek MansourFounding year: 2018Location: New York, NYTotal equity funding raised: $215.2M

2. Ramp $200.0MRound: Series EDescription: New York-based Ramp is a financial operations platform designed to save companies time and money. Founded by Eric Glyman, Gene Lee, and Karim Atiyeh in 2019, Ramp has now raised a total of $1.3B in total equity funding and is backed by General Catalyst, Stripe, Citi, Sequoia Capital, and Founders Fund.Investors in the round: 137 Ventures, 8VC, Avenir, D1 Capital Partners, Definition, Founders Fund, General Catalyst, GIC, ICONIQ Growth, Khosla Ventures, Lux Capital, Pathlight Ventures, Sands Capital Ventures, Stripes, Thrive CapitalIndustry: Finance, Financial Services, FinTechFounders: Eric Glyman, Gene Lee, Karim AtiyehFounding year: 2019Location: New York, NYTotal equity funding raised: $1.3B

2. Ramp $200.0MRound: Series EDescription: New York-based Ramp is a financial operations platform designed to save companies time and money. Founded by Eric Glyman, Gene Lee, and Karim Atiyeh in 2019, Ramp has now raised a total of $1.3B in total equity funding and is backed by General Catalyst, Stripe, Citi, Sequoia Capital, and Founders Fund.Investors in the round: 137 Ventures, 8VC, Avenir, D1 Capital Partners, Definition, Founders Fund, General Catalyst, GIC, ICONIQ Growth, Khosla Ventures, Lux Capital, Pathlight Ventures, Sands Capital Ventures, Stripes, Thrive CapitalIndustry: Finance, Financial Services, FinTechFounders: Eric Glyman, Gene Lee, Karim AtiyehFounding year: 2019Location: New York, NYTotal equity funding raised: $1.3B

1. Cyera $540.0MRound: Series EDescription: New York-based Cyera is an AI-powered data security platform that gives enterprises deep context on their data to assure cyber-resilience and compliance. Founded by Tamar Bar-Ilan and Yotam Segev in 2021, Cyera has now raised a total of $1.3B in total equity funding and is backed by Accel, Sequoia Capital, Lightspeed Venture Partners, Sapphire Ventures, and Coatue.Investors in the round: Accel, Alta Park Capital, Coatue, Cyberstarts, Georgian, Greenoaks, Lightspeed Venture Partners, Redpoint, Sapphire Ventures, Sequoia Capital, Spark CapitalIndustry: Artificial Intelligence (AI), Cloud Data Services, Cyber Security, Network SecurityFounders: Tamar Bar-Ilan, Yotam SegevFounding year: 2021Location: New York, NYTotal equity funding raised: $1.3B

1. Cyera $540.0MRound: Series EDescription: New York-based Cyera is an AI-powered data security platform that gives enterprises deep context on their data to assure cyber-resilience and compliance. Founded by Tamar Bar-Ilan and Yotam Segev in 2021, Cyera has now raised a total of $1.3B in total equity funding and is backed by Accel, Sequoia Capital, Lightspeed Venture Partners, Sapphire Ventures, and Coatue.Investors in the round: Accel, Alta Park Capital, Coatue, Cyberstarts, Georgian, Greenoaks, Lightspeed Venture Partners, Redpoint, Sapphire Ventures, Sequoia Capital, Spark CapitalIndustry: Artificial Intelligence (AI), Cloud Data Services, Cyber Security, Network SecurityFounders: Tamar Bar-Ilan, Yotam SegevFounding year: 2021Location: New York, NYTotal equity funding raised: $1.3B

📈 ENGAGE NYC DECISION MAKERS

Connect with NYC’s tech ecosystem through AlleyWatch, the most trusted voice in local tech and startups. Learn More →