The hospitality industry faces mounting challenges with fragmented software systems, rising operational costs, and persistent labor shortages that make scaling operations increasingly difficult. Disconnected front and back-office teams create inefficiencies that impact both guest experience and profitability. SuiteOp offers an all-in-one platform that consolidates critical functions into a seamless ecosystem, from smart device management to guest screening and task management. Actual operators created this platform after facing these challenges firsthand while managing hundreds of units. Their automation-first approach delivers tangible results, with customers reporting up to 20% reduction in operational expenses and a 3.5x return on investment through enhanced revenue. AlleyWatch sat down with SuiteOp Co-founder and COO Simon Seroussi to learn more about the business, its strategic expansion plans, and recent $3M seed round.

Who were your investors and how much did you raise?

$3M Seed from ScopVc, Dream, and angel investors including Kunal Shah, and Sudeep Singh, and Song Pak.

What inspired the start of SuiteOp and please tell us about the product or service that SuiteOp offers?

SuiteOp emerged from the real-world challenges faced by our founding team while scaling Sosuite — a short-term rental brand managing hundreds of units across Philadelphia. In the wake of COVID-19, they grappled with skyrocketing operational costs, chronic labor shortages, and disjointed software stacks that made scaling harder. Rather than accept these inefficiencies, they set out to build the automation-first operating system they couldn’t find in the market.While SuiteOp was born in the short-term rental space, it now powers a wide range of lodging businesses — from boutique hotels to hybrid operators — facing the same operational challenges.

How is SuiteOp different?

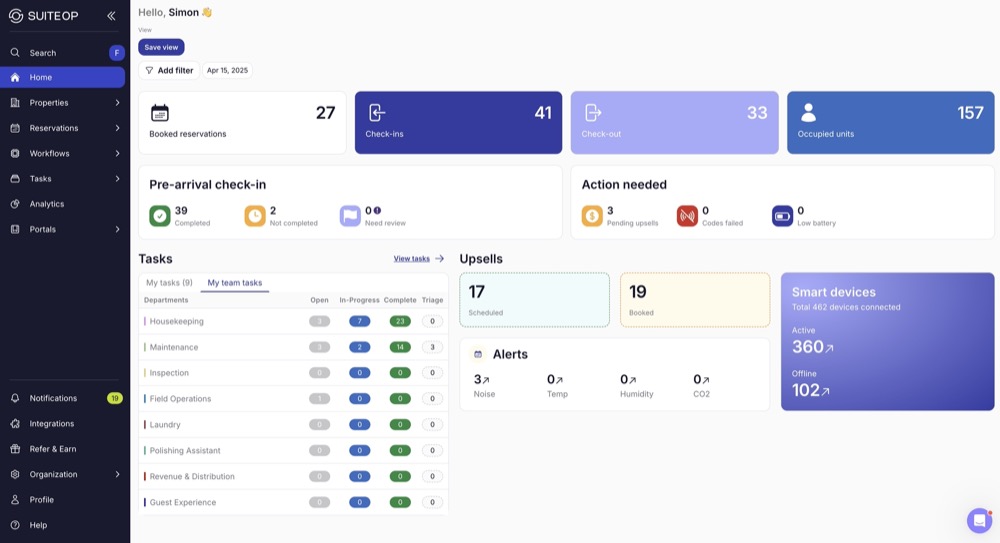

SuiteOp is the first “Guest Operations Platform” that connects hospitality teams, operations, and guest experience tools in one cohesive ecosystem, eliminating the need for fragmented software stacks and multiple tools.

It was created by actual operators (the founders of Sosuite) who faced real-world challenges in managing hundreds of units, giving them practical insight into industry pain points

SuiteOp is specifically designed with automation as its core focus, helping hospitality operators run efficiently despite labor shortages and high operational costs

IoT oversight and smart automation

White-labeled guest portals

Guest screening

Task management

Analytics

It combines several key capabilities into one cohesive workflow:

Unlike enterprise-level platforms built for massive hotel chains, SuiteOp is accessible to operators of all sizes – including smaller, independent businesses – enabling them to deliver high-end guest experiences without needing extensive internal resources.

SuiteOp has impressive market validation with zero percent customer churn despite industry challenges, suggesting strong product-market fit

SuiteOp also solves one of the industry’s biggest pain points: disconnection between front- and back-office teams. By integrating these workflows, it helps operators unlock a new level of efficiency and service quality.

What market does SuiteOp target and how big is it?

SuiteOp addresses the operational challenges across the fragmented $1.2T global lodging industry, with strategic focus on the rapidly growing short-term rental segment, vacation rental properties, and independent boutique hotels.This market encompasses over 10 million professionally managed properties worldwide seeking technology solutions to enhance operational efficiency and revenue optimization in an increasingly competitive landscape.

What’s your business model?

SuiteOp employs a straightforward utilization-based pricing structure: a simple monthly fee based on the number of active properties managed through our platform. Our commitment to transparency means you’ll never encounter hidden costs or surprise charges that compromise your financial planning.Unlike competitors who rely on complex transaction-based fee structures that can fluctuate unpredictably month-to-month, SuiteOp’s consistent pricing model allows property managers to forecast expenses with confidence and maximize their operational efficiency without financial uncertainty.

How are you preparing for a potential economic slowdown?

SuiteOp enables property operators to thrive in any economic climate by enhancing operational efficiency and generating ancillary revenue in the typically low-margin hospitality sector. It was in part developed in response to post-COVID challenges, and was created to help operators maintain profitability during economic downturns.Our solution delivers tangible results: a 3.5x average return on investment through revenue enhancement, while reducing operational expenses by up to 20%. With that in mind, SuiteOp becomes a solution of choice during economic slowdowns, and we are actually seeing increased adoption in these times.

What was the funding process like?

It unfolded organically. We weren’t actively seeking capital in December, having only held preliminary conversations months earlier without conviction about timing. As momentum built, the partnership with ScopVC emerged naturally. Their operator mindset and understanding of company-building fundamentals aligned perfectly with our vision, making the decision to proceed straightforward.

What are the biggest challenges that you faced while raising capital?

Finding investors who truly understood our business and were willing to commit on aligned terms proved challenging. The process requires coordinating various stakeholders – individuals and institutional funds – each with distinct priorities, investment thresholds, and decision-making timelines.Maintaining consistent terms while accommodating these differences required us to navigate this with a lot of attention and a lot of care.

What factors about your business led your investors to write the check?

I think they were three compelling factors drove our investment success:

Industry expertise that enables us to anticipate market needs rather than merely react to them: deep domain knowledge allows us to leverage customer feedback as validation rather than direction, keeping us ahead of trends.

Technical background from our founding team, resulting in rapid development cycles and the ability to iterate quickly based on real-world implementation, significantly shortening our time-to-market for new features.

Exceptional product-market fit evidenced by near-zero churn rates, which we believe is the most powerful indicator that our solution delivers measurable value and has become essential to our customers’ operations.

What are the milestones you plan to achieve in the next six months?

We’re targeting aggressive but achievable growth on two fronts: growing our revenue through expanded market penetration while simultaneously launching a next-generation automation suite.This new technology will push beyond current industry capabilities, introducing AI-driven operational tools that reduce manual intervention by 70% across property management workflows –something currently impossible with existing solutions.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Prioritize validation and revenue generation before chasing venture funding. The New York ecosystem provides ample opportunities to test your concept through customer pilots and strategic partnerships.Build a sustainable business model that generates early cash flow: even modest revenue provides both validation and runway. Remember that VC funding is a tool, not a destination; many successful companies bootstrap to profitability by solving real customer problems. When you do demonstrate market traction, you’ll negotiate from a position of strength rather than necessity.

Where do you see the company going in the near term?

We’re at an inflection point in our growth trajectory. Until now, we’ve been primarily product-driven, allowing our solution’s capabilities to speak for themselves while growing organically through word-of-mouth.With our recent funding, we’re strategically accelerating on two fronts: ramping up our go-to-market initiatives to expand market penetration, while simultaneously maintaining the rapid product development pace that has established us as an emerging leader in the space.

What’s your favorite spring destination in and around the city?Too many to count! Walking from Pier 25 to Pier 97 on a spring day is always amazing. We have an adventurous dachshund, Couscous, who’s a real outdoor fella, and it’s always an incredible walk as it warms up, stopping at various establishments along the way for a juice or a little spritz.We’re all foodies, and have discovered a couple of new spots recently – Boni and Mott has phenomenal Mediterranean food (and a burger to die for) that’s perfect on a spring day. And one of the best chicken burgers in the city is at Forefeather, who just opened their Manhattan spot between Gramercy Park & Murray Hill. Spring in NYC just hits different after winter!