In the United States, only 27% of private sector workers have access to paid family leave, leaving millions of new parents to choose between financial stability and time with their newborn children. Current solutions fall short, with state programs excluding many families and traditional short-term disability insurance offering limited coverage that primarily benefits only birthing parents. Parento addresses this critical gap by providing the first-ever insurance product specifically designed for paid parental leave, offering companies a three-in-one solution that combines customized insurance coverage, streamlined leave management, and personalized parent coaching. The platform serves both birthing and non-birthing parents, achieving a remarkable 95% return-to-work rate compared to the industry standard of 60%. With its comprehensive approach, Parento helps employers control expenses while supporting employees through one of life’s most significant transitions, targeting the $43B total addressable market for parental leave solutions.

AlleyWatch sat down with Parento CEO and Founder Dirk Doebler to learn more about the business, its future plans, recent funding round, and much, much more…

Who were your investors and how much did you raise?

Parento raised $5.9M in a Seed II round led by ResilienceVC, with participation from Kapor Capital, Bread & Butter Ventures, Operator Stack, Coyote Ventures, ffVC, Human Ventures, Springbank, Precursor, Cross Impact, K Street, Evidenced, and Avesta. Parento’s total funding to date is $10.3M.

Tell us about the product or service that Parento offers.

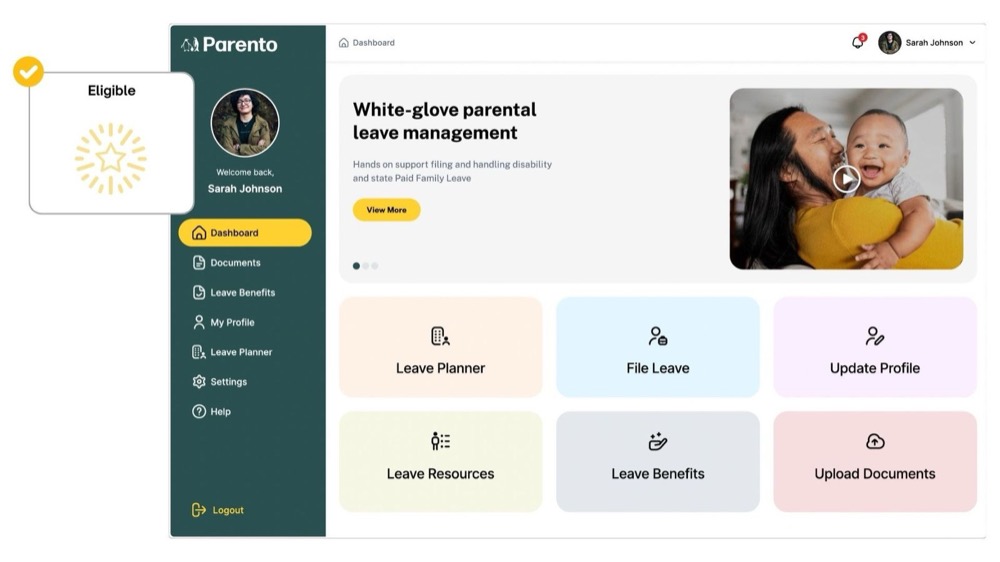

Parento provides a three-in-one paid parental leave solution that combines insurance, streamlined parental leave management, and personalized parent coaching. This approach helps employers control expenses, ease HR burdens, and support employees. Parento drives outcomes like a 95% return-to-work rate, surpassing the industry standard of 60% with strong participation from both mothers and fathers.

What inspired the start of Parento?

I founded Parento in 2019. Previously serving as a CFO of a consumer-packaged goods brand with a large base of women and new parents, I saw firsthand how inadequate existing parental leave solutions were. At the time, the only available options were state-paid family leave programs and short-term disability insurance. Both options excluded many families, failed to provide sufficient time off, and offered limited financial support. Private alternatives, such as self-funding leave, were expensive and unsustainable for most employers. Recognizing the urgent need for a more inclusive and effective solution, Parento was founded to close these gaps within paid parental leave.

How is Parento different?

Parento stands apart because we pioneered the first-ever insurance product for paid parental leave, giving companies a way to anticipate birth rates, manage risk, and turn unpredictable costs into predictable ones. Unlike consultants or policy advisors, Parento delivers a comprehensive three-in-one solution:

Financial support through customized PPL insurance policies tailored to each company’s employee demographics; much like car insurance is built around a driver’s profile.

Administrative support that streamlines the complexities of leave management for HR teams.

Employee engagement and coaching that enhances the parent experience, boosts mental health, and drives retention.

While short-term disability policies have long been used as a stopgap for maternity leave, Parento’s coverage is intentionally inclusive, designed for both birthing and non-birthing parents. This combination of innovation, customization, and inclusivity makes Parento fundamentally different and a powerful stand-alone from anyone else in the space.

What market does Parento target and how big is it?

Parento targets small and mid-sized businesses across diverse sectors (including nonprofits and manufacturing/warehousing) and is expanding via partnerships and unions such as the International Union of Operating Engineers (IUOE). Our primary vision is to provide paid parental leave to all individuals in need of insurance.

We target companies with at least 10 full-time employees

All industries are welcome but we see quick adoption in consulting and professional services, public entities, and those with employees across multiple states, both with and without access to paid parental leave .

TAM is roughly $43B.

What’s your business model?

Parento provides paid parental leave insurance to employers directly, with unlimited expert support to working parents, especially when they’re welcoming a new kid. Combining these services, even if optionally available, enables us to provide such hands-on support to even the smallest of companies.

How are you preparing for a potential economic slowdown?

We’re focusing on sectors that stay resilient early in any slowdown, ensuring we grow while supporting clients through uncertainty.

What was the funding process like?

The funding process was both intense and humbling. It was an experience marked by long hours, high stress, and plenty of ups and downs. After securing an initial term sheet, I assumed the rest of the round would come together quickly, but in reality it took another two months to bring additional investors on board. The process was more complex than anticipated, requiring persistence, patience, and constant engagement to see it through.

What are the biggest challenges that you faced while raising capital?

The stress of not knowing when, or even if, the round will come together and close, or if it will fall apart. The pressure only intensifies the longer the process takes, especially as more funds reject you.

What factors about your business led your investors to write the check?

We have a lot of alignment between the social impact we’re having in getting more money into average Americans’ pockets. Our investors are looking for social returns in addition to financial ones, and that alignment is refreshing.

What are the milestones you plan to achieve in the next six months?

Parento plans to scale the team, launch new automations, launch with new distribution partners, and boost revenue by 3-4x.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Nearly every founder goes through it, and even some that raise can run uncomfortably low on capital. Reach out to the other founders in your network regularly and commiserate with them because the lows of founding a company are really low, and really only other founders will appreciate how tough it is to have very little cash.

Where do you see the company going now over the near term?

We will be launching a number of new products while investing in more brand awareness, so expect to see our name out there much more often.

What’s your favorite fall destination in and around the city?

Definitely the Rivertowns. Our favorite cafe that has my favorite croissants is over in Hastings-on-Hudson. The changing leaves with the Palisades and Hudson in the background are perfect.