The $175B U.S. life insurance market stands at a critical inflection point: while 90% of policies are sold through financial advisors, these professionals navigate a fragmented ecosystem of over 10 disconnected legacy tools, each handling separate aspects of quoting, underwriting, and case management. This operational complexity translates into a six-month average policy cycle time for permanent life insurance, creating friction at every stage of the client journey and limiting advisors’ capacity to serve their clients effectively. Modern Life addresses this systemic inefficiency by consolidating the entire life insurance workflow into a single AI-powered platform that enables advisors to instantly quote across 30+ carriers, receive underwriting decisions in minutes rather than weeks through its Express Decision capability, and manage the complete client lifecycle from a unified dashboard. The platform’s proprietary AI analyzes medical and financial data to identify the most competitive carriers for each client’s unique needs while helping advisors navigate the intricate intersections of tax planning, financial optimization, and medical underwriting—capabilities that would otherwise require a team of specialized experts. With access to every major product type from permanent and term life to annuities and long-term care, Modern Life delivers up to 20% cost savings for clients through smarter product selection and expert underwriting advocacy, all while maintaining SOC 2 certification and enterprise-grade data security.

AlleyWatch sat down with Modern Life Founder and CEO Michael Konialian to learn more about the business, the future plans, recent funding round, and much, much more…

Who were your investors and how much did you raise?

We raised a $20M Series A led by Thrive Capital, with participation from New York Life Ventures, Northwestern Mutual Future Ventures, and Allegis. That brings our total funding to $35M, following our earlier $15M seed round, which was also led by Thrive.

Tell us about the product or service that Modern Life offers.

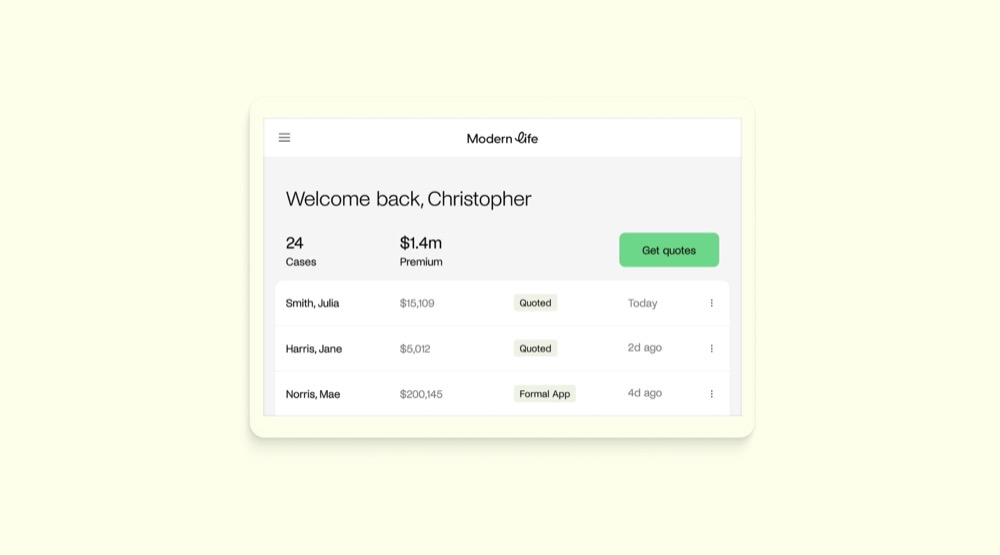

At Modern Life, we’ve built an AI-powered, tech-enabled life insurance brokerage platform designed specifically for financial professionals. Advisors use our platform to obtain and compare instant quotes from more than 30 leading carriers, leverage AI-driven underwriting, receive as soon as instant decisions, and manage the entire case lifecycle, from quotes to applications to policies, within a single, unified dashboard.

What inspired the start of Modern Life?

The inspiration for Modern Life came directly from my own experience trying to buy life insurance. Even as a relatively young and healthy person, I found the process confusing, invasive, and incredibly outdated. There were complex products I barely understood, long and repetitive forms, endless phone interviews, and medical exams that felt like they belonged to another era. Given my background in building digital platforms for advisors, it was clear to me that technology and AI could dramatically improve the life insurance purchasing experience for both advisors and their clients, which ultimately led to the start of Modern Life.

How is Modern Life different?

Modern Life is different because of our singular focus on empowering advisors. We enable the 500,000 professionals who distribute life insurance and are responsible for 90% of the total market but who have an incredibly challenging job. We bring together what would otherwise require multiple fragmented legacy tools into a single platform that handles quoting, underwriting, workflow, and client lifecycle management. We also offer instant or near-instant underwriting decisions in many cases, often without medical exams, which dramatically speeds up the process. Because we’ve built our technology in-house, we can embed AI across the entire journey in a way that legacy brokerages simply can’t match.

What market does Modern Life target and how big is it?

We focus on the U.S. life insurance market, which is roughly a $175B market, 90% of which is sold through advisors. We also distribute long-term care, annuities, and disability insurance which together are meaningful markets as well. Our clients are financial firms and professionals primarily serving affluent clients and who need better tools, workflows, and experiences for their client service.

What’s your business model?

Our business model is B2B through advisors. Advisors and firms use our platform at no cost to them and receive commissions from Modern Life if licensed. We generate revenue from carriers on policies placed through Modern Life.

What was the funding process like?

Thrive Capital has been a consistent and incredibly supportive partner, leading both our seed and Series A rounds. We also brought in strategic investors from New York Life Ventures and Northwestern Mutual Future Ventures who understand the importance of advisor-driven distribution and see the need for modernization in life insurance.

What are the biggest challenges that you faced while raising capital?

Before Modern Life, virtually all VC investment in life insurance — about $1B — focused exclusively on transactional term insurance sold either D2C or through more D2C-like limited agent experiences. Our approach is different because it focuses on the advisor as the customer, not a specific insurance product. This presents a 10x larger addressable market, albeit a much harder one to serve. A big part of our story is how we differentiate from both the first wave of D2C startups and legacy players who focus on advisors.

What factors about your business led your investors to write the check?

We’ve established ourselves as the category leader focused on innovating for advisors and in permanent life insurance, which is the considerable majority of the market by value. The sheer size and under-digitized nature of the life insurance market make it one of the biggest untapped opportunities in financial services. Also, our ability to bring meaningful AI-driven innovation to an industry that has lagged on technology is compounding our differentiation to D2C startups and legacy players.

What are the milestones you plan to achieve in the next six months?

Over the coming months, we are focused on scaling our client base of firms and advisors, deepening our strategic partnerships across the industry, and building out our AI-powered platform. In particular, we are focused on underwriting, workflow automation, and client lifecycle management.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

There has never been a better time to be a builder today. The AI boom has fueled innovative traditional business models and delivered unique customer experiences without requiring tons of capital. At every scale, teams can get significant leverage without needing an abundance of resources.

Where do you see the company going now over the near term?

In the near term, I see Modern Life continuing to scale and serve the country’s top firms and advisors, strengthening and expanding strategic partnerships with carriers and large financial firms, and cementing our position as a category leader in AI-powered life insurance distribution. We are going to keep investing in the technology and AI capabilities that make advisors more effective and give their clients a better, faster, and more transparent experience.

What’s your favorite fall destination in and around the city?

Storm King in the fall is a special place — a great place to wander around and get lost in.