The commercial insurance landscape presents significant challenges for mid-market businesses, with many facing unpredictable premium increases, coverage restrictions, and a frustrating lack of control over their risk management strategy. While Fortune 500 companies have long leveraged captive insurance solutions—a form of self-insurance where a company creates its own insurance subsidiary to manage risks and potentially generate profits from underwriting—to convert insurance from an expense into a strategic asset, the complexities of formation have kept this powerful tool out of reach for most mid-market companies. Luzern Risk has created the first fully integrated, digital captive insurance platform specifically designed for the underserved middle market. Luzern combines decades of insurance expertise with modern technology to deliver a seamless experience for evaluating, forming, and managing captives—giving businesses the power to take control of their insurance future. The platform replaces an opaque and cumbersome formation process with an intuitive digital system designed for clarity, ease of use, and long-term growth.

AlleyWatch sat down with Gabriel Weiss, CEO and Cofounder of Luzern Risk, to learn more about the business, its future plans, and recent funding round.

Who were your investors and how much did you raise?$12M Series Al; Caffeinated Capital.

Tell us about the product or service that Luzern Risk offers.

Luzern helps businesses stop renting insurance—and start owning it through captive insurance. Luzern integrates insurance expertise into a modern digital platform that streamlines captive evaluation, formation, and management—giving clients the power to control their insurance future.

What inspired the start of Luzern Risk?

We saw too many good businesses overpaying for underperforming insurance. Meanwhile, Fortune 500s were quietly using captives to turn insurance from an expense into a strategic asset. Luzern was built to close that gap—for the mid-market.

How is Luzern Risk different?

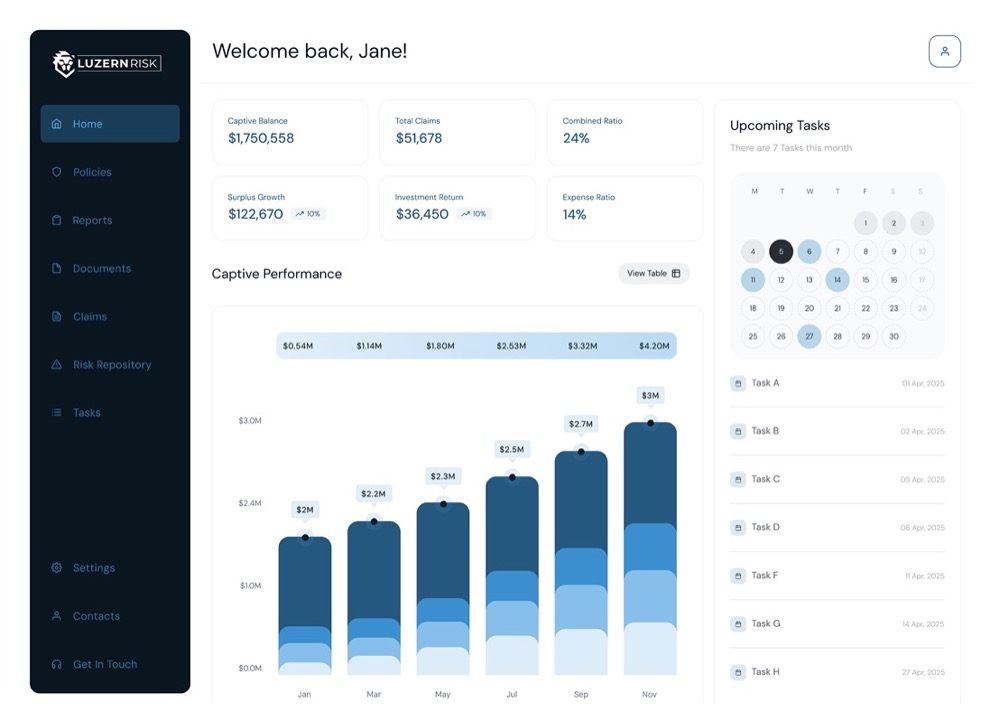

We’re not a black box that insurance customers are used to, including in many cases existing captive owners. Luzern combines the strategic thinking of a top-tier consultancy with the execution and clarity of purpose-built technology. What we offer is closer to the modern experience that consumers are used to when managing an investment portfolio. The difference being that you sit at a digital command center for your insurance. We guide clients from concept through renewals with speed, precision, and transparency.

What market does Luzern Risk target and how big is it?

We serve the middle market—companies typically paying $1M+ in commercial premiums—where frustration with traditional insurance is rising fast. This market controls over $200B in commercial premium, yet has historically struggled to access captives—too often held back by the complexity of the process, which overwhelms lean teams lacking the in-house expertise or bandwidth to navigate it confidently.

What’s your business model?

From first ideation through annual renewal, we’ve identified the nine core professional services required to successfully plan, form, and manage a captive. We’ve bundled them into a single, transparent flat rate—so clients never have to guess what’s included or worry about surprise fees. You get everything you need, when you need it, delivered by best-in-class experts from start to finish.

How are you preparing for a potential economic slowdown?

Captives are a hedge against volatility. In uncertain markets, not only can insurance prices spike—but coverage itself can tighten, or disappear without warning. That unpredictability leaves businesses exposed. Captives offer an alternative: more control, more stability, and the chance to decouple your insurance future from the whims of the market. We’re leaning into this moment by making captives more accessible, more intuitive, and more aligned with long-term financial strategy.

What was the funding process like?

Selective. We knew we wanted true partners. We looked for firms that understood the market opportunity and shared our long-term vision. As it turns out, we didn’t have to look far. Caffeinated Capital led our Seed round, and expanded their vote of confidence by leading our Series A. Their support has been instrumental in helping us move quickly, think long-term, and grow with conviction.

What are the biggest challenges that you faced while raising capital?

Captive insurance is relatively unfamiliar to many VCs. Educating investors on a market that lives between finance and insurance required clarity, patience, and proof. Thankfully, we have the team to execute on that front.

What factors about your business led your investors to write the check?

Three things: a massive, overlooked market; a team with deep capability and credibility across insurance, finance, and tech; and a product that delivers.

What are the milestones you plan to achieve in the next six months?

We’re focused on two key areas: scaling operations to meet rising demand while staying obsessively client-focused, and expanding our platform’s analytics suite.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Operate with discipline, but don’t play scared. Focus on what drives value for your customers, and simplify everything else. In constrained markets, clarity wins.

Where do you see the company going now over the near term?

We’re becoming the go-to platform for captive insurance in the middle market. In the near term, that means building deeper relationships with strategic buying groups—making Luzern synonymous with the future of insurance: risk ownership.

What’s your favorite spring destination in and around the city?

The towns along the Hudson River Valley. There’s something about heading just far enough north to breathe a little deeper and think a little clearer.