The consumer packaged goods industry operates as a $2T+ market where bringing products to market traditionally required months or years of navigating trade shows, vetting manufacturers, and coordinating endless communications. This complex process creates significant friction between brands seeking to innovate and manufacturers capable of bringing those ideas to life. Keychain addresses this challenge with an AI-powered manufacturing platform that connects over 30,000 manufacturers with more than 20,000 brands and retailers through strategic data matching and automated workflows. The platform turns product ideas into data and data into manufacturing decisions instantly, enabling CPG brands to keep pace with rapidly evolving consumer trends without sacrificing quality or cost. With the recent launch of KeychainOS, their AI-native operating system, Keychain now facilitates over $1B in manufacturing projects monthly while expanding into new verticals like beauty and personal care.

AlleyWatch sat down with Keychain CEO and Founder Oisin Hanrahan to learn more about the business, its future plans, recent funding round, and much, much more…

Who were your investors and how much did you raise?

Keychain is announcing a $30M Series B funding round, marking our third raise in 18 months, led by Wellington Management and existing investor, Box Group, alongside other major returning investors. This brings total capital raised to $68M.

Tell us about the product or service that Keychain offers.

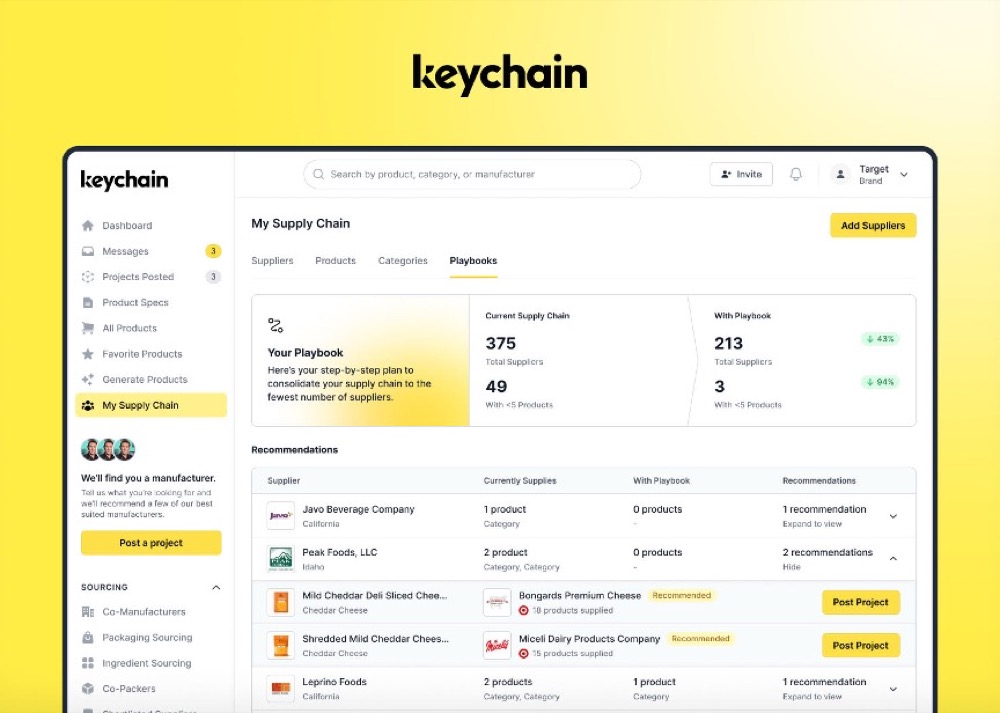

Keychain is an AI-powered manufacturing platform transforming how CPG brands bring products to market. Connecting 30,000+ manufacturers with over 20,000 brands and retailers in one simple click, Keychain is designed to simplify and connect the manufacturing process, using AI to strategically bridge the gap between product ideation and physical manufacturing.

What inspired the start of Keychain?

Traditionally, bringing a product to market required months–and sometimes years–of navigating trade shows, vetting manufacturers, and coordinating endless emails and calls. With this constant inconvenience, Keychain was born. The platform turns product ideas into data, and data into decisions—instantly. As consumer trends evolve faster than ever, Keychain enables CPG brands to keep pace without sacrificing quality or cost.

How is Keychain different?

Keychain is the first AI native operating system to truly unify and streamline the entire product development journey in the CPG sector—from concept to shelf. Unlike traditional sourcing platforms or supply chain tools, Keychain embeds AI at the core of every workflow, offering manufacturer matching, real-time collaboration, and instant costing insights. It’s not just a tool—it’s a connected ecosystem that accelerates innovation and reduces friction across the board.

What market does Keychain target and how big is it?

Keychain targets the consumer packaged goods industry – a $2T+ market, facilitating innovation across categories like food and beverage, beauty, and personal care.

What’s your business model?

Keychain operates on a usage-based SaaS model. Manufacturers pay based on how they use the platform and which features they need. Brands ranging from CPG giants like General Mills and Hersey’s to startups, offering an entry point into modern manufacturing. The goal is to make Keychain useful regardless of company size or complexity–whether you’re a startup launching your first product or a global brand.

How has the business changed since we last spoke after Keychain’s Seed round?

Keychain is evolving rapidly. We are rolling out a brand new AI operating system designed to further simplify the manufacturing process for our partners. We’ve also expanded into the Beauty and Personal Care category, where the platform now features 250,000+ products representing a market value of over $100B. Currently, Keychain is working with more than 1,000 beauty and supplement manufacturers, with U.S. coverage expected to exceed 90% in the coming months.

What was the funding process like?

The Series B came together smoothly. Investor interest was strong given the traction Keychain has shown across multiple CPG verticals. This round brings Keychain’s total funding to $68M and positions the company for global scale.

What are the biggest challenges that you faced while raising capital?

Fundraising is always time-consuming. Maintaining the balance of focus on the business and raising capital is always a challenge. Thankfully, I’m fortunate to have two amazing co-founders who can run the business.

What factors about your business led your investors to write the check?

Keychain’s growth speaks for itself – high demand with eight out of ten retailers using the service and platform it has grown to facilitate more than $1 billion in manufacturing projects monthly and brought over 20,000 brands and retailers into the ecosystem. Investors were drawn to the platform’s rapid expansion and its role in bringing AI to the consumer packaged goods industry, helping companies transform their supply chains. The team’s execution, the depth of the product, and the clear path to scale made this an easy bet for both new and existing investors.

What are the milestones you plan to achieve in the next six months?

We are very focused on rolling out KeychainOS, our AI native operating system, for manufacturers to better run their businesses. This positions us as the leading AI operating system for CPG manufacturers and an amazing alternative for them.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Focus on customer pain points and deliver value early. In today’s climate, capital follows traction. Stay close to your users, and show how your product drives real business outcomes because investors will always want to see momentum—even if it’s scrappy.

Where do you see the company going now over the near term?

Over the next six months, we’re focused on rolling out Keychain’s new AI operating system, which is designed to make product development and manufacturing even more intuitive for our partners. It’s a major step forward in how brands and manufacturers collaborate on the platform. At the same time, we’re doubling down on the beauty and personal care sector, where we’re already seeing significant traction and scaling quickly.

What’s your favorite restaurant in the city?

Claud.