As enterprises race to embed AI into their operations, finance teams find themselves caught in a paradox: they need to move faster than ever to support business growth, yet 75% of their time is consumed by manual data manipulation and spreadsheet maintenance. This bottleneck has intensified as companies scale, with the typical CFO’s office drowning in disconnected systems spanning ERPs, billing platforms, CRMs, and data warehouses that refuse to speak to each other. Traditional finance software forces teams to choose between rigid automation that can’t adapt to business needs or manual flexibility that doesn’t scale past a certain headcount. Concourse addresses this gap by deploying enterprise-grade AI agents that connect directly to a company’s existing financial stack, automating complex analysis while showing their work through transparency panels that surface the underlying SQL and Python logic behind every calculation. Teams using Concourse cut manual work by over 75% and produce 6x more analysis than before, generating presentation-ready reports in minutes rather than days. With the recent acquisition of Cambrean and general availability launch, Concourse is extending capabilities previously available only to Fortune 500 enterprises to finance teams of any size.

AlleyWatch sat down with Concourse CEO and Cofounder Matthieu Hafemeister to learn more about the business, the future plans, and recent funding round that brings total funding raised to $27M, and much, much more…

Who were your investors and how much did you raise?

We raised $12M in a Series A round. The round was led by Standard Capital with participation from a16z, CRV, and Y Combinator. We were also lucky to have an incredible group of angel investors join, including SV Angel, Ritual Capital, and several world-class CFOs and operators from companies like OpenAI, Vercel, Cursor, Carta, 1Password, and Brex.

Tell us about the product or service that Concourse offers.

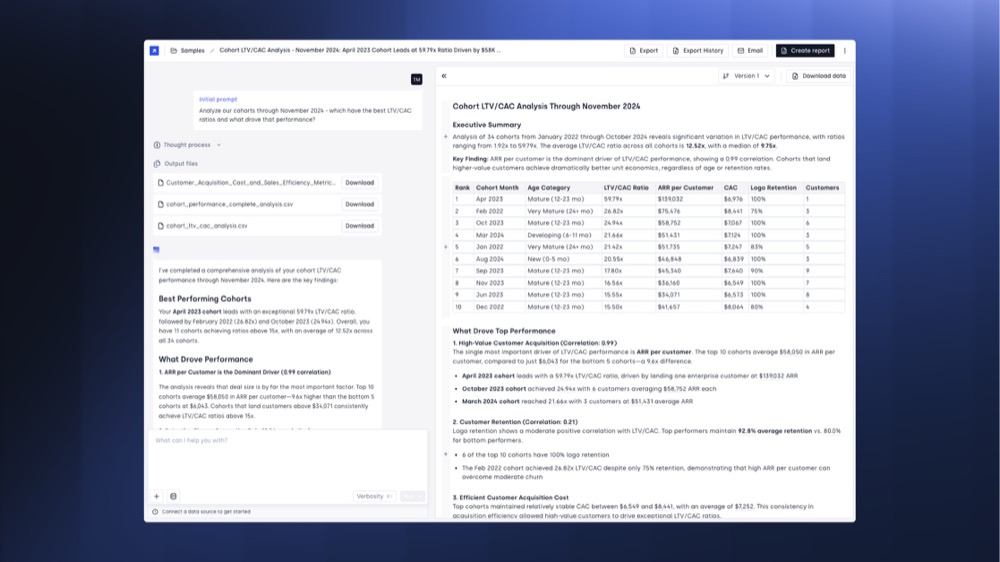

Concourse provides enterprise-grade AI agents purpose-built for finance teams. Instead of forcing teams to choose between rigid software automation or the manual flexibility of a spreadsheet, our agents connect directly to your financial stack. This includes ERPs like NetSuite and QuickBooks, billing systems like Stripe, and data warehouses like Snowflake. Using natural language, finance teams can automate complex analysis, generate presentation-ready reports (PPT, PDF, Word), and perform cross-system data retrieval in minutes rather than days.The biggest hurdle for AI in finance is trust. We solve that by showing our work. Our transparency panel lays out the underlying SQL and Python, giving teams a clear audit trail so they can verify the logic and trust the numbers.

What inspired the start of Concourse?

The idea was born out of a problem that was deeply personal to my cofounder, Ted Michaels, and me. While scaling Jeeves from the early days to a $2.1B global unicorn startup, we saw firsthand the immense complexity finance teams face as they grow. We were managing dozens of bank accounts and data scattered globally. Even with a world-class team, you eventually hit a ceiling where more people and more spreadsheets just can’t match the speed of the business. We realized there was a massive gap between the flexibility teams need and the automation traditional software solutions provide. We saw LLMs as the bridge to finally let finance teams focus on driving the business forward instead of being bogged down by manual data manipulation.

How is Concourse different?

Concourse isn’t another tool for finance team members and isn’t trying to force you into a painful data migration. Instead, we act as an intelligent agent layer that integrates seamlessly with your existing stack. This architecture allows for true cross-system reasoning. Unlike a single-tool AI, Concourse can pull from Stripe and Snowflake simultaneously to explain the “why” behind revenue changes, not just the “what.” We also solve the trust issue inherent in AI by ditching the black-box approach. Our transparency panel surfaces the raw SQL and Python logic behind every calculation, providing a clear audit trail so you can verify the work. Because our agents are benchmarked specifically for financial accuracy and compliance, they deliver a level of reliability that a base LLMs can’t match.

What market does Concourse target and how big is it?

We currently serve the office of the CFO at every scale. Our AI agents are already deployed inside Fortune 500 companies like Palo Alto Networks, unicorns like Front, and high-growth brands like Tecovas. In the past, you really only saw this level of tech inside massive companies with huge budgets and long implementation times. With our recent launch, we’re changing that, and we’re putting those same enterprise-grade agents into the hands of any finance team, regardless of their size. By opening general availability, any finance team can now get started for free and connect their core data sources in minutes. We are effectively bridging the gap between the complex needs of a large enterprise and the speed required by a startup.

What’s your business model?

To support teams of all sizes, we’ve moved to a hybrid model that balances a fast self-serve experience for small companies with our established partnership and forward-deployed model for larger organizations. Early-stage finance teams can now get started for free, connecting data sources like QuickBooks, Ramp, Stripe, or in about five minutes. For teams ready to scale, we offer transparent, usage-based plans, including a Starter and a Professional plan, both of which include a 7-day free trial so you can see the impact before committing. For enterprise companies running on NetSuite, Snowflake, or SAP, we continue to offer custom, high-touch support. This includes deeper integrations and the rigorous security and compliance standards, such as SOC 2 Type II certification and SAML/SSO support, that Fortune 500 customers require. We also build custom agents for these enterprises and help train their teams with prompting and more to help them transition into the AI and agentic world.

How are you preparing for a potential economic slowdown?

In a tightening economy, finance teams are under more pressure than ever to do more with less. Concourse is built for this exact environment. Our platform allows teams to 10x their capacity, automate over 75% of their time currently spent on manual work. At the same time, finance teams need to respond faster and be more flexible than ever, and agents are a great way to give them that extra capacity and speed. We aren’t just an efficiency tool. We also help companies uncover revenue leakage and catch million-dollar expense errors, providing immediate ROI when budgets are under scrutiny.

What was the funding process like?

The process was really about finding partners who understood our vision and recognized the obvious, growing demand for it. We had strong signals over the last 12 months with 19x revenue growth and a 13x increase in our customer base. When you can point to that kind of product-market fit and logos like Palo Alto Networks, Front, and Tecovas, the conversation moves quickly.Partnering with Standard Capital—who has deep YC roots like Concourse—was a natural fit because Dalton, Paul, and the rest of the team saw that we had already proven these agents deliver real value inside large enterprises. They share our belief that AI isn’t just about making workflows slightly better, but that it is about a fundamental shift in what finance teams can achieve. Now that we have built for the most complex workflows in the Fortune 500, we are ready for this next phase.

What are the biggest challenges that you faced while raising capital?

The biggest challenge in the current market is cutting through the AI noise. Every company claims to have AI agents now. We had to prove that our agents are capable of deep integration into complex, enterprise-level data stacks. We let the data speak for itself—our customer retention and the volume of analysis our users are producing.

What factors about your business led your investors to write the check?

Our investors saw we weren’t just pitching a vision, but we had the numbers to back it up. We showed proof that our agents were already solving complex problems for huge companies while we were still behind a closed waitlist. Standard Capital understood that we’ve built something that delivers value immediately. Dalton and Paul recognized that most finance teams are desperate for automation that actually works, and they saw that we have the background from Jeeves and the technical foundation to actually build the AI agents they need.

What are the milestones you plan to achieve in the next six months?

We are focused on moving the thousands of companies on our waitlist onto our new self-serve plans. We want to take the five-minute onboarding experience we built for QuickBooks and Ramp and expand it to include more complex ERP and CRM integrations. By making the setup for these deeper systems just as fast, we can ensure any finance team is able to plug in their data and deploy agents quickly and easily.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Focus on practicality. Customers, especially in finance, only care about what saves them time or makes them money today. Build narrow solutions for painful problems. If you can prove 10x value for a specific workflow, eventually the capital will follow.

Where do you see the company going now over the near term?

If a CFO is thinking about AI agents, we want Concourse to be the first platform they consider because of our trust and proven impact at scale.