Financial crime costs the global economy over $2 trillion annually, while compliance teams at banks and credit unions struggle with antiquated systems generating thousands of false positive alerts daily. Legacy financial crime detection systems force institutions to choose between accuracy and speed, creating bottlenecks that delay customer onboarding and payments while real threats slip through undetected. Castellum.AI builds the only platform with fully in-house AI agents, risk data, and AML/KYC screening capabilities. Their explainable AI agents reduce false positives by 94% and compliance review time by 83% out of the box, while their proprietary data collection process monitors over 200,000 global sources updated every 5 minutes. With AI agents that have passed CAMS practice exams and training aligned with regulatory guidance from the OCC, NCUA, and NY DFS, Castellum.AI enables compliance teams to focus on preventing actual financial crime rather than drowning in false alerts. The platform’s modular implementation approach allows institutions to integrate AI capabilities without disrupting existing workflows, making it the compliance solution of choice for major financial institutions, credit unions, sponsor banks, fintechs, and leading crypto exchanges.

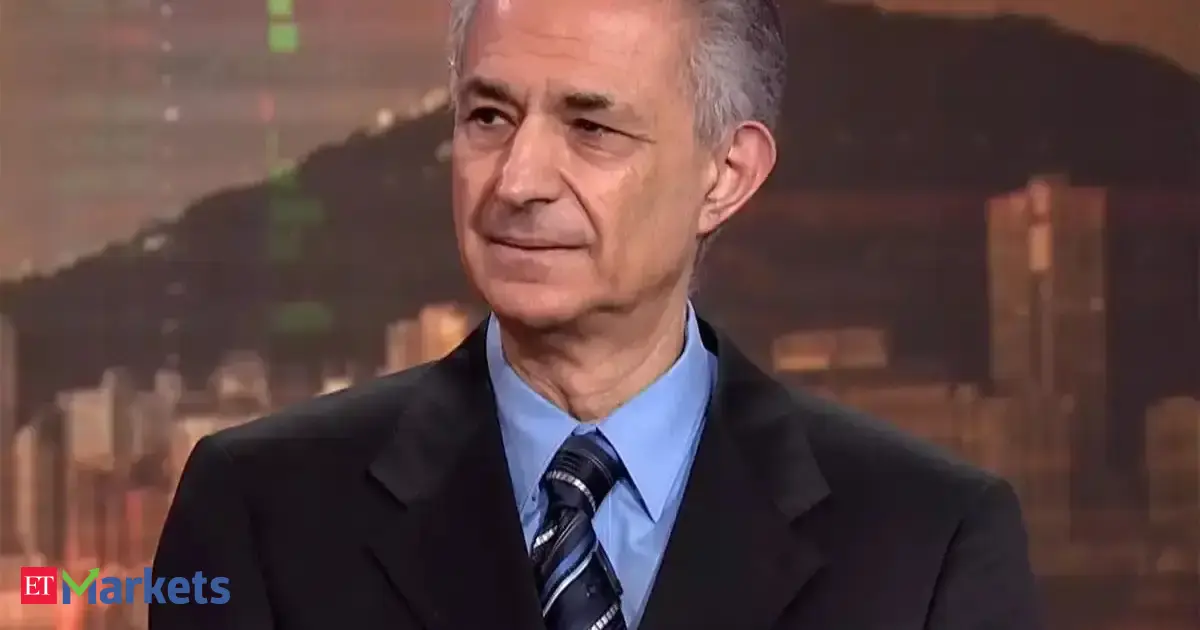

AlleyWatch sat down with Castellum.AI CEO and Co-Founder Peter Piatetsky to learn more about the business, its future plans, and recent funding round, which brings the company’s total funding raised to $12.9M.

Who were your investors and how much did you raise?

We closed an oversubscribed $8.5M Series A funding round. The round was led by Curql, a fund backed by over 130 credit unions including Navy Federal, with participation from BTech Consortium, a fund backed by over a dozen banks including Customers Bank, and Framework Venture Partners, a fund backed by Tier 1 Canadian financial institutions including RBC. Existing investors from Spider Capital, Remarkable Ventures, and Cameron Ventures also participated in the round.

Tell us about the product or service that Castellum.AI offers.

Castellum.AI is the only financial crimes compliance platform with in-house AI agents, risk data, and AML/KYC screening.

We help compliance teams at banks, credit unions, fintechs, and other financial services identify and prevent financial crime while removing bottlenecks that slow down customer onboarding and payments.

What inspired the start of Castellum.AI?

I’m a former regulator and a former regulated compliance executive.

At the Treasury Department, I fined and helped shut down banks that didn’t comply with sanctions. When I realized the US government didn’t even know where Canada’s sanctions list was, I knew there was a crisis of data access.

When I moved into banking, I expected that private sector resources would have figured out this problem. They hadn’t. Legacy vendors provided poor-quality, outdated financial crime data, and the software to identify risk was antiquated, inaccurate, and expensive. In our space, you’re legally mandated to review every alert that your compliance system generates. In one month, we had 38,000 alerts and only one alert turned out to be a real risk.

I knew there was a better way. A way to identify financial crime accurately and reduce the burden of compliance on businesses. That’s when we founded Castellum.AI.

How is Castellum.AI different?

We have a core focus on what we do and we do it well: Enabling compliance teams to identify financial crime threats and reducing the time spent on manual reviews by 83% out of the box.

We do this by combining explainable AI aligned to regulator expectations, a compliance screening engine and data that we collect and enrich ourselves using our patented data process.

The true value of AI in compliance is entirely dependent on the quality of the underlying data and screening alerts – garbage in, garbage out. As evidence: Our AI agents have a CAMS practice exam – an essential certification for financial crimes compliance professionals – on the first try. The AI agent training was led by ex-regulators and included AML/KYC best practices and guidance from financial services regulators like NY DFS, OCC, NCUA, and others.

What market does Castellum.AI target and how big is it?

We serve the highly regulated financial services industry. This means financial crimes compliance teams at tier 1 financial institutions, credit unions, banking-as-a-service (BaaS) sponsor banks, fintechs, and crypto firms.

What’s your business model?

We operate on a straightforward subscription model that aligns with clients usage and products. Our goal is to make it very simple for our clients to understand the value delivered based on the time their team saves and plan for that pricing based on usage.

How are you preparing for a potential economic slowdown?

AI infrastructure is becoming essential rather than a nice-to-have, and our platform delivers immediate ROI for our clients. Institutions that invest in the right technology during a downturn often emerge stronger.

What was the funding process like?

Having a product that performs and a targeted vertical meant we were able to be focused with our funding process. We worked exclusively with funds that understand our space and are backed by the institutions we serve.

What are the biggest challenges that you faced while raising capital?

Raising is a full-time job, and you’re doing that plus your day job running a company. Luckily, we have an excellent team that I can depend on to execute.

What factors about your business led your investors to write the check?

Clear mission and a vision for the future that challenges the status quo. We’ve built something distinct in the market by having fully in-house data, screening and AI agents (most competitors cobble together other solutions to create a platform), and we’ve been dedicated to AI since we were founded – we’re not just riding the AI wave. Instead, we’ve been investing in and building with explainable AI from day one to solve the challenges facing our customers.

Clear mission and a vision for the future that challenges the status quo. We’ve built something distinct in the market by having fully in-house data, screening and AI agents (most competitors cobble together other solutions to create a platform), and we’ve been dedicated to AI since we were founded – we’re not just riding the AI wave. Instead, we’ve been investing in and building with explainable AI from day one to solve the challenges facing our customers.

What are the milestones you plan to achieve in the next six months?

We’re investing heavily in engineering, customer success and go to market teams so we can support growing demand. We’re also investing heavily in expanding our AI agent offerings to serve additional financial crimes compliance workflows.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Three things: Revenue, revenue and ecosystem.

First, get laser-focused on activities that directly drive revenue. If you’re pre-revenue, prioritize getting to paying customers over perfecting features.

Second, also revenue, but look for partnerships that can expand your market reach. Sometimes a pilot program or partnership deal can provide both revenue and validation.

Third, NYC is one of the best places to build a company. The startup ecosystem here is robust. We went through the Entrepreneurs Roundtable Accelerator (ERA) here in NYC and it was foundational to helping us mature as a company. Also the opportunity to meet your future clients and partners across nearly every industry is unparalleled in New York.

Where do you see the company going now over the near term?

Up and to the right! That means scaling what’s working. We’re laser-focused on supporting adoption to meet demand so that our core segment – banks, credit unions, fintechs – can easily and quickly integrate Castellum.AI into their compliance workflows. Our goal is to become the obvious choice for compliance leaders looking to remove the bottlenecks slowing down their operations.

What’s your favorite summer destination in and around the city?

Our family spot in the Rockaways where my daughters and I spend every weekend getting outside and enjoying the beach! Also spearfishing!