The promise of breakthrough pharmaceuticals has created an unexpected crisis in employer benefits. As GLP-1 medications demonstrate remarkable efficacy for weight management and chronic disease prevention, their costs have become untenable for most businesses. The numbers tell the story: U.S. prescription drug spending hit $805.9B in 2024, climbing 10.2% year-over-year, while two-thirds of employers have dropped GLP-1 coverage entirely rather than face projected healthcare cost increases of 10% in 2026. Andel is building a membership platform that sidesteps the traditional pharmacy benefit manager infrastructure, aggregating employee demand across multiple employers to negotiate directly with manufacturers. The cooperative model allows employers to contribute subsidies at whatever level fits their budget while members pay a small monthly fee for access, creating a benefit structure that doesn’t require employers to absorb the full cost of coverage.

AlleyWatch sat down with Andel CEO and Cofounder Jay Bregman to learn more about the business, the future plans, recent fudning round, and much, much, more…

Who were your investors and how much did you raise?

Andel’s investors include Lightbank, Seedcamp, Bertelsmann Healthcare Investments, Houghton Street Ventures, and Springboard Health Angels, backing a seed round of $4.5M.

Tell us about the product or service that Andel offers.

Andel is a revolution in drug affordability — a cooperative employee platform that unlocks access to GLP-1s and other brand-name medications. Employees need these medications, but employers can’t afford to cover them.

We solve this problem by leveraging the combined buying power of our members to go directly to manufacturers for better prices and a guaranteed supply. Then, employers add a subsidy of their choosing to further reduce costs to members.

What inspired the start of Andel?

My family comes from medicine and I had always wanted to build a healthcare startup. As my fourth business, I felt I could take a big swing and solve the most important problem in American healthcare: brand name prescription pricing and distribution.

I saw the power of GLP-1s and other next-generation brand-name drugs and I wondered why it was so difficult for people to access them. It seemed like getting access to generic older drugs was easy but truly life-changing medicines were out of reach. It felt like a ‘miracle drug paradox’ where pharma was inventing truly amazing therapies but the better they were and more people that could benefit the fewer and fewer people were actually getting them. It felt like the market was crying out for a new model.

Ritu (cofounder) and I have the expertise needed to solve this problem. I have raised more than $250 million and successfully exited three companies, including the ridesharing network Hailo, which went on to become Lyft Europe, and Thimble, which was later acquired by Arch Insurance.

Ritu is a former senior executive at CVS Caremark and a licensed pharmacist with over 20 years leading the industry’s largest benefit consulting firms at Segal and Pharmaceutical Strategies Group.

How is Andel different?

Andel’s platform combines manufacturer’s discounts with employer subsidies to reduce costs for members. We deliver the capabilities of a licensed pharmacy through a user-friendly digital platform that offers an incredible member experience.

Ultimately, our goal is to become what I like to call the Spotify of the drug industry: a central platform that facilitates the sale of goods even if it’s not making them itself.

Employers pay nothing for the program, unlike other solutions, and because we make money through a small monthly fee charged to employees, our incentives are aligned with employers and employees to reduce drug costs and grow our membership as broadly as possible.

What market does Andel target and how big is it?

US prescription drug expenditures rose to $805.9B in 2024, an increase of 10.2% over the previous year. Globally it is in the trillions of dollars.

Andel targets any plan sponsors who either have already dropped GLP-1 coverage for weight loss or are considering it. This could include employers of all sizes, unions, coalitions, and even health plans. Andel will also carry other medicines beyond GLP-1s which are not widely covered by insurance.

Although Andel is currently focused on the US market, we believe the dynamic of high drug costs (especially driven by MFN policies) will allow us to expand elsewhere in North America, Europe, and beyond.

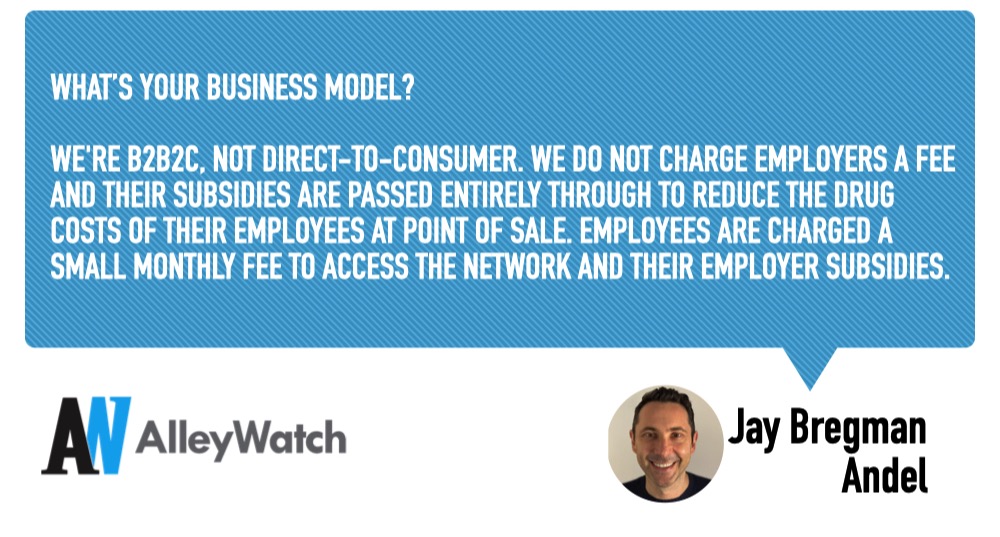

What’s your business model?

We’re B2B2C, not direct-to-consumer. We do not charge employers a fee and their subsidies are passed entirely through to reduce the drug costs of their employees at point of sale. Employees are charged a small monthly fee to access the network and their employer subsidies.

How are you preparing for a potential economic slowdown?

We are hiring a sales team. Because during economic downturns, the first thing companies do is review their benefits, and the first benefit likely to be cut is GLP-1 coverage and their pharmacy benefit. That will mean they will be looking for alternatives that allow them to provide GLP-1 benefits in a more cost-effective way.

For drug manufacturers, a downturn means they will be looking for ways to expand their payer channels, and Andel is a perfect way to address coverage gaps and increase sales.

What was the funding process like?

Ferocious. GLP-1 / brand name access and affordability is the most important topic facing humanity. Andel is an opportunity to help build a massive business while also solving a crucial societal problem, and that combination only comes along so very rarely.

What are the biggest challenges that you faced while raising capital?

The drug pricing market is very complex and difficult to understand. Even some very smart people think that the solution is for manufacturers to simply reduce prices across the board, but that fails to recognize a key tenant of insurance – when you have a product that applies to almost everyone in your population, prices would have to be 90% below current levels to make that viable, and that would leave pharma companies no incentive to create the next life-changing medicine.

What factors about your business led your investors to write the check?

Some of them knew me well and that I could execute. Others saw the progress we had made funding it ourselves and were convinced we could make it happen. Beyond that, the market was working in our favor, the relentless focus on lower prices, innovation, and more direct solutions were super-helpful.

Some of them knew me well and that I could execute. Others saw the progress we had made funding it ourselves and were convinced we could make it happen. Beyond that, the market was working in our favor, the relentless focus on lower prices, innovation, and more direct solutions were super-helpful.

What are the milestones you plan to achieve in the next six months?

Over the next six months, we’re focused on preparing for our nationwide launch in early 2026: growing our employer network, deepening relationships with plan sponsors and pharmaceutical manufacturers, and ensuring a perfect experience for the first members who join Andel.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Endure.

Where do you see the company going now over the near term?

We are witnessing the largest seismic shift in the way drugs are priced and distributed in US history. There will continue to be an explosion in pharma D2C and direct-to-business will be a natural complement to that. This will lead to many exciting pharma partnerships both for GLP-1s and other brand drugs.

Companies of all sizes will continue to drop GLP-1 coverage for weight loss and that will create thousands of opportunities for Andel. Many will start reviewing their coverage for other brand drugs or classes as well.

In the near term, we’re focused on scaling thoughtfully, so we can expand access through employer and pharmacy partnerships, refine the member experience, and lay the groundwork for a successful nationwide launch in 2026.

The future of pharmaceutical access will be Americans paying membership fees for low-cost brand drugs, with pricing subsidized by their employer. Andel will be as important as direct-to-consumer and insurance to pharma manufacturers and new drugs will be created based on the fact that they do not have to depend on legacy insurance companies for payback.

What’s your favorite fall destination in and around the city?

Battery Park.