Monarch Money is a sleek budgeting app that caters to couples. The app — and accompanying desktop version — allows you to manage personal and shared accounts, manage bills and track spending and goals without having to jump between apps, spreadsheets and bank websites.

For me, moving away from my current shared Google spreadsheet tracking method was really enticing, so I decided to test out Monarch with my husband for a month.

We’ve been looking for ways to cut household expenses, and our normal way of tracking things — putting family purchases like gas, groceries and entertainment on a joint credit card and hoping it doesn’t hit the maximum threshold we’ve set — just isn’t cutting it.

We were drawn in by Monarch’s couple-friendly features and flexible budgeting options — enough to justify the cost for a real-world test.

How much does Monarch cost?

Some budgeting apps offer a free version, but Monarch does not. You can get a seven-day free trial, but that might not be enough time to decide if this system works for you.

A monthly subscription to Monarch costs $14.99. You can save by purchasing a yearly subscription for $99.99 ($8.33 per month). A current promotion lets you save 30% on your first year, provided you sign up on Monarch’s website rather than using the app store. You can cancel anytime and get a prorated refund for the remaining time on your subscription.

There aren’t any membership tiers, so one fee gets you access to all the features. There aren’t any ads, either, and the company promotes its data connectivity and promises not to sell your financial data, which is a plus.

Monarch recommends signing up on the website rather than the Apple App Store or Google Play Store. It’s easier to manage your subscription and you can take advantage of special discounts the company provides.

How does Monarch work?

Over the month I spent using Monarch — both the app and the desktop version — I paid close attention to how easy it was to set up, how well it synced with our accounts, and how useful the features were for managing shared finances.

Since Monarch is designed with couples in mind, I also looked at how well the collaboration tools worked for my husband and me. From account setup to budgeting options and goal tracking, here’s how it worked for me.

Set up and bank integration for couples

It was fairly easy to get started. I set up my Monarch account by providing basic information, like my name and email address, and then I started connecting my financial accounts. I invited my husband to join via email, and he was able to add his personal checking, savings and credit cards.

We also added our children’s 529 savings accounts, our high-yield joint checking and savings account, car loan and some store credit cards like Target and Old Navy.

The process was fairly quick, and because I was using my laptop to set up my account, the passwords for my various accounts were auto-populated to smooth out the process. The only account I still haven’t been able to connect is our mortgage.

Once we entered all our accounts, we could rename them for easier identification.

Choose a flex or category budget

The biggest task we had after setting up our account was figuring out which budget template we wanted to use: flex, the default offered in the app, or category.

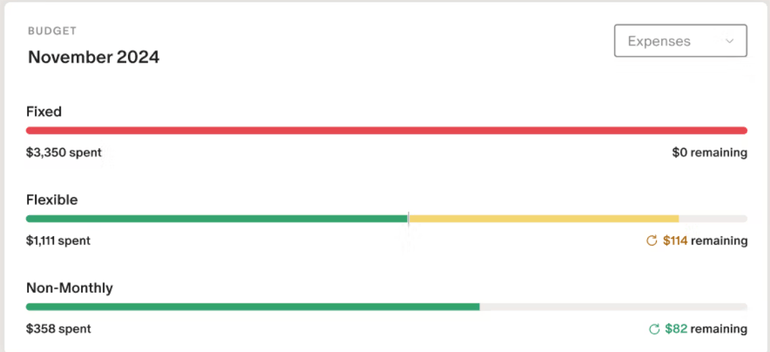

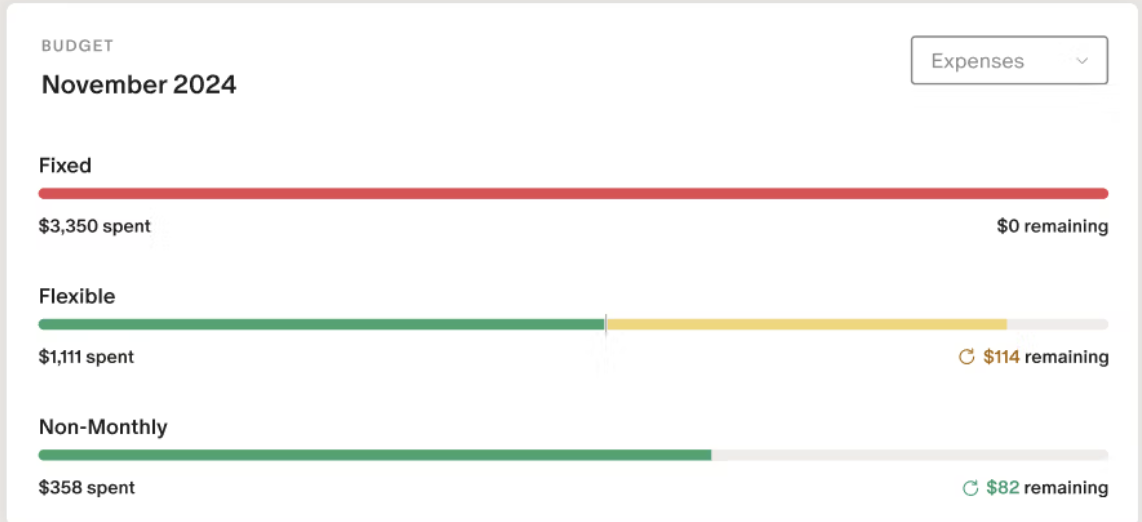

The flex option focuses on your variable expenses, or the things that change each month. For example, how much you spend dining out, buying groceries and filling up your car with gas change monthly. Your fixed expenses (e.g., rent/mortgage, childcare payments and some utilities) are separated out so your focus is on that “flex number.” Here’s what that looks like.

An example of a budget in Monarch Money. Image taken from monarchmoney.com.

Category budgeting is the more traditional option, where every expense is assigned to a category and your spending is tracked through those categories. Make your budget more personalized by excluding categories that aren’t relevant.

We picked the category option because it seemed more closely aligned with how we currently budget, but that was the wrong move — more on that later.

Collaborate to track expenses and goals

Monarch’s promise to help couples manage their money together is integrated into some key collaboration tools. The dashboard on the home screen shows the entire household’s financial picture, not just the user who is logged in. You can enable credit score monitoring for both you and your partner, so you can keep an eye on any changes together.

Expenses are logged and users are prompted to tag who they belong to. So, if you were planning on purchasing an engagement ring or surprising your partner with a birthday gift, you might want to hide that transaction — an eye icon appears to let you know the expense is being privately tracked.

You can set shared financial goals, whether it’s to build an emergency fund, buy a house or take that anniversary trip you’ve been planning. Set target dates and amounts for each goal and watch Monarch track your progress.

Monarch features I liked

Month in review: At the end of the month, Monarch generated a report showing my top spending categories: our mortgage, shopping (we had to replace our refrigerator), home improvement (we serviced and repaired our HVAC) and groceries.

The month had a few unusual expenses because of appliance and home repairs, so I’m curious to see what our spending looks like next month without those surprises. The report also included our monthly cash flow trends and a chart illustrating how our net worth changed, broken down by assets and liabilities.

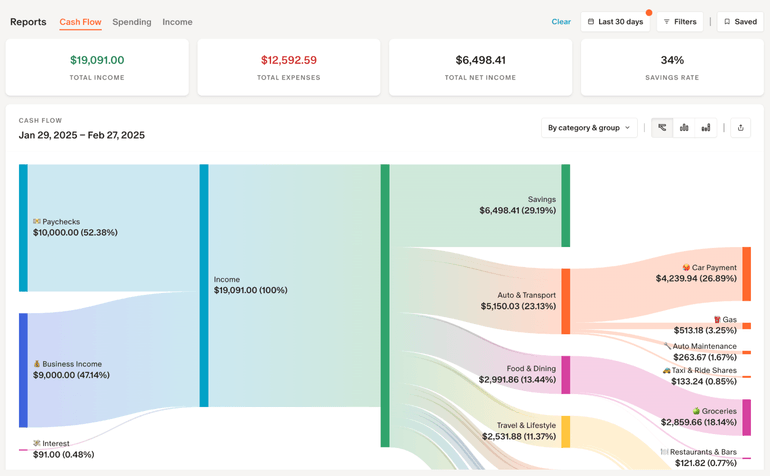

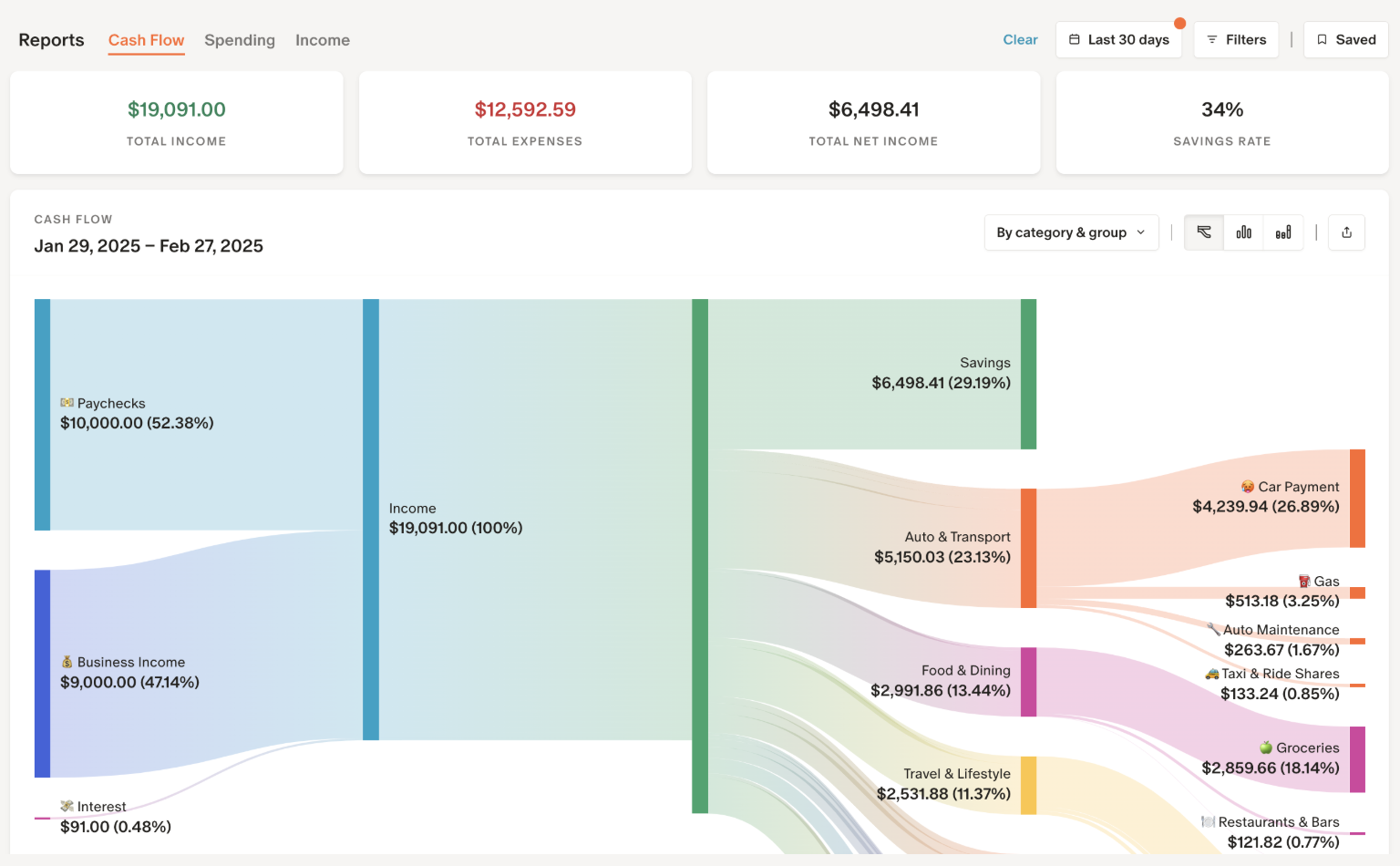

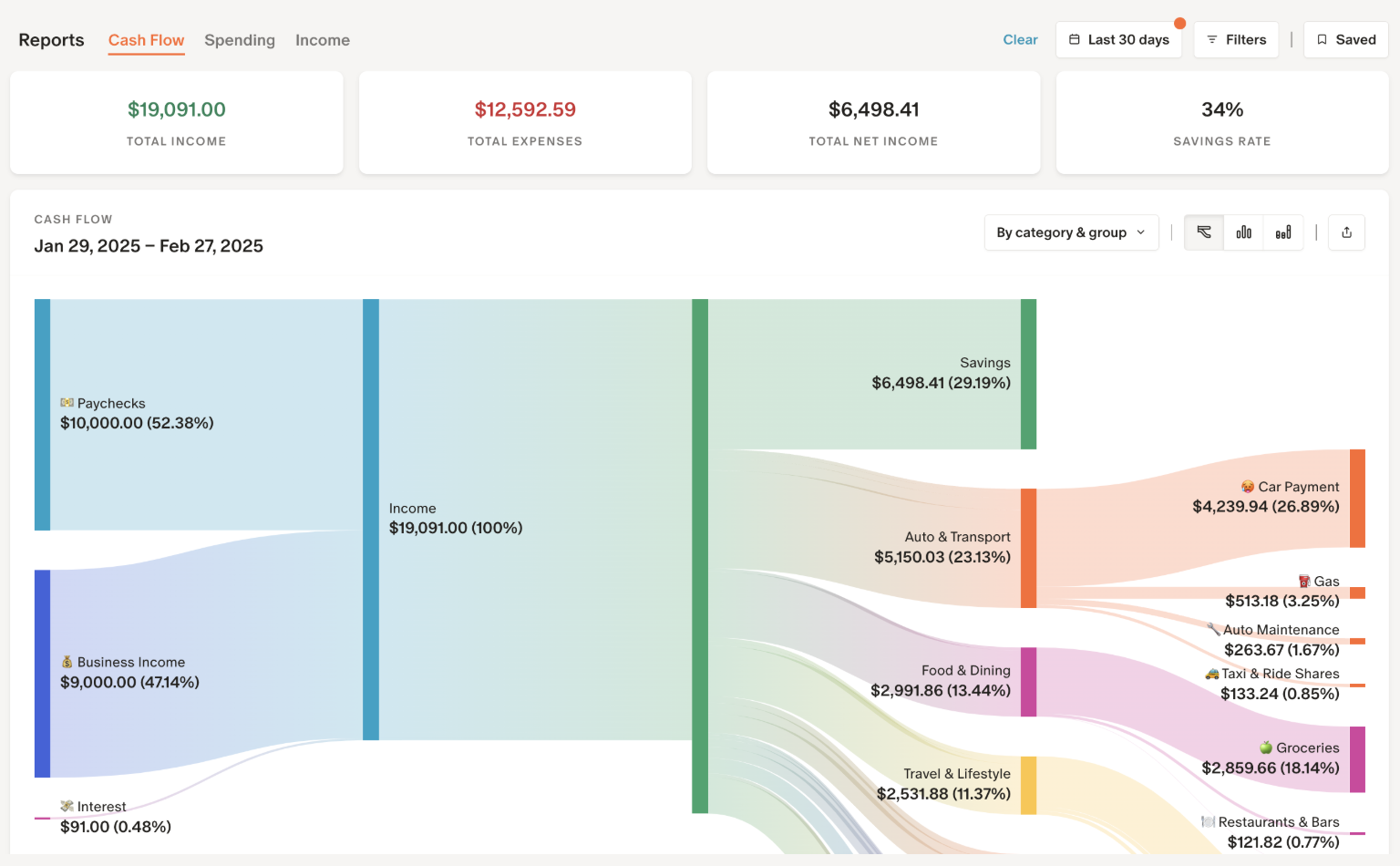

Reports: This feature offers a visual breakdown of your spending. You can choose a time frame and see how much you’ve spent in each category, along with the percentage of your budget it uses. Click on a category to highlight it and see the individual expenses below. It was perfect for a visual learner like me.

An example of how cash flow appears in the Monarch budgeting app and browser versions. Image taken from monarchmoney.com.

Visibility: The app has given me insight into parts of our finances I don’t usually track, like the kids’ 529 accounts. My husband contributes to them each month, and I used to have to ask him for the balances. With Monarch, I simply log in and check myself.

Downsides of my Monarch experience

Payment alerts: Sometimes the way payments were reported was misleading and made me think I was getting a store refund when really all I did was pay a bill.

Data syncing issues: As the month went on, some accounts had error messages beside them, noting that data syncing had been paused because those connections required two-factor authentication. I can see that being a hassle moving forward.

Doesn’t sync savings buckets: My husband and I keep a joint high-yield savings account with separate buckets for travel, auto repairs, an emergency fund, home maintenance, and gifts. Monarch doesn’t reflect those buckets. I could create individual savings goals in Monarch, but the actual amounts we’re saving each month don’t carry over or sync.

Creating custom categories is a challenge: Monarch does provide quite a few categories for fixed, flexible and non-monthly expenses, and it advertises the ability to make custom categories — but it just wasn’t intuitive.

For example, I had to research how to create a separate category for our monthly Costco haul, since that’s often a mix of groceries, household supplies and kids items, like diapers. Other times, I wasn’t clear where to put my monthly credit card payments or store card payments. I’m sure I could customize things eventually, but it just feels tedious and time consuming.

Is Monarch worth it?

It depends on you and your family. Overall, I really like how Monarch looks and the promise it offers for couples who want to merge their financial tracking and goals. That said, I don’t think it’s the best option for us.

While it did give me and my husband a shared view of our household spending, there were expenses that fell through the cracks and didn’t easily align with the categories provided. Adding custom expenses more tailored to our regular spending became burdensome and frustrating.

Switching from category to flex budgeting helped with some of our complaints and more easily aligned with how we have been thinking about our household costs. For example, we didn’t originally set budgets for more specific categories like “coffee shops” or “travel and lifestyle,” but as the month went on, we kept getting alerts that we’d overspent in those areas.

Switching budgeting styles helped reduce some of those small annoyances and more closely aligned with how we track our spending. Having this option to switch styles, even mid-month, is a nice element.

Monarch does seem to be adding features, like the new retail sync extension, which allows you to split and recategorize items in a single purchase from Amazon and Target so they don’t just automatically fall under the “shopping” category.

Even though Monarch isn’t the tool for us, it helped us be more intentional with our money and start better conversations about our shared goals. This past month was a good exercise in talking about our money and how we want to track spending in a way that works for us.

Maybe I am a spreadsheet lover, after all?

I wanted to see what other people thought, so I went to Reddit.

How Redditors say Monarch stacks up against competitors

We sifted through Reddit forums to get a pulse check on how users think Monarch compares to other budgeting apps. We used an AI tool to help analyze the feedback. People post anonymously, so we cannot confirm their individual experiences or circumstances.

Redditors generally view Monarch as a good middle-ground option between basic and advanced budgeting tools and apps. It’s a popular alternative for former Mint users.

Redditors say that Monarch has a more modern interface than YNAB, another popular budgeting app. They also say transaction categorization is better than Quicken Simplifi, but it’s also less comprehensive, especially for investment tracking. And while it’s more expensive than the free alternatives out there, it’s also more reliable.

Monarch methodology

NerdWallet’s editorial team chose to review this app because of its popularity and high ratings in both major app stores. It has 4.9 stars and 54.9K ratings in the Apple App store and 4.7 stars and 13.7K reviews in the Google Play Store. We signed up for a paid membership and conducted hands-on testing, using both the desktop and mobile app versions of Monarch, to understand the budgeting process and explore key features across one full month of expenses.