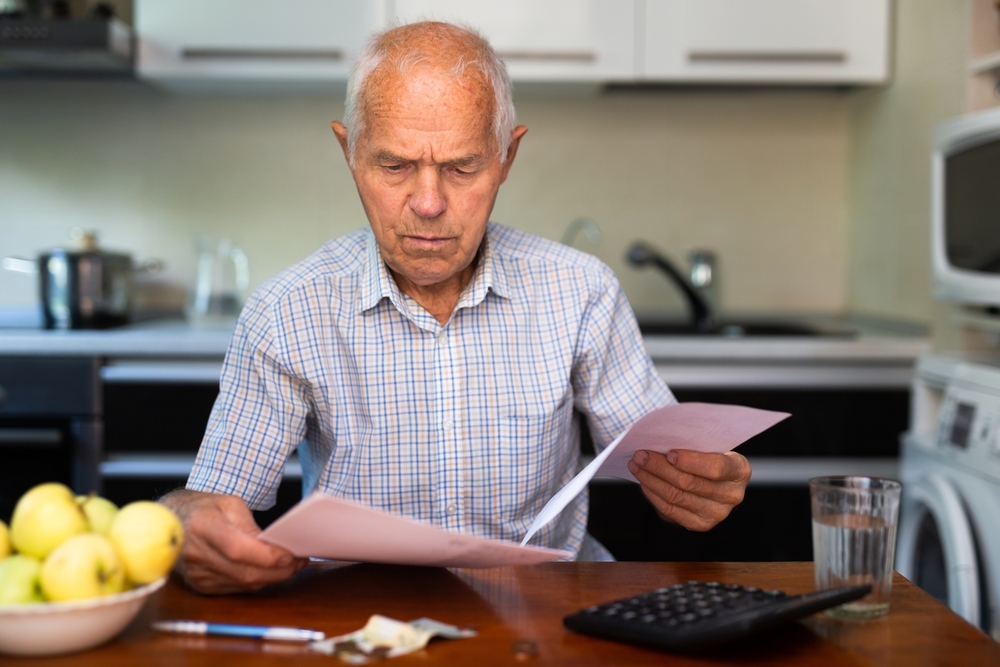

For many older adults, financial independence is more than just a matter of dollars—it’s a symbol of dignity, freedom, and self-worth. But when that control is lost, whether through cognitive decline, family interference, or financial abuse, the consequences can be devastating. Seniors who once managed their own budgets, paid their bills, and made confident decisions may suddenly find themselves sidelined, confused, or even manipulated. And while the emotional toll is immense, the practical fallout can be just as severe.

How Financial Control Slips Away

The loss of financial control rarely happens overnight. It often begins subtly—with missed payments, forgotten passwords, or difficulty understanding bank statements. In some cases, adult children or caregivers step in with good intentions, offering to “help out” or “take over” financial tasks. But without clear boundaries or legal protections, that help can quickly become control. Seniors may find themselves locked out of accounts, unable to access funds, or pressured into decisions they don’t fully understand.

Cognitive decline plays a major role, too. Conditions like dementia or mild cognitive impairment can erode a senior’s ability to manage money, making them vulnerable to scams, overspending, or poor judgment. Unfortunately, many seniors are reluctant to admit they’re struggling—fearing loss of independence or judgment from loved ones.

The Emotional Toll of Losing Autonomy

When seniors lose control over their finances, they often experience a deep sense of shame and helplessness. Money is tied to identity, and being told you can’t manage it anymore can feel like being told you’re no longer capable. This can lead to depression, anxiety, and withdrawal from social activities. Some seniors even hide financial problems out of embarrassment, allowing the situation to worsen.

Family dynamics can complicate things further. Disagreements over money, inheritance, or caregiving costs can create tension, especially when one relative assumes control while others are left in the dark. Seniors may feel caught in the middle, unable to assert themselves or advocate for their own needs.

Financial Abuse: The Hidden Threat

In some cases, the loss of financial control is not accidental—it’s abusive. Financial exploitation is one of the most common forms of elder abuse, and it often goes unnoticed. Relatives, caregivers, or even strangers may manipulate seniors into giving away money, signing over property, or changing legal documents. Because the abuse often happens behind closed doors, and the victim may be confused or afraid to speak up, it’s rarely reported.

Warning signs include unexplained withdrawals, missing checks, sudden changes to wills or powers of attorney, and isolation from trusted friends or advisors. Seniors who suspect abuse should speak to a lawyer, financial advisor, or adult protective services agency immediately.

Reclaiming Control With Support

Losing financial control doesn’t have to be permanent. With the right support, seniors can regain autonomy and protect their assets. This starts with honest conversations—with family members, financial professionals, and healthcare providers. Seniors should be encouraged to express their concerns, ask questions, and set boundaries.

Legal tools like powers of attorney, trusts, and financial guardianship can help clarify roles and responsibilities. But these tools must be used ethically and transparently. Seniors should be involved in every decision and given access to regular updates and account statements.

Technology can also help. Budgeting apps, automatic bill pay, and fraud alerts can simplify money management and reduce risk. Seniors who struggle with digital tools can ask for training or assistance from trusted sources.

Financial control is a cornerstone of independence—and every senior deserves to keep it as long as possible. Losing that control isn’t just a logistical issue—it’s a personal crisis. But with awareness, support, and safeguards, seniors can protect their autonomy and live with confidence.

If you or someone you love has faced financial control issues, leave a comment—your story could help others speak up and seek help.

You May Also Like…

Teri Monroe started her career in communications working for local government and nonprofits. Today, she is a freelance finance and lifestyle writer and small business owner. In her spare time, she loves golfing with her husband, taking her dog Milo on long walks, and playing pickleball with friends.