From January to December 2022, the Vanguard Balanced ETF Portfolio (VBAL), which holds a 60/40 mix, lost 15.04%, nearly as much as the 16.88% decline posted by the 100%-stocks Vanguard All-Equity ETF Portfolio (VEQT). The problem wasn’t the stocks; investors should expect volatility with them. It was the bonds.

As interest rates spiked to combat inflation, the bond component of VBAL was hit hard. Its higher-than-average intermediate duration (a measure of rate sensitivity) meant that prices fell more sharply than shorter-term bond holdings might have. This caught many conservative investors off guard, particularly those who believed fixed income would provide ballast in a downturn.

In response, many portfolio strategists began proposing a new model: the 40/30/30. That’s 40% equities, 30% bonds, and 30% alternatives.

While institutions and advisors have access to sophisticated private alternatives to make this work, the question is whether Canadian retail investors can replicate a similar structure using publicly listed ETFs. Here’s my take, and some suggested ETFs to obtain exposure to the alternative space.

What is the 40/30/30 portfolio?

The 40/30/30 portfolio is a conceptual framework that modifies the traditional balanced portfolio by carving out space for alternative assets. The idea is to introduce a third asset class that behaves differently from the other two.

In periods like 2022, when both stocks and bonds declined together due to rising inflation and interest rates, traditional diversification strategies failed. The extra alternatives sleeve is designed to preserve capital in times when the other two pillars of a portfolio move in tandem.

It’s not a one-size-fits-all prescription. The 30% allocated to alternatives can vary widely depending on the portfolio manager’s preferences. In most institutional and advisor-led implementations, that portion could include:

Hedge fund-like strategies such as long-short equity, managed futures, long volatility, and market-neutral approaches that rely on quantitative models and multi-asset exposure to generate absolute returns.

Hard assets or digital stores of value like gold, commodities, or cryptocurrencies such as bitcoin, typically used as static allocations to offset traditional financial asset volatility.

Private market investments such as private equity, private credit, and direct real estate holdings, which offer long-term return potential in exchange for liquidity risk and limited pricing transparency.

MoneySense’s ETF Screener Tool

Does the 40/30/30 portfolio work?

It’s hard to draw firm conclusions because two factors limit the usefulness of most data used to support the 40/30/30 thesis.

X

The first is survivorship bias. It’s easy to look backward and identify strategies that delivered low correlation and solid returns, but that’s hindsight. Investors didn’t necessarily have access to these funds or conviction in them when it mattered most. The danger is cherry-picking success stories that weren’t widely known or available at the time.

Second, results are highly time-period dependent. The performance of any diversified strategy can vary meaningfully depending on the start and end dates. A few good or bad years in alternatives can drastically skew the overall return and risk profile of a portfolio.

That said, there is a relatively robust benchmark with over two decades of data that helps assess the viability of the concept: the MLM Index. This benchmark tracks a systematic trend-following strategy across 11 commodities, six currencies, and five global bond futures markets. It weights each category based on historical volatility and equal-weights individual contracts within each basket. While not a perfect proxy for all alternatives, it offers rare long-term, transparent, and rule-based data in a space often lacking both.

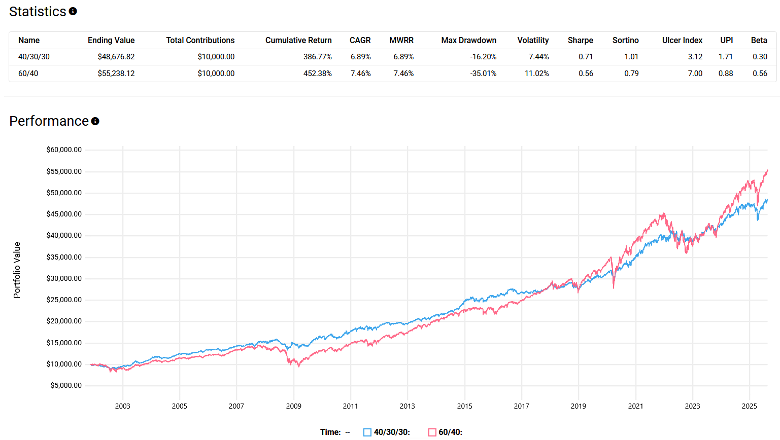

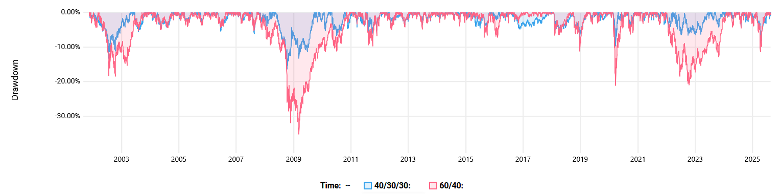

Using data from Nov. 12, 2001, through Aug. 19, 2025, a 40/30/30 portfolio built with the S&P 500, Bloomberg U.S. Aggregate Bond Index, and KFA MLM Index (rebalanced quarterly) underperformed a traditional 60/40 mix on total returns, with a 6.89% compound annual growth rate (CAGR) versus 7.46%. However, it significantly outperformed on a risk-adjusted basis, with a Sharpe ratio of 0.71 versus 0.56.

More importantly, the diversification benefit showed up when it mattered. The 40/30/30 portfolio demonstrated better downside protection during key stress events like the bursting of the dot-com bubble, the 2008 financial crisis, the COVID-19 crash in 2020 and the bear market of 2022.

Investors can access the KFA MLM Index through a U.S.-listed ETF: the KraneShares Mount Lucas Managed Futures Index Strategy ETF (KMLM). It directly tracks the benchmark and provides exposure to trend-following futures strategies across commodities, currencies and fixed income.

The catch? Since KMLM is U.S.-listed, Canadians face a few hurdles: currency conversion, a high 0.90% management expense ratio, and a 15% foreign withholding tax on distributions unless it’s held in a registered retirement savings plan (RRSP).