In the financial world, the appeal of “low-maintenance” or “hands-off” investments is undeniable. They promise returns without effort, income without involvement, and growth without the grind. But what many investors don’t realize—until it’s too late—is that some of the most popular so-called passive investments require far more attention than advertised.

The notion of effortless wealth is alluring, but markets shift, regulations change, and what seemed like a safe bet last year may demand micromanagement today. Whether it’s real estate that needs tenant management or dividend stocks that quietly cut their payouts, ignoring these assets can cost you, not just in dollars, but in time, stress, and missed opportunity.

Below are eight “low-maintenance” investments that often surprise investors by becoming anything but.

1. Rental Properties That Demand 24/7 Attention

Real estate is often marketed as a dependable, passive income stream, especially if you’re renting out a property. But owning rental property rarely lives up to the passive promise. Even with a property manager, issues like tenant turnover, maintenance emergencies, late payments, and legal compliance require continuous involvement.

Unexpected expenses like roof repairs, plumbing disasters, or pest infestations can blow through your cash flow. And if you’re managing the property yourself to save on fees, say goodbye to weekends and vacations. From navigating local ordinances to screening tenants and dealing with evictions, “set it and forget it” quickly becomes “watch it or regret it.”

2. Dividend Stocks That Quietly Shrink

Dividend-paying stocks are often viewed as a safe, reliable source of passive income. But dividends are never guaranteed, and companies can cut or suspend them with little warning. Even well-established blue-chip stocks aren’t immune to market forces, changing leadership, or declining profits.

What looks like an effortless income stream can turn into a sinking ship if you’re not tracking earnings reports, market news, and industry trends. Investors who don’t periodically reassess their dividend portfolios often miss early warning signs that a payout is in danger—or that the company’s fundamentals are eroding.

3. ETFs That Drift Off Course

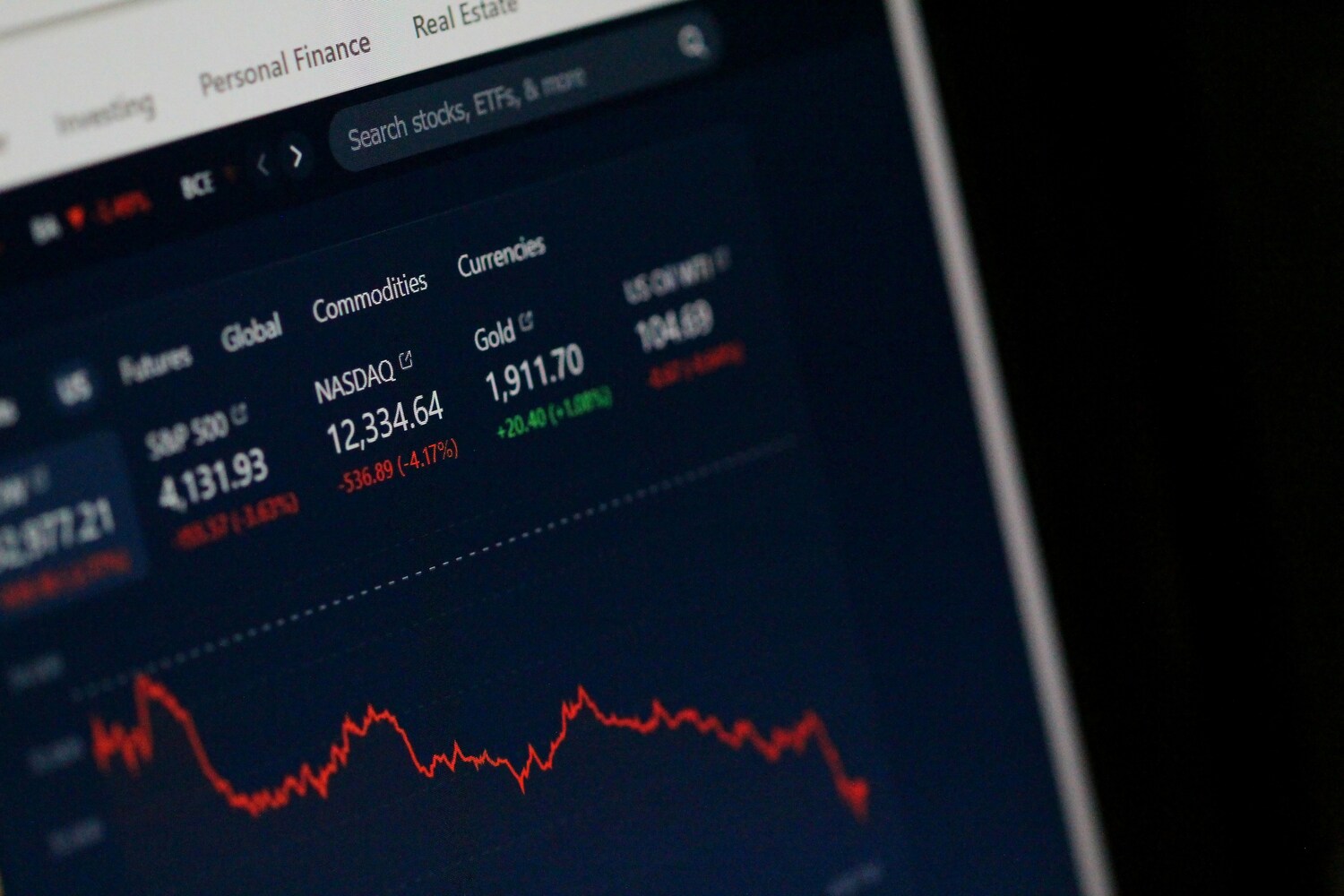

Exchange-Traded Funds (ETFs) are beloved for their simplicity and diversity. You buy a basket of assets, often pegged to an index, and let it grow. But not all ETFs are created equal. Some are sector-specific or leveraged, and they require vigilant oversight to ensure they still match your investment goals and risk tolerance.

What starts as a diversified play on clean energy or emerging markets can quickly become a volatile bet that no longer fits your strategy. Even broad-market ETFs can become too concentrated in a few mega-cap stocks over time, changing your exposure and risk profile without you realizing it.

4. Robo-Advisors That Still Need Human Eyes

Robo-advisors offer automated portfolio management, promising low fees and minimal involvement. But “automated” doesn’t mean “perfect.” These platforms operate on algorithms that may not account for major life changes, shifting goals, or broader economic disruptions.

If you forget to update your preferences or ignore emails and alerts, you may find your allocation out of sync with your actual needs. Worse, many investors assume robo-advisors eliminate the need for deeper financial planning, only to discover too late that tax-loss harvesting, estate planning, and income projections still require human intervention.

5. REITs With Unseen Volatility

Real Estate Investment Trusts (REITs) offer a way to invest in real estate without the headaches of physical property ownership. They’re often pitched as low-maintenance, high-yield vehicles perfect for passive income seekers. But REITs can be surprisingly volatile, especially in a changing interest rate environment.

Some REITs focus on niche sectors, like office space, retail malls, or healthcare facilities, that carry unique risks. A downturn in one segment can drag down your returns fast. Also, REIT dividends are taxed as ordinary income, which can impact your after-tax yield more than you anticipated. Without regular oversight, investors can miss the signs of declining performance or overexposure.

6. Municipal Bonds That Aren’t Always Safe

Muni bonds are often viewed as sleepy, reliable, tax-advantaged investments. But not all municipalities are financially stable. Defaults are rare, but they do happen, and fiscal mismanagement, pension crises, or declining tax bases can affect the quality of your investment.

Even if the bond doesn’t default, changes in interest rates can affect the bond’s market value. If you need to sell before maturity, you might take a loss. And if your bond portfolio isn’t laddered properly or diversified across regions, you’re taking on more risk than you probably realize. Monitoring credit ratings, yield changes, and local fiscal news is crucial if you want this “low-maintenance” asset to stay healthy.

7. Peer-to-Peer Lending That Turns Risky

Platforms that let you lend money directly to individuals or small businesses may seem like an easy way to earn high returns while bypassing traditional banks. But peer-to-peer lending often carries more risk than investors are led to believe.

Default rates can spike during economic downturns, and once the money is lent, it’s illiquid. Recovery can be difficult or impossible. Plus, unlike a bank, these platforms offer no FDIC protection. Monitoring your loan portfolio, reinvesting repayments, and adjusting your risk exposure based on market conditions all require regular hands-on management.

8. “Buy and Hold” Portfolios That Become Stagnant

The classic “buy and hold” strategy is often hailed as the epitome of low-maintenance investing. Choose a well-balanced portfolio, stick with it, and let time do the work. But what’s rarely mentioned is how easily this type of portfolio can become outdated.

Your risk tolerance, time horizon, and financial goals are not static. They evolve. What made sense at 35 may not at 55. Ignoring your portfolio for too long can leave you overexposed to certain sectors, under-diversified, or poorly positioned for retirement income.

Even index funds need periodic checkups. Market conditions, tax law changes, and life events all demand strategic rebalancing that won’t happen unless you’re actively involved.

The Illusion of “Passive” Can Cost You

Investing should work for you, but not without you. Too often, people fall for the myth that some financial vehicles will take care of themselves. But markets are dynamic, personal circumstances change, and even the best automated tools can miss the nuance that human insight provides.

True low-maintenance investing is possible, but it still requires a foundation of education, awareness, and periodic engagement. Ignoring your investments because they’re “supposed to be passive” is a fast way to end up with underperformance, unnecessary risk, or outright loss.

Which “Low-Maintenance” Investment Has Surprised You?

Have you ever invested in something that promised peace of mind, only to find it constantly on your radar?

Read More:

The Secret to Investing Wisely–Understand the Investment Pyramid

5 “Safe” Investments That Look Safe But Aren’t

Riley Jones is an Arizona native with over nine years of writing experience. From personal finance to travel to digital marketing to pop culture, she’s written about everything under the sun. When she’s not writing, she’s spending her time outside, reading, or cuddling with her two corgis.