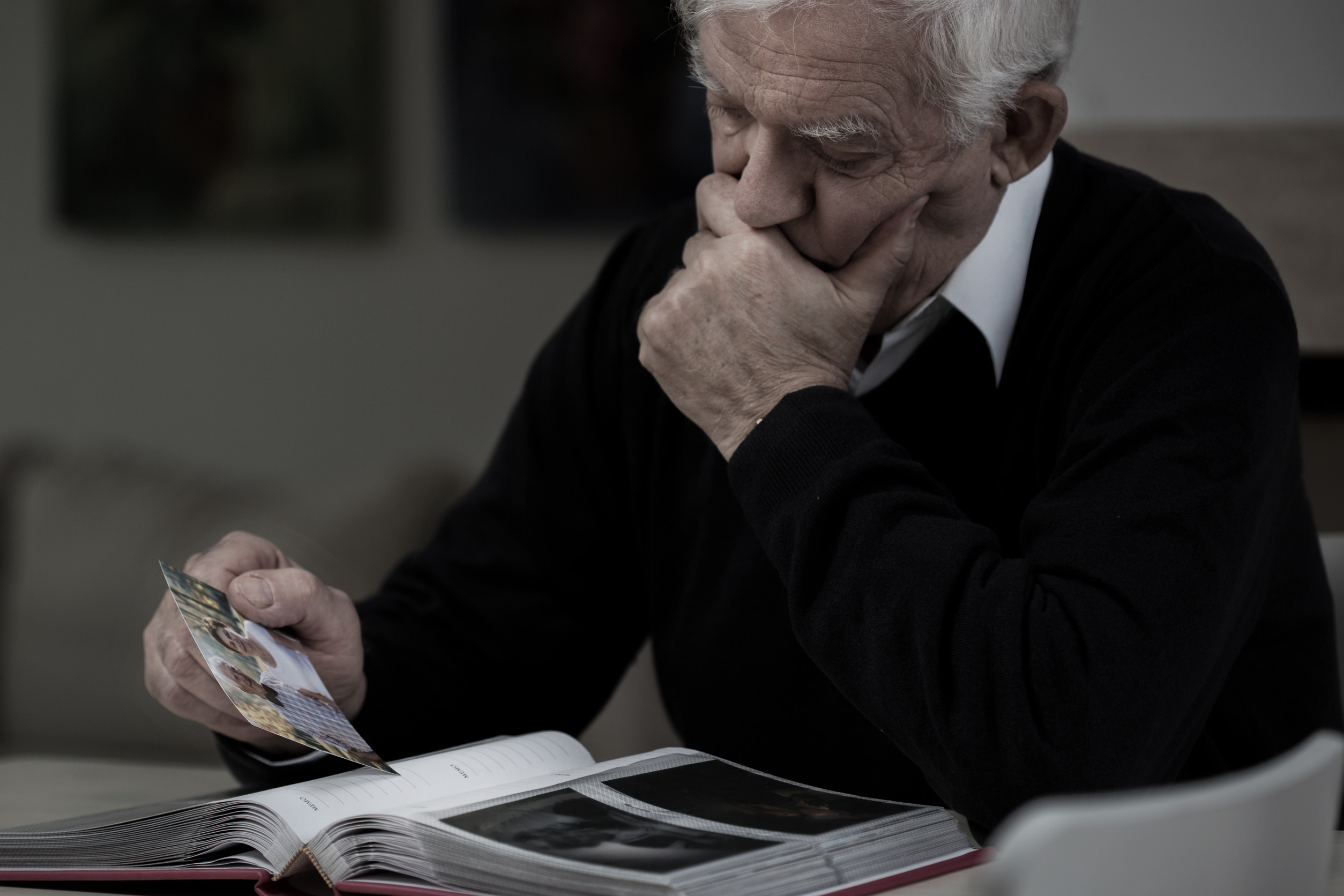

Serving as an executor is one of the toughest responsibilities a family member can face. It requires handling legal documents, settling debts, distributing assets, and keeping peace among heirs—all while grieving. Too often, estates become nightmares because key details were never organized. Executors aren’t magicians—they can only work with the tools left behind. Taking these steps now ensures your estate will be settled smoothly and with less stress for loved ones.

1. Keep a Clear, Updated Will

The foundation of estate planning is a current, legally valid will. Without one, the probate court decides who gets what, often creating conflict and delays. Updating the will every few years—or after major life events—keeps it relevant. Store it in a secure but accessible place, like a fireproof safe or attorney’s office. A clear will prevents confusion and eases an executor’s first step.

2. Create a Master Document List

Executors often waste weeks hunting for bank accounts, insurance policies, and property deeds. A master list of all assets, debts, and accounts solves this problem. Include account numbers, institutions, and login instructions where appropriate. This list should be stored securely but known to the executor. Organized paperwork is the executor’s best gift.

3. Name Beneficiaries on Accounts Directly

Many financial accounts allow you to name beneficiaries through “payable-on-death” designations. These bypass probate and go directly to heirs. Executors can then focus on the rest of the estate without delays. Retirement accounts, life insurance, and bank accounts all benefit from this step. Direct beneficiary designations simplify the process dramatically.

4. Simplify Debts and Liabilities

Executors must settle debts before distributing assets. Multiple credit cards, loans, or unpaid bills create unnecessary complexity. Paying off small accounts and consolidating debts now lightens their burden later. Even making a list of recurring obligations helps. Fewer creditors mean fewer headaches for everyone.

5. Share Digital Asset Access

Email accounts, online banking, and digital subscriptions can lock executors out without preparation. A secure password manager or a written list in a safe location ensures access. Without it, valuable accounts may be lost—or important notifications missed. Digital assets are as critical as physical ones in today’s world. Executors need a clear path in.

6. Communicate Intentions With Family

Surprises cause resentment, not just legal problems. Discussing your estate plan openly with family reduces misunderstandings later. When heirs know your wishes, executors aren’t forced to mediate disputes. Transparency builds trust and lowers tensions. Executors benefit when your voice has already set expectations.

7. Choose the Right Executor (and Backup)

Not everyone has the time, skills, or temperament to handle executor duties. Choosing someone responsible, organized, and impartial makes a difference. Naming a backup ensures continuity if the first choice cannot serve. This decision can prevent chaos at the worst possible moment. The executor should be a person who can manage both paperwork and people.

8. Pre-Arrange Professional Help

Even the best-prepared executors need legal and financial guidance. Leaving names of trusted attorneys, accountants, or advisors helps them act quickly. Professional support prevents costly mistakes and speeds the process. Executors feel less overwhelmed when resources are already in place. Planning for help is as important as planning for assets.

How Preparation Turns Stress Into Clarity

Executors often describe the role as both an honor and a burden. By taking these steps—updating wills, simplifying debts, and sharing access—you remove obstacles before they appear. Instead of scrambling, your executor can carry out your wishes with confidence. Preparation doesn’t just protect money—it protects relationships. The smoother the process, the less strain on grieving loved ones.

Have you ever served as an executor? What step would have made the process easier? Share your experience in the comments.

You May Also Like…

7 Digital-Asset Steps You Must Take Before Your Executor Gets Locked Out

Should You Ever Name a Non-Family Member as Executor of Your Will?

Should You Opt Out of Online Banking Before Naming a Financial Executor?

The Unspoken Costs of Being Named Executor of a Will

Could Your Password Manager Be the Weak Link in Your Estate Plan?