Most families expect their financial information to stay private. But some state programs can let strangers access your family’s financial records. This isn’t just about privacy—it can affect your safety, eligibility for benefits, and even your peace of mind. Knowing which state programs have this kind of access helps you make informed decisions. It can also help you spot errors or misuse before they become big problems. Let’s look at seven state programs that may let strangers peek into your finances, and what you can do about it.

1. Medicaid Asset Verification Programs

Medicaid is a vital safety net for millions of families. But to prevent fraud, most states use Medicaid Asset Verification Programs (AVPs). These programs allow state agencies—and sometimes their contractors—to review your bank accounts, property records, and other financial assets. In some cases, third-party vendors handle these checks, meaning people outside the government could see your family’s financial records.

While this is meant to ensure only eligible families get benefits, it can feel invasive. If you apply for Medicaid, be prepared for your financial details to be scrutinized by more than just a state worker. This is a key reason why understanding which state programs access your financial records is so important.

2. State Child Support Enforcement Agencies

If you or your co-parent is involved in child support cases, state agencies may dig into your finances. These agencies are tasked with tracking down nonpayment and ensuring the right amount is paid. To do this, they might share your financial data with employers, banks, or even private collection firms.

Sometimes, these third parties are unfamiliar faces who gain access to your bank statements, pay stubs, and tax returns. If you’re ever in a child support dispute, ask who will see your financial records and how they’re protected.

3. State Housing Assistance Programs

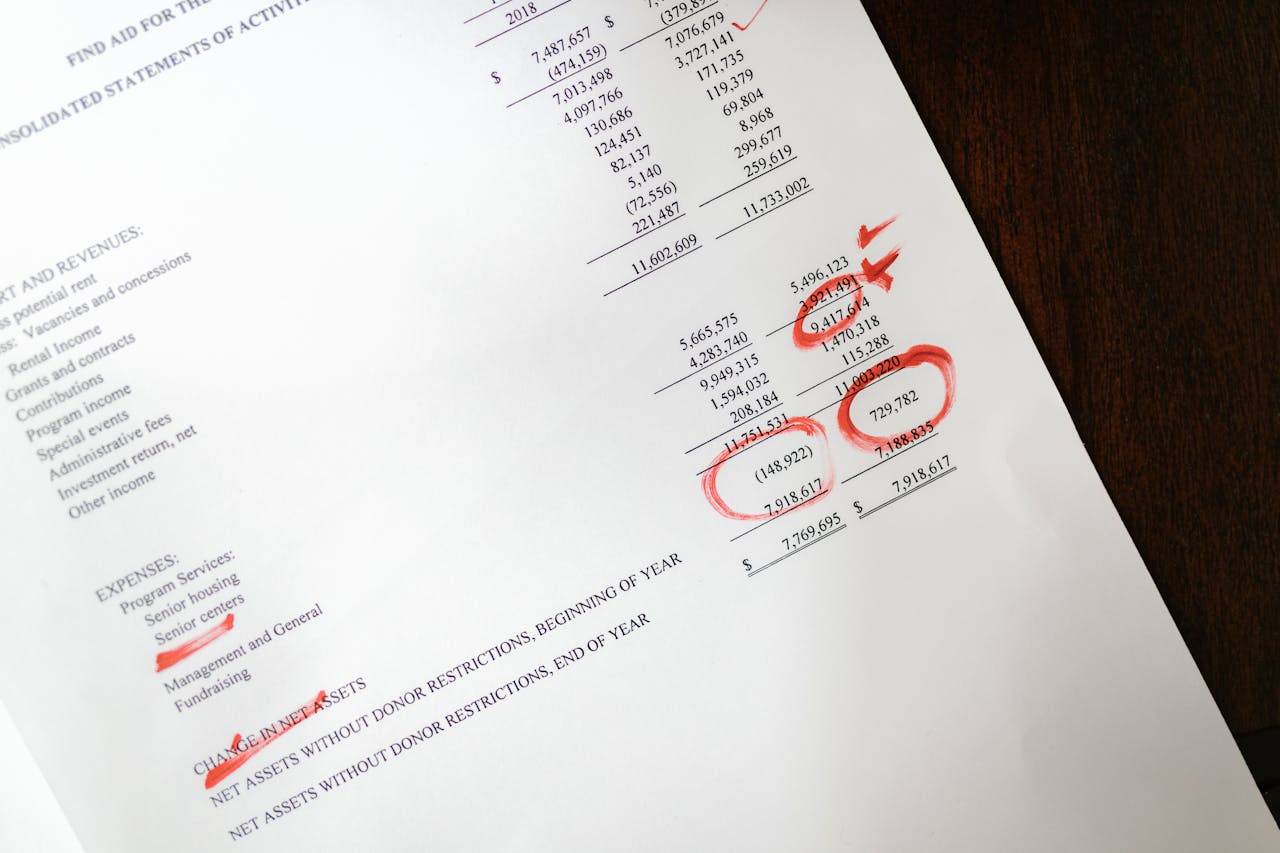

Applying for state housing assistance often means opening up your family’s financial records. State housing authorities verify your income, assets, and even your spending habits to determine eligibility. Sometimes, this information is shared with partner agencies or private landlords.

For example, public housing authorities may use outside contractors to process applications or conduct audits. That means someone you’ve never met could review your paychecks or savings. Awareness of this process is the first step in protecting your privacy when dealing with these programs.

4. State Unclaimed Property Programs

States run unclaimed property programs to return lost money or property to the rightful owners. To do this, they collect detailed financial records from banks, insurers, and utility companies. When you search for unclaimed property, your information may be handled by both state employees and third-party vendors managing the database.

In some states, anyone can search the unclaimed property database and see if they have assets listed—sometimes including their address or other personal details. If you use these services, check the privacy policies and be aware of who might see your financial information.

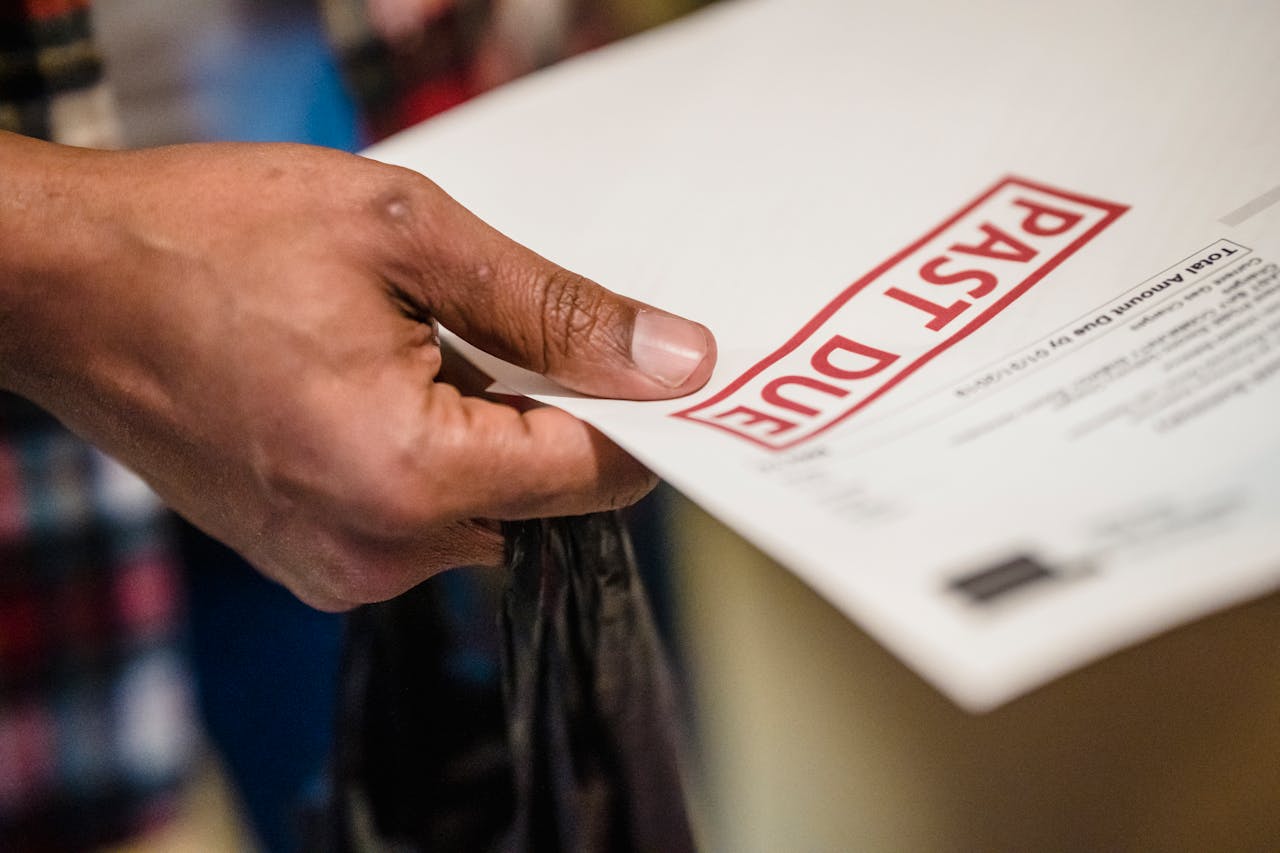

5. State Tax Refund Intercept Programs

If you owe money for child support, back taxes, or certain debts, state tax agencies may intercept your refund. To do this, they often share your financial records with other state departments or outside collection agencies. This collaboration means your tax details could be accessed by more people than you expect.

Some collection agencies hired by the state may not have the same data protections as government offices. Knowing how state programs access your financial records can help you stay alert to potential privacy issues.

6. State-Funded Financial Aid Offices

When you or your child applies for state-funded financial aid, you’re required to submit detailed financial records. These records are reviewed by state agencies and sometimes by contracted evaluators. In some cases, information is also shared with universities or scholarship boards for verification.

This process can mean people outside your direct control see your family’s financial data. While most offices are careful, mistakes and leaks do happen. Review your application’s privacy statements and ask questions about who will see your information.

7. State Energy Assistance Programs

Energy assistance programs, like the Low Income Home Energy Assistance Program (LIHEAP), help families pay utility bills. To qualify, you must provide proof of income and other financial records. State agencies may contract with nonprofits or private companies to process applications, so someone outside the state government could view your data.

For example, a third-party contractor may review your pay stubs or bank statements to confirm eligibility. If you’re worried about privacy, ask the agency how your financial records are stored and who can access them. This is another example of why understanding which state programs access your financial records is essential.

How to Protect Your Family’s Financial Privacy

Knowing which state programs access your financial records is just the start. Always read privacy policies before submitting sensitive information. Ask agencies how your data is stored, who can see it, and what happens if there’s a breach. You have the right to know—don’t be afraid to push for clear answers.

If you spot an error or suspect your information has been misused, report it immediately. Staying informed and proactive is the best way to protect your family’s privacy in a world where more programs—and more strangers—may access your financial records than you think.

Have you ever been surprised by who could access your family’s financial records through a state program? Share your experience in the comments below.

Read More

7 Awkward Money Talks to Have with Your Family Before It’s Too Late

9 Ways You’re Unintentionally Inviting Strangers into Your Life

Travis Campbell is a digital marketer and code developer with over 10 years of experience and a writer for over 6 years. He holds a BA degree in E-commerce and likes to share life advice he’s learned over the years. Travis loves spending time on the golf course or at the gym when he’s not working.