After a turbulent stretch marked by margin compression and muted delivery growth, Tesla Inc. (NASDAQ: TSLA) is showing signs of a turnaround, with sales rebounding in the latest quarter. The recent Robo-taxi rollout adds a fresh catalyst, unlocking a new revenue stream and reinforcing the company’s long-term autonomous strategy.

Q3 Report Due

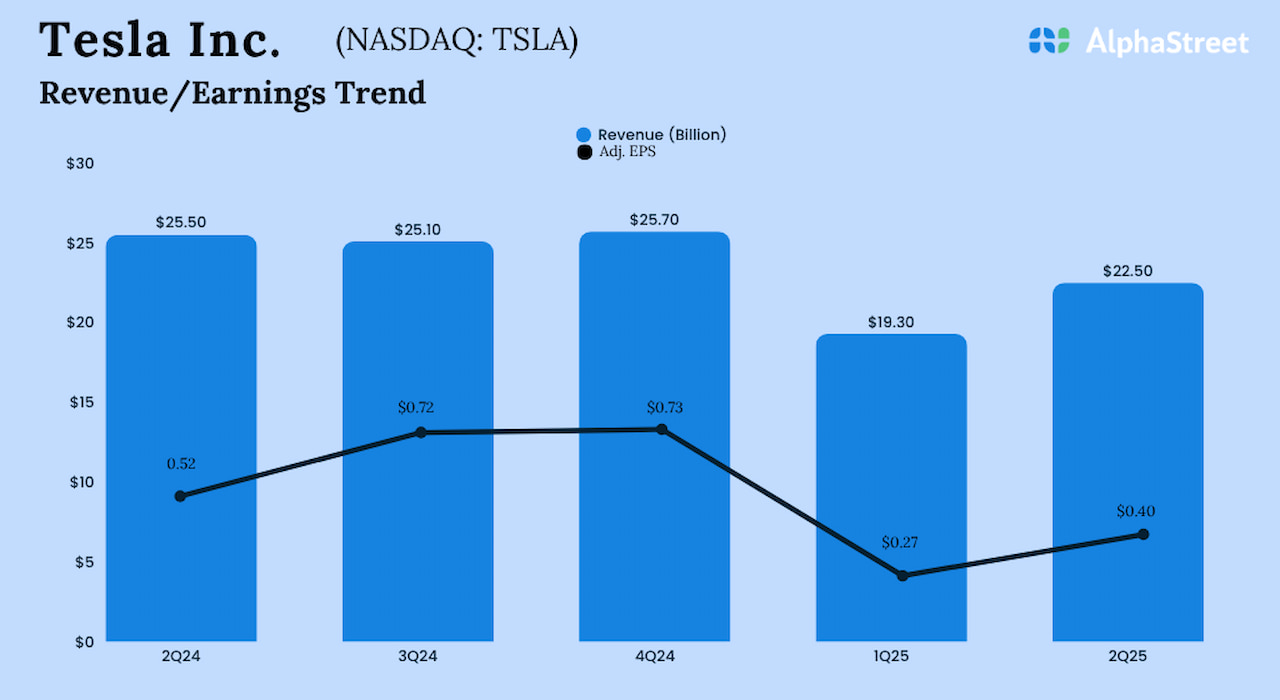

The Austin-headquartered tech giant is all set to unveil its Q3 FY25 numbers on October 22, at 4:15 pm ET. On average, analysts following the company predict that September-quarter earnings, excluding special items, declined sharply to $0.55 per share from $0.72 per share in Q3 last year. It is estimated that revenues rose around 5% YoY to $26.58 billion in the third quarter.

Tesla’s stock experienced heavy fluctuations this year, driven by multiple factors such as falling sales in key markets like Europe, rising competition, and concerns of execution risks due to CEO Elon Musk’s divided attention. Although TSLA has recovered from its early-year losses, the stock is trading well below its December peak.

Mixed Outcome

Notably, Tesla’s second-quarter results nearly matched Wall Street’s expectations, after missing in the trailing two quarters. In the June quarter, revenues declined to $22.5 billion from $25.5 billion in Q2 2024. The company produced a total of 410,244 vehicles during the quarter and delivered 384,122 units. On an adjusted basis, Q2 earnings dropped to $0.40 per share from $0.52 per share a year earlier. Unadjusted net income was $1.17 billion or $0.33 per share in Q2, vs. $1.40 billion or $0.40 per share last year.

“We have done what we said we were going to do. We are not always on time, but we get it done. Great progress by the Tesla team. I do think if Tesla continues to execute well with vehicle autonomy and humanoid robot autonomy, it will be the most valuable company in the world. A lot of execution between here and there. It doesn’t just happen. Provided we execute very well, I think Tesla has a shot at being the most valuable company in the world. Obviously, I am extremely optimistic about the future of the company,” Musk said at the Q2 earnings call.

Road Ahead

Recently, the company announced the commercial launch and geographic expansion of its robotaxi service in Austin. It is planning to expand the service to half the country’s population by year-end. Going forward, revenue and margins are expected to benefit from higher average selling prices and improved product mix. However, a part of those gains will be offset by the impact of tariffs and the recent expiration of EV credits.

Tesla shares traded mostly sideways this week, staying well above their 12-month average price. The stock closed the last trading session slightly lower.