Walmart Inc. (NYSE: WMT) entered the second half of FY26 navigating a challenging retail landscape marked by tariff-related cost pressure and cautious consumer behavior. At the same time, the company is accelerating its transition from a legacy brick-and-mortar operator to a multichannel retail platform.

Q3 Report Due

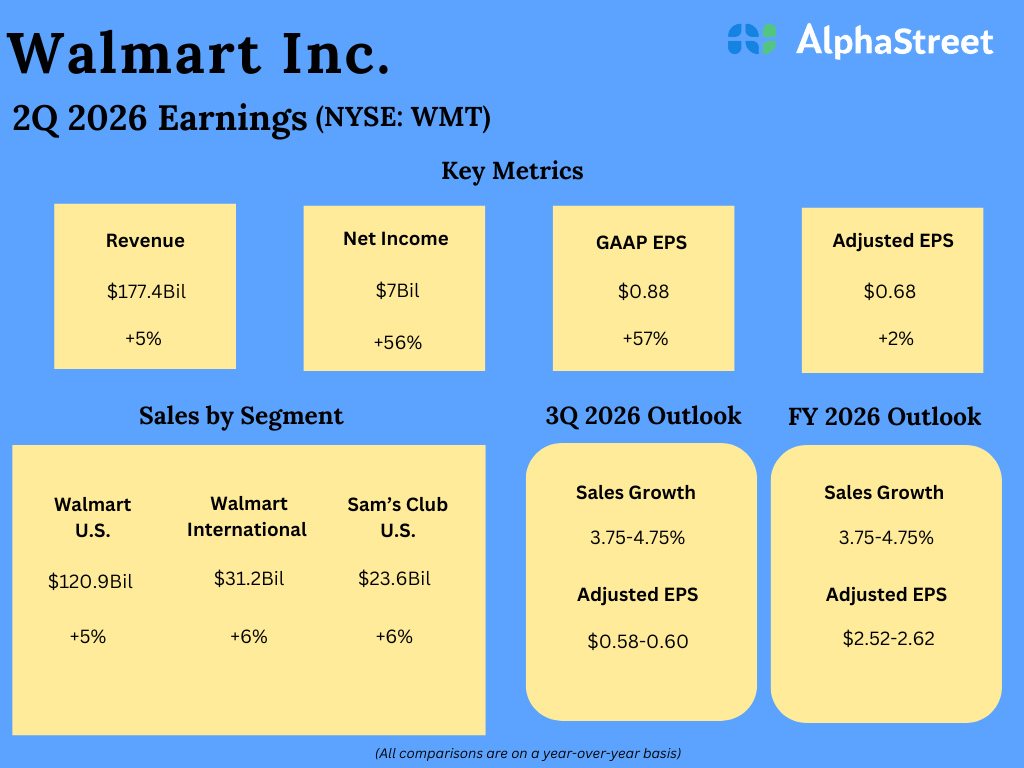

Walmart is getting ready for the release of its third-quarter fiscal 2026 financial report, which is expected on November 20, at 7:00 am ET. On average, analysts following the business predict earnings of $0.60 per share for the October quarter. It is estimated that third-quarter earnings benefited from a 4.3% increase in net sales to $175.1 billion. In a recent statement, the Walmart leadership said it expects third-quarter sales to increase 3.75-4.75% YoY on a constant currency basis. The management’s forecast for Q3 adjusted earnings is $0.58-0.60 per share.

After hitting a new high a month ago, the retail giant’s stock pulled back, paring some of its earlier gains. The shares have risen approximately 20% over the past year, outpacing the broader market. The recent dip in value presents an investment opportunity, with market watchers forecasting a rebound in the coming months.

Strong Sales

In the second quarter of FY26, Walmart’s e-commerce sales grew an impressive 25% globally, reflecting strong growth across all segments. Total revenue rose 5% YoY to $177.4 billion, or 5.6% in constant currency, exceeding analysts’ consensus estimates. Adjusted earnings moved up 2% annually to $0.68 per share in Q2, and reported net income attributable to the company increased around 56% to $7 billion or $0.88 per share. However, earnings fell short of expectations, marking the first miss in more than three years.

Walmart’s chief executive officer, Douglas McMillon, said in his post-earnings interaction with analysts, “We’re keeping our prices as low as we can for as long as we can. Our merchants have been creative, and acted with urgency to avoid what would have been additional pressure for our customers and members. They’ve done a terrific job managing pricing and mix across merchandise categories. They managed to generate rollbacks. They made good quantity and flow decisions, and they’ve set us up well as we start the back half of the year. As it relates to what we’re experiencing with customers and members here in the US, their behavior has been generally consistent.“

Road Ahead

For fiscal 2026, the company forecasts a 3.75-4.75% growth in net sales, in constant currency. Full-year adjusted earnings are expected to be in the range of $2.52 per share to 2.62 per share. The management said it is on track to reach 95% of the US population with delivery options of three hours or less by year-end. The aggressive e-commerce push, combined with competitive prices, has enabled Walmart to consistently gain market share in the US and across markets internationally.

Walmart shares maintained an uptrend this week and traded slightly above the $100 mark. On Thursday, the stock mostly traded lower during the session. The average stock price for the last 52 weeks is $96.61.