Shares of Lennar Corporation (NYSE: LEN) were up over 2% on Thursday. The stock has gained 24% in the past three months. The homebuilder is scheduled to report its earnings results for the third quarter of 2025 on Thursday, September 18, after the market closes. Here’s a look at what to expect from the earnings report:

Revenue

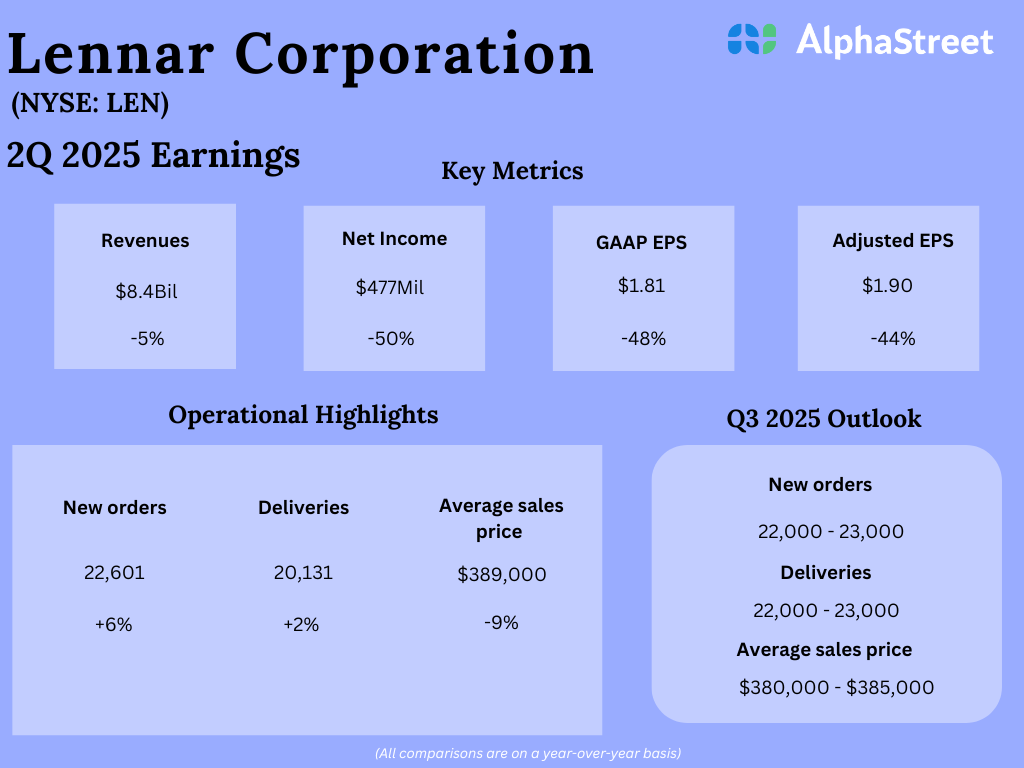

Analysts are projecting revenue of $9.05 billion for Lennar in Q3 2025, which indicates a decline of nearly 4% from the same period a year ago. In the second quarter of 2025, revenues decreased 5% year-over-year to $8.4 billion.

Earnings

Lennar has guided for earnings per share of $2.00-2.20 for the third quarter of 2025. Analysts’ estimates point to EPS of $2.10, implying a decrease of 46% from the third quarter of 2024. In Q2 2025, adjusted EPS fell 44% YoY to $1.90.

Points to note

As mentioned on its last quarterly call, Lennar does not expect the headwinds it has been facing to subside in the near term. The uncertain macroeconomic environment continues to pose challenges to the housing market, with high interest rates, inflationary pressures, and a shortage of new homes hindering affordability in spite of strong demand. The company has been offering incentives to drive sales of houses but this has been weighing on margins.

In this environment, Lennar’s strategy has been to focus on driving volume and growth, and match the pace of production and sales. Consistent volume helps drive efficiencies across the platform and the sale and delivery of homes help avoid inventory build-up.

In Q1, deliveries increased 2% and new orders rose 6%. Average sales price was down 9% while gross margins dropped to 17.8% from 22.6% last year. In order to improve margins, Lennar is working on reducing costs across its business. The company believes that lowering costs will help bring down the prices of homes and thereby aid affordability while reducing the pressure on profits.

The homebuilder has forecast new orders and deliveries to range between 22,000-23,000 homes for the third quarter of 2025. Average sales price is expected to be $380,000-385,000. Gross margin is projected to be approx. 18% for the quarter, which is down from last year.