In This Article

Tenant scammers are taking rental fraud to new heights, dipping in and out of false identities as easily as Ethan Hunt swaps masks in Mission: Impossible. However, in the rental scenario, the only thing about to self-destruct is a landlord’s bank account.

Gone are the days of forged pay stubs and embellished credit histories. Now, an entire web of fraudulent information, supported by tech-savvy perpetrators, is forcing landlords to adapt by using enhanced screening techniques. These techniques could make some innocent tenants wonder if they were applying to join the CIA instead of moving into a new apartment.

First- and Third-Party Fraud

Business Insider recently reported that the rental industry distinguishes between first-party fraud —where applicants use their real names, but submit falsified income, bank, or employment documents—and third-party fraud, in which scammers impersonate or steal an entire identity to secure a lease.

The publication highlighted the case of Jared Decker, a local Tampa businessman who discovered thousands of dollars missing from his bank account. A fraudster used his identity to charge $10,000 in rental payments for apartments Decker did not know of. The culprit had moved into the apartment before Decker figured out what was happening.

A costly eviction and court proceedings followed, further racking up expenses. Ultimately, the actual landlords, a mom-and-pop operation, were liable for most of the costs.

Smaller Landlords Could Be Targets

Smaller landlords who lack the sophisticated screening techniques used by larger, corporate landlords are particularly vulnerable. Once a tenant moves in, getting them out involves time and money due to the formal eviction process.

Mom-and-pop operations own more than a third of all American rental properties, and they are particularly vulnerable, as the artificial intelligence boom is making document manipulation far more sophisticated and challenging to detect. However, fraudsters do not discriminate in their targets, with major corporate management companies and landlords equally likely to receive falsified information.

“At Habitat, the most pressing fraud issue is the rise in fraudulent lease applications involving stolen identities,” Wendy Deetjen, VP of The Habitat Company’s Market-Rate Portfolio group, a Chicago-based management and development company specializing in mixed-use and multifamily housing, told The Apartment Association of Greater Los Angeles.

“Applicants are using sophisticated tactics—such as AI-generated documents and forged employment records—to secure units under false pretenses,” Deetjen added.

Nearly 95% of Landlords Have Experienced Rental Fraud

According to a survey from the National Multifamily Housing Council (NMHC), 93.3% of respondents reported experiencing varying degrees of fraudulent activity in the past year. The most common (84.3%) was based on falsified documents such as pay stubs, employment references, and income verification.

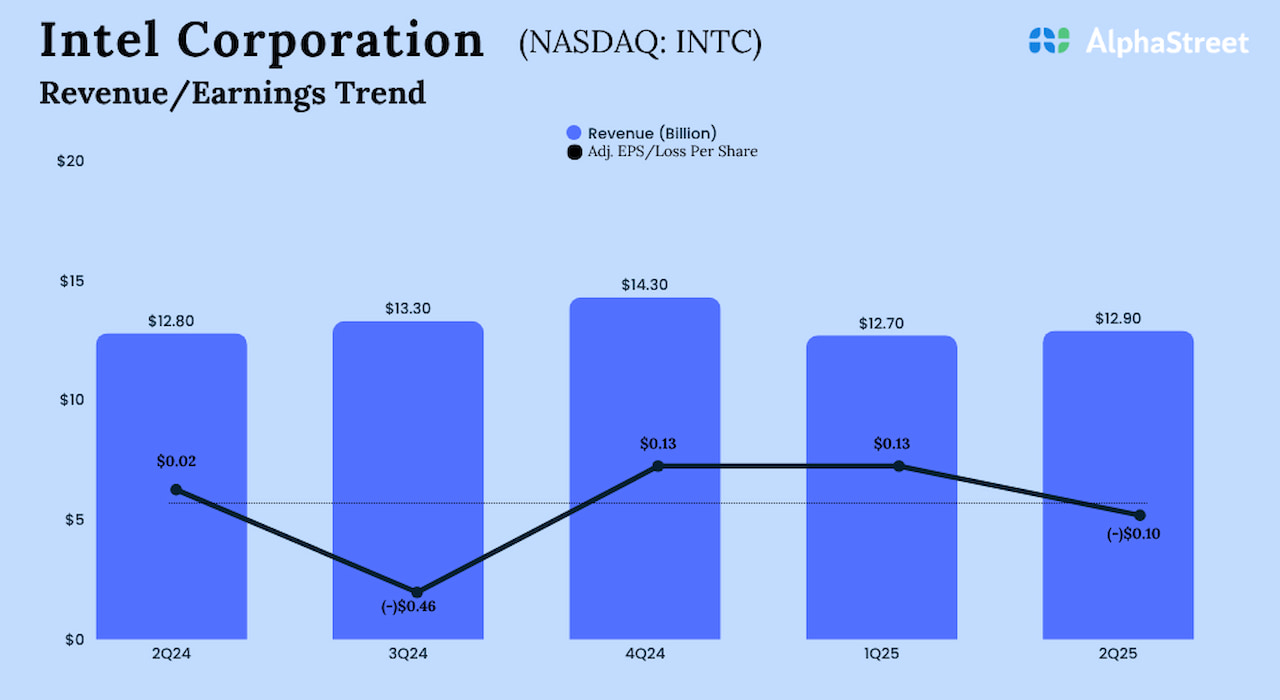

Fraud is causing landlords to encounter serious financial problems by renting to tenants who have no intention of paying their rent.

Remote Leasing Tenants Are a Big Red Flag

For prospective landlords, a red flag, according to Louie Colella, vice president of leasing and operations at Chicago-based developer CRG, is tenants leasing apartments sight unseen. He told the Apartment Association of Greater Los Angeles:

“One of the biggest fraud issues we’ve seen at CRG happens right in the application process, especially in cities like Chicago and with renters who are leasing without seeing the unit in person. During the pandemic, when in-person tours were tough or impossible, we rolled out virtual tours and online leasing tools to keep things moving and make it easier for renters. That convenience was great, but it also opened the door for fraud.”

Where Rental Fraud Is Rampant

Greystar, one of the largest residential management companies in the U.S., overseeing 960,000 multifamily units and 44,000 in Atlanta alone, told Business Insider that in certain cities, rental fraud is rampant. In Atlanta, they claim to flag around half of their rental applications in the midtown, downtown, and Buckhead areas of the city. In Durham-Chapel Hill, North Carolina; Salt Lake City; Portland; Charleston, South Carolina; and Boston, they identified around 14% to 18.5% of applications as fraudulent.

“We definitely have seen that leasing fraud attempts have grown in both volume and sophistication in recent years,” Jamie Teabo, senior managing director at Greystar, told Business Insider.

You might also like

Rental management software provider RealPage found that 75% of nearly 400 surveyed property managers across five major cities observed rising levels of fraud, Business Insider reported, noting that 25% of all evictions over the last three years resulted from fraud and, in a related story, the inability to pay rent.

Landlord Incentives Leave New Construction Vulnerable

A recent explosion in new apartment construction has further opened the floodgates to fraud, especially with incentives like a month or two of free rent, making the lease-up period ripe for abuse. The increasingly digital and anonymous nature of this process makes it difficult to separate the scammers from legitimate tenants.

Curbing Fraud

Although rental fraud has been painful for landlords, it has been wildly profitable for the companies hired to stop the scammers. Snappt is one—an identity and income-verification software firm that received $100 million in venture capital funding in 2022 and is used by landlords who own 2.2 million apartments across the U.S.

“Business has been kind of a rocket ship,” Kyle Nelson, the company’s vice president of corporate strategy, told Business Insider.

Final Thoughts: Practical Steps for Landlords to Screen and Spot Fraud

Adhere to tenant screening laws

Although understandably, landlords will want to take precautions when screening tenants, there is a danger that excessive caution could be perceived as overly intrusive by some tenants. They could have a point because there are tenant screening laws that each landlord or property management company must adhere to, and they differ from state to state.

If you overstep your boundaries, a savvy tenant could file a complaint. There are also some gray areas, where common sense should prevail. Asking for personal photos to accompany an application or using inaccurate credit score calculation methods could put a landlord in hot water.

Due diligence is essential

Amid sophisticated forgeries of documents such as pay stubs and employment letters, following up by calling publicly listed business addresses (no personal phone numbers) should be standard due diligence.

Insist on in-person viewings

The pandemic is over. A landlord can request in-person viewings only. Not only will that give the owner/manager the chance to gauge the personality of a prospective tenant, but it should also give the prospective renter the chance to check out their possible future home in person—a sign that they are serious about renting from you.

Never accept rent before a lease is signed

As tempting as it might be, accepting money from a tenant before a lease is signed could set a landlord up for a scam. Follow protocols and verify everything.

Outsource to the experts

Consider outsourcing identity and income verification to third-party companies like Snappt, and background checks to services such as TransUnion SmartMove and Checkr.