Intel Corporation (NASDAQ: INTC) has reported muted results for the first half, as the chipmaker continues to navigate a challenging market environment. Despite the company actively executing its turnaround strategy, intense competition and capital constraints continue to cloud its near-term outlook. Margins remain under pressure due to operating losses linked to Intel’s nascent foundry operations.

Q3 Data on Tap

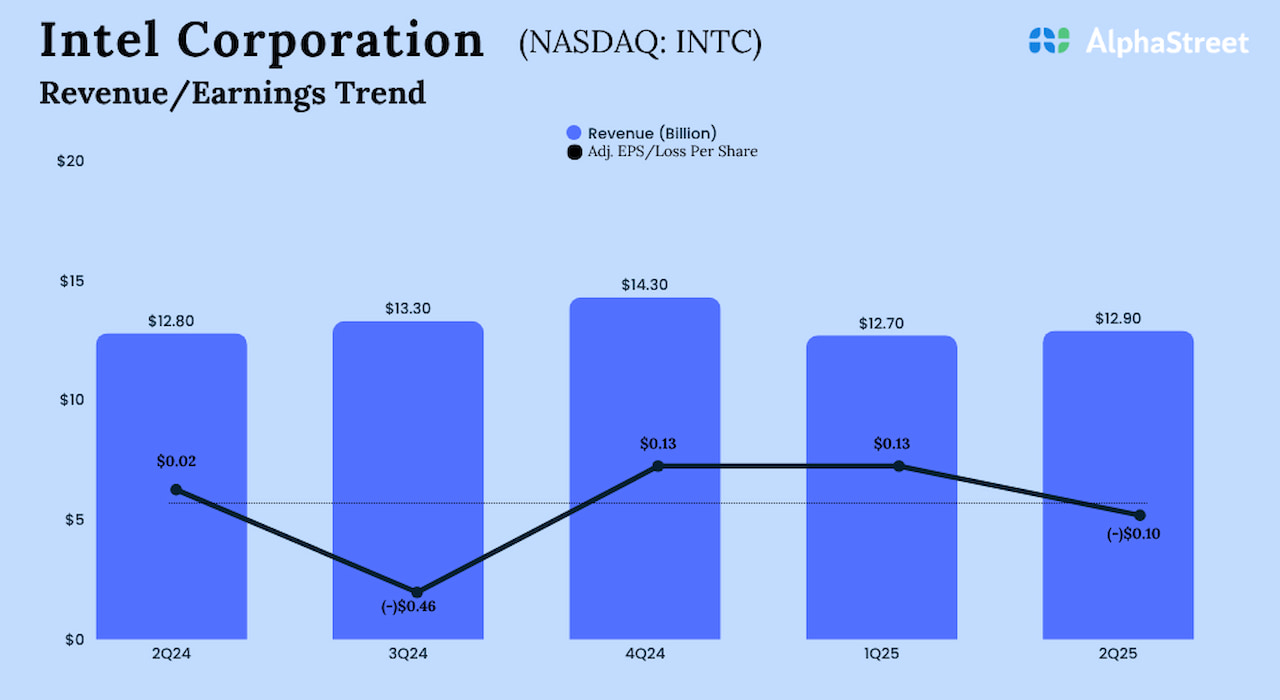

Market watchers see a mixed performance in the third quarter – they predict an improvement in the bottom line compared to last year, despite a decline in revenues. The consensus earnings estimate is $0.01 per share, excluding one-off items, on revenues $13.12 billion. In the prior-year quarter, the company generated $13.28 billion in revenues and incurred a loss of $0.46 per share. The Q3 report is expected to be out on Thursday, October 13, at 4:00 pm ET.

In early October, Intel’s stock reached its highest value in about one-and-half years, after making steady gains over the past few weeks. INTC has grown around 28% in the past 30 days, consistently trading above its 12-month average price of $23.10 during that period. The investor optimism mainly reflects positive developments like recent investments from the US government, Nvidia, and Softbank.

Q2 Loss

In the second quarter, the tech firm’s revenue remained broadly unchanged at $12.9 billion as a decline in Client Computing revenue was offset by higher Data Center and AI revenues. It reported a loss of $0.10 per share for the June quarter, on an adjusted basis, compared to earnings of $0.02 per share in the year-ago quarter. Revenues exceeded estimates, while the bottom-line missed. On a reported basis, it was a net loss of $2.9 billion or $0.67 per share for Q2, compared to a loss of $1.6 billion or $0.38 per share last year.

Lip-Bu Tan, Intel’s new CEO, said in the Q2 earnings call, “As mentioned in our Q1 earnings call, we need to right-size and scale back the company while ensuring that we are retaining our best internal talent and hiring the best external talents from industry and universities. During Q2, we completed the majority of the actions needed to achieve our year-end target of seventy-five thousand employees. These were hard but necessary decisions, and we reduced management layers by approximately fifty percent in the process.”

In Turnaround Mode

Intel is actively bolstering its liquidity through external investments and government support, as it navigates mounting financial pressures. Over the years, heavy capital spending, strategic missteps and rising competition have dealt a serious blow to the company’s financial health. On the AI front, it is shifting to a software-led model focused on addressable segments like inference and agentic AI.

A few months ago, the management inked a $2-billion deal with SoftBank for investing in advanced technology. Meanwhile, the company said its Arizona fab is fully operational and is on track to start high-volume production of Panther Lake, its first AI PC platform built on the advanced 18A process node. Recently, Intel announced a partnership with Nvidia to co-develop multiple generations of custom data center and personal computer products.

Intel’s stock was trading up 3% on Monday afternoon, extending the uptrend seen in recent weeks. The value has more than doubled since early August.

The post Intel Q3 Preview: Can foundry bets and AI tailwinds drive a rebound? first appeared on AlphaStreet.