FB Financial Corporation (NYSE: FBK) reported solid fourth-quarter 2025 results, reflecting improved profitability, balance sheet growth, and continued progress in business diversification. Results were supported by margin expansion, disciplined expense control, and stable credit performance.

Fourth Quarter Performance

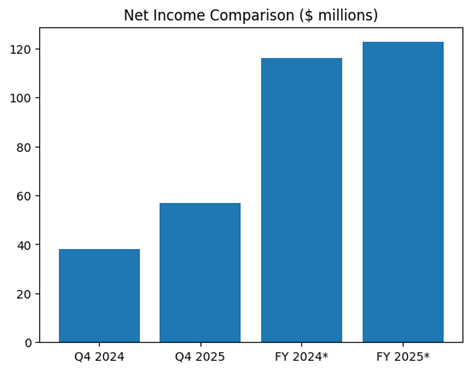

Net income for Q4 2025 reached $57.0 million, or $1.07 per diluted share. This compares with $37.9 million, or $0.81 per share, in Q4 2024. Year over year, net income rose 50%. Total revenue increased to $178.6 million from $130.4 million a year earlier. This represented growth of approximately 37%. Net interest income was the primary driver, reflecting both loan growth and improved funding costs.

Net interest margin expanded to 3.98% in Q4 2025 from 3.50% in Q4 2024. Lower deposit costs following Federal Reserve rate cuts supported the improvement. Noninterest income also increased year over year, led by stronger mortgage banking revenue and service fees. Operating efficiency remained sound despite higher performance-based compensation.

Full-Year Highlights

For full-year 2025, FB Financial reported net income of $122.6 million, compared with $116.0 million in 2024. This represented a year-over-year increase of about 6%. On an adjusted basis, earnings growth was stronger, reflecting lower merger-related costs and improved core profitability. While reported revenue for the full year was not disclosed in aggregate terms, annualized performance based on the fourth-quarter run rate suggests a materially higher revenue base in 2025 compared with 2024.

Return on average assets improved to 1.40% in Q4 2025 from 1.14% a year earlier. Return on average equity also strengthened, supported by earnings growth and active capital management. The company repurchased approximately 3% of outstanding shares during the quarter, enhancing per-share metrics.

Balance Sheet and Funding

Loans held for investment reached $12.38 billion at year-end 2025, up 29% from the prior year. Growth was driven by commercial real estate, commercial and industrial, and residential lending. Deposits totaled $13.91 billion, an increase of 24% year over year. Management continued to prioritize core deposit growth while reducing reliance on higher-cost, non-core funding.

Credit quality remained stable. Net charge-offs were minimal at 0.05% of average loans, well below prior-year levels. Nonperforming assets edged higher but remained manageable. The allowance for credit losses stood at 1.50% of loans, indicating a conservative credit posture.

Business Development and Diversification

FB Financial continued to diversify revenue streams beyond traditional spread income. Mortgage banking remained a key contributor to noninterest income. The company also benefited from expanded wealth management, insurance, and treasury management services. Integration of prior acquisitions and ongoing branch optimization supported operating leverage and market expansion across Tennessee, Kentucky, Alabama, and Georgia.

Management emphasized disciplined capital deployment, organic growth, and selective acquisitions as part of its long-term strategy. The focus remains on building a durable funding base, expanding fee-based businesses, and maintaining strong risk management.

Overall, FB Financial exited 2025 with improved margins, steady credit quality, and a more diversified earnings profile. These factors position the company for stable performance entering 2026, despite a shifting interest rate environment.