Cisco Systems Inc. (NASDAQ: CSCO), a leading manufacturer and distributor of data networking products, ended fiscal 2025 on a positive note, with the business benefiting from a sharp increase in AI infrastructure orders. As the company prepares for its first-quarter earnings, market watchers are optimistic about the outcome.

Estimates

Recently, the San Jose-headquartered tech firm said it expects first-quarter revenue to be in the range of $14.65 billion to $14.85 billion, and adjusted earnings to be between $0.97 per share and $0.99 per share. At the mid-point, the guidance is broadly in line with analysts’ estimates for earnings of $0.98 per share on revenues of $14.78 billion. The Q1 report is expected to come on Wednesday, November 12, at 4:05 pm ET.

Cisco’s shares have maintained a steady uptrend in recent months and reached an all-time high this week. Trading well above its 52-week average value of $63.61, the stock is expected to sustain the momentum ahead of the earnings. The shares have gained about 23% since the beginning of 2025. The company has a strong track record of raising its dividends. With a bigger-than-average yield of 2.7%, CSCO remains a favorite among income investors.

EPS Grows

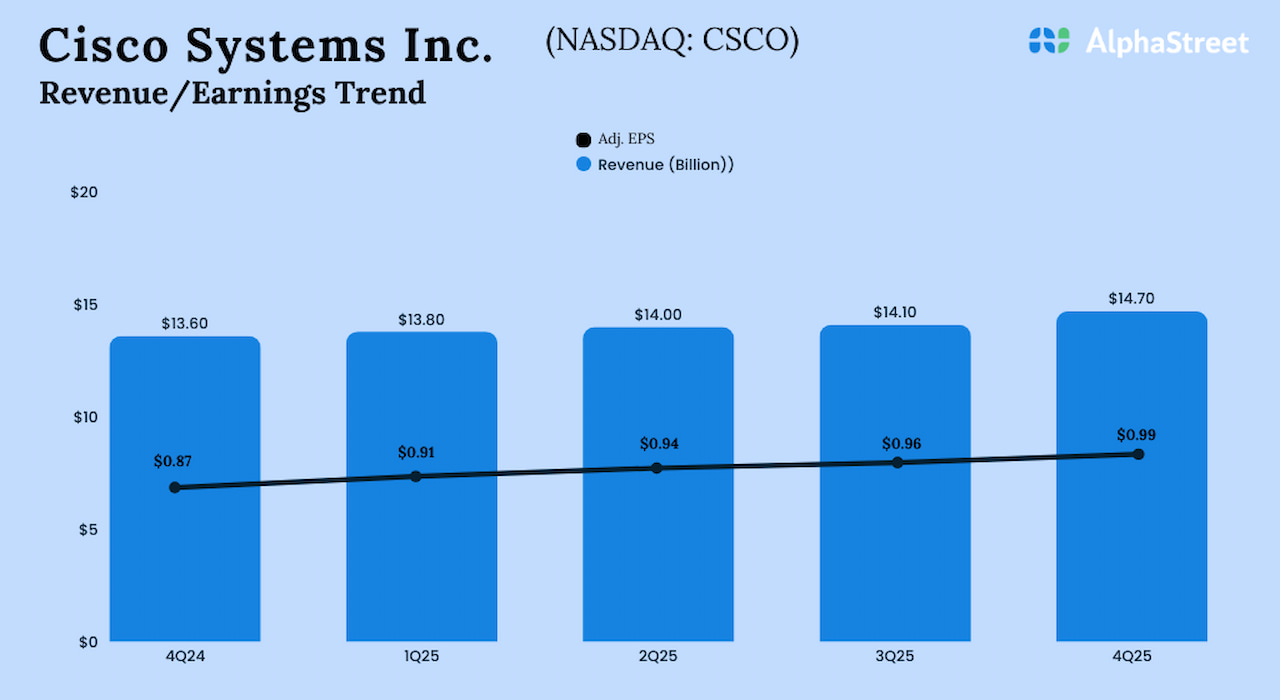

In the final three months of fiscal 2025, Cisco’s adjusted earnings increased to $0.99 per share from $0.87 per share in the same period last year. Unadjusted net income was $2.8 billion or $0.71 per share in Q4, compared to $2.2 billion or $0.54 per share in Q4 2024. Fourth-quarter revenue rose to $14.7 billion from $13.64 billion in the prior-year quarter. Revenue and profit exceeded analysts’ estimates, extending the recent streak of outperformance.

“We had a strong close to fiscal ’25, delivering revenue and gross margin at the high end of our guidance ranges for the fourth quarter. Continued operating leverage across our business produced strong profitability with earnings per share above the high end of our guidance. In addition, we generated solid growth in annualized recurring revenue, remaining performance obligations, and subscription revenue, which provides a strong foundation for our future performance,” Cisco’s CEO Chuck Robbins said during the fourth-quarter earnings call.

AI Prowess

Cisco’s aggressive investments in cloud and AI are beginning to pay off. In fiscal 2025, orders for AI infrastructure from web-scale customers more than doubled management’s original target. To meet rising demand for AI-native security solutions, the company is also expanding its security portfolio. Notably, robust infrastructure reliability and security are essential for enterprises to fully unlock the potential of artificial intelligence.

After opening Tuesday’s session higher, Cisco’s stock changed course and was trading down 2% in the afternoon. The shares have grown by one-third since the beginning of the year.