The Procter & Gamble Company (NYSE: PG) is set to report its first-quarter results on Friday, with Wall Street analysts forecasting a modest YoY increase in sales. The company is leaning on productivity gains and strategic pricing to ease the impact of economic uncertainties on the business, but has warned of significant tariff headwinds in the current fiscal year. P&G is the largest consumer goods company, consistently dominating in categories like Fabric & Homecare and Grooming.

Estimates

P&G will publish its first-quarter 2026 financial results on Friday, October 24, at 7:00 am ET. It is estimated that core earnings declined modestly to $1.90 per share in Q1 from $1.93 per share in the year-ago quarter. The consensus sales estimate for the September quarter is $22.17 billion, which represents a 2% year-over-year increase. In Q4, both sales and profit beat analysts’ expectations, after missing in the prior quarter.

Based on the last closing price, P&G shares have slid about 14% since hitting an all-time high in December last year. After entering 2025 on a positive note, PG lost momentum and has experienced high volatility, maintaining a downtrend. The value has dropped about 10% since the beginning of the year.

Sales Rise

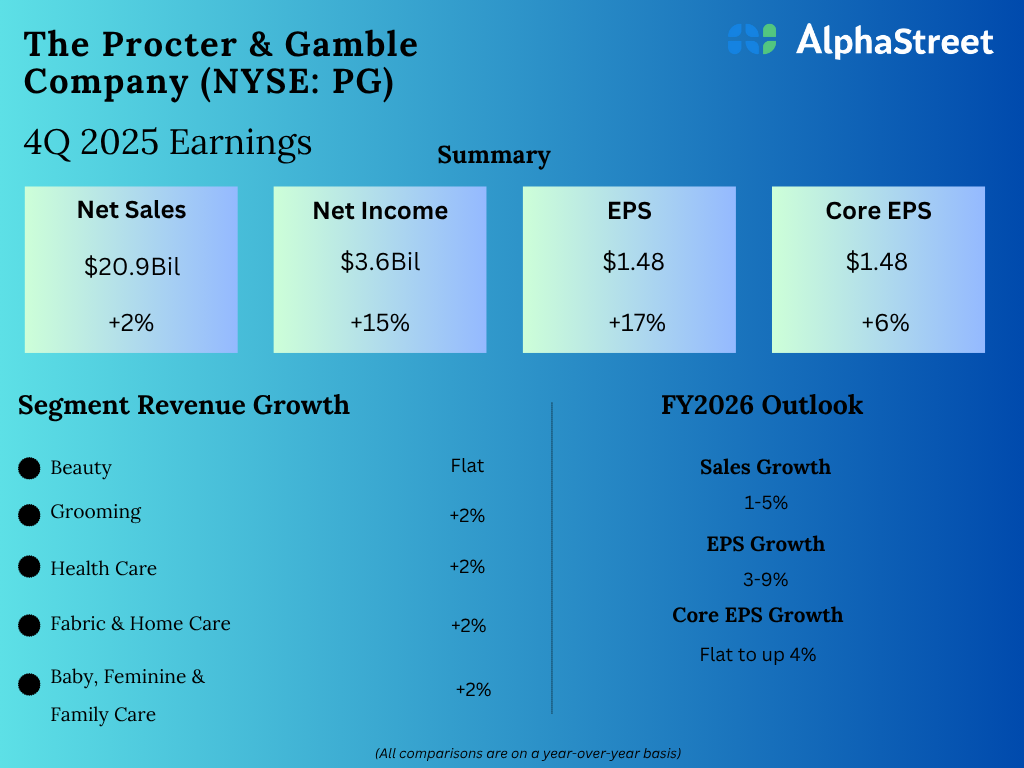

In the fourth quarter of FY25, Procter & Gamble’s net sales were $20.9 billion, up 2% versus Q4 2024. Organic sales increased 2%. Core earnings, excluding special items, rose 6% annually to $1.48 per share in the fourth quarter. Unadjusted net income attributable to shareholders was $3.6 billion, up 15% from the prior-year period.

From Procter & Gamble’s Q4 2024 Earnings Call:

“The innovation plans across the businesses are broad and strong as each category team works to increase their margin of superiority and consumer delight. Superior innovations that are driven by deep consumer insights communicated to consumers with more effective and efficient marketing programs, executed in stores and online in conjunction with retailer strategies to grow categories and our brands and priced to deliver superior value across each price tier where we compete.”

Outlook

The P&G leadership said it expects sales to grow 1-5% in fiscal 2026, and core earnings per share to be flat to up 4%. The guidance for full-year reported earnings per share growth is 3-9%. The company sees $1 billion in additional costs related to new import tariffs, and targets a mid-single-digit increase in prices of products affected by tariffs, which of about 25% of all items. Earlier this year, the company announced an organizational restructuring, with a focus on ramping portfolio and streamlining the supply chain. The revamp will include the reduction of around 7,000 non-manufacturing roles.

On Tuesday, Procter & Gamble shares opened at $151.96 and traded mostly lower during the session. The average stock price for the last 52 weeks is $163.08.