Domino’s Pizza, Inc. (NYSE: DPZ) is set to report its third-quarter results next week. While the fast-food chain delivered mixed results in the first half of FY25, its steady sales performance suggests improving momentum in the coming months. Management attributed the company’s resilient performance to a business strategy designed to appeal to a broad customer base.

Estimates

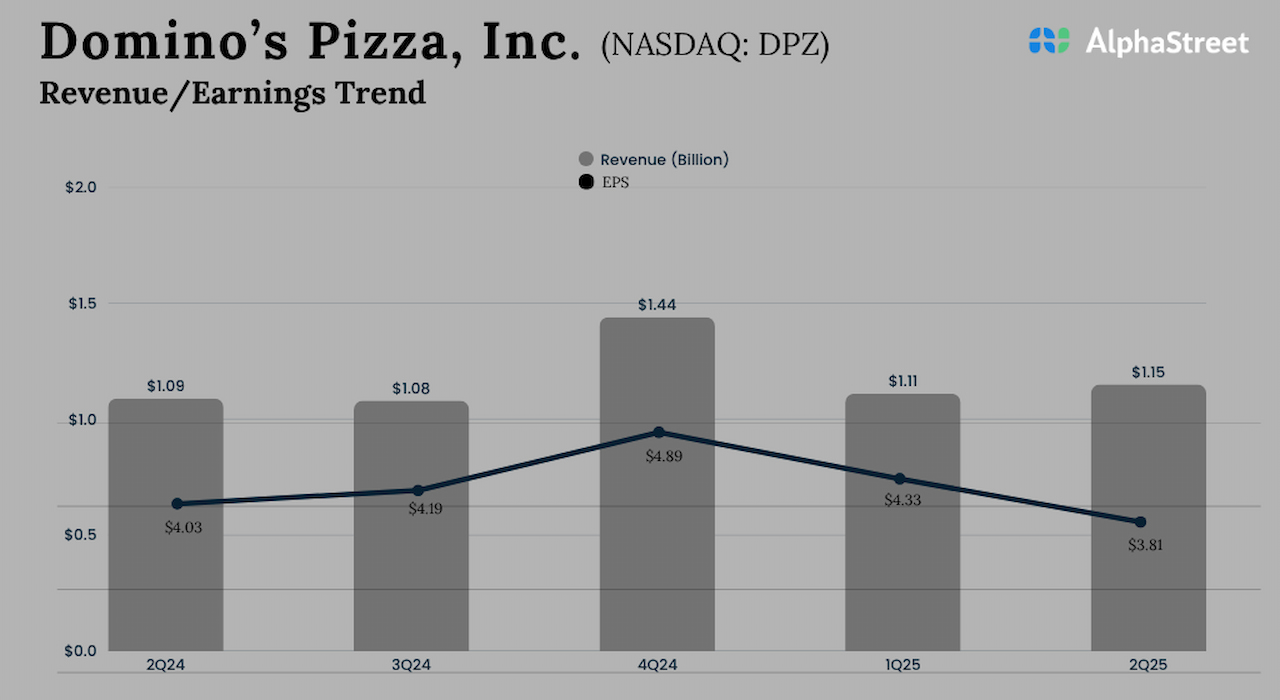

The Ann Arbor, Michigan-headquartered company is expected to report its third-quarter earnings on October 14 at 6:05 am ET. It is estimated that September quarter earnings declined to $3.96 per share from $4.19 per share in the comparable period a year earlier. Meanwhile, market watchers forecast a 5.2% annual growth in revenues to $1.14 billion.

Domino’s shares have experienced significant volatility this year — after all the ups and downs, they ended the last trading session close to their January levels. The stock has declined nearly 8% in the past 30 days, and its performance was broadly in line with the S&P 500 index during that period. The stock appears to be a solid investment, since the company’s innovation-focused growth strategy and aggressive technology adoption are expected to generate long-term shareholder value.

Key Metrics

For the second quarter, Domino’s reported net income of $131.1 million or $3.81 per share, compared to $142.0 million or $4.03 per share in the prior-year quarter. The bottom line missed analysts’ estimates. Revenues increased 4.3% annually to $1.15 billion in the June quarter, in line with Wall Street’s expectations. Domestic comparable-store sales grew 3.4% annually. International same-store sales growth, excluding foreign currency impact, was 2.4%.

“Internationally, we continue to grow despite a challenging macro environment. It is clear that our Hungry-for-More strategic pillars are working together to deliver more sales, more stores, and more profits. I’d like to highlight some of the initiatives that helped us drive these results. The “M” in Hungry for More stands for the most delicious food. An important way to drive deliciousness is through new products. Late in the first quarter, we added one of the biggest new menu items in our history, Parmesan-stuffed-crust pizza,” Domino’s CEO Russell Weiner said in the Q1 earnings call.

What’s Cooking

Despite tariff-related cost pressure and the cautious consumer environment, the company continues to expand its store network, adding 178 net new stores in the most recent quarter. After spreading its footprint across the country, Domino’s is actively expanding its store network in India and China, where it sees significant growth in the coming years.

Recently, Domino’s executives expressed confidence in the company’s ability to turn current challenges into strategic opportunities, positioning it to gain share from competitors. Promotional offers targeting different customer types and Innovations like the launch of stuffed-crust pizza earlier this year are driving sales.

The average price of Domino’s Pizza for the last 12 months is $453.43. On Monday, DPZ opened at $426 and traded slightly higher in the early hours of the session.