Although there have been many false dawns over the past decade-and-a-half, there is good reason to believe that now is one of the best times in recent history to expect a turn in the long-term cycle of Emerging vs Developed market equity dominance.

Here’s why we should be looking at EM to start outperforming vs DM:

Valuations: on a variety of metrics, EM equities are trading at a major valuation discount vs developed market equities; this is an important starting point, but it’s also something that has been true for quite some time (so we also need to consider other factors when it comes to timing and conviction).

Allocations: as detailed in the bonus chart section below, investor allocations to EM equities are well below average, and represent major underweights vs the market cap weight of emerging markets.

Currencies: the has peaked for this cycle and is overvalued, meanwhile EMFX looks cheap and is turning up from a long downtrend (this will help EM equities outperform mathematically due to FX translation effects, but also due to financial conditions effects).

Sentiment: investor sentiment is still very skeptical on EM equities, in fact I imagine most people reading this are already coming up with arguments as to why I am wrong to be optimistic on EM 🙂 !

Cycles: EM central banks have been stimulating their economies, and many within this group have undergone a long period of stagnation and reform that will place them well to capitalize on the coming global economic upturn.

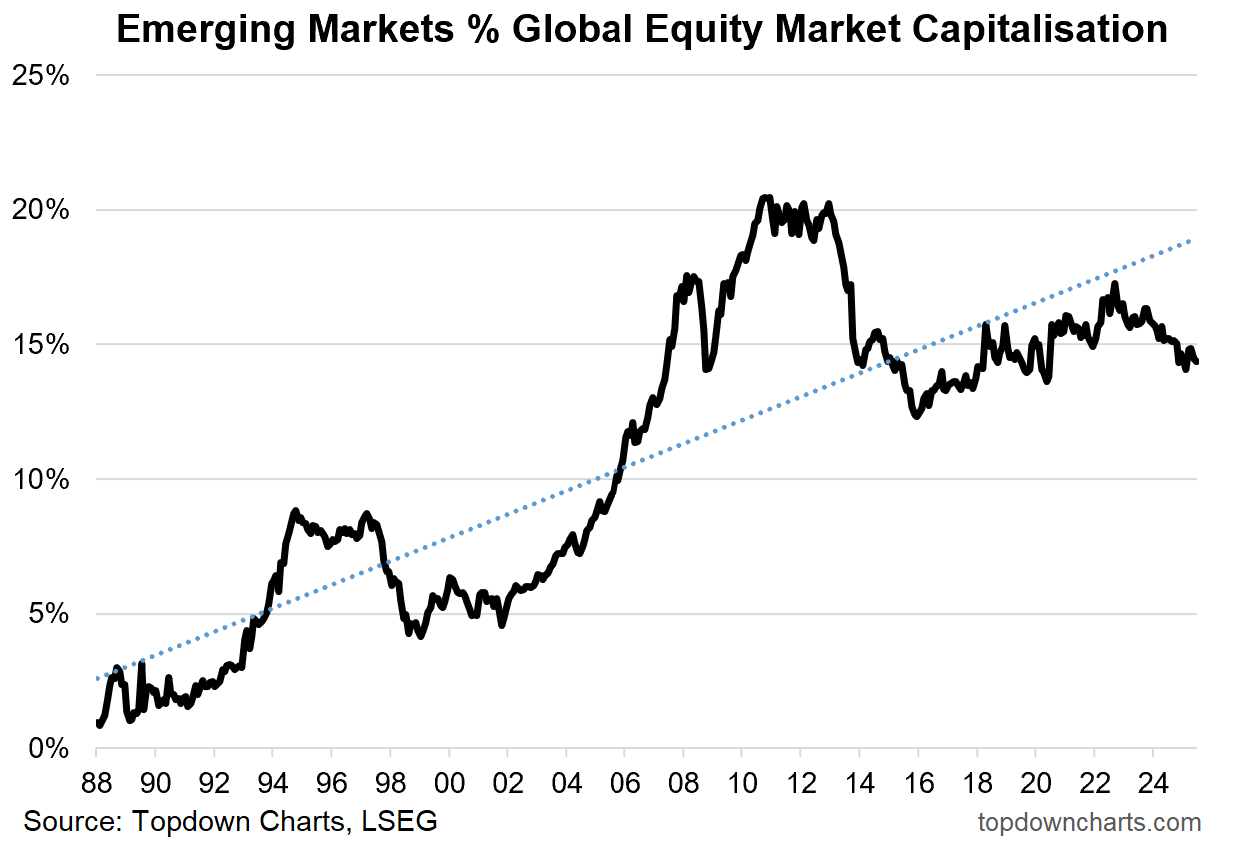

And then finally, let’s just take a look at the main chart this week — two key things should become obvious straightaway. First, there is a clear long-term uptrend in play, second, there are clear long-term cycles around that trend.

So, even just keeping it simple, and focusing on that chart, you can see that we have deviated significantly to the downside of that long-term uptrend line (the big opportunities/risks come when you deviate substantially above/below that trend) — AND the cycle looks to be turning up again.

And then ultimately, if we pair those technical chart observations with the various constructive fundamental observations, it sure starts to stack up.

We may well be on the cusp of a golden decade for emerging markets.

Key point: Long-term investors should rethink their global equity allocations, placing a greater emphasis on global diversification, especially with regards to EM equities.

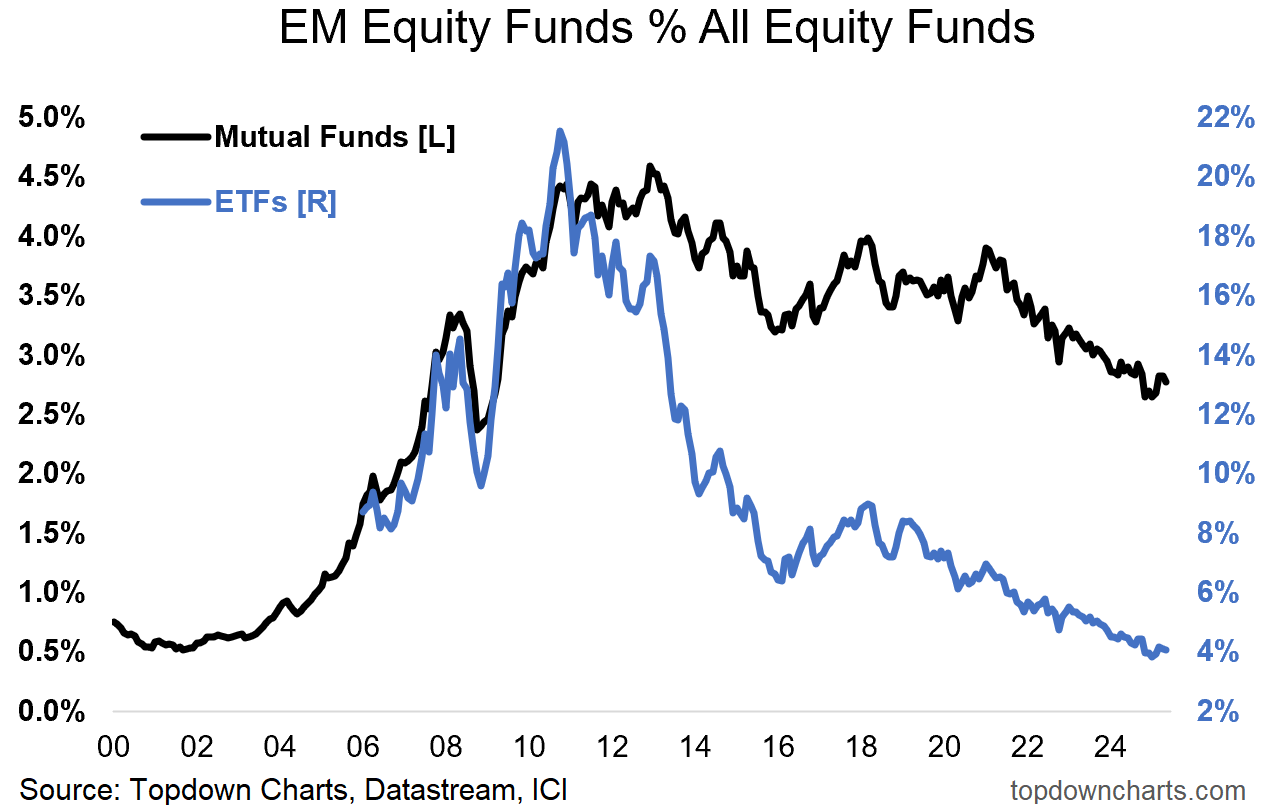

Bonus Chart 1 — EM Equity Allocations

This chart shows the market share of dedicated emerging market equity funds in both the US mutual fund market and ETF market — we can think of this as the implied allocation by investors to emerging market equities (in the aggregate).

So it’s fascinating then to see that mutual fund investors have an implied ~3% allocation to emerging market equities, while ETF investors are not much better; with 4% (which is down substantially from recent years, and a fraction of where it peaked at over 20% at the height of the post-08 recovery EM climax).

But really the key point is investors are running materially lower allocations than those seen over the past 20 years, and as you’ll see in the next chart, it’s also a fraction of the global market cap weight of EM equities (which is tracking just below 15%).

Bonus Chart 2 — EM Equities Market Cap Weight

As noted, emerging market equities’ global market cap weight is hovering just below 15% — this is well below trend, and is at the low end of the range of the past 20-years. It’s also well below the GDP weight of emerging and developing countries (which is estimated by the IMF at 60%, or 41% excluding China, and that compares to advanced economies at 40%).

So the key point here is that this chart by itself is arguably another piece of evidence favoring EM equities given the deviation from trend (+undershooting of recent decades average), and given the disparity vs GDP weighting*, but perhaps most of all: even at the current lowish level it’s about 4x the typical investor’s allocation. That’s a massive underweight that investors in the aggregate are running.

All that’s needed is an excuse, a catalyst, a reason to reallocate, and we could see something really special here — something that only happens about once a decade (a shift and turn in the decadal cycles of relative performance in global equities).

*p.s. yes, there are good reasons why EM is tracking below its GDP weight, and that DM is tracking above its GDP weight, but even if you assume it doesn’t get all the way there, it still has a lot of room to move. Also as a sidenote, the US (record high) market-cap-to-GDP-ratio is basically another datapoint affirming overvaluation there.