Safe havens like gold and CHF are on the defensive in Asia trade

Gold, USD/CHF Resume Unwind

Positivity stemming from weekend trade talks between the United States and China has safe havens like and the on the back foot in early Asian trade on Monday. Despite a lack of specific detail, optimism from both the U.S. and Chinese delegations as to how discussions went is not only good news for their respective economies but also the world as a whole, adding to the risk that recent unwinds in safe haven assets may have further to run near term.

Risk Aversion Wanes on US-China Trade Talks

The United States and China reported “substantial progress” following two days of trade talks in Switzerland, agreeing to establish a new mechanism for continued negotiations. While no concrete measures were announced, both sides described the meetings as a constructive reset, with U.S. Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng set to lead ongoing discussions.

A joint statement is expected later Monday, reinforcing the message that tensions may be easing after weeks of escalating tariffs.

The talks follow a period of intensifying trade friction, with U.S. tariffs on Chinese goods climbing to 145% and Beijing responding with 125% duties of its own. The positive tone and commitment to future engagement suggest both countries are now more open to de-escalation, casting doubt on the need to retain trade war hedges through overweight positions in safe-haven assets.

Gold Struggling After Another $3400 Failure

Source: TradingView

Gold has not had any success above $3,400 per ounce in recent weeks, with two probes above the level reversing quickly, sparking minor pullbacks. And that was in an environment of escalating trade tensions and weakness—the exact opposite of prevailing market conditions. If the de-escalation trend persists, it suggests this unwind could have legs.

For now, bids at $3,270 have absorbed the latest wave of offers, coinciding with where gold found support for large periods in April. If that level were to buckle, it may bring a potential retest of $3,200, the 50-day moving average, and the December 2023 uptrend into play. The latter two are key levels to watch. On the topside, sellers may emerge should we see pops back towards $3,367.

Momentum indicators like RSI (14) and MACD are currently trending lower, albeit they are yet to shift into outright bearish territory. The overall signal is of waning bullish momentum, favouring a neutral bias at this stage.

USD/CHF Approaches Key Resistance Zone

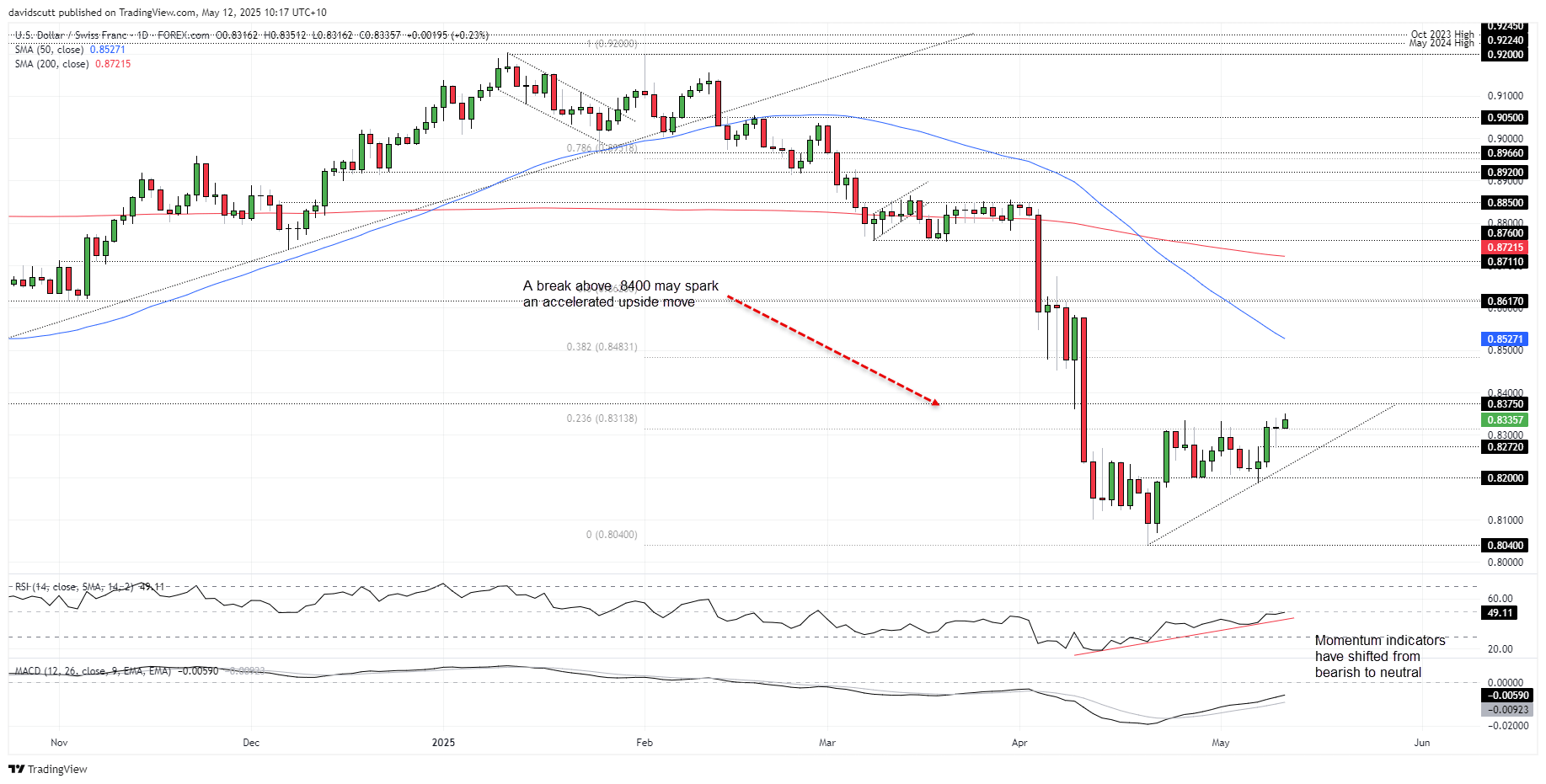

Source: TradingView

USD/CHF rose to more than one-month highs upon the resumption of trade in Asia, pushing further above the 23.6% Fib retracement of the February–April downtrend at .83138. A decent resistance zone running between .8375–.8400 awaits overhead, coinciding with where the pair found buying support in the second half of 2024. A large bounce off the level on April 9 underlines its importance.

If the price were able to get a foothold above .8400, it would increase the probability of a push towards the 38.2% Fib retracement at .84831. Beyond, a far tougher technical test awaits at the 50-day moving average and .8617. Beneath .83138, support levels of note include .8272 and .8200. Also keep an eye on the April 21 uptrend located in between.

Price momentum has shifted from bearish to neutral, putting increased emphasis on price signals. If recent trends persist, it would begin to favour buying dips over selling rips.

Original Post