The regained some ground on Thursday as Treasury yields rose after a chaotic session driven by speculation about Fed Chair Powell’s future.

The Dollar strengthened against all major currencies, continuing its rally this month. The dropped to 148.51 per Dollar, with some experts predicting it could fall below 150. dipped 0.2% after U.S. stocks rallied when Trump downplayed firing Powell. Treasury yields rose, with up two basis points to 4.47%. Asian stocks traded in a tight range.

The fell sharply, and government bonds dropped, as expectations grew for an by the central bank in August.

On tariffs, Trump softened his stance with China, aiming to arrange a summit with President Xi Jinping and secure a trade deal. He also announced plans to send letters to over 150 countries about new tariffs, expected to range from 10% to 15%.

Chinese stocks rose on Thursday, supported by government backing for the auto industry and renewed interest in AI-related shares. Citi also upgraded China equities, pointing to better earnings trends and long-term growth opportunities.

The gained 0.4% to close at 3,516.83, while the blue-chip Index rose 0.7%.

AI-related stocks climbed 1.8%, and the info tech sector jumped 2.1%, boosted by news that Nvidia (NASDAQ:) will increase its supply of H20 chips to China. Auto stocks were up 1.7% after authorities promised to address excessive competition and price wars in the EV market.

In Hong Kong, the stayed flat but remained near a four-month high.

Biotech and healthcare stocks surged over 5% each, as optimism grew about a potential trade deal after U.S. President Trump softened his tone on China.

Citi upgraded China equities to “overweight,” citing better earnings prospects, fair valuations, and growth themes like AI and corporate reforms.

TSMC Posts 60% Jump in Second-Quarter Profit

Taiwan Semiconductor Manufacturing (NYSE:), the leading maker of advanced AI chips, reported record-breaking quarterly profits on Thursday, beating forecasts. The company highlighted growing demand for AI and raised its full-year revenue outlook, expecting strong sales in the third quarter.

TSMC also noted that Nvidia, a key client, has been allowed by the U.S. to resume selling its H20 AI chips to China, which is a major market. CEO C.C. Wei called this a positive development for both Nvidia and TSMC.

However, TSMC warned that U.S. tariffs could impact its earnings, possibly starting in the fourth quarter.

UK Wage Growth Slows

In the UK, regular pay (excluding bonuses) increased by 5% year-on-year to £677 per week in the three months to May 2025. This is the slowest growth in nearly three years, down from a revised 5.3% in the previous period but slightly above the 4.9% forecast according to ONS data.

Wage growth slowed in both the private sector (4.9% vs 5.2%) and public sector (5.5% vs 5.6%). Among industries, the highest wage growth was in wholesale, retail, hotels, and restaurants (7.1%), followed by services (6%), construction (4.9%), manufacturing (4.8%), and finance/business services (3.1%).

After adjusting for inflation, real wages grew by 1.1%.

European Open

European stocks rose on Thursday after four days of losses, helped by strong earnings from Switzerland’s ABB (ST:) and hopes for a U.S.-EU trade deal.

The gained 0.8% by early morning.

ABB shares jumped 8.2% after reporting record orders, driven by strong U.S. demand and AI-related products for data centers. Rivals Siemens (ETR:) and Schneider Electric (EPA:) also rose 3.6% and 5.8%, boosting the European market.

Chipmakers recovered some losses from the previous day, with ASML (NASDAQ:) up 1.7% after an 11% drop on Wednesday. This followed TSMC’s record Q2 profit.

On trade, EU trade chief Maros Sefcovic traveled to Washington for tariff talks with U.S. officials, according to an EU spokesperson.

On the FX Front, the dollar strengthened on Thursday, gaining 0.44% against the , almost recovering from a spike late Wednesday.

The dipped 0.2% to 1.3395, while the Australian dollar dropped 1% to a three-week low of 0.646 after disappointing jobs data and rising unemployment.

New Zealand’s also fell, losing 0.54% to 0.5914.

Currency Power Balance

Source: OANDA Labs

struggled overnight and that has continued following the European Open. The precious metal trading around the 3327 handle at the time of writing. Yesterday’s brief rally following the Powell/Trump fiasco proved to be short-lived.

continue to hold and trade in a tight range despite President Trump’s statement yesterday that he would like to see Oil prices around $64 a barrel. Oil prices have remained muted since Monday’s selloff with the last two days seeing choppy price action.

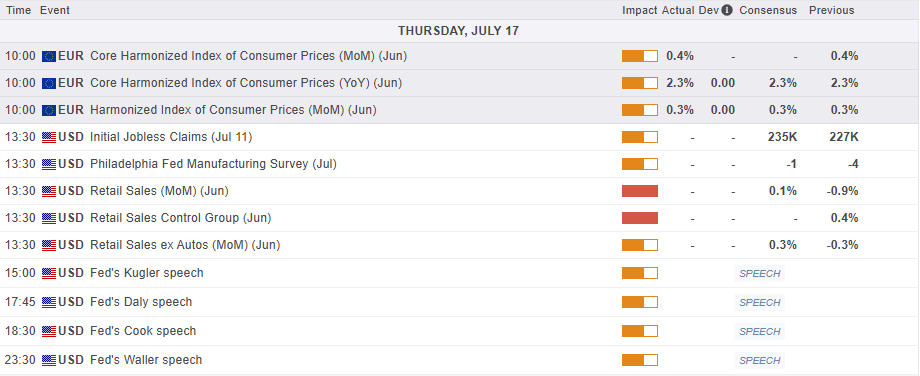

Economic Data Releases and Final Thoughts

Looking at the economic calendar, there is some medium and high-impact data from the US later in the day.

US and data will be released along with some earnings releases. We also have a few more Federal Reserve policymakers speaking ahead of the Feds blackout period.

MarketPulse Economic Calendar

Chart of the Day – DAX Index

From a technical standpoint, the has remained cautious and rangebound since Mondays retest of the key 24000 handle.

The index is supported by both the 20 and 50-day MAs which rest around the 24000 handle as well while the RSI is also finding support at the neutral 50 handle.

Trade deal announcements between the EU and the US could be the catalyst needed for the DAX to shake off this choppy price action and find some direction.

DAX Daily Chart, July 17. 2025

Source: TradingView.com

Support

Resistance

Original Post