The announcement of Unilever’s $1.5B acquisition of Dr. Squatch from Summit Partners has sparked considerable discussion among industry analysts. While this brand acquisition may not have dominated headlines, I think it is a fascinating acquisition. It is a case study in strategic growth and the evolving marketing landscape of consumer goods.

For CPG leaders evaluating their own growth strategies, this Unilever acquisition offers valuable insights into when buying beats organic growth building, and what separates successful acquisitions from costly missteps.

Why the Dr. Squatch Acquisition Makes Strategic Sense

On the one hand, there are many strategic positives for Unilever. Firstly, the men’s grooming market presents attractive growth opportunities that extend well beyond the US (more on that later).

Secondly, Dr. Squatch has built, grown and expanded its customer base and product line rapidly on the strength of clever, authentic branding that resonates with its target demographic and direct-to-consumer (DTC) sales. Since launching in 2016 in San Diego by Jack Haldrup, Dr. Squatch has captured over 8% US share in both bar soap and skin/body care categories. From 2023 to 2024, Dr. Squatch’s skin/body care sales nearly doubled, surpassing Unilever’s Axe brand.

On the other hand, this acquisition calls to mind Unilever’s purchase of Dollar Shave Club, which was not exactly a homerun…

What is different this time? Should we be optimistic or pessimistic?

Learning From Past Acquisition Changes

To truly understand the potential of Unilever’s latest deal, we must examine Unilever’s past attempt to acquire a brand in the men’s grooming space. Much has changed since 2016 when Unilever bought Dollar Shave Club for $1B. It was a time when DTC in consumer packaged goods was nascent. The men’s shaving category was both expensive and dominated globally by Gillette.

Dollar Shave Club spoke directly to this frustration with great success. The brand’s launch advertisement “Our Blades are F**king Great!” became legendary, and founder Michael Dubin positioned the company as an everyman’s solution to saving a few bucks on shaving. And he did so with brilliant humor. It worked.

In 2010, Gillette had 70% global market share while Mr. Dubin owned a warehouse of surplus razor blades. By creating a brand, undercutting existing pricing, launching great advertising and locking in consumers via a DTC subscription model, Dollar Shave Club was the catalyst that led to Gillette’s share being cut from 70% in 2010 to under 50% in 2016.

Gillette’s market dominance left them vulnerable at the low end of the market. They were a victim of their own success.

What did Unilever buy in Dollar Shave Club? They bought a DTC company with a newly-installed customer base, enticed by great advertising, primarily cost-focused. What they did not buy is a superior product or a strong platform for category expansion, ready for innovation. New competitors like Harry’s and others rushed in to seize the opportunity, while Gillette worked hard to defend its turf.

Mintel’s data reveals that by 2024, Dollar Shave Club’s share was down to 1.1% following a 19% sales decline from the prior year. Surely, Unilever gained learnings and knowledge of DTC and marketing to this audience, but it was not a resounding success. While Unilever retains a 35% investment in the company, they sold the majority stake to Nexus Capital Management in 2023.

What Makes Dr. Squatch Different?

Jack Haldrup launched 2013 in Dr. Squatch in San Diego. The brand shares some common important aspects with Dollar Shave Club, namely:

A DTC-first strategy

Marketing that has resonated deeply with their target audience

Effective use of humor

Authentic, irreverent brand personalities difficult to create and maintain in a large company environment

So why should Dr. Squatch be any different from Dollar Shave Club?

There are several key factors that distinguish the Dr. Squatch acquisition from Dollar Shave Club, which hint to a stronger potential for long-term success. Let’s explore them below:

Evolved Market Conditions

For starters, the retail market has fundamentally changed since 2016. Consumers are now more willing to buy by subscription and spread their buying across channels. While Dollar Shave Club was a pioneer, DTC and subscription services have matured to include consumer goods. According to Statista, DTC sales are projected to reach $186B in the US alone, with more than 20% coming from DTC native brands.

This market evolution creates a more favorable environment for Unilever to capitalize on Dr. Squatch’s established DTC expertise while expanding through traditional retail channels.

Superior Product

Unlike Dollar Shave Club’s focus on cost reduction, Dr. Squatch has a different value proposition and has built its reputation on something different. From the outset, Dr. Squatch produced high-quality soaps that quickly led to adjacent category expansion. The brand’s commitment to premium quality and ingredients makes it a more flexible platform for product development and innovation, rather than addressing a single-category frustration with the cost of shaving like Dollar Shave Club’s strategy.

Favorable market shifts and a diverse, quality-first product portfolio enable more robust growth opportunities for Dr. Squatch, where growth can come from new customer acquisitions and regimen expansion with existing users.

Explosive Male Grooming Category Growth

The male grooming sector has experienced a huge expansion. Mintel’s data reveals that the male grooming category has grown 31% to nearly $6B in the US between 2018 and 2023, and is poised for continued growth. This trajectory provides a positive runway for Dr. Squatch’s expansion under Unilever’s new ownership.

Global Expansion Opportunities

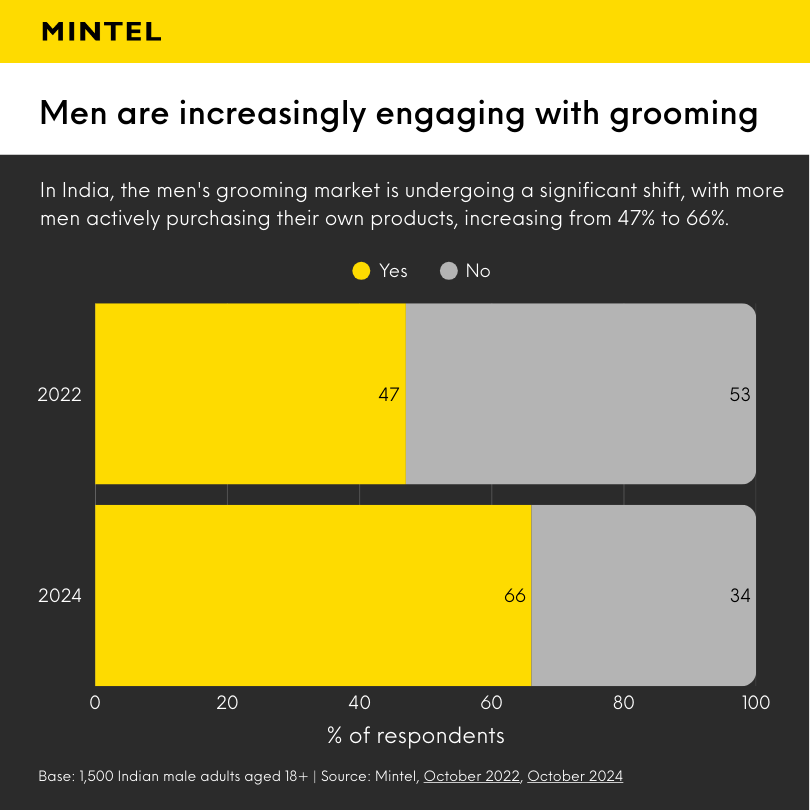

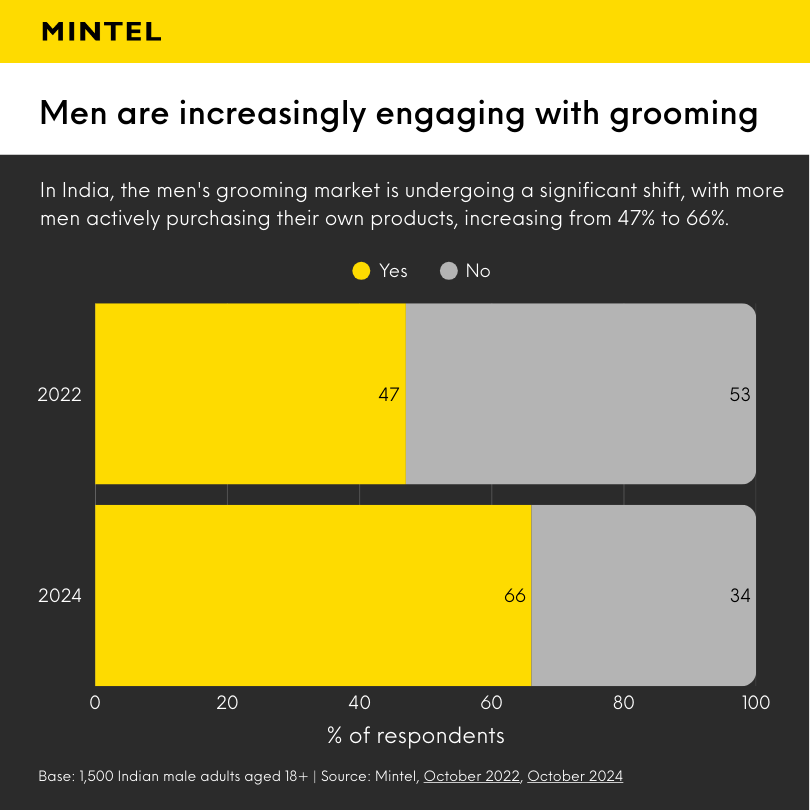

Unilever’s stated intention with Dr. Squatch is to expand internationally. The timing may be right. For example, in India, a critical growth market for Unilever, 66% of men in 2024 purchased within the male grooming category in the past 6 months, compared to just 47% in 2022, signalling global demand.

The challenge will be to maintain the credibility and authenticity of the Dr. Squatch brand, adapting it effectively to other markets and diverse cultural contexts. This is far easier said than done.

Key Success Factors Moving Forward

While the market growth picture appears strong and Dr. Squatch has favorable momentum, some important questions will determine this acquisition success:

Brand authenticity: Can Unilever effectively manage Dr. Squatch through rapid social changes while maintaining the brand’s “secret sauce?”

Portfolio integration: Unilever’s Axe is the leading global deodorant brand. What is the cannibalization risk to the existing portfolio, and how will Dr. Squatch differentiate to mitigate the risk?

Market localization: How will the Dr. Squatch brand translate to other markets, and how much adaptation will be required to resonate with local market consumers?

Investment prioritization: Unilever currently has 13 brands that generate over $1B in annual sales. Will Dr. Squatch get the necessary investment to ensure its continued innovation and growth?

Be the First to Know About Brand Acquisitions with Mintel

The acquisition looks promising on paper, but… success from here depends on the decisions Unilever takes to build upon the brand’s successes, make smart innovation choices, and resonate in local markets.

The Dr. Squatch acquisition is consistent with the trend of Big CPGs growing “non-organically” by acquiring smaller innovative companies rather than innovating in-house. We covered Pepsico’s acquisition of Poppi, read our analysis here! With extremely fast-moving consumer markets and broad access to start-up capital for entrepreneurs, I expect to see more of these kinds of acquisitions in the near-term future.

Is your company capitalizing on acquisitions as part of its market expansion strategy?

Looking for tailored insights? At Mintel Consulting, we specialize in exploring real-time market data to deliver customised opportunities and recommendations to help propel market expansion and fuel consumer demand. Contact us today, so you can lead in competitive markets!

Book a Consultant Strategy Session