Fed Holds Rates, Maintains Cautious Stance Amid Trade Uncertainty

As expected, the US held the federal funds rate steady at 4.25%–4.50% for the third consecutive meeting, maintaining its cautious “wait and see” approach amid growing concerns over the economic impact of US trade tariffs. In its post-, officials highlighted rising risks on both sides of the Fed’s dual mandate, noting increased concerns about both inflation and unemployment.

During the press conference, Fed Chair Jerome Powell reiterated his recent messaging: “We don’t think we need to be in a hurry.” He acknowledged that both a rate cut and a pause remain possible but emphasized uncertainty, stating, “I couldn’t confidently say that I know which direction policy will take”.

Market Reaction: Volatility in US Stocks, Modest Gains in the US Dollar

US equity markets initially fell after the FOMC decision, with the posting an intraday loss of 0.5%. However, stocks rebounded during Powell’s press conference, closing the session with a 0.4% gain. The strengthened slightly, with the rising 0.5% to test near-term resistance at its 20-day moving average around 99.80. Gold () declined by 2% but held above support near US$3,360 from the previous Asian session.

Fed Funds Futures: June Cut Odds Fall, Long-Term Cuts Still Expected

According to the CME FedWatch Tool, markets are now pricing just a 20% chance of a 25-basis-point rate cut in the June FOMC meeting, down from 30% prior to the announcement. Despite the near-term uncertainty, expectations remain for three 25-bps cuts in 2025, bringing the policy rate down to 3.50%–3.75%.

Trade Headlines Drive Market Moves in Asia

On Wednesday, President Trump claimed China initiated upcoming trade talks, stating he would not reduce tariffs to encourage negotiations. Treasury Secretary Bessent confirmed that this weekend’s discussions in Switzerland are preliminary in nature. In a Truth Social post during today’s Asian session, Trump announced a 10 a.m. Washington D.C. press conference to reveal “a major trade deal with a big country.”

A New York Times report later identified the UK as the likely partner in this trade deal. The responded positively, rising 0.4% intraday against the US dollar and holding support at its 20-day moving average (1.3300), despite expectations of dovish forward guidance from the Bank of England later today.

Cross-Asset Reactions Mixed in Asia

Trump’s trade-related announcement sparked mixed reactions across asset classes. US stock futures advanced, with the and E-mini contracts up 0.8% and 1.1%, respectively. Asian equity markets also responded positively: Japan’s rose 0.4%, while Hong Kong’s climbed 1.1%.

Conversely, safe-haven demand also increased. Gold (XAU/USD) rebounded 1.2% intraday, recovering over half of the previous day’s losses, suggesting lingering market caution despite the trade optimism.

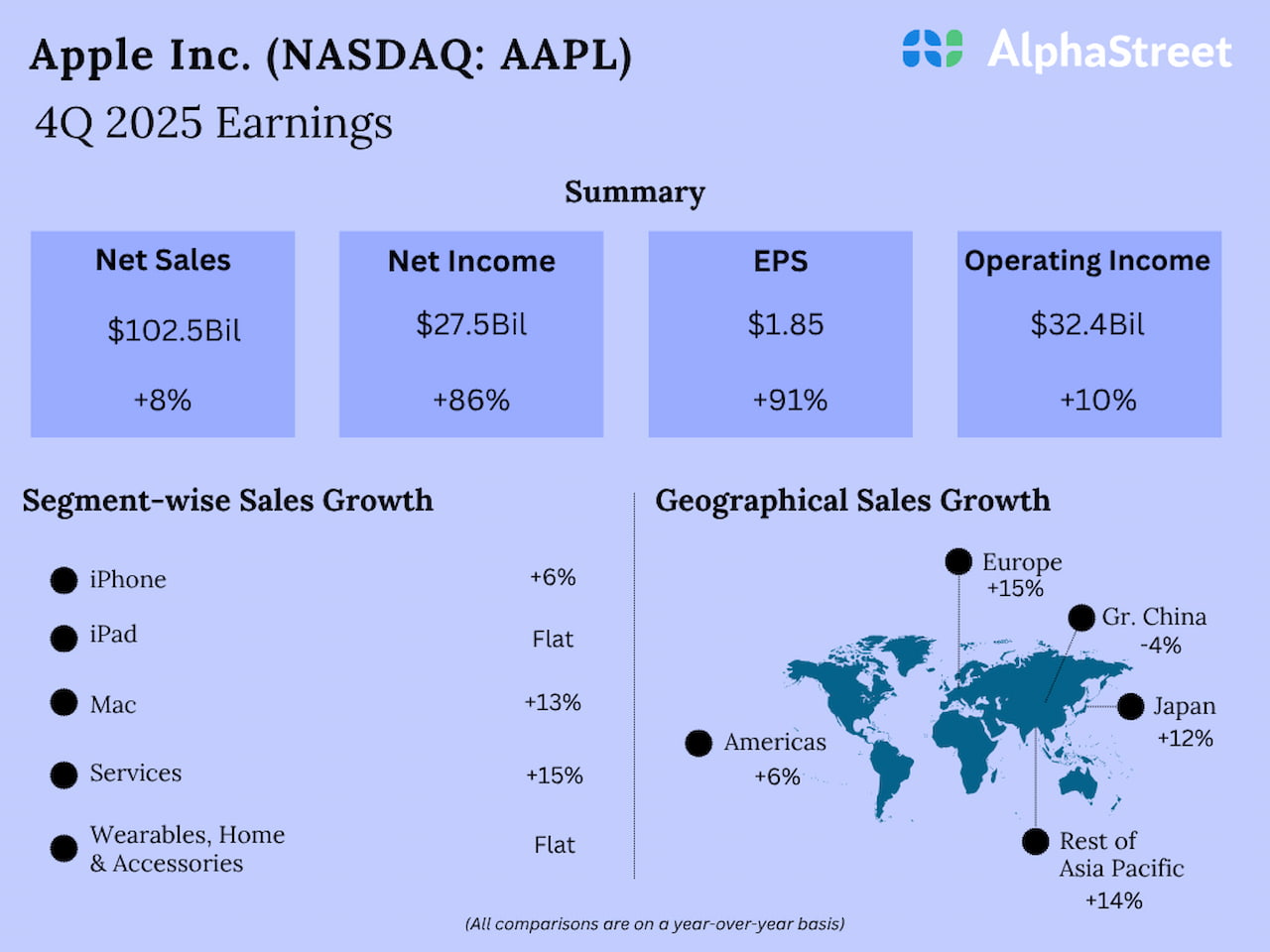

Economic Data Releases

Source: MarketPulse

Fig 1: Key data for today’s Asian mid-session

Chart of the Day – EUR/GBP May Face Further Downside Pressure Below 20-Day MA

Source: TradingView

Fig 2: EUR/GBP minor trend as of 8 May 2025

Since it’s 21 April 2025 minor swing high of 0.8624, the price actions of the cross pair have been evolving in a minor descending channel and traded below the 20-day moving average since 28 April.

In addition, its hourly RSI momentum indicator has continued to exhibit a bearish momentum reading since 8 May, which suggests that the EUR/GBP may continue its minor downtrend phase (see Fig 2).

Watch the 0.8540 key short-term pivotal resistance with the next intermediate supports coming in at 0.8450 (20-day moving average) and 0.8410 next.

On the flip side, a clearance above 0.8540 negates the bullish tone for a potential squeeze up to expose the next intermediate resistances at 0.8580 and 0.8620.

Original Post