Trump-China talks and geopolitical risks may drive safe-haven demand.

A break above $90 could target $100, while $80 remains key support.

By the end of last week, futures prices had fallen again, with sellers pushing the metal to new lows around $67 per ounce.

A weaker has helped support precious metals. The US dollar has slipped partly due to speculation that Chinese banks may slow their purchases of US bonds. When the US dollar weakens, metals such as and silver often become more attractive. Gold moved back above $5,000 per ounce, and silver also found some support.

Investors are now waiting for key US economic data, especially figures on inflation and the labor market. These reports are likely to shape the direction of prices in the coming days.

The is also important for silver. It appears to be forming another downward move, which could push it below the 95 level. If the US dollar continues to weaken, it may provide further support for silver prices

Trump’s Key Visit to China is Ahead of us

Beyond upcoming US economic data and the ongoing structural shortage in the silver market, investors are also watching global politics closely.

One key event is Donald Trump’s expected visit to China, which unofficial reports suggest could take place in early April. The main topics are likely to include Taiwan, Ukraine and Iran. Tensions around these regions have been rising since the start of the year, along with the risk of possible military action.

How markets react will depend on the tone and outcome of the talks. If the meeting signals easing tensions between Washington and Beijing, risk appetite could improve. If the tone is confrontational, investors may turn to safe haven assets such as gold and silver.

Recent developments can be seen as part of this broader positioning. The grouping of US naval forces near Iran, or warnings related to the US bond market, may be signals of strength ahead of negotiations. For precious metals, any clear escalation in tensions would likely support higher prices as investors seek protection.

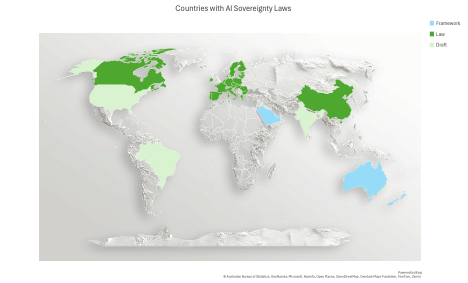

Silver Nears Key Supply Zone

Silver prices are now moving higher after rebounding from lows near $67 per ounce.

The short-term trend has turned upward, and buyers are trying to build momentum. The next key level to watch is around $90 per ounce. This area acted as strong resistance before and was the point from which the recent sharp sell off began.

If silver reaches that zone again, it could face renewed selling pressure. How price behaves near $90 will likely determine whether the current recovery continues or stalls.

A key technical signal would be a clear move above the $90 to $91 per ounce range. A breakout there could open the way toward the next resistance area, which sits just above the important psychological level of $100 per ounce.

On the downside, traders are watching the $80 per ounce level as near term support. If silver holds above $80 and rebounds, it could signal that selling pressure is easing and that prices may return to a sideways range. However, a decisive drop below $80 would likely put the current recovery under pressure.

Sellers Maintain Grip on

After a strong rebound in late January and early February, buyers were unable to maintain momentum.

Since then, sellers have taken control and erased more than half of that earlier rally. From a technical point of view, the main scenario now points to a continuation of the downtrend, with the risk of fresh lows if selling pressure continues.

This bearish scenario would lose strength if price breaks above the steep downward trend line and moves through the local resistance near 98 points. Such a move would signal that selling pressure is fading and that a broader recovery may be developing.

***

Below are the key ways an InvestingPro subscription can enhance your stock market investing performance:

ProPicks AI: AI-managed stock picks every month, with several picks that have already taken off this month and in the long term.

Warren AI: Investing.com’s AI tool provides real-time market insights, advanced chart analysis, and personalized trading data to help traders make quick, data-driven decisions.

Fair Value: This feature aggregates 17 institutional-grade valuation models to cut through the noise and show you which stocks are overhyped, undervalued, or fairly priced.

1,200+ Financial Metrics at Your Fingertips: From debt ratios and profitability to analyst earnings revisions, you’ll have everything professional investors use to analyze stocks in one clean dashboard.

Institutional-Grade News & Market Insights: Stay ahead of market moves with exclusive headlines and data-driven analysis.

A Distraction-Free Research Experience: No pop-ups. No clutter. No ads. Just streamlined tools built for smart decision-making.

Not a Pro member yet?

Already an InvestingPro user? Then jump straight to the list of picks here.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.