China’s antitrust probe on the company may cost 1–10% of revenue, affecting stock sentiment.

Its record $26 billion profit supports strong fundamentals, potentially driving shares above $184.

Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

The ongoing trade conflict mainly involves the US and China, focusing heavily on computer chips. There’s a temporary pause in this conflict until at least November 10. During this time, both countries have relaxed some restrictions: the US is allowing more advanced chip sales, and China has resumed exporting important raw materials used in electronics and cars. , a major chip company, is caught in the middle and is affected more by political decisions than economic ones.

China Fortifies Its Bargaining Position

Antitrust violation proceedings have started, likely tied to the ongoing economic talks in Madrid between the US and China, possibly as a strategic move in negotiations. Beijing accuses US company Nvidia of breaking the rules regarding its 2020 purchase of Israeli company Mellanox Technologies. Nvidia was allowed to make this purchase on the condition that it would fairly distribute products in China, but this is now being questioned. If found guilty, NVIDIA might face fines between 1% and 10% of its annual revenue.

Since China’s market makes up 13% of Nvidia’s total revenue, losing sales there would significantly impact the company, possibly lowering its stock value. Nvidia’s CEO, Jensen Huang, warned that if the US restricts its business with China, competitors like Huawei could step in, helping China become more self-sufficient in this area. Investors are closely watching the negotiations, as their outcomes might impact Nvidia more than the company’s .

Nvidia’s Fundamental Strength

Nvidia’s latest financial report shows that its net profit is continuing to grow rapidly, reaching a new record high of over $26 billion.

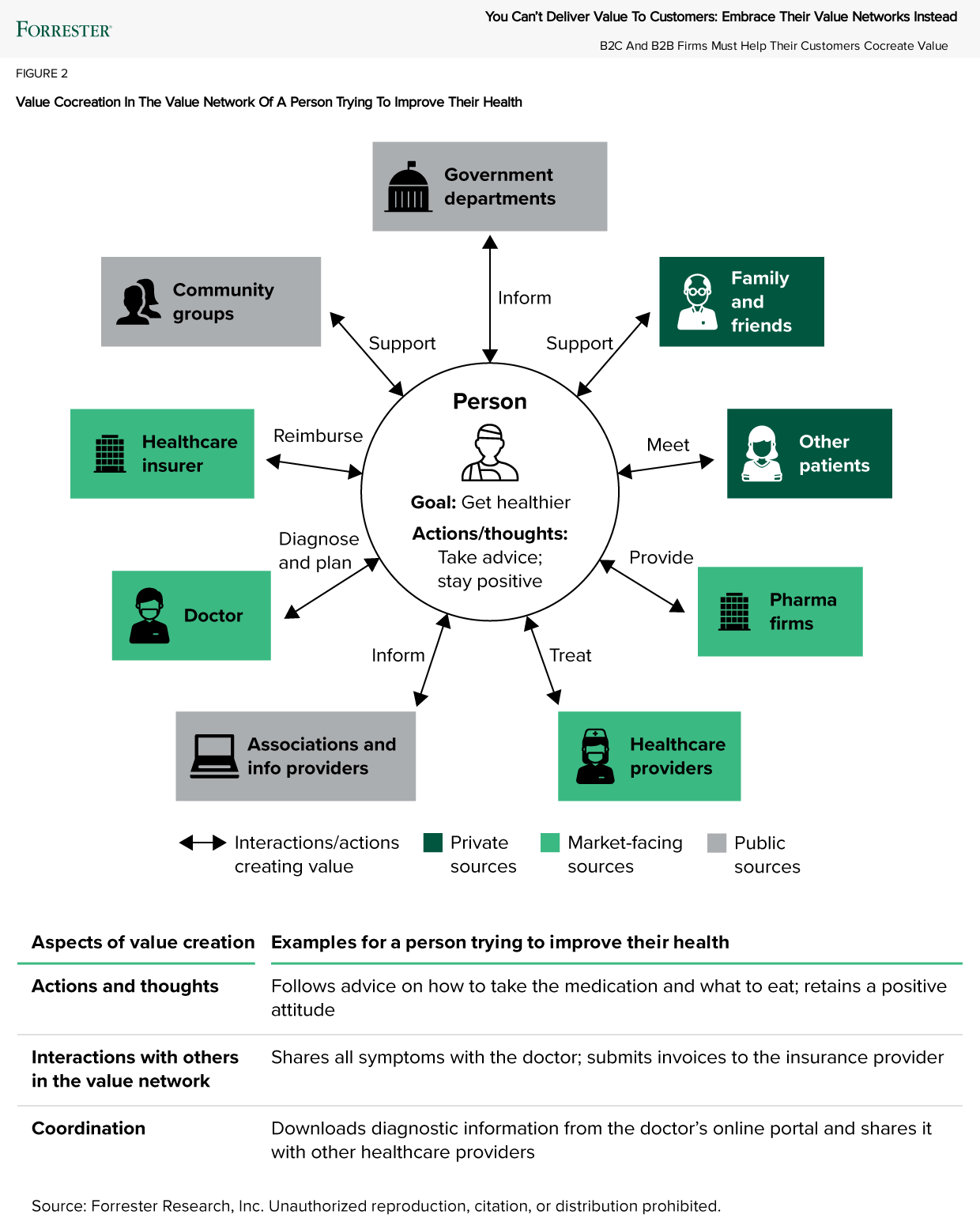

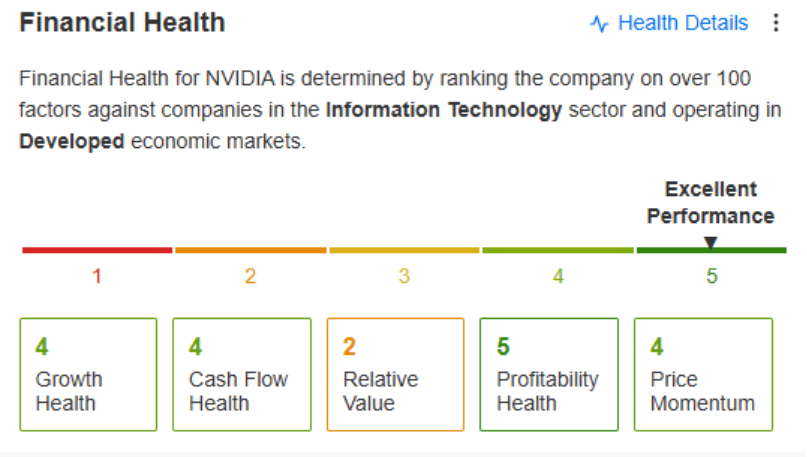

Source: InvestingPro

This impressive profit contributes to Nvidia receiving the highest rating on the financial health index, signaling a very strong foundation for the company’s future growth.

Source: InvestingPro

Source: InvestingPro

So, if geopolitical issues and the results of trade negotiations don’t become major obstacles, Nvidia’s stock value could keep increasing.

Nvidia’s Share Decline Pauses

In late August and early September, Nvidia’s stock price stopped its decline at around $164 per share, effectively leading to sideways movement. The current price is near its historical high of around $184 per share. The most likely scenario is that the stock will break through this high and continue to rise, especially since the news about possible antitrust violations hasn’t caused a significant drop in price.

For those who are optimistic about Nvidia’s stock (the bull camp), a negative signal would be if the price drops below the support level of $164 per share. If this happens, it could lead to further declines, potentially bringing the price down to around $144 per share.

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

AI-managed stock market strategies re-evaluated monthly.

10 years of historical financial data for thousands of global stocks.

A database of investor, billionaire, and hedge fund positions.

And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.