Tariff disruption is fertile ground for innovation

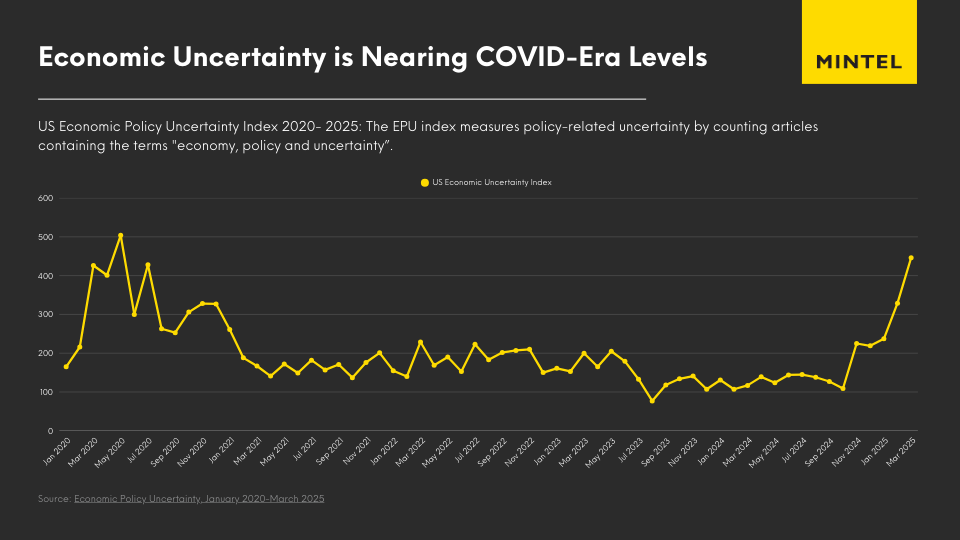

Last week, we had Liberation Day, ushering in a period of intense upheaval. The US imposed tariffs on markets and sectors across the world, before rapidly reversing some, while doubling down on others, particularly with China.

No matter what your knowledge or experience, there is still confusion about what’s next. I discussed this with several analysts and senior Consultants at Mintel, and after some initial shocked – something businesses everywhere likely experienced – we regrouped. We reminded ourselves that helping businesses navigate uncertainty is what we do best at Mintel, especially after 15 years of back-to-back market disruptions.

Each of these crises has been very different. But from the financial crash to COVID-19, Mintel has gained valuable insights from each period of disruption. Our collective knowledge and experience, along with datasets that date back decades, means that we’re equipped to understanding what’s next. This is what defines Mintel.

So, what have we learned? Well, over the past 15 years, we’ve seen a fair share of economic and political earthquakes: the tremors of the financial crash, the unprecedented impact of COVID-19, the drawn-out saga of Brexit, and the ongoing cost-of-living crisis. Each event has been a lesson in adaptation, resilience, and has provided a masterclass in finding opportunity amidst the chaos. Through it all, one principle has remained steadfast: consistency. In times of uncertainty, brands need to show a trusted voice and be guided by a steady hand on the tiller.

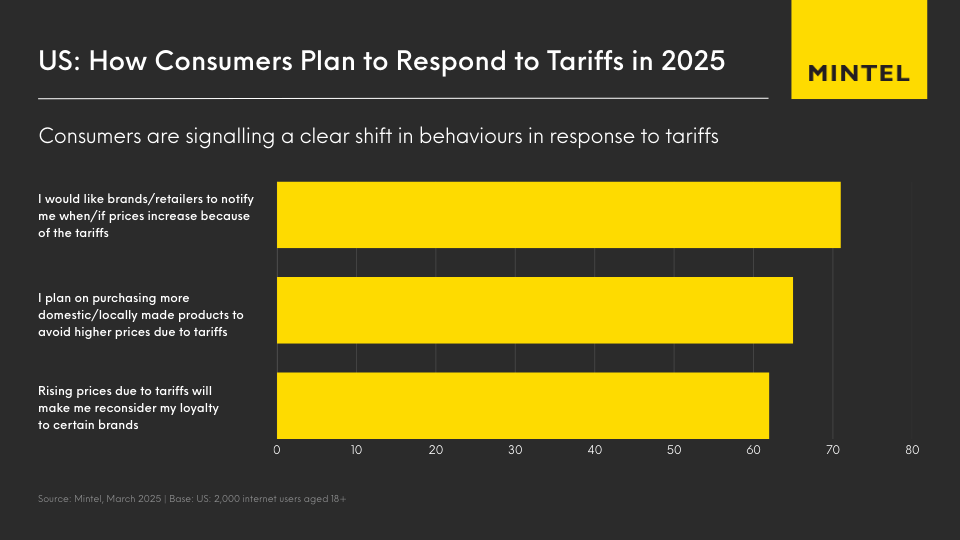

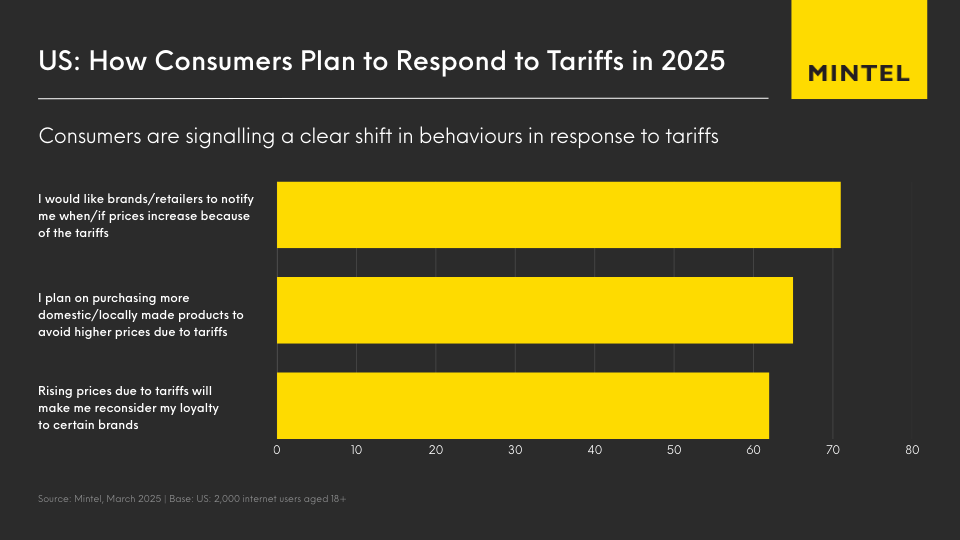

The challenge now goes beyond the immediate impact of the tariffs. They amplify even more uncertainty to an already unpredictable global situation. And uncertainty has an inevitable impact on how both businesses and consumers behave.

This is particularly challenging, given that consumer confidence is still fragile. Only a minority of people say their finances are healthy, while many behaviours adopted during the cost-of-living crisis are still in full effect. Brands must adapt to this reality with clarity and purpose.

40% of UK consumers say they are cutting back on luxuries, and 34% say they are switching to lower-cost retailers.

Are brands truly doing enough to reinforce their value proposition, to remind consumers why they’re worth that little extra, especially when budgets are tighter than ever? Or are some simply hoping to ride out the storm, heads down, perhaps assuming consumers won’t even notice their silence? That, in itself, is a gamble. Because in times of uncertainty, inaction can be just as deafening as a misstep. But here’s the exciting part: this very disruption, this feeling of being ‘stuck,’ is fertile ground for innovation.

History doesn’t repeat itself – but it often rhymes

At Mintel, we’ve got an immense resource of institutional knowledge that we can draw on. We’ve been tracking markets, consumers and brands for over 50 years. We’ve guided our clients through uncertainty before, providing a clear, actionable path forward when it matters most.

And while each time, the cause and shape of the crisis has been different, when you track back through Mintel’s research and data, there are common themes.

The greater the level of uncertainty in the broader market, the more that businesses and consumers try to take back control by reassessing their spending.

Often, that involves reducing spend. When uncertainty hits, it makes rational sense to try to create a margin of safety. (“The paradox of thrift”: economic activity drops, just as an economy needs the most support.)

But focusing on spending also plays into our underlying need for control. None of us has any control over Donald Trump’s trade policies (or, in previous crises, over energy prices, or COVID-19, or global financial stability), but we do have control over our own spending.

Five ways that consumer behaviour changes during times of economic uncertainty…

While specific changes vary by market and individual, certain consistent patterns tend to emerge.

Focus on value and efficacy When every penny counts, every purchase matters. We saw this clearly in the household care sector during the cost-of-living crisis. COVID-19 had already pushed efficacy up the agenda, but the cost-of-living crisis added another layer. Consumers wanted to ensure that the purchases they made were not only effective for health reasons, but also offered true value for money.

Trading down…A lot of the commentary on consumer behaviour during tough times revolves around ways people are trying to save money. Some people are forced to trade down, while others do so by choice. In categories they’re not super-engaged in, or where there’s a way to cut spend without reducing quality, they’ll switch to lower-cost alternatives.

… And trading upBut shoppers’ behaviour is much more sophisticated than just cutting back across the board. They’re also prepared to spend more if they think that’ll give them a better return on their investment.

The financial crisis, for example, significantly accelerated the growth of the UK’s premium ready meal market. Retailers saw an opportunity to capitalise on shoppers who were cutting back on dining out, and repositioned the ready meal from a convenient but uninspiring fallback to an indulgent but affordable luxury.

This pattern happens across categories. Beauty brands know all about the “lipstick effect”: people treating themselves to luxury products in order to lift their mood. Mintel’s experience shows that nearly every category will have its own equivalent of this trend, whether that’s premium ready meals, luxury fragrances, or affordable upgrades to vacation packages.

Market polarisationThe combination of selective trading down and trading up means categories become more polarised. The middle ground becomes a tough place to be. It’s neither affordable enough to be a bargain, nor indulgent enough to be a treat.

Branded products are particularly vulnerable to this effect, given the continued improvement in private label alternatives, both at the upper and lower end of the market.

Flight to safety Brands can thrive by focusing on the tendency for shoppers to become more risk-averse. If you can’t afford to waste money, experimenting with new products is risky. You might save a bit of money by switching to a cheaper alternative, but if your kids don’t like that alternative, then the money is wasted altogether.

…And why brands can’t afford to sit back and wait for conditions to improve

It’s not just consumer behaviour that changes. In previous economic slowdowns, our Global New Products Database (GNPD) has highlighted the way innovation trends shift. We have seen a decline in brand-led innovation, with private labels taking a greater share of innovation.

Just as with consumers’ changing emphasis on reducing costs, it’s a logical response to market uncertainty. Innovation is expensive and risky.

However, inaction is also risky, especially given the threat posed by private label. When consumers are under pressure, their habits change. This creates opportunities as well as challenges. It means they’re no longer shopping on autopilot, and that existing loyalties are up for grabs. If brands abandon the innovation battleground to private label, they risk permanently losing market share.

What’s next?

Mintel has already published multiple articles examining the impact of the tariffs on consumer behaviour across multiple categories and markets, including one on what it may mean for European food and drink markets (client-access only), alongside insight pieces on how UK, US and Southeast Asian consumers are likely to react.

However, the implications won’t only differ across different categories and regions. They’ll also be dramatically different across brands operating in exactly the same market. That’s where our Mintel Consulting team can help. We can draw on Mintel’s heritage and our collective genius to create winning strategies tailored to your individual objectives.

We did this throughout COVID-19 and the cost-of-living crisis, and we’ll do it again. For example, we’re already talking to an iconic American brand to help them understand whether recent events will have an impact on the way global consumers relate to their products.

If you’re looking to understand how these changes affect your own brand, your customers, and your innovation strategy, then get in touch with Mintel Consulting to learn more about how we can use our methods to help drive your growth strategies.

We can help you identify what’s already happening in your sector, predict what’s coming next, and understand what it means for your business’s strategy.

Contact a Consultant