First, during market hours, the financial world will hang on every word from Federal Reserve Chair Jerome Powell.

Then, once the closing bell rings, the real fireworks begin as a trio of tech titans—Microsoft, Alphabet, and Meta—report their highly anticipated earnings.

Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners!

Wednesday promises to deliver one of the most frenetic and market-moving trading sessions of the year, combining a highly anticipated and Chair Jerome Powell’s press conference with a blockbuster earnings trifecta from Microsoft (NASDAQ:), Alphabet (NASDAQ:), and Meta (NASDAQ:) after the closing bell.

As the hovers near record highs amid AI-driven optimism and cooling inflation, this double-whammy of macroeconomic policy and corporate heavyweights has volatility indexes like the ticking higher, signalling a potential for sharp swings.

Source: Investing.com

Investors are on edge: Will the Fed signal more easing to cushion a softening labor market, or pivot toward caution on sticky inflation? And can Big Tech deliver the growth narratives needed to justify sky-high valuations? Here’s a deep dive into the day’s key events and what to watch.

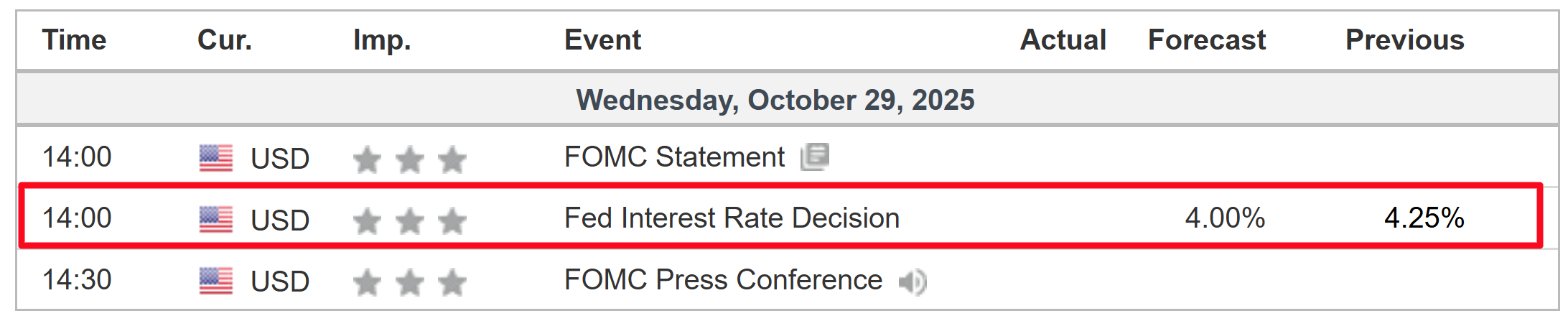

• Morning Drama: Fed Rate Cut Decision and Powell’s Press Conference

The day kicks off with the highly anticipated Federal Reserve rate decision, due at 2:00PM ET. Fed funds futures signal a 98% chance that the U.S. central bank will cut interest rates by 25 basis points, bringing the Fed funds target rate to 4.00%. This would mark the second consecutive reduction following September’s easing.

Source: Investing.com

The rate cut itself, however, is just the appetizer. The main event is Fed Chair Powell’s press conference at 2:30PM ET. Powell is expected to leave the door open for another rate cut in December, a reflection of recent data showing inflation continuing its slow but steady descent toward the Fed’s 2% target and a labor market that is moderating but not collapsing.

A hawkish surprise, like signalling a pause, could spark a bond yield spike and equity sell-off; conversely, hints at further rate cuts (aligning with the Fed’s latest dot-plot) might fuel a risk-on rally.

• Evening Fireworks: Big Tech Earnings Extravaganza

Immediately after the close, the earnings deluge hits, with Microsoft, Alphabet, and Meta—collectively worth about $9 trillion— all reporting in a single hour. Here’s what to watch for from each company:

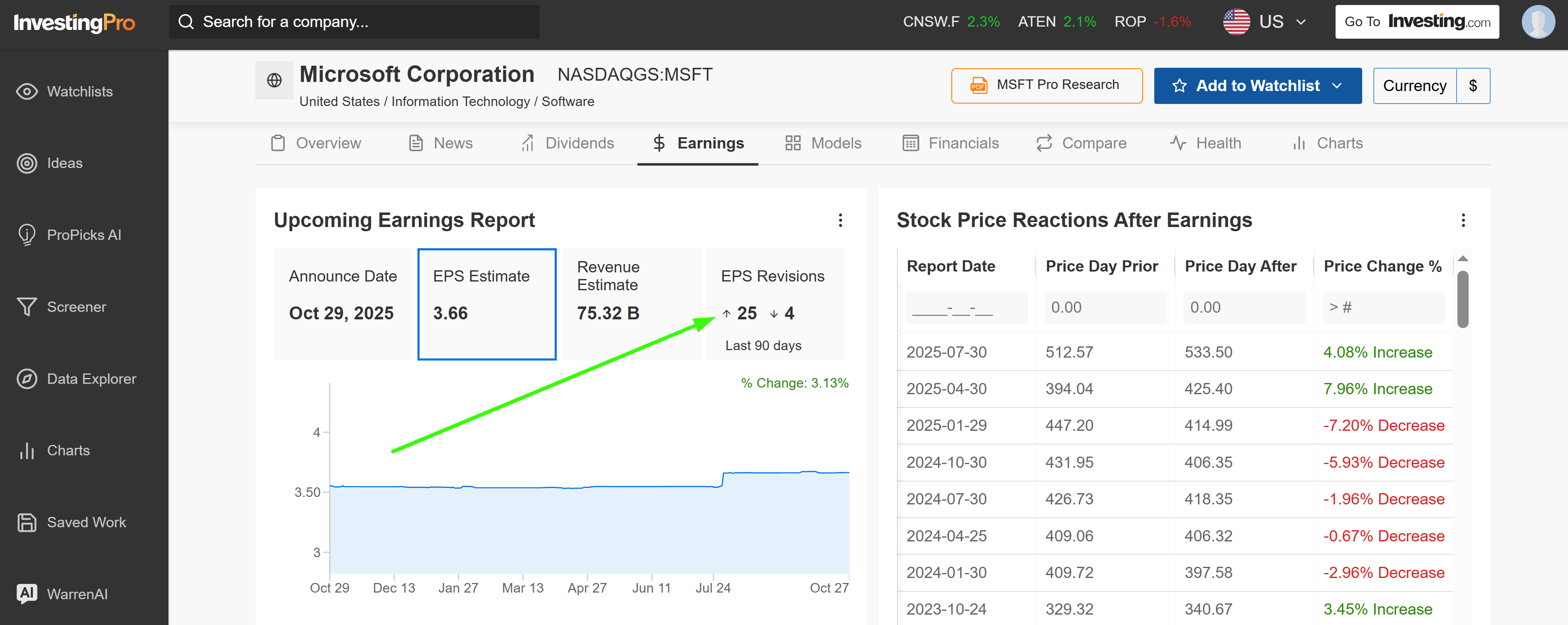

• Microsoft – Reports at 4:05 PM ET

Earnings Forecast: EPS $3.66 (+10.9% Y/Y) on revenue of $75.3B (+14.8% Y/Y)

Implied Volatility: +/-4.9%

Source: InvestingPro

•What to Expect: Microsoft is the undisputed leader in the enterprise AI race. The entire focus will be on the growth of its Azure cloud platform. Investors will be looking for another quarter of accelerating growth, driven by insatiable demand for its AI services and the continued adoption of its Copilot AI assistants. The Azure growth percentage is the single most important metric.

A strong number might propel shares toward $600; a soft outlook, however, could drag the Nasdaq lower, echoing last January’s 7% post-earnings drop.

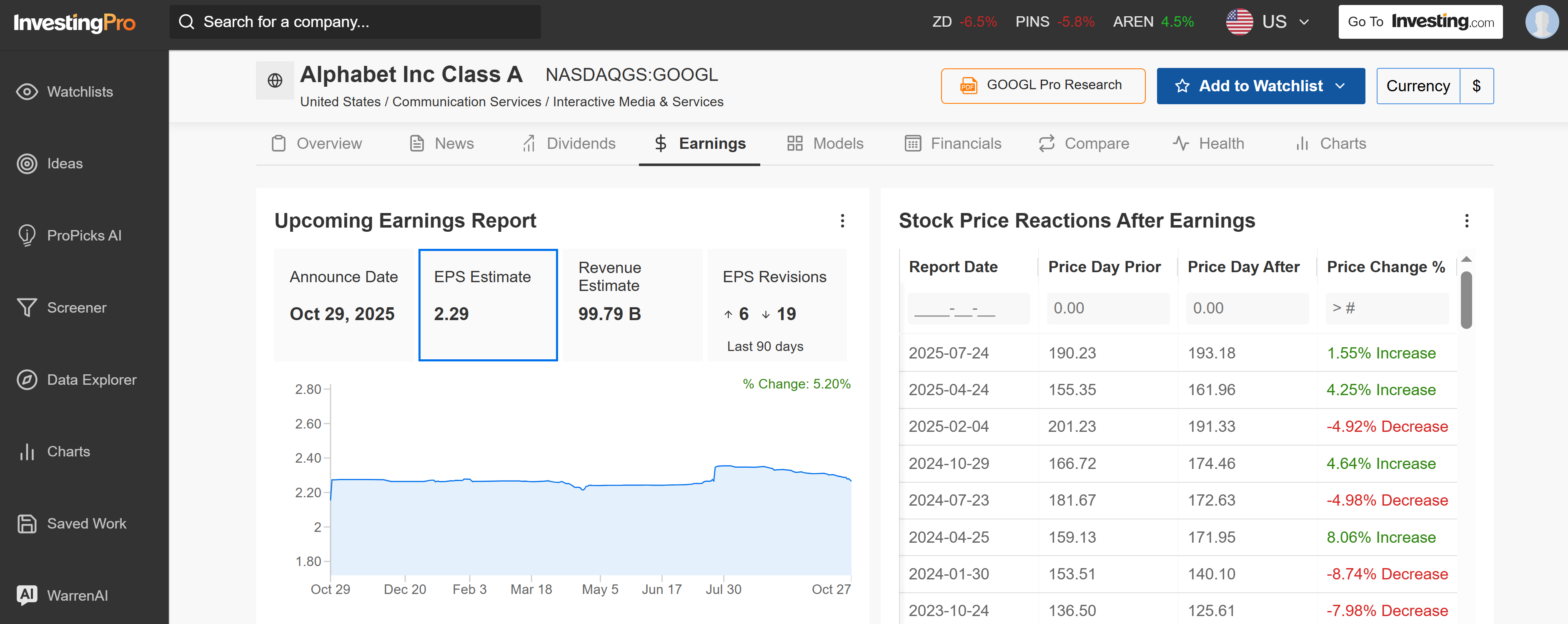

• Alphabet – Reports at 4:05 PM ET

Earnings Forecast: EPS $2.29 (+8% Y/Y) on revenue of $99.8B (+13% Y/Y)

Implied Volatility: +/-6.8%

Source: InvestingPro

• What to Expect: Alphabet’s report will be a story of two businesses. First, can its Google Cloud Platform (GCP) demonstrate continued momentum and prove it is capturing a significant share of the AI workload pie against Amazon Web Services and Microsoft Azure? Second, how resilient is its core advertising business? Strong results from Search and YouTube would signal that the digital ad market remains robust, a positive sign for the broader economy.

CEO Sundar Pichai will likely highlight the “full stack” AI virtuous cycle, including Gemini integrations and TPU efficiencies curbing capex. A cloud beat might lift shares 5%+ (as in October 2024), but AI spending hikes could pressure margins to 32%.

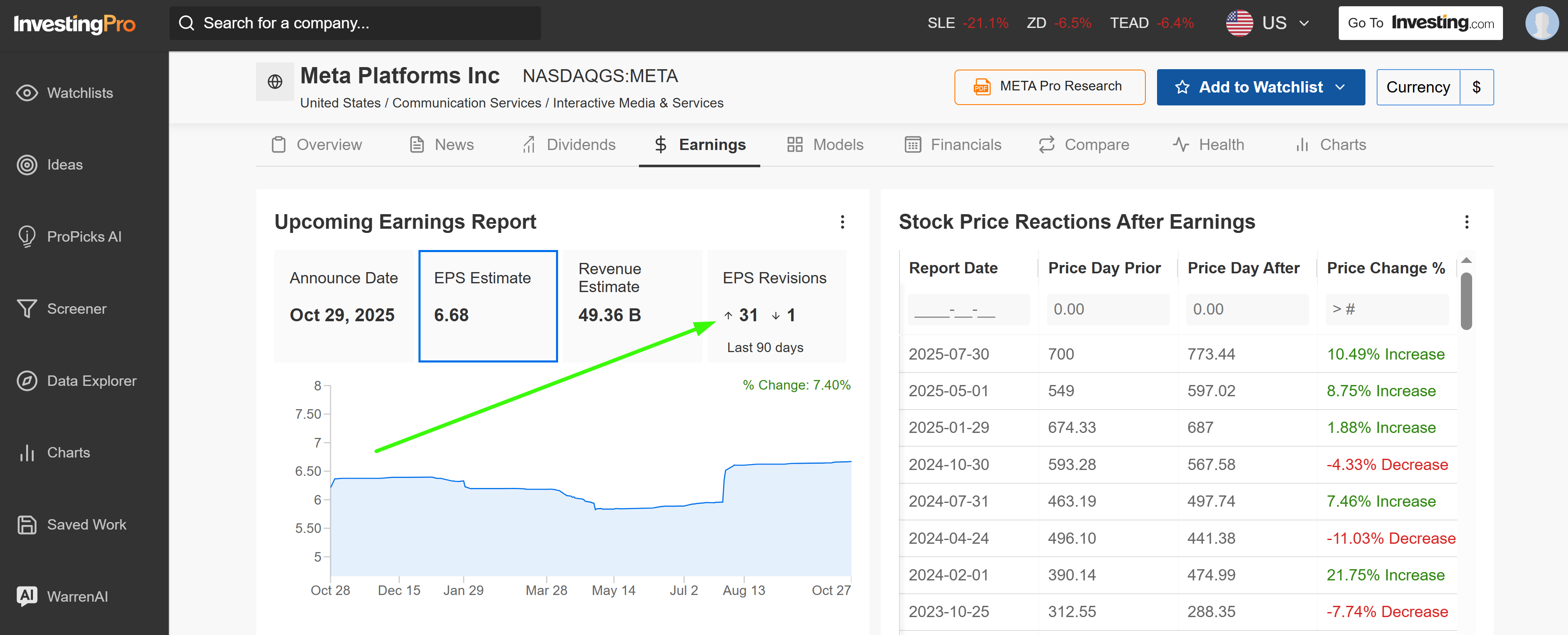

• Meta Platforms – Reports at 4:05PM ET

Earnings Forecast: EPS $6.68 (+10.8% Y/Y) on revenue of $49.3B (+21.6% Y/Y)

Implied Volatility: +/-7.1%

Source: InvestingPro

• What to Expect: Meta’s narrative is all about the power of its AI-driven advertising engine. After a “year of efficiency” that dramatically improved its profitability, the focus is now squarely on revenue growth. Its AI-powered recommendation algorithms for Reels and its core ad platform have been driving higher user engagement and delivering superior returns for advertisers.

A user miss or capex warning could sink shares, but strong ad revenue growth and a confident outlook for the coming quarter might extend 2025’s 30% YTD gains.

Conclusion

Wednesday is a day of immense consequence. The morning will be dictated by the macro, with the Fed setting the tone for interest rates and the economy. The afternoon will be driven by the micro, with the results from the AI titans providing a real-time health check on the biggest growth story in the market. When the dust settles, the path for the rest of the year will be significantly clearer—or perhaps, thrillingly more volatile.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.