Bitcoin struggles near $108,000 support, with potential decline toward $100,000 if broken.

Ethereum consolidates at key support, breakout above $4,450 signals trend reversal.

Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

The cryptocurrency market has seen a sell-off in the past few days, which looks more like a short-term correction from a long-term view. The drop in , , and other cryptocurrencies was driven less by the Fed’s recent and more by uncertainty about when the next cut will happen. Markets currently expect two more by the end of the year.

Technically, Bitcoin’s key level is around $108,000 per coin. If it breaks this level, the correction could extend toward the $100,000 psychological mark.

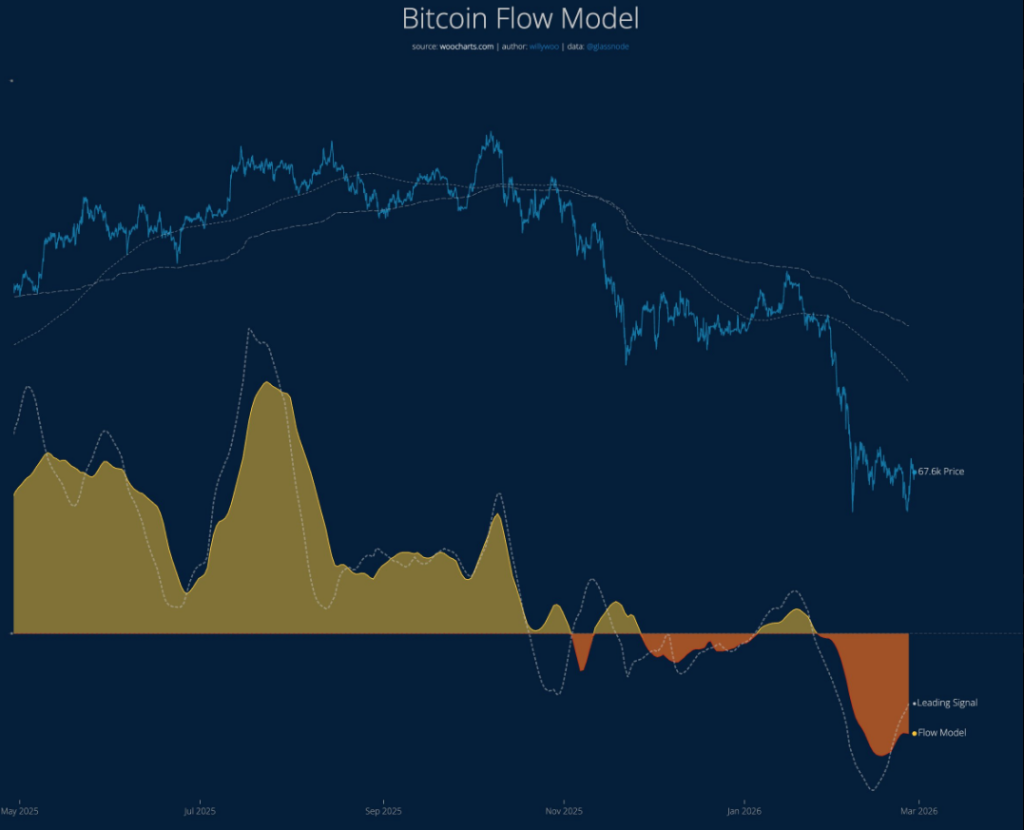

Should Bitcoin Buyers Be Concerned?

Even though recent news highlights a strong sell-off in Bitcoin and other major cryptocurrencies, this move looks more like a normal market pullback. Over the past week, Bitcoin has dropped less than 3%, which is small for an asset that can swing several percent in just a few days. The drop seems driven mainly by short-term investors taking profits, while long-term holders continue to keep their positions.

The fundamentals still favor buyers, and last week saw strong inflows into mutual funds, totaling $1.9 billion for the industry. Bitcoin received $997 million, and Ethereum got $773 million. If this trend continues, demand could regain the upper hand in the market.

Bitcoin Fails to Break Local Resistance

The attempt to resume the uptrend failed at the local resistance around $118,000 per coin. In the short term, selling pressure is building, with the first target likely around the recent low of $108,000 per coin.

A clear sign of a potential uptrend would be a break above the recently tested resistance, paving the way toward the all-time high just under $125,000 per BTC. On the other hand, a drop below the $98,000 support level would be a warning for buyers.

Ethereum Consolidates Near Key Support

The sharp downward move that sped up at the end of last week has slowed near the support level set by last month’s local lows. This suggests the market is now consolidating, and the next breakout should indicate the short-term direction.

If an upward breakout happens, the correction could end, with the first target around $4,450 per ETH, where the downtrend line meets resistance. If ETH falls below the $4,000 psychological level, the decline could speed up.

****InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

AI-managed stock market strategies re-evaluated monthly.

10 years of historical financial data for thousands of global stocks.

A database of investor, billionaire, and hedge fund positions.

And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.