While it can be a hunting ground for speculative, high-risk ventures, it is also where the market’s overreactions can create extraordinary opportunities.

Here are five stocks under $10 that are flashing strong upside potential and are worth buying right now.

Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners!

The current market environment has created compelling opportunities among quality companies trading below $10 per share. Five stocks stand out as particularly attractive turnaround candidates: Snap (NYSE:), Melco Resorts & Entertainment (NASDAQ:), Bausch Health Companies (NYSE:), Wendy’s (NASDAQ:), and JetBlue Airways (NASDAQ:).

These are not fallen startups; they are well-known brands and significant players in their industries that have been pushed into single-digit territory. For investors with a bit of patience, these five stocks under $10 represent compelling turnaround stories, each with a clear path to reclaiming the double-digit mark and beyond.

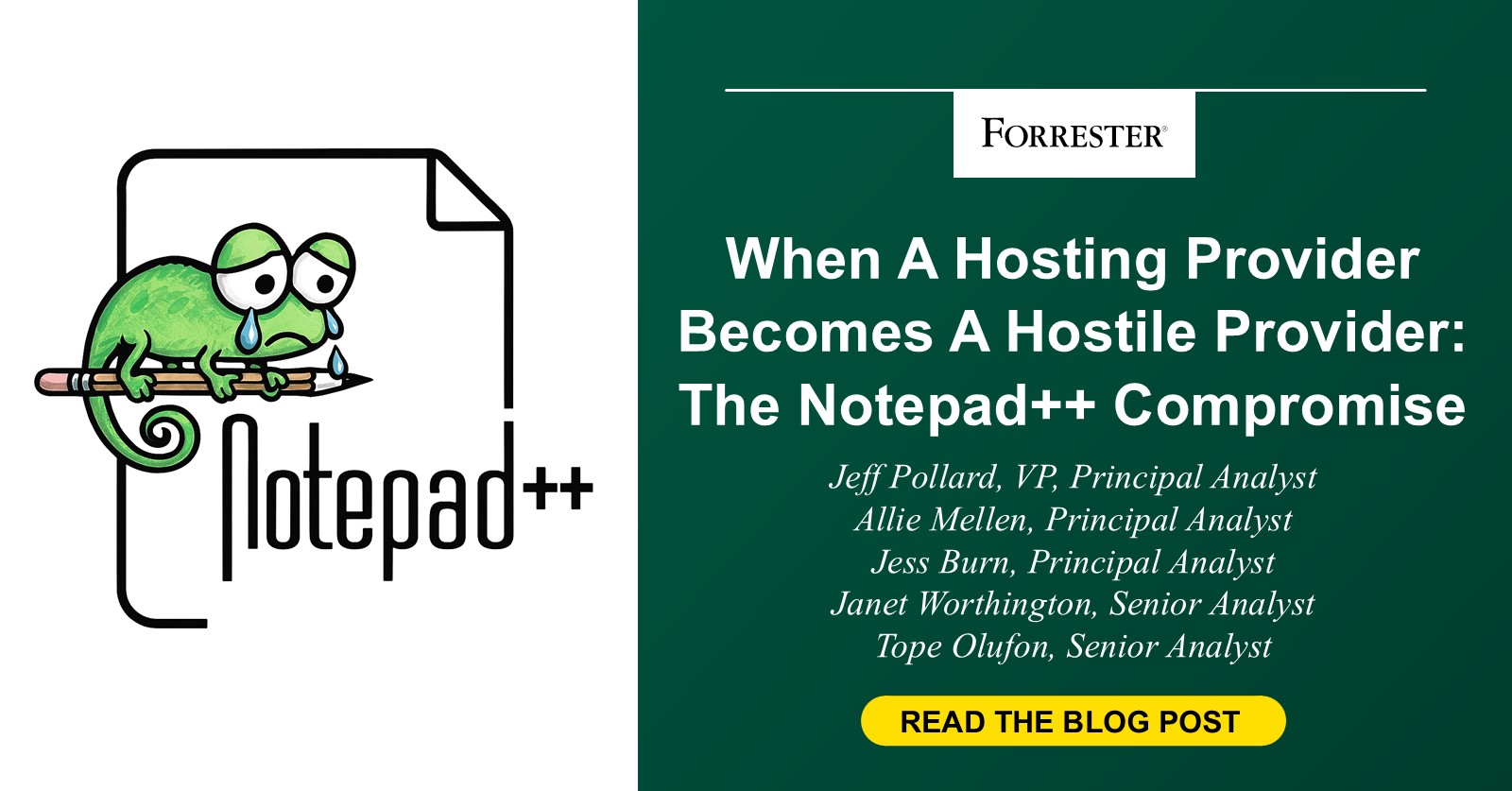

1. Snap – Social Media Platform with AI Upside

Current Price: $7.60

Fair Value Estimate: $11.27 (+48.2% Upside)

Market Cap: $12.8 Billion

Snap, the parent of Snapchat, has been hammered by ad market volatility and competition from TikTok and Meta, leaving its stock near all-time lows at $7.60—down over 90% from its 2021 peak.

Source: Investing.com

But this pessimism overlooks Snap’s explosive user growth and innovative monetization plays. With 414 million daily active users (up 10% year-over-year) and Snapchat+ subscriptions surging 42%, the company is diversifying beyond volatile ads into stable recurring revenue.

Analysts peg a consensus target of $11.27, implying +48.2% upside, while machine-learning-driven ad tools have boosted conversions by 30% for app-install campaigns.

Source: InvestingPro

At a forward P/S ratio of just 3x—half the tech sector average—SNAP is undervalued by 8-60% per DCF models. As ad spending rebounds in 2026, expect SNAP to snap back above $10, rewarding patient holders with 50%+ gains.

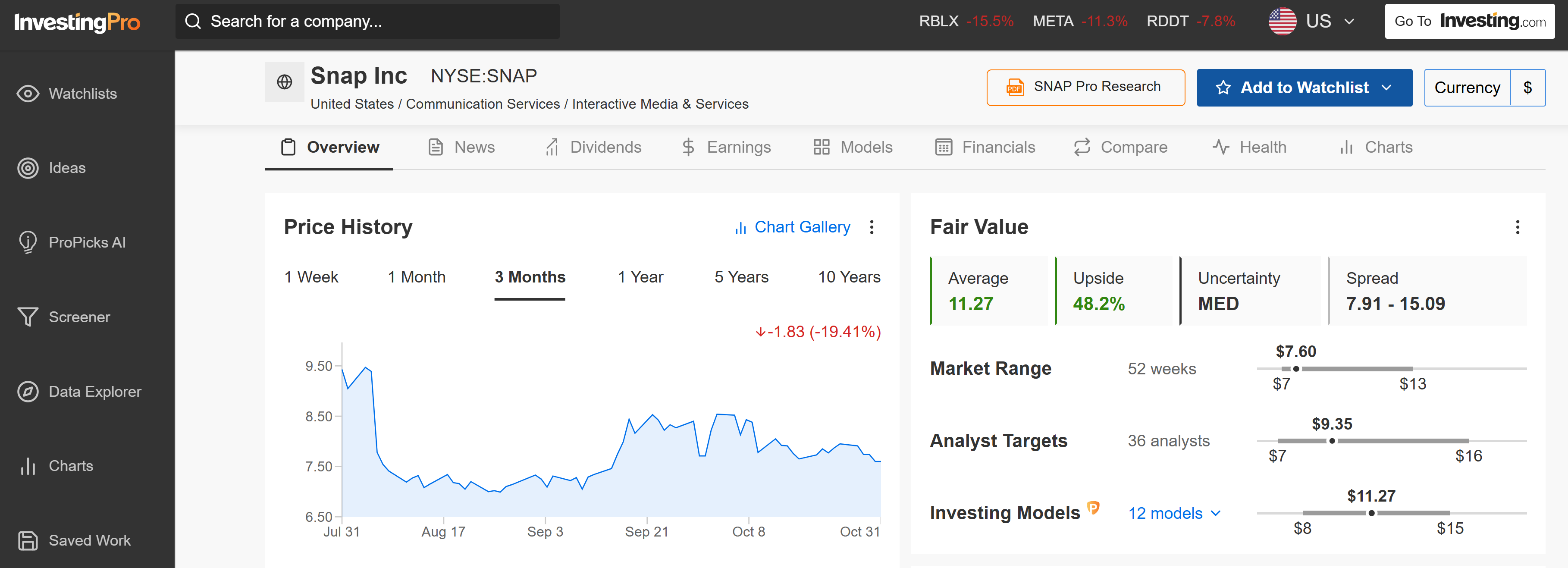

2. Melco Resorts & Entertainment – Macau’s Gaming Revival Play

Current Price: $8.19

Fair Value Estimate: $11.56 (+41.2% Upside)

Market Cap: $3.2 Billion

Melco, a luxury casino operator in Macau and the Philippines, is stuck at $8.19 amid regulatory overhangs and post-pandemic tourism lags, but China’s economic reopening is unleashing pent-up demand.

Source: Investing.com

Trading at a P/S of 0.83x—versus the industry’s 1.4x—MLCO screams value, with InvestingPro Fair Value’s $11.56 target barely scratching the surface of its potential. Upgrades from Goldman Sachs and JPMorgan highlight its buy rating, citing robust EBITDA margins.

Source: InvestingPro

Debt reduction and RFID tech upgrades will boost efficiency, positioning Melco for 20-30% revenue growth as visitor numbers normalize. Undervalued by traditional metrics and poised for a tourism boom, MLCO could easily eclipse $10 by mid-2026.

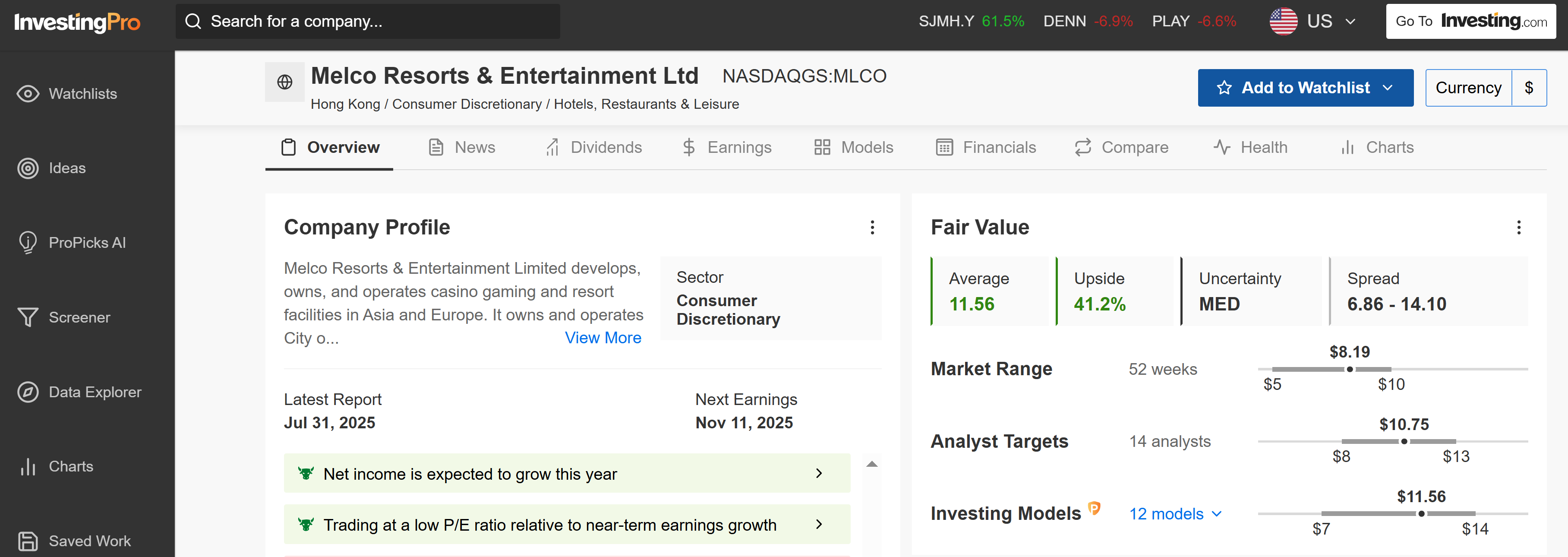

3. Bausch Health Companies – Pharma’s Debt-Discount Bargain

Current Price: $6.61

Fair Value Estimate: $7.94 (+20.1% Upside)

Market Cap: $2.45 Billion

Bausch Health, formerly Valeant, carries baggage from past scandals and a heavy debt load, keeping shares at a rock-bottom $6.61—near 52-week lows.

Source: Investing.com

Yet, this overshadows its diversified portfolio in eye care, dermatology, and gastroenterology. InvestingPro rates it a consensus Buy with a target of around $8.00 (+20% upside), citing undervaluation at a P/S of 1.21x versus the pharma industry’s 2.89x.

Trading at a forward P/E of 6.4x—far below peers—BHC is undervalued amid stable cash flows and debt refinancing progress.

Source: InvestingPro

As interest rates ease and generics competition wanes, expect BHC to climb toward $10/share, delivering defensive growth in a volatile market.

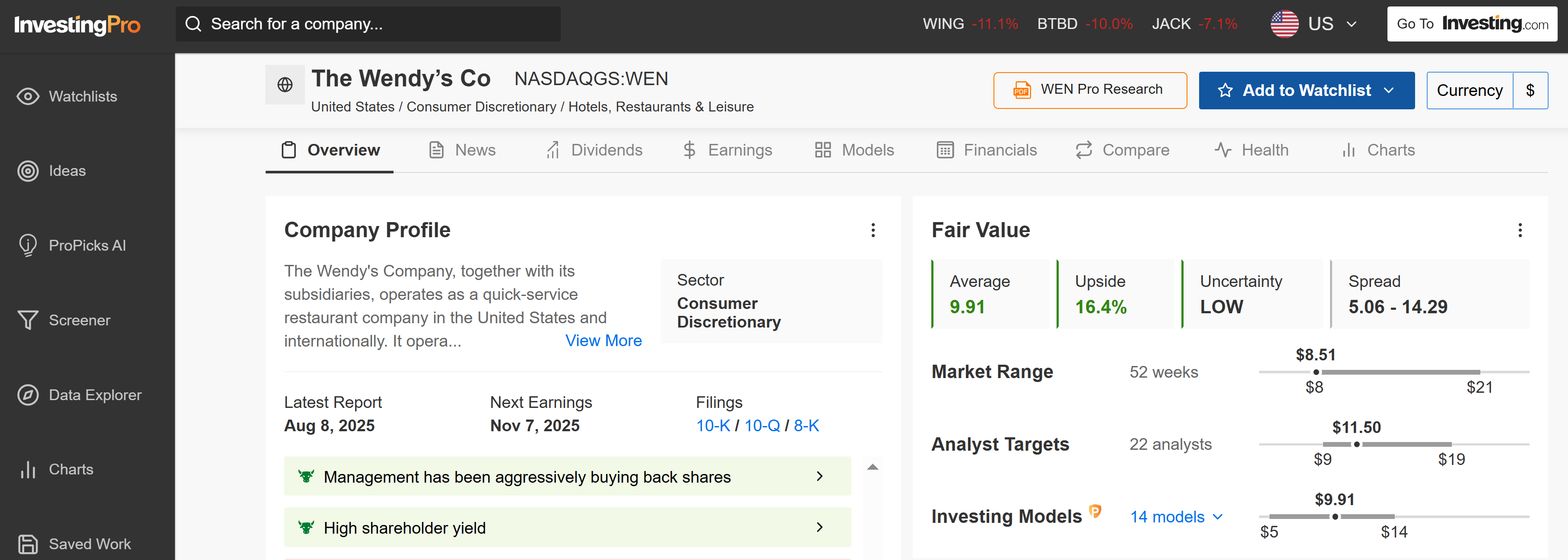

4. Wendy’s – Fast Food’s Yield-Rich Value Bet

Current Price: $8.51

Fair Value Estimate: $9.91 (+16.4% Upside)

Market Cap: $1.6 Billion

Wendy’s, the burger chain icon, is trading near 52-week lows of $8.51 after soft U.S. comps sales pressured margins, but global expansion and menu innovations are flipping the script.

Source: Investing.com

With a 5%+ dividend yield and aggressive plans for 1,000+ new stores by 2026 (focusing on international markets), revenue could swell 5-7% annually. The Fair Value price target sits at $9.91, suggesting +16.4% upside, while a forward P/E of 11.8x lags peers like McDonald’s (24x).

Digital sales now account for 14% of revenue (up 25% YoY), and breakfast menu traction—despite early stumbles—has stabilized with $1 billion in annualized sales.

Source: InvestingPro

Trading at just 1.6x sales versus the restaurant sector’s 2.5x, WEN is deeply undervalued. As inflation cools and wage pressures ease, margin expansion will drive earnings growth, pushing shares comfortably above $10 in the next 12-18 months.

5. JetBlue Airways – The Airline Underdog Recovery Story

Current Price: $4.13

Fair Value Estimate: $5.48 (+32.8% Upside)

Market Cap: $1.5 Billion

JetBlue has been grounded by high fuel costs, labor disputes, and a failed Spirit merger, sending shares to $4.13—down 60% from 2023 highs.

Source: Investing.com

But the storm is passing: Q3 2025 unit revenue turned positive for the first time in two years, capacity discipline is restoring pricing power, and cost-cutting initiatives (including $1 billion in annual savings) are taking hold.

InvestingPro’s Fair Value models project a $5.48 target (+33% upside). At a forward P/E of 8.2x and EV/EBITDA of 5.1x—both below historical averages and peers like Southwest (9.5x)—JBLU is undervalued by 40%+ per cash flow models.

Source: InvestingPro

New routes in high-margin transatlantic markets and fleet modernization with fuel-efficient A220s will boost profitability. With oil stabilizing and consumer spending resilient, JetBlue is set to rebound as sentiment shifts from fear to fuel.

Conclusion

These five stocks—SNAP, MLCO, BHC, WEN, and JBLU—are trading under $10 not because of broken business models, but due to temporary macro pressures, sector rotations, and overblown fears. Each offers strong balance sheets, growth catalysts, and analyst support pointing to double-digit rebounds.

For risk-tolerant investors with a 12-24 month horizon, this basket of undervalued names could deliver outsized returns as the market recognizes their true worth.

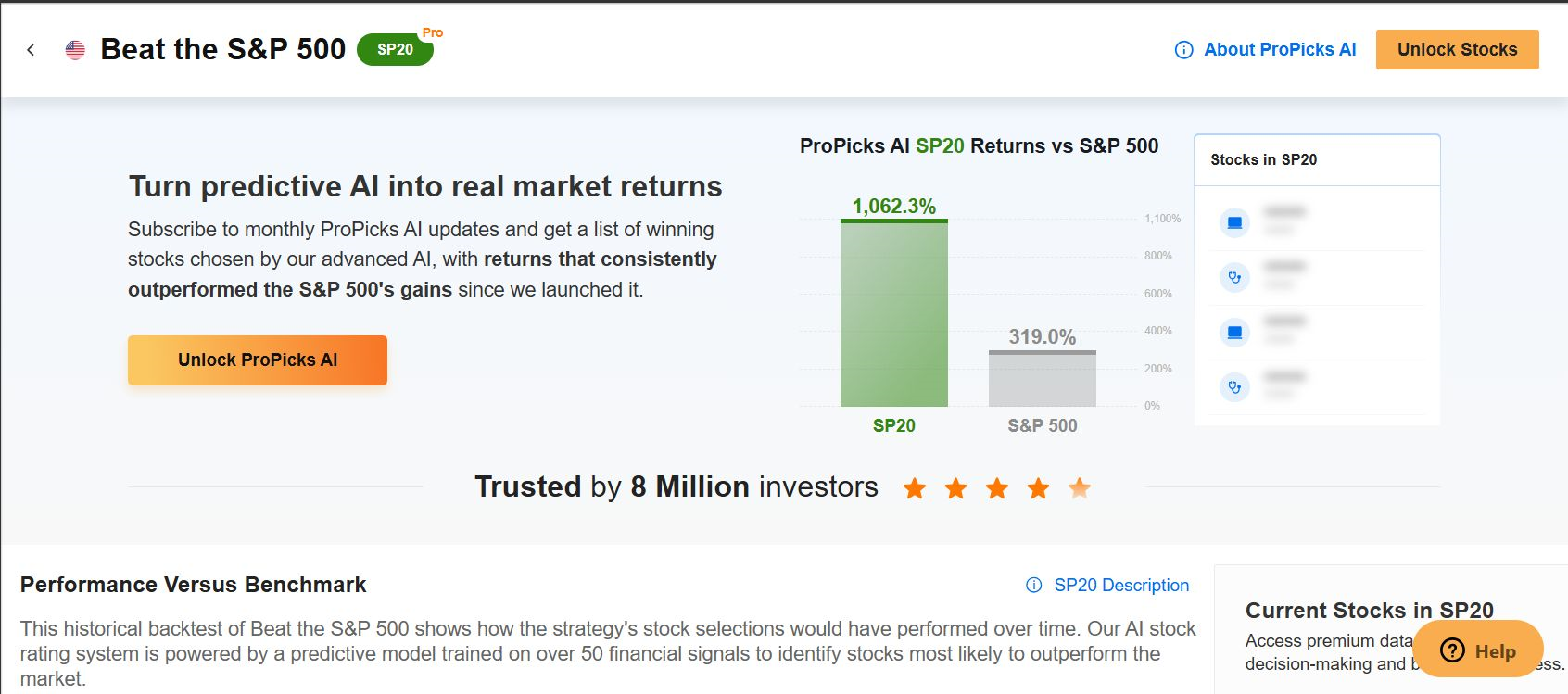

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.