Quality companies in sectors that benefit in the current environment warrant increased attention.

Chevron and LyondellBasell stand out as resilient, value-driven investments poised to deliver strong returns.

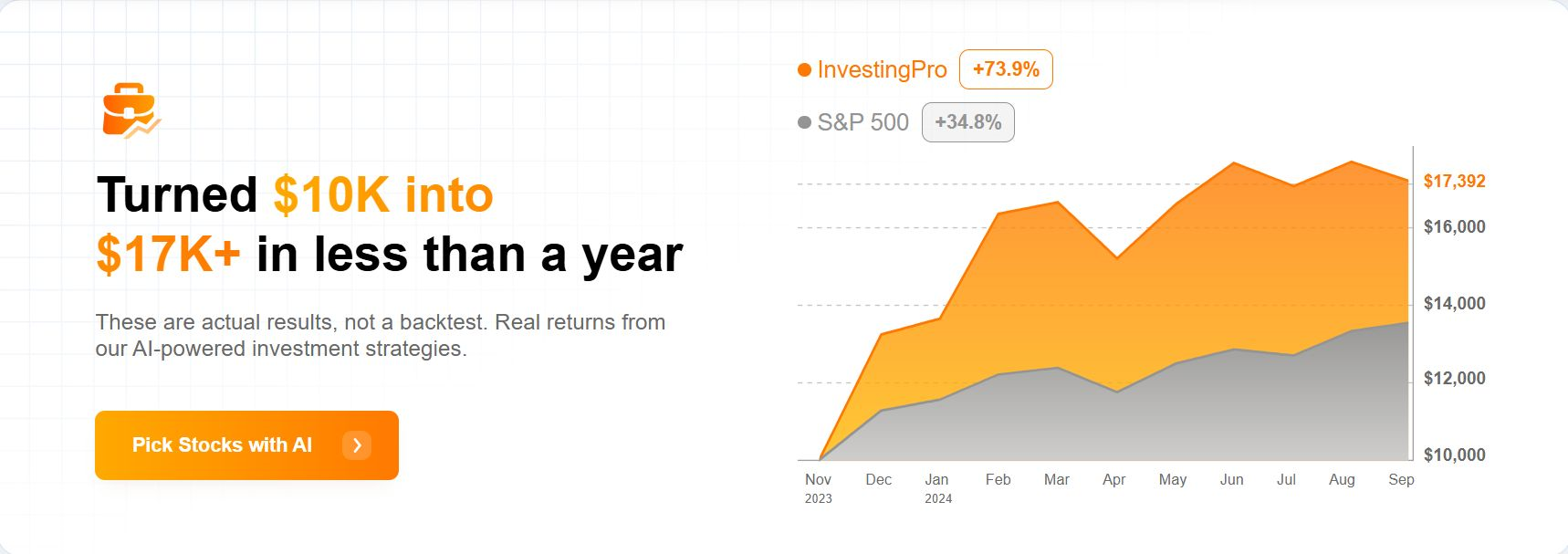

Looking for more actionable trade ideas? Subscribe here for 45% off InvestingPro!

As bond yields climb in 2025, with the note hovering around 4.50%, investors face a shifting market landscape. Rising yields, often a signal of increasing interest rates and inflationary pressures, tend to challenge growth-oriented sectors like technology while creating opportunities in value-driven, cyclical industries.

Source: Investing.com

Two companies that stand out as compelling investment opportunities in this environment are Chevron (NYSE:) and LyondellBasell Industries NYSE:). These firms, rooted in the energy and chemicals sectors, are well-positioned to outperform when yields spike due to their resilience, attractive dividend yields, and exposure to macroeconomic tailwinds.

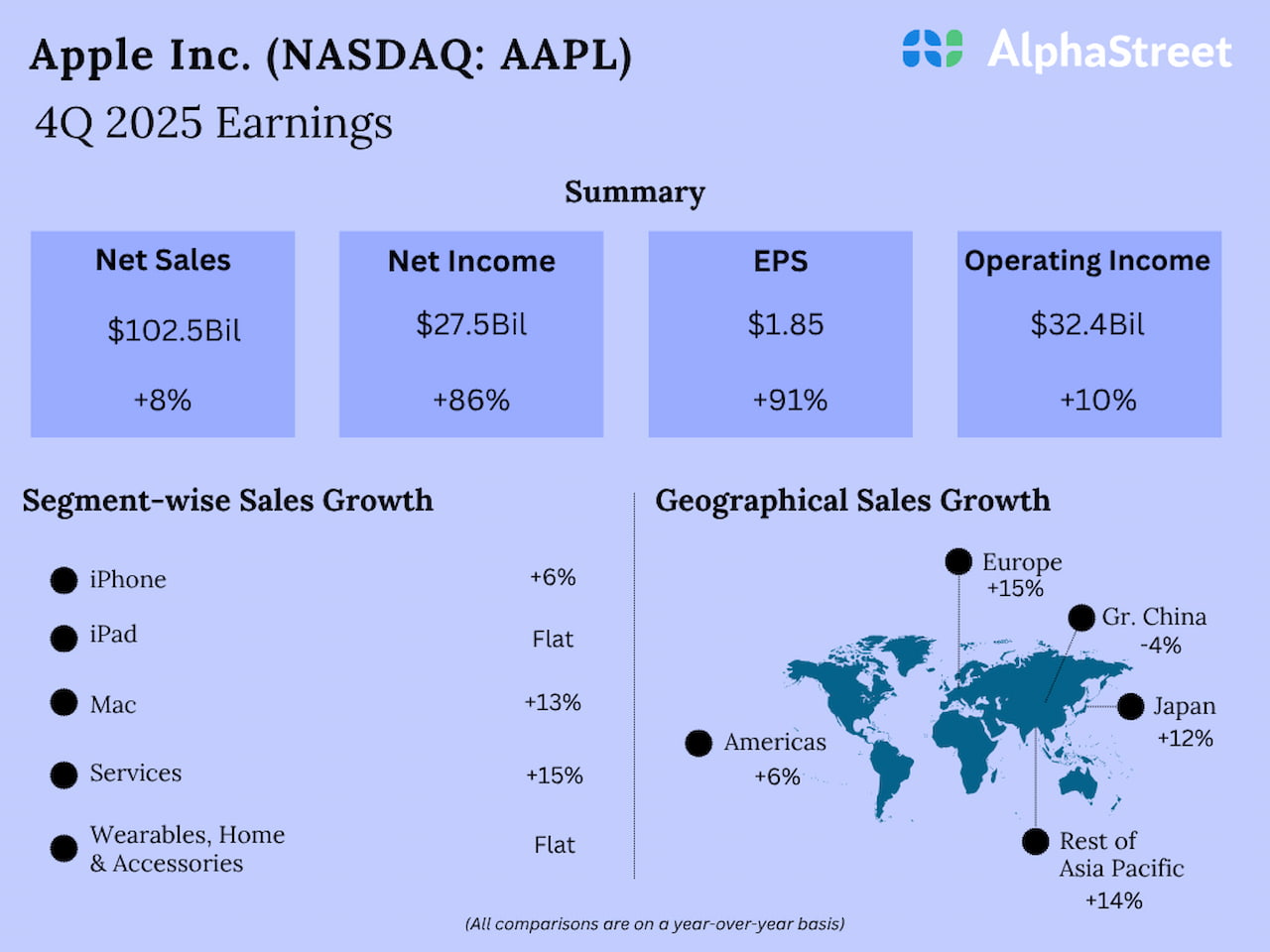

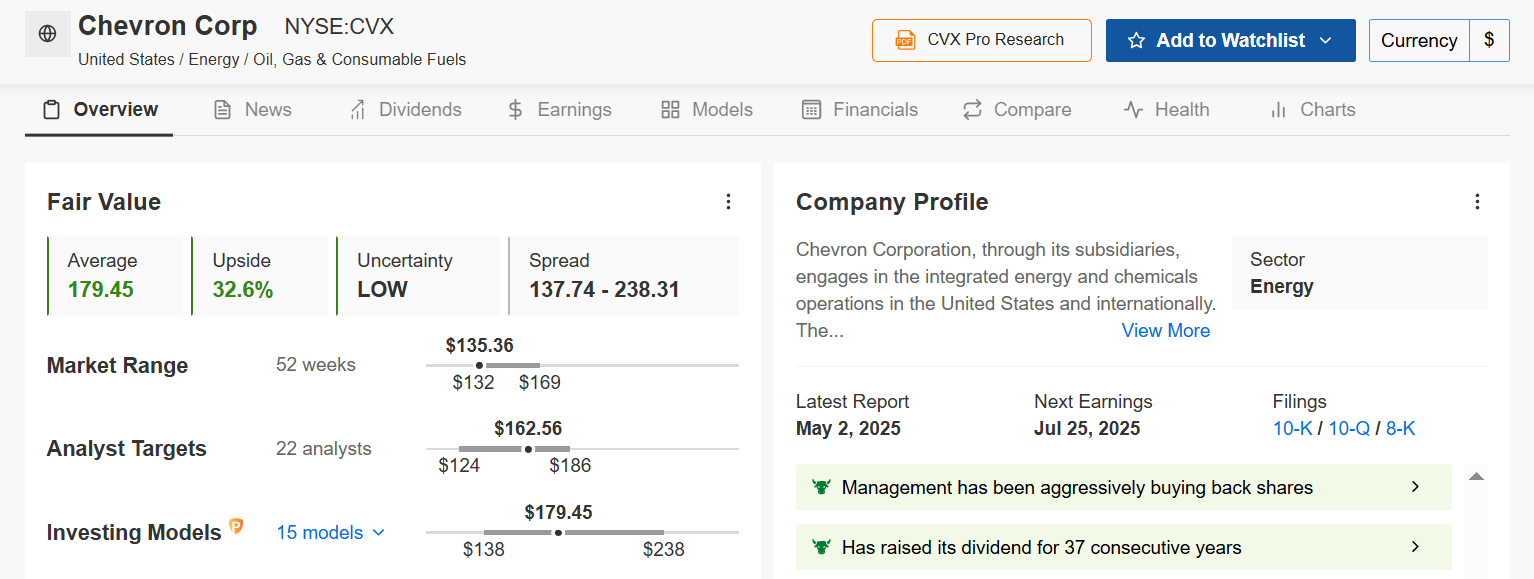

1. Chevron

Current Price: $135.29

Fair Value Estimate: $179.45 (+32.6% Upside)

Dividend Yield: 5.05%

Chevron, one of the world’s largest integrated oil and gas companies, is a standout choice when bond yields rise. Higher yields often correlate with inflationary pressures, which tend to push commodity prices, including oil, upward. Chevron’s diversified operations, spanning upstream exploration, midstream transportation, and downstream refining, allow it to capitalize on elevated energy prices.

Source: Investing.com

The oil giant’s substantial dividend yield—currently at 5.05%—offers investors a premium over the 10-year Treasury yield, creating an attractive income proposition even as rates rise. Importantly, Chevron has increased its dividend for 37 consecutive years, demonstrating a commitment to returning capital to shareholders throughout economic cycles.

The company’s 32.6% ‘Fair Value’ upside suggests CVX stock is currently undervalued by the InvestingPro models, providing notable potential for capital appreciation. With the stock trading near its 52-week low, Chevron could offer a value opportunity if fundamentals remain stable.

Source: InvestingPro

Several additional tailwinds support Chevron’s outlook beyond the rising yield environment. The company’s disciplined capital allocation strategy emphasizes high-return projects while maintaining one of the strongest balance sheets in the industry. Analysts see profitability ahead this year, and with cash flows ample enough to cover interest payments, its moderate debt level appears manageable.

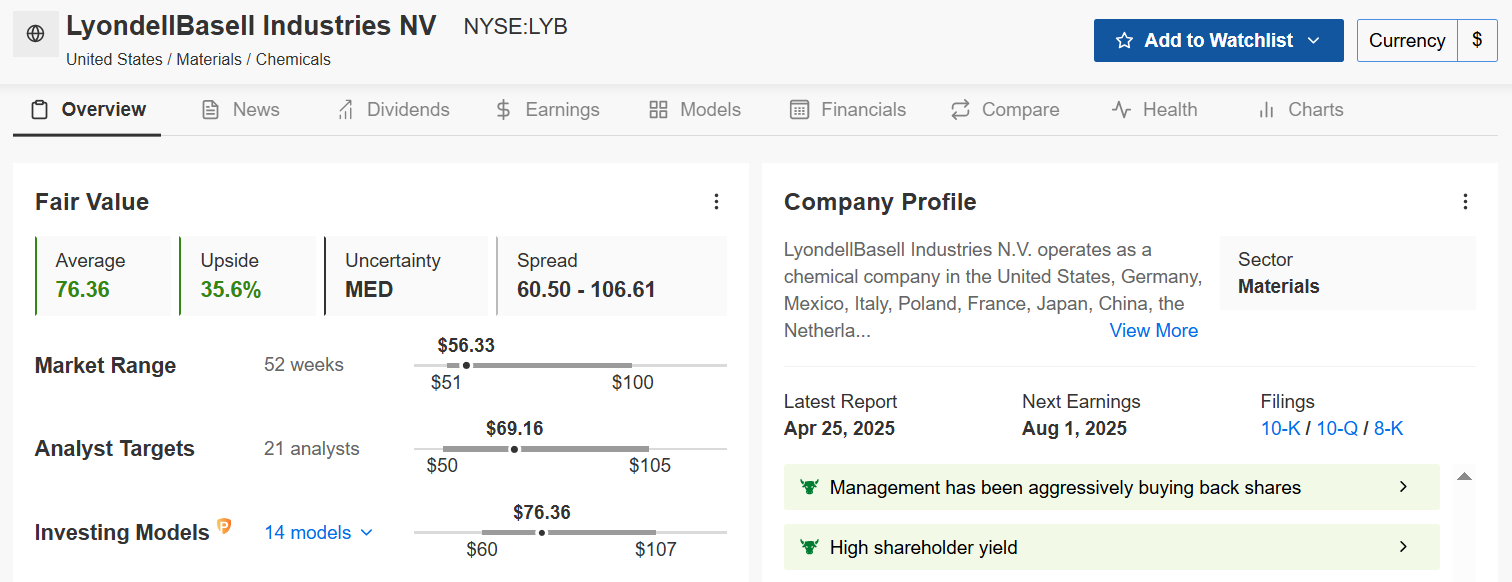

2. LyondellBasell Industries

Current Price: $56.33

Fair Value Estimate: $76.36 (+35.6% Upside)

Dividend Yield: 9.48%

LyondellBasell Industries, a global leader in chemicals, plastics, and refining, is another stock well-suited for a rising yield environment. The company produces essential materials like polyethylene and polypropylene, which are critical to industries such as packaging, automotive, and construction. Higher commodity prices, particularly for petrochemicals, boost the company’s margins, as raw material costs are often passed through to customers.

Source: Investing.com

The company stands out for its high shareholder yield and a 15-year streak of uninterrupted dividends. LyondellBasell currently sports a robust 9.48% dividend yield, positioning it among the higher-yield options in chemicals. The firm’s strong free cash flow yield and ongoing share buybacks add to its investor appeal.

LYB stock’s 35.6% InvestingPro ‘Fair Value’ upside is even more generous than Chevron’s, reflecting deep undervaluation according to consensus models, while its 2.35 Financial Health Score points to reasonable, if slightly lower, balance sheet strength.

Source: InvestingPro

LyondellBasell benefits from additional tailwinds that could propel its stock higher in 2025. The company’s global footprint, with significant operations in the U.S. and Europe, positions it to capitalize on regional demand surges, particularly if U.S. infrastructure spending accelerates under new fiscal policies.

Furthermore, the company’s exposure to the circular economy, through initiatives like recycled plastics production, aligns with growing environmental, social, and governance (ESG) considerations, potentially attracting a broader investor base.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.