Stocks on Wall Street ended little changed in choppy trading on Friday, as tariffs continued to worry investors.

Source: Investing.com

Both the and tech-heavy posted weekly gains, rising 0.6% and 1.5%, respectively. The 30-stock was marginally lower on the week, falling less than 0.1%.

More volatility could be in store in the week ahead as investors assess the outlook for the economy, inflation, interest rates and corporate earnings amid ongoing global trade jitters.

The earnings season shifts into high gear, with reports expected from Tesla (NASDAQ:) and Google-parent Alphabet (NASDAQ:) – two of the so-called Magnificent Seven megacap companies. Other high-profile companies on the agenda include Intel (NASDAQ:), IBM (NYSE:), AT&T (NYSE:), Verizon (NYSE:), T-Mobile (NASDAQ:), Lockheed Martin (NYSE:), RTX (NYSE:), Northrop Grumman (NYSE:), American Airlines (NASDAQ:), Southwest Airlines (NYSE:), Philip Morris (NYSE:), Coca-Cola (NYSE:), Chipotle Mexican Grill (NYSE:), and General Motors (NYSE:).

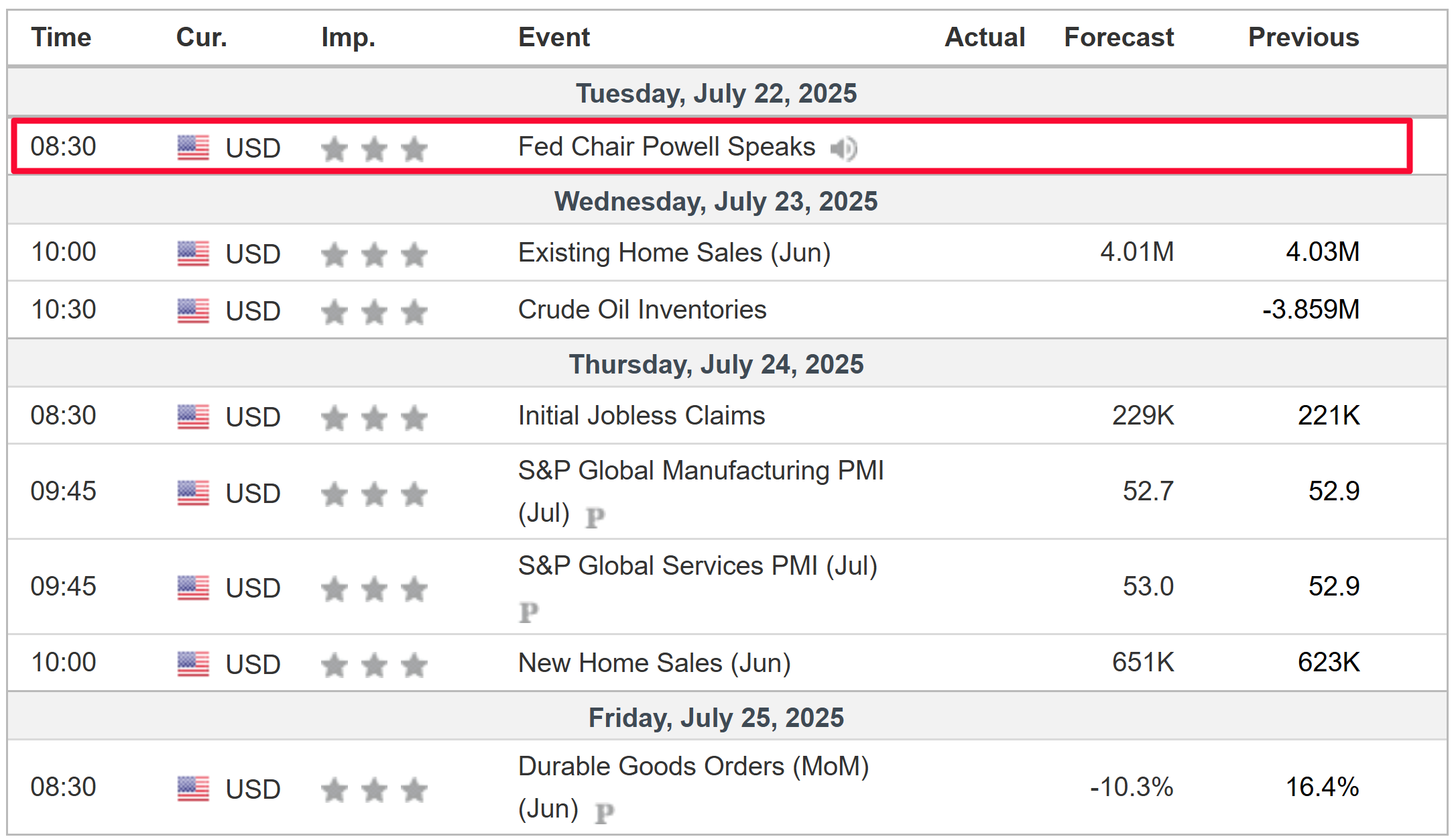

Meanwhile, on the economic calendar, flash PMI readings on manufacturing and the services sector will grab attention on Thursday, along with updates on the housing market.

Source: Investing.com

In addition, Federal Reserve Chair Jerome Powell is scheduled to give a speech at the Integrated Review of the Capital Framework for Large Conference, in Washington DC, on Tuesday.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, July 21 – Friday, July 25.

Stock to Buy: Tesla

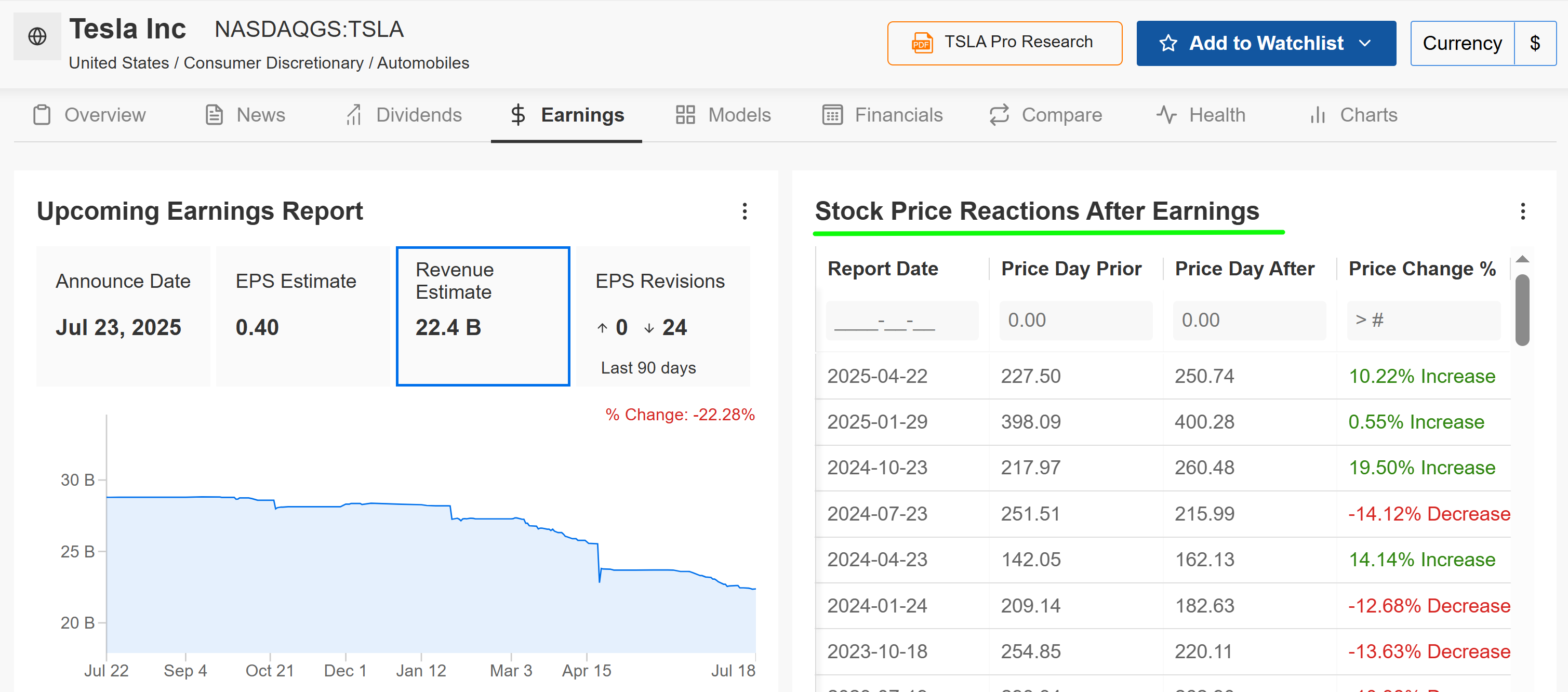

Tesla presents a compelling contrarian opportunity this week, with expectations set remarkably low ahead of its Q2 earnings report. While the headline numbers may be underwhelming, this could be a classic case where the backward-looking data may not be the main event.

Tesla’s second quarter update is scheduled to come out after the close on Wednesday at 4:05PM ET in what will likely be one of the most closely watched reports of the week. A call with analysts is set for 5:30PM ET.

Market participants expect a sizable swing in TSLA stock following the print, with an implied move of +/-7.4% in either direction as per the options market. Notably, TSLA shares surged 10% after the last earnings report in April.

Source: InvestingPro

Consensus expectations call for the Austin, Texas-based EV giant to post a profit of $0.40 per share, falling 23.1% from earnings per share of $0.52 in the year-ago period. Revenue is seen declining 12.1% year-over-year to $22.4 billion, with global vehicle sales slipping more than 13%.

These figures reflect a period of slowing EV adoption rates, declining sales in key markets like China and Europe, and some brand backlash against CEO Elon Musk’s political interventions.

So why buy? Because the market has largely priced in this weakness. The real catalyst for the stock will be the commentary from Musk on the earnings call. Positive guidance on robotaxi timelines, new model launches, autonomous humanoid robots, or AI progress could overshadow weak financials and reinforce Tesla’s narrative as more than just a car company.

Source: Investing.com

TSLA stock ended Friday’s session at $329.65, just above both its 50- and 200-day moving averages. Technically, momentum is bullish across all timeframes, supported by a rising RSI (53.2), and every major moving average and indicator flashes “strong buy.”

Additionally, Tesla demonstrates solid financial health, boasting an InvestingPro Health Score of 2.59 (“GOOD”), which reflects a strong balance sheet and improving cash flow.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now for 50% off and position your portfolio one step ahead of everyone else!

Stock to Sell: Intel

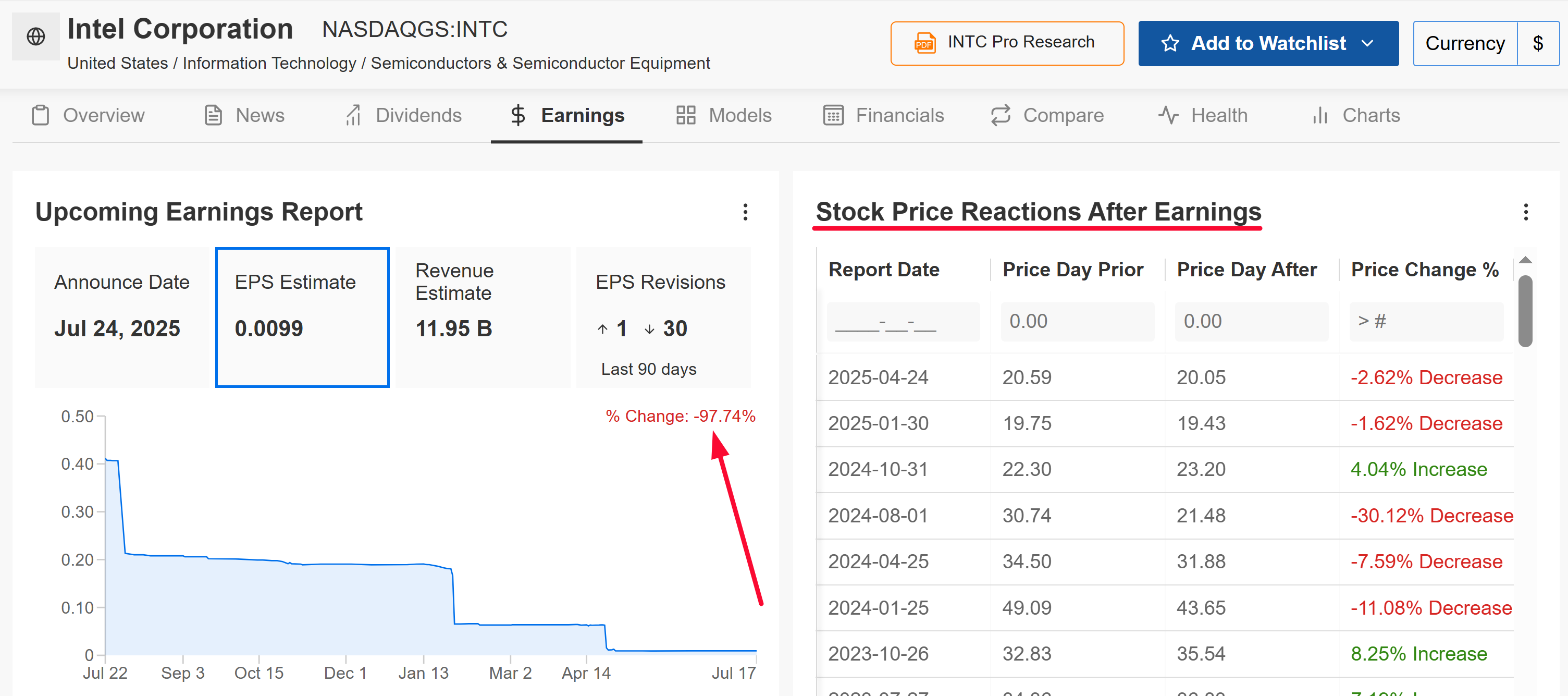

On the other side of the trade, I recommend a “sell” on Intel, which reports its earnings on Thursday after the close. Unlike Tesla, where the focus is on a future narrative, Intel remains a “show me” story burdened by significant execution challenges and mounting headwinds.

With implied volatility pointing to an 8.2% stock move post-earnings, the risk of a miss looms large.

Analysts have grown increasingly bearish on the chipmaker ahead of the print, with 30 of the 31 surveyed by InvestingPro revising EPS estimates downward over the past three months, reflecting a sharp decrease in confidence.

Source: InvestingPro

Wall Street expects Intel to report a profit of $0.01 per share, down 50% year-over-year from EPS of $0.02 in the year-ago period. Intel’s foundry ambitions have yet to deliver meaningful results, with high capital expenditures weighing on profitability.

Meanwhile, the company’s sales are expected to decline 6.8% annually to $11.95 billion amid a sluggish performance in its all-important chip business, weak data center sales, as well as dwindling PC demand from consumers.

Looking ahead, it is my belief that Intel’s forward guidance will point to further near-term weakness amid ongoing margin pressures and competitive headwinds.

Once considered the undisputed leader in the computer processors industry, Intel has been steadily losing market share in recent years to more agile rivals like AMD (NASDAQ:), Nvidia (NASDAQ:), ARM (NASDAQ:), and Taiwan Semi (NYSE:), particularly in AI and high-performance computing. In addition, its business has also suffered as more and more ‘Big Tech’ companies, including Apple (NASDAQ:), Microsoft (NASDAQ:), and Amazon (NASDAQ:), opt to develop their own chips and microprocessors.

Source: Investing.com

INTC stock closed at $23.10 on Friday, hovering above both its 50- and 200-day averages, but technicals are mixed: short-term signals swing from “strong sell” to “buy,” and only the daily/weekly indicators offer clear optimism.

It is worth noting that Intel holds a 1.88 InvestingPro Financial Health Score (“FAIR”), flagging weak profitability, eroding revenue growth, and margin headwinds.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now for up to 50% off amid the summer sale and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.